Micron and Western Digital Each Exploring Ways to Buy Kioxia

Micron and Western Digital competing for control over Kioxia.

Micron Technology and Western Digital are each exploring a potential deal to acquire their rival Kioxia in a transaction that could value the Japanese company at $30 billion, the Wall Street Journal reported on Wednesday. If either of the companies manage to take over Kioxia, the shape of the NAND memory market will change significantly.

Kioxia planned its initial public offering last fall. Back then, the company's management expected Kioxia's valuation to reach $16 billion. Yet, the company decided to postpone its IPO indefinitely citing the ongoing pandemic, market uncertainties, and the trade war between the U.S. and China. Now, Micron and Western Digital are each studying a possibility to gain control over Kioxia, which is majority owned by private equity firm Bain Capital. The deal is not guaranteed though, according to WSJ.

When Toshiba were selling its NAND flash memory assets several years ago, multiple makers of NAND attempted to buy these assets in a bid to strengthen their positions on the market. Western Digital was among the interested parties. At the time, Toshiba's management decided to sell its NAND assets to a consortium of investors led by Bain Capital and including Apple, SK Hynix, Dell, and Seagate Technology. But Bain Capital may now offer Kioxia to the highest bidder.

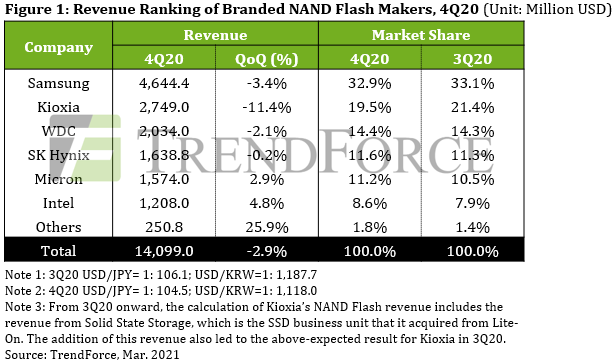

Kioxia and Western Digital co-own fabs located at two sites in Japan. Together, Kioxia and Western Digital produce more NAND flash than any other maker in the industry: in Q4 2020 they controlled 33.9% of the market. To somewhat reduce competition between each other, the two companies have slightly different business strategies. Western Digital is mostly focused on selling products based on its NAND memory, whereas Kioxia sells bulk NAND flash to makers of actual products.

The companies use the same process technology to produce NAND, so if Western Digital gains control over Kioxia, not a lot will change from manufacturing point of view. However, because of different strategies, the transaction might have an impact on both bulk NAND market and the market of actual NAND-based products.

If Western Digital takes over Kioxia, it will become the world's largest maker of flash memory, controlling over a third of the market that will only be challenged by Samsung with a similar market share. SK Hynix, which is in the process of taking over Intel's 3D NAND business, will control about 20% of the market. This will leave Micron and emerging Chinese manufacturers about 14% if the NAND market, which will put them into not so favorable positions from a scale perspective.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Micron has been focused on NAND-based products for mobile and client applications for years now. Buying Kioxia, whose 3D NAND operation is considerably larger than Micron's, may not be optimal for the company. Yet, Micron certainly needs to get bigger to face up against its rivals. Meanwhile, process technologies used by Micron and Kioxia-Western Digital are different, so it remains to be seen how the companies organize their manufacturing operations.

Anton Shilov is a contributing writer at Tom’s Hardware. Over the past couple of decades, he has covered everything from CPUs and GPUs to supercomputers and from modern process technologies and latest fab tools to high-tech industry trends.

-

escksu ReplyColif said:Why don't they merge and then they can both buy it?

Micron and WD merge?? Hmm..... possible although highly unlikely. -

kal326 Wow, I didn’t realize Western Digital was even that large of a player in the SSD space. I realize consolidation is folding most under a few holding companies and several brands. Like WD/Sandisk, but I didn’t realize their market share was second behind Samsung in drive manufacturing companies and higher than Crucial/Micron.Reply