NFT 'Market Collapse' Reports Greatly Exaggerated

But is it the death of NFTs? No; not today, at least.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

You are now subscribed

Your newsletter sign-up was successful

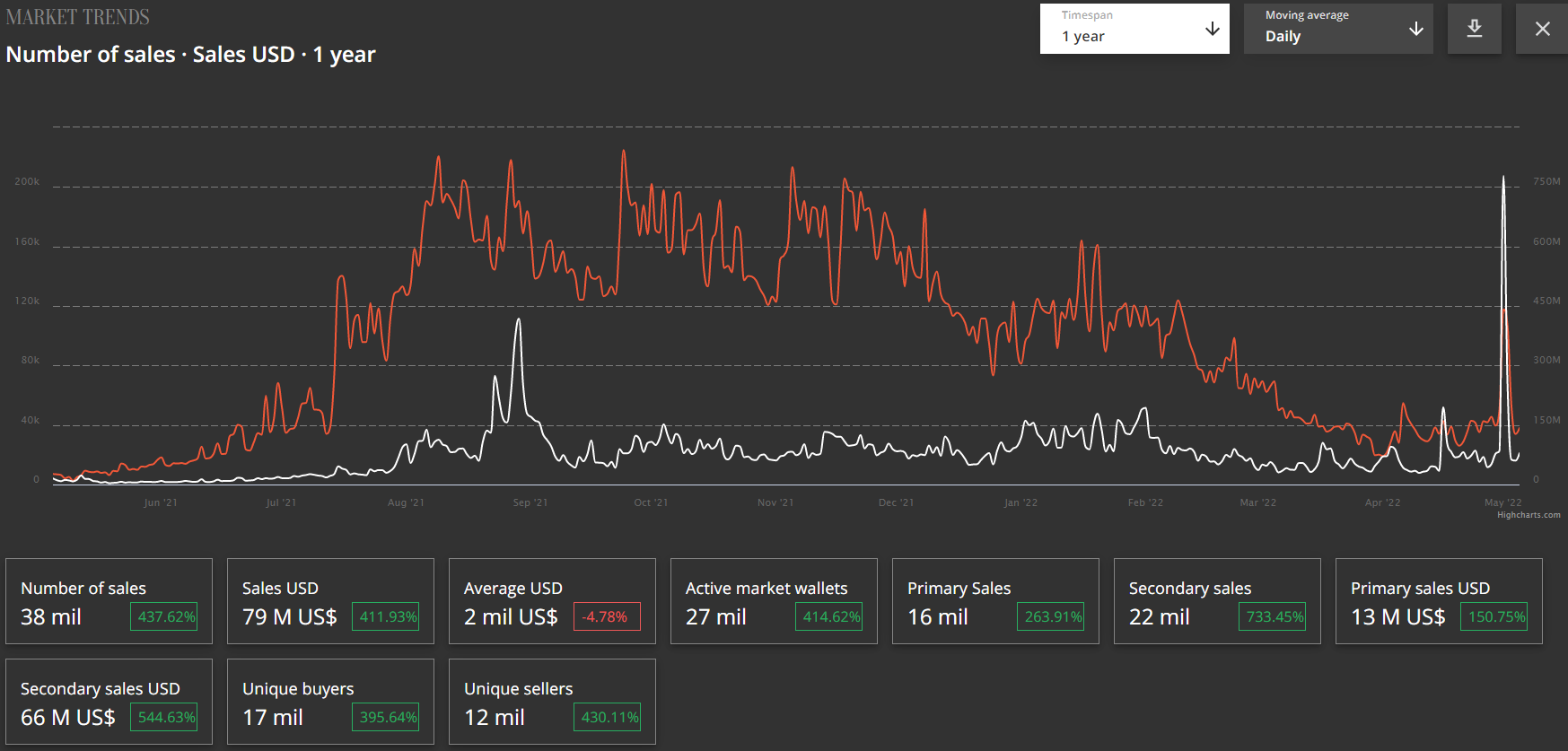

A recent report pioneered by the Wall Street Journal made headlines with the claim of a market collapse in the NFT space, following a 92% decline in transaction volume from September last year. Quoting data from NFT market analysis firm Nonfungible, the report cherry-picked data; and likely with no ill will, ended up not painting the forest for the trees.

However, the same analysis firm has just released its 1Q2022 NFT market report and sure, the market has collapsed: if we consider a 4.6% decrease in QoQ (Quarter over Quarter) volume as a sign of "flatlining" or "collapsing" demand. While this writer is no philosopher, it definitely seems like both statements can't be simultaneously true. This is no quantum physics, after all.

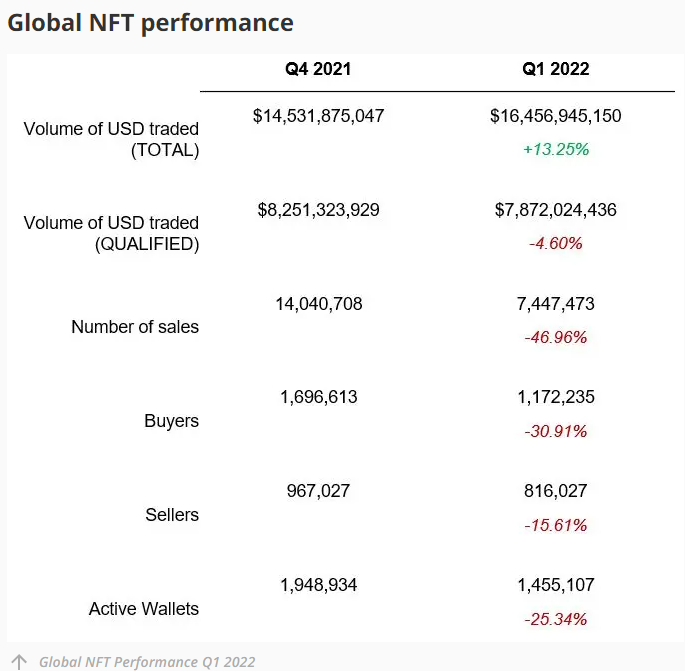

According to Nonfungible, the NFT market did experience a downturn on qualified trading volume, dipping from 4Q2021's roughly $8.25 billion down to around $7.87 billion on the first quarter of 2022. Other NFT market metrics saw more significant contractions: the total number of NFT sales dropped by 46.96%; the numbers of active buyers and sellers too declined by 30.91% and 15.61%, respectively; and the number of active wallets declined by a still significant 25%.

Even so, there's important data to be gleaned; for one, the 5% decrease in trading volume contrasts with the significant reduction in number of NFT sales. This indicates - and Nonfungible's data backs it up - that while the number of transactions declined, the value of those transactions actually increase. According to the analysis firm, the average price of NFT sales shot up by an incredible 80%, from $587 in Q4 2021 to $1,057 in Q1 2022.

This isn't a collapse: this is the result of a market that's been evolving away from PFP (Profile Pic) collections (think Cryptopunks) with releases that reach the tens of thousands of NFTs in a single drop, to smaller, value or utility-added collections (with added costs). At the same time, there's a broad, macroeconomic picture to consider. The Russian-Ukraine war hasn't left PC hardware alone, and the Traditional Finance (TradFi) sector hasn't emerged unscathed either: today has already been one of the worst days in years.

Of course, all of the above falls flat in its face if the meaning of the word "collapse" changed. But at time of writing, and according to Merriam-Webster, it hasn't.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Francisco Pires is a freelance news writer for Tom's Hardware with a soft side for quantum computing.

-

Tell that to all the people who were ignorant enough to spend 3 million on a NFT to resell and they get offered $20.Reply

-

drivinfast247 Reply

A real bridge or just a digital representation of one?UWguy said:I have a bridge to sell you -

Blacksad999 The volume of trading is largely false, as there's a LOT of people simply trading items back in forth to give the illusion that the market is healthy and viable so that the value of their NFT's don't drop like a rock.Reply -

Colif Have to keep the dream alive, if its seen to be dying people won't be sucked into buying them. BIg companies want to get in on this "sell people nothing" game. They can't have the market die before they get there... some are throwing everything they had away to get into market... lol https://www.pcgamer.com/embracer-tomb-raider-deus-ex-acquisition-square-enix/Reply

FB lost 3billion last quarter on Metaverse. Its lost 20 billion in last 3 years on VR. There is a lot of money to lose if people can see NFT are nothing.

I don't see any value in owning a position on a database. You don't own anything else, the rest is smoke and mirrors to make it appear you get more. -

Colif Reply

https://nintendoeverything.com/nintendos-full-comments-on-the-metaverse-and-nfts/“The metaverse has captured the attention of many companies around the world, and it has great potential. When the concept of the metaverse is introduced in the media, games like Animal Crossing: New Horizons are sometimes brought up as examples. In that sense, the metaverse is of interest to us.

But at this point in time, there is no easy way to define specifically what kinds of surprises and enjoyment the metaverse can deliver to our consumers. As a company that provides entertainment, our main emphasis is on ways to deliver fresh surprises and fun to our consumers. We might consider something if we can find a way to convey a ‘Nintendo approach’ to the metaverse that many people can readily understand, but we do not think that is the situation at the present time.”

they active in the elimination of all NFT based on their IP, as you just know there are pokemon based ones. -

WrongRookie ReplyColif said:https://nintendoeverything.com/nintendos-full-comments-on-the-metaverse-and-nfts/

they active in the elimination of all NFT based on their IP, as you just know there are pokemon based ones.

Article strictly talks about metaverse only. Nothing is said about NFT.

I believe metaverse and NFT are different things. I don't recall Pokemon having NFTs as far as I can remember unless i'm missing something. -

jacob249358 NFT is absolutely silly. Make a dumb drawing, sell it to my friend for $10,000 (I give him the money back and now we have made a $10,000 NFT from nothing. Some guy sees it and buys it for $10,000 because apparently its that valuable and we get rich.Reply -

Colif There aren't any official Nintendo NFT but plenty of NFT look like them.Reply

You don't own the art. You own a position on a database, the picture is just an image representing the NFT. People think they own the picture, they don't

XwMjPWOailQ

NFT is a shell game, and they trying to get as many people as possible to play it to buy these nothings.