PC Shipments Drop Again in Q2, IDC Says

Inventory levels remain above expectations.

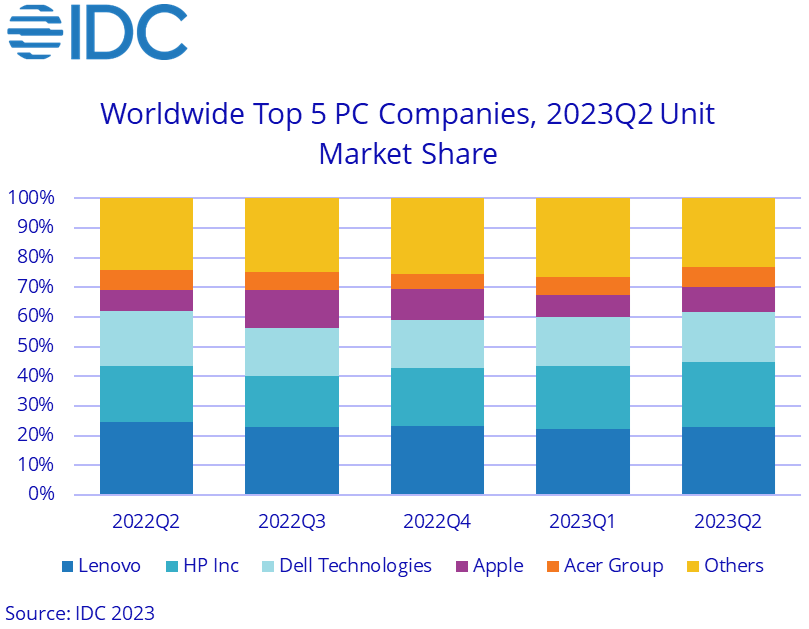

Global PC shipments declined by 13.4% year-over-year in the second quarter of 2023, according to initial data from the International Data Corporation (IDC). This downturn marks the sixth straight quarter of shrinkage, spurred by macroeconomic factors, diminished demand across consumer and commercial sectors, and a shift in IT expenditure away from device acquisition. Still, IDC claims that the market outperformed the projected estimates for the quarter.

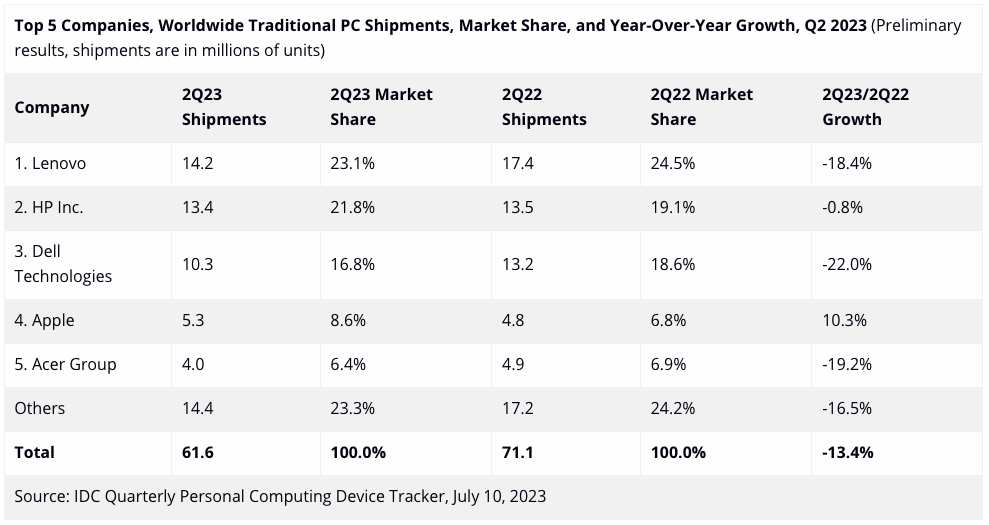

The industry shipped 61.6 million PCs in Q2 2023, down from 71.1 million computers in the same quarter a year ago. Lenovo shipped 14.2 million systems and remained the world's largest computer supplier in the second quarter of 2023, but its sales contracted by 18.4%. As a result, HP came close to besting leader by shipping 13.4 million desktops and laptops in Q2 2023. Dell came in third, with 10.3 million PCs, and Apple remained the world's fourth-largest PC supplier with 5.3 million machines sold during the quarter. Acer shipped approximately four million computers, based on data from IDC.

"The roller coaster of supply and demand the PC industry has faced over the past five years has been extremely challenging," said Ryan Reith, group vice president for IDC's Client Device Trackers. "Companies don't want to be caught with short supply like they were in 2020 and 2021, but at the same time, many seem hesitant to make the big bet on a market rebound. On the consumer side, we're seeing a return to pre-pandemic habits where computing needs are shared across multiple devices, and we firmly believe the consumer wallet will favor smartphones over the PC. On the commercial side, workforce reductions (for many big companies) as well as the introduction of generative AI only add more confusion as to where to place an already reduced budget."

Except for Apple and HP, all large PC makers suffered double-digit decreases during the quarter. Apple enjoyed a favorable year-over-year growth due to supply constraints in Q2 2022, as a result of COVID-related supply chain disruptions. HP, meanwhile, has dealt with an excess of inventory in the previous year and is now nearing normalized inventory levels, resulting in a better growth rate amid this slowdown, according to IDC.

Still, persistently weak demand has led to inventory levels remaining high for an extended period, affecting both completed systems at the channel level and the supply chain.

"Elevated channel and component inventory are once again dragging down the market," said Jitesh Ubrani, research manager for IDC's Mobility and Consumer Device Trackers. "And despite these issues slowly easing, many component suppliers continue to offer reduced pricing in an effort to clear their inventory though PC makers and channels are still cautious about new systems due to the reduced demand."

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Anton Shilov is a contributing writer at Tom’s Hardware. Over the past couple of decades, he has covered everything from CPUs and GPUs to supercomputers and from modern process technologies and latest fab tools to high-tech industry trends.