Graphics Cards Prices Continue to Fall in Europe

But they are still considerably higher than MSRPs.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

You are now subscribed

Your newsletter sign-up was successful

Graphics cards have been highly overpriced for nearly two years now, despite the fact that both AMD and Nvidia have been gradually increasing their GPU production orders. But while it is still impossible to get most GPUs at their recommended price, it looks like there may be light at the end of the tunnel, as prices of cards in Austria and Germany are actually getting lower.

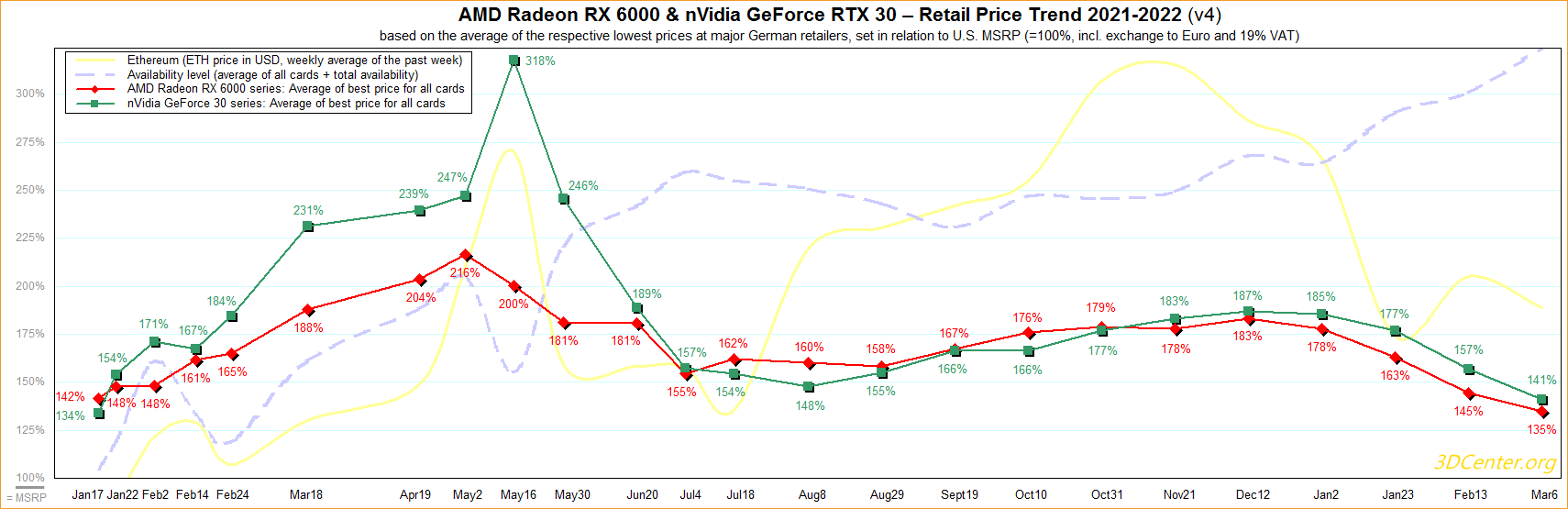

3DCenter.org monitors prices of contemporary AMD Radeon RX 6000-series and Nvidia GeForce RTX 30-series graphics cards in nine stores in Austria and Germany, calculates average prices, and compares them to recommended prices. In the past few months, prices of AMD's Radeon RX 6000-series graphics boards were 60% - 80% higher compared to MSRPs, whereas Nvidia GeForce RTX 30-series boards cost 48% - 87% higher than their recommended price. In February, the price above MSRP of AMD's Radeon RX 6000 cards decreased to 45%, whereas overprice of Nvidia's GeForce RTX 30-series products declined to 57%. In March, surcharges decreased to 35% and 41%, respectively.

As expected, higher-performance (yet not range-topping) products like AMD's Radeon RX 6800/6800 XT and Nvidia's GeForce RTX 3070/3080cards come with the highest price hikes. Meanwhile, AMD's Radeon RX 6900 XT sells at prices that are 24% higher than its MSRP in the USA, whereas Nvidia's GeForce RTX 3080 Ti and RTX 3090 are sold with a 16% and a 34% surcharge, respectively.

The graphics cards tracked are available today at anything close to their MSRPs, so they are still expensive, though it looks like either the supply is catching up with demand, or people in Europe are less inclined to spend given the uncertain situation in Europe amid the ongoing conflict between Russia and Ukraine.

Considering the popularity of high-performance graphics cards is evidently high (and we can see that the supply chain is capitalizing on this), average selling prices of graphics boards (and therefore GPUs) will likely remain at high levels for the time being, even if prices continue to slowly fall.

Last year the industry shipped around 49 million of discrete graphics cards for desktop PCs, up from around 41.5 million a year before, according to Jon Peddie Research. Meanwhile, since the boards are still expensive, it is evident that AMD and Nvidia did not supply enough GPUs. To that end, what remains to be seen is how Intel's entrance into this market will affect shortages and prices of graphics cards. So far, Intel made a rather clear signal that it wants to pursue the laptop market first, to a large degree because it is easier to sell GPUs to PC makers rather than to end users.

Nonetheless, it is obvious that prices of graphics cards are getting lower just before Intel is about to start shipping its desktop offerings in the second quarter. So perhaps, assuming that Intel's products are even remotely competitive, their launch may trigger further price drops.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Anton Shilov is a contributing writer at Tom’s Hardware. Over the past couple of decades, he has covered everything from CPUs and GPUs to supercomputers and from modern process technologies and latest fab tools to high-tech industry trends.

-

digitalgriffin What you will notice next is a slowing down in the price drop. But you'll also notice a slowing down in cards sold on ebay and amazon by 3rd parties.Reply

The scalpers have overhead and are loathe to sell at cost, so they sit on them at higher pricing.

Soon readily available supply will cause the bottom fall out similar to last crypto crash. -

bigdragon Reply

I hope so! People just need to wait and hold for those lower prices to happen. Current prices and AIB MSRPs are still ridiculously inflated compared to the standards Nvidia set with the FE products. Same goes for the AMD products. Intel's entrance should shake things up further.digitalgriffin said:Soon readily available supply will cause the bottom fall out similar to last crypto crash.

I do worry that people will "buy the dip" and find some new crypto craze to pump up, or the AIBs will use the developing oil crisis as another excuse to keep prices high.