Average GPU Pricing Skyrockets as Market Quadruples to $12.5 Billion, Report Says

GPU makers enjoy robust demand and absurdly high pricing

Discrete GPU suppliers for desktop PCs nearly quadrupled the cash they raked in during Q1 2021 compared to this time last year. That's due to the skyrocketing increases in average selling prices (ASPs), according to Jon Peddie Research.

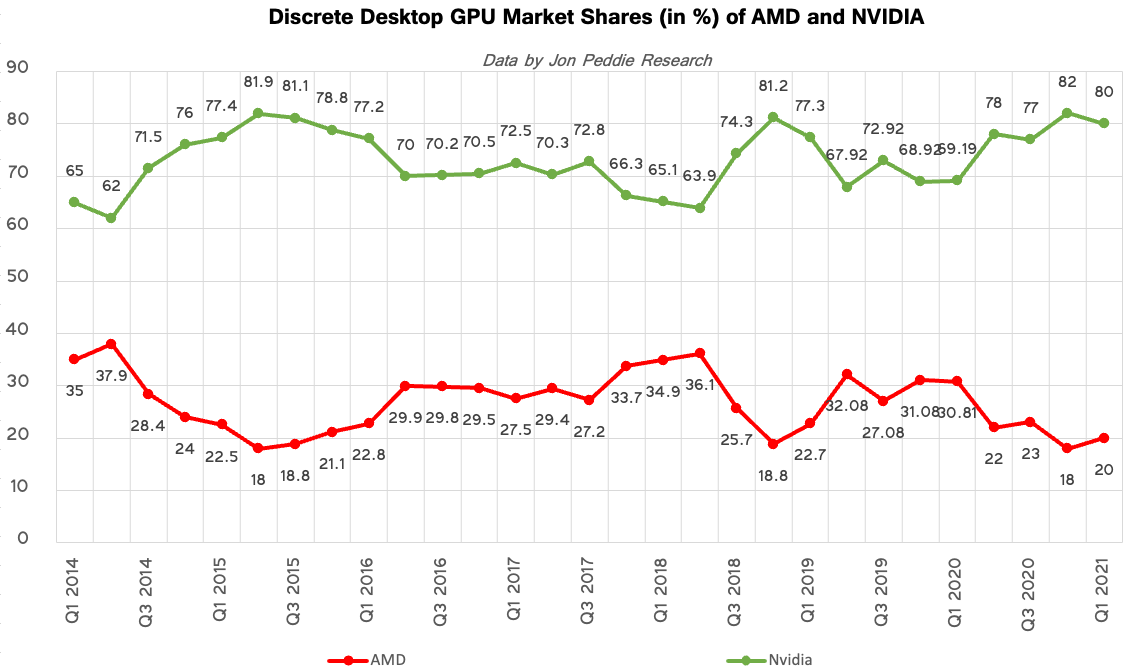

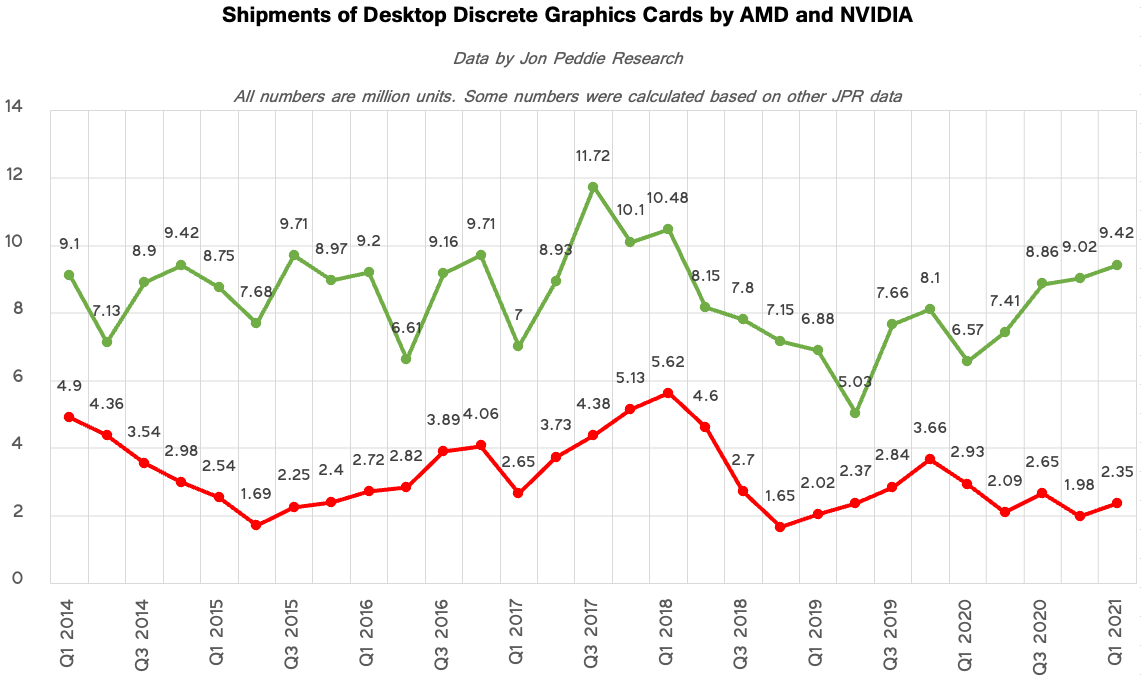

Nvidia retained its leadership and outsold its rival AMD four-to-one in the discrete GPU market, but it's clear that both vendors are selling every chip they can manufacture.

GPU Pricing Skyrockets, Revenue Jumps 370%

According to the report, GPU makers earned around $12.5 billion in Q1, a whopping 370% increase over last year. A big part of that gain is due to skyrocketing pricing.

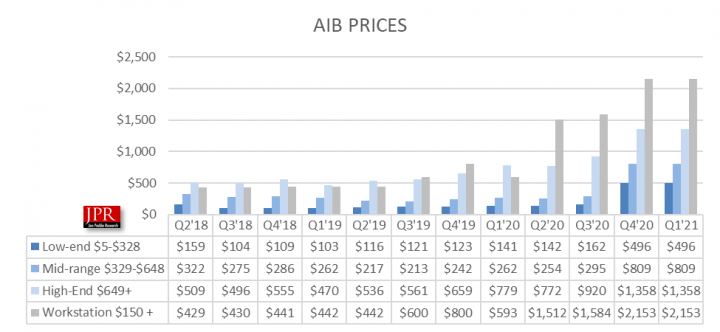

As you can see in the image above, everything changed in the second half of 2020 when GPU pricing — from entry to midrange and from high-end to workstation — skyrocketed nearly overnight in the fourth quarter as a result of demand from gamers and miners.

Today the average price of an entry-level graphics card is $496, a mid-range board costs $809, and a high-end GPU carries an $1,358 price tag, according to JPR.

Analysts from Jon Peddie Research believe that price increases are driven by a number of factors, including component shortages, insufficient manufacturing capacity, strong demand from gamers, and solid (albeit limited) demand from Ethereum cryptocurrency mining.

Interestingly, the average price of a GPU has increased slowly over the years as lower-end systems migrated to integrated GPUs, whereas owners of higher-end machines demanded better standalone graphics boards. For instance, the average pricing for a high-end graphics card increased from around $500 in the first half of 2018 to around $780 in the first half of 2020. Meanwhile, average prices of entry-level and midrange third-party cards tend to fluctuate depending on actual offerings and refresh cycles. Those incremental price increases turned into an avalanche in recent times, though.

11.77 Million Graphics Cards for Desktops Sold in Q1

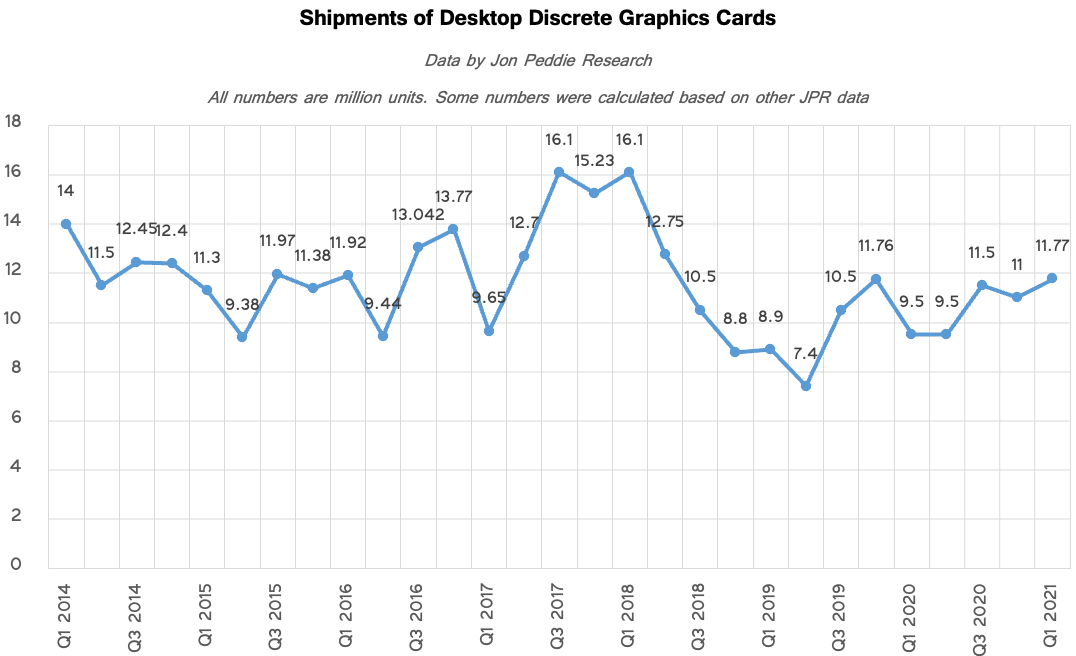

Unit shipments of discrete graphics cards for desktop PCs reached 11.77-11.8 million units in Q1 2021, a 7.77% quarter-over-quarter increase and a noticeable 24.4% year-over-year growth, JPR reports. Typically, sales of graphics boards drop in Q1 compared to the prior quarter, but that was not the case this year.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

The increased sales can be explained by the growing demand for gaming graphics cards as well as add-in-boards used for cryptocurrency mining.

AMD managed to increase its market share by 3% in the first quarter and commanded 20% of discrete GPU unit shipments. In contrast, Nvidia lost 3% but had a market share of 80%, still a dominant position.

"We believe the stay-at-home orders created demand in 2020 and in the first quarter of 2021," the analysts said. "Home PCs and workstations became the center of professional life and often the main source of entertainment during the lockdowns. Gaming added to the pressure on the supply chain as it continued to grow in popularity. But, as we said, this is also an anomalous period in graphics history. Prices are high as a result of shortages and so is demand in response to cryptocurrency prices."

Anton Shilov is a contributing writer at Tom’s Hardware. Over the past couple of decades, he has covered everything from CPUs and GPUs to supercomputers and from modern process technologies and latest fab tools to high-tech industry trends.

-

Jimbojan The unit sale has not increased QoQ, just the price increases, then it is not going to last, especially Intel is driving hard into the discrete market, the sale value will bound to decrease either through price reduction or through volume demand. The splendid demand due to covid virus is an abnormal event, it is not clear how long will it last.Reply -

hannibal I was expecting the low end to become $500 next year… so we are early in it. I was expecting middle range to be $1000 next year… so we are behind the schedule.. and i expected highend to become $2000 to $3000 next year… also behind schedule in there…Reply

Have to see what low end gpus i can afford in the years to come… -

JarredWaltonGPU ReplyJimbojan said:The unit sale has not increased QoQ, just the price increases, then it is not going to last, especially Intel is driving hard into the discrete market, the sale value will bound to decrease either through price reduction or through volume demand. The splendid demand due to covid virus is an abnormal event, it is not clear how long will it last.

Unit sales did increase, by 0.77 million units. I'd love to know the breakdown of various GPU models, but if you look at the above chart, that's around 34 million discrete GPUs sold since the RTX 30-series and RX 6000-series first launched. Going with the 80-20 figures, that's 27 million GPUs sold by Nvidia in the past nine months. However, many of those could still be Turing GPUs. Still, probably at least half would be Ampere? Actually, maybe half are GTX 16-series, then half of the remaining are Ampere? (Those cheaper cards have far higher volumes — could be way more than half of the sales for GTX 16-series.) -

saunupe1911 Cryptocurrency is the devil. The crap is messing up numerous markets. It's even affected the auto industry. Folks have loss more than they have gained with it. But heck these insane markets have affected your quality of life even if you had gained a lot of cash from crpyto smh. You can't buy what's not for sale smhReply -

Johnpombrio The chip shortage is strictly due to CoVid. A year ago, the bottom had dropped out of jobs, shopping, office work, school, airlines, auto sales, and SO much more. tech companies reacted by slashing sales expectations, inventory, laying off workers, and CANCELLING orders for computer parts. Since it takes a YEAR from the time a chip is ordered and queued for a FAB until the finished product, we are in the midst of all these canceled orders.Reply

FP_g-as29x0View: https://www.youtube.com/watch?v=FP_g-as29x0 -

russell_john That's kind of bogus data and doesn't really say what you claim it does .....Reply

Manufacturers don't get any more money because some scalpers have jacked up the prices, they make the exact same whether it's sold at MSRP or if it is sold for astronomical prices by Scalpers ...... Any increase for manufacturers is based on units sold alone and not the warped market prices -

russell_john ReplyJohnpombrio said:The chip shortage is strictly due to CoVid. A year ago, the bottom had dropped out of jobs, shopping, office work, school, airlines, auto sales, and SO much more. tech companies reacted by slashing sales expectations, inventory, laying off workers, and CANCELLING orders for computer parts. Since it takes a YEAR from the time a chip is ordered and queued for a FAB until the finished product, we are in the midst of all these canceled orders.

FP_g-as29x0View: https://www.youtube.com/watch?v=FP_g-as29x0

If you actually looked at AMD's and Nvidia's finacial reports in 2020 you'd know that just wasn't true ..... The shortage is caused by record demand and TSMC is booked solid and never cut production even for a week in 2020 -

hannibal They just sell everything! Also they have consentrate to most expensive versions instead of low end ones. And that is that! Their profit themselves is not gone up and their sell out price has remained to be about the same as before. But instead of mixed sales, they only sell the most expensive variants.Reply -

hotaru.hino Another piece of data I would love to see along with this is how many systems were sold with said GPUs in the same time period.Reply