Samsung Foundry Update: 5nm SoCs in Production, HPC Shipments to Expand in Q4

Samsung's first 5LPE SoCs for smartphones to ship in Q4

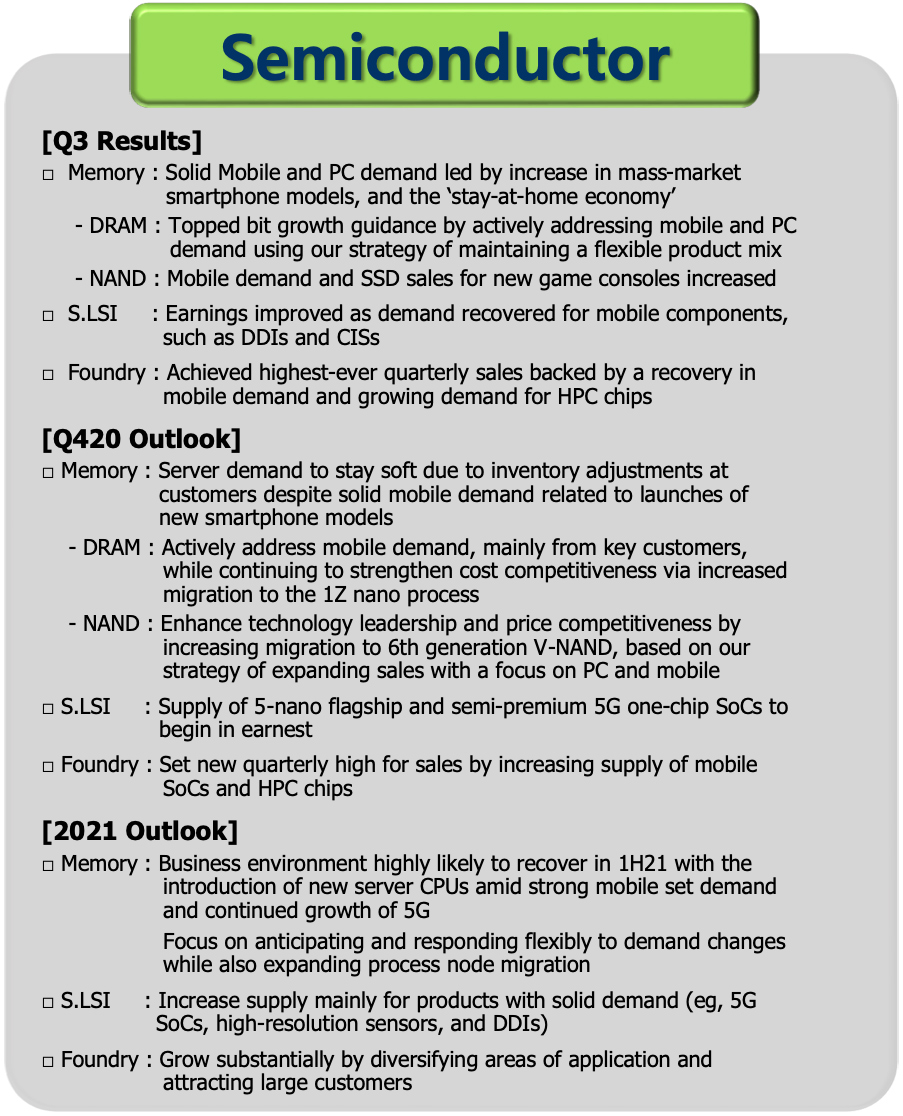

As part of its Q3 2020 earnings report, Samsung Electronics revealed some updates about its contract semiconductor production business. In the third quarter, Samsung Foundry recorded its most financially successful quarter ever and started shipments of mobile SoCs produced using its 5LPE (5 nm, low power early). The contract maker also intends to increase its shipments of HPC chips in Q4, which might be an indicator of improved supplies to Nvidia.

Highest Ever Quarterly Sales

Samsung said that its foundry unit had set a new quarterly high sales record because of increased shipments of mobile system-on-chips (SoCs) as well as high-performance computing (HPC) chips.

"The Foundry Business achieved record quarterly revenue on the back of a recovery in mobile demand and increased demand for HPC chips," a statement by Samsung reads. "The Company has established a position for future growth by beginning the shipment of 5-nm mobile products and 2.5D packages."

Samsung does not reveal what kind of HPC chips increased its foundry unit's sales to record highs. It is known that the company produces IBM's POWER10 processors for performance-hungry applications using its 7 nm manufacturing technology, and it also fabs Nvidia's latest Ampere GPUs that use the '8N' process. Both CPUs and GPUs are considered as HPC products in the semiconductor world (as they use appropriately tuned nodes).

As for mobile SoCs, Samsung Foundry not only continued to supply them to Samsung LSI and other clients but also started ramping up Samsung's next-generation SoCs using its leading-edge 5 nm fabrication process.

There is no information about volumes delivered to IBM and Nvidia in Q3, but these two large customers inevitably contributed to Samsung Foundry's revenues in the quarter. Furthermore, SoCs made using the latest nodes sell at a premium.

Q4 Revenue Rise: More Nvidia's Ampere GPUs?

The fourth quarter is usually strong for foundries, so it is not surprising that Samsung expects its semiconductor production business to post higher revenue than in Q3 2020, thus setting another per-quarter revenue record. It is noteworthy that the company expects sales of its mobile SoCs and HPC chips to drive its sales increases in Q4.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

"In the fourth quarter, the business aims to achieve another record quarterly revenue by expanding mobile SoC and HPC chip shipments to major customers," the statement by Samsung reads.

Because Samsung Mobile and other smartphone makers will be stockpiling SoCs for their upcoming products in the fourth quarter, it was not unpredicted that Samsung Foundry would sell a boatload of such chips. But if Samsung Foundry really considers Nvidia's Ampere GPUs as 'HPC' products, expanding HPC shipments means that Samsung Foundry will sell more graphics processors to its partner in Q4 than it did in Q3 (which is not exactly surprising). Ultimately, this might lead to better availability of actual GeForce RTX 30-series graphics cards.

5LPE in Production

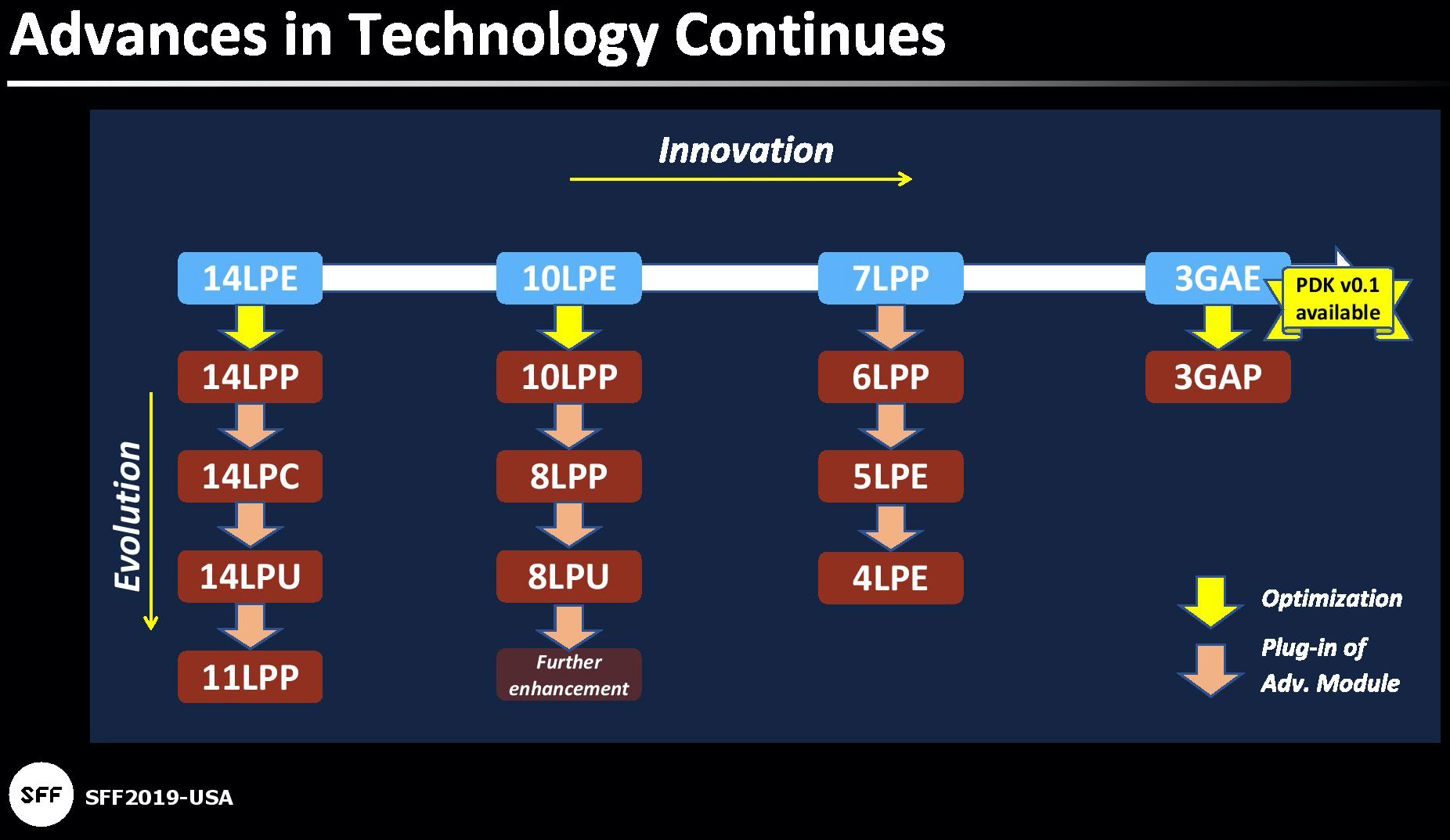

Samsung Foundry's 5LPE (5 nm low power early) manufacturing technology is an advancement of the company's 7LPP (7 nm low power performance) fabrication process that has been used for well over a year now.

5LPE enhances the use of extreme ultraviolet (EUV) lithography tools when compared to 7LPP in a bid to provide a 10% performance improvement (at the same power and complexity) or a 20% power reduction (at the same clocks and complexity) along with a ~25% area reduction (1.33x transistor density depending on exact transistor structures). 5LPE adds several new modules to the original process, including FinFETs with Smart Diffusion Break (SDB) isolation structure for extra performance, first-gen flexible contact placement (Samsung's tech that's similar to Intel's COAG, contact over active gate) for scaling, and single-fin devices for low-power applications.

Samsung says that 5LPE is largely design-rule compatible with 7LPP, which means that this is a process recharacterization, not an all-new technology. As a result, 5LPE designs can re-use at least some IP designed for the original process, which reduces costs and speeds time to market. However, for IP that can take substantial advantage of things like SDB, Samsung recommends a redesign.

Samsung Foundry's first 5LPE chips are made at its first EUV-dedicated V1 line in Hwaseong, South Korea. Eventually, it will also be used at Samsung Foundry's upcoming production line in Pyeongtaek, South Korea, starting in the second half of 2021.

Samsung's First 5LPE SoCs: Single-Chip 5G SoC, High-End Flagship SoC

As it usually happens in recent years, system-on-chips (SoCs) for smartphones are the first to adopt the latest fabrication processes. Samsung's first SoCs to be made using 5LPE are aimed at handsets. Based on a slide issued by Samsung, there are at least two 5LPE SoCs in production. One SoC was designed for flagship smartphones and therefore is tailored for performance as well as features (i.e., it does not come with an integrated modem); the other SoC was developed for semi-premium handsets and thus comes with an integrated 5G modem.

Behind TSMC, But Ahead of the Industry

Samsung Foundry began producing its 5LPE technology sometime in the third quarter and even began shipments of the first 5-nm SoCs to Samsung LSI. In contrast, Taiwan Semiconductor Manufacturing Co. (TSMC) initiated high-volume production of SoCs using its N5 node at some point in the second quarter. Therefore, Samsung Foundry is a bit behind its bigger rival by several months with its 5 nm node.

But it is hardly a problem for Samsung, which is by and large an IDM (integrated device manufacturer), to be a bit behind TSMC, the world's largest contract maker of semiconductors. What is noteworthy is that the company is ahead of the rest of the industry, including Intel, another huge IDM. Other foundries decided to focus on specialty fabrication processes and left the leading-edge race a couple of years ago, so they will not introduce their versions of 5-nm-class nodes any time soon.

Samsung Foundry cannot disclose its customers' names, but it looks like for now, the contract chipmaker produces 5LPE chips only for Samsung LSI. Historically, Samsung Foundry's LPE nodes were primarily used by Samsung LSI. In contrast, other customers opted for something more mature, such as LPP, LPC (low power cost), or LPU (low power ultimate). But keeping in mind that there are Arm's 5LPE POP (processor optimization pack, physical implementations of Arm's cores optimized for a certain node) offerings, plenty of tools from companies like Cadence and Synopsys to enable 5LPE designs, and a lack of rivals except TSMC, it is reasonable to expect that Samsung's 5LPE to be used by many customers outside of Samsung Electronics.

There is intrigue, though. During the conference call with analysts and investors, the head of Samsung Foundry said that the business unit was about to complete the design of its second-gen 5nm and first-gen 4 nm products.

"In the fourth quarter, […] we will continue our efforts to widen our leap in advanced processes by completing the design of second generation of [the] 5-nano products and the first generation of mobile-use 4-nano products," said Seung Hoon Han.

Samsung Foundry's public roadmap does not list 5LPP technology (it listed one years ago, but when it planned to move to GAAFETs at 4 nm – it has been removed since then), but it does have 4LPE and 4LPP nodes. At this point, it is unclear whether there is a second-gen 5nm technology. The SVP of Samsung Foundry mentioned 5LPE with all the yields and performance variability continuous process improvements (CPI) implemented (unlikely since they are implemented based on a statistical analysis of tens of millions of chips produced), or there is indeed 5LPP technology for 'general' usage as well as 4LPE for mobile SoCs.

More Customers & Substantial Growth in 2021

Speaking of customers, it is necessary to note that Samsung Foundry expects to attract new large clients next year. To land new orders, the contract chipmaker intends to expand the number of high-profile applications it can address, which essentially means introducing process technologies with modules that could benefit particular applications.

"In 2021, the company expects growth in the Foundry Business to exceed the industry’s growth significantly," the statement by Samsung reads. "It plans to diversify applications to HPC, consumer, and network products, and secure additional major customers."

Just days ago, Intel's Raja Koduri presented at Samsung's Advanced Foundry Ecosystem (SAFE) Forum, which naturally (re)sparked rumors that the world's leading CPU supplier might outsource some of its production to Samsung Foundry. Intel recently ran into issues with its 7 nm fabrication process and is now considering outsourcing some of the components using this technology to a third-party. So far, Bob Swan, Intel's CEO, has confirmed that the company has been working with TSMC, a long-time partner that fabricates a number of Intel's product lines acquired by the company in recent years.

Keeping in mind that GlobalFoundries and United Microelectronics Corp. (UMC) dropped developing leading-edge fabrication processes in recent years, Samsung Foundry's optimism about landing orders from large clients that need advanced nodes are completely justified.

Sources: Samsung, Samsung/SeekingAlpha, Cadence Community, Intel/SeekingAlpha

Anton Shilov is a contributing writer at Tom’s Hardware. Over the past couple of decades, he has covered everything from CPUs and GPUs to supercomputers and from modern process technologies and latest fab tools to high-tech industry trends.

-

Kamen Rider Blade Samsung isn't going to lose such a valuable Foundry Customer like nVIDIA, they're going to do everything they can to keep them on board.Reply

They don't want nVIDIA contracts going to TSMC, so they'll continue to sweeten the deal with nVIDIA.