Seagate to Cut 3,000 Jobs Amid Poor Quarter, Charges of Export Violations

As demand for hard drive slumps, Seagate adjusts its workforce

Seagate on Thursday announced plans to cut down its hard drive production and reduce its workforce by 3,000 people due to significantly lower demand for HDDs that it faced in the first quarter of its fiscal 2023. The company's Q1 of FY2023 was the company's worst quarter in 15 years as its earnings barely exceeded $2 billion and the company's net income dropped by 18 times year-over-year. Also, Seagate is facing charges for shipping hard drives to Huawei.

Exabytes Shipments Decline for First Time

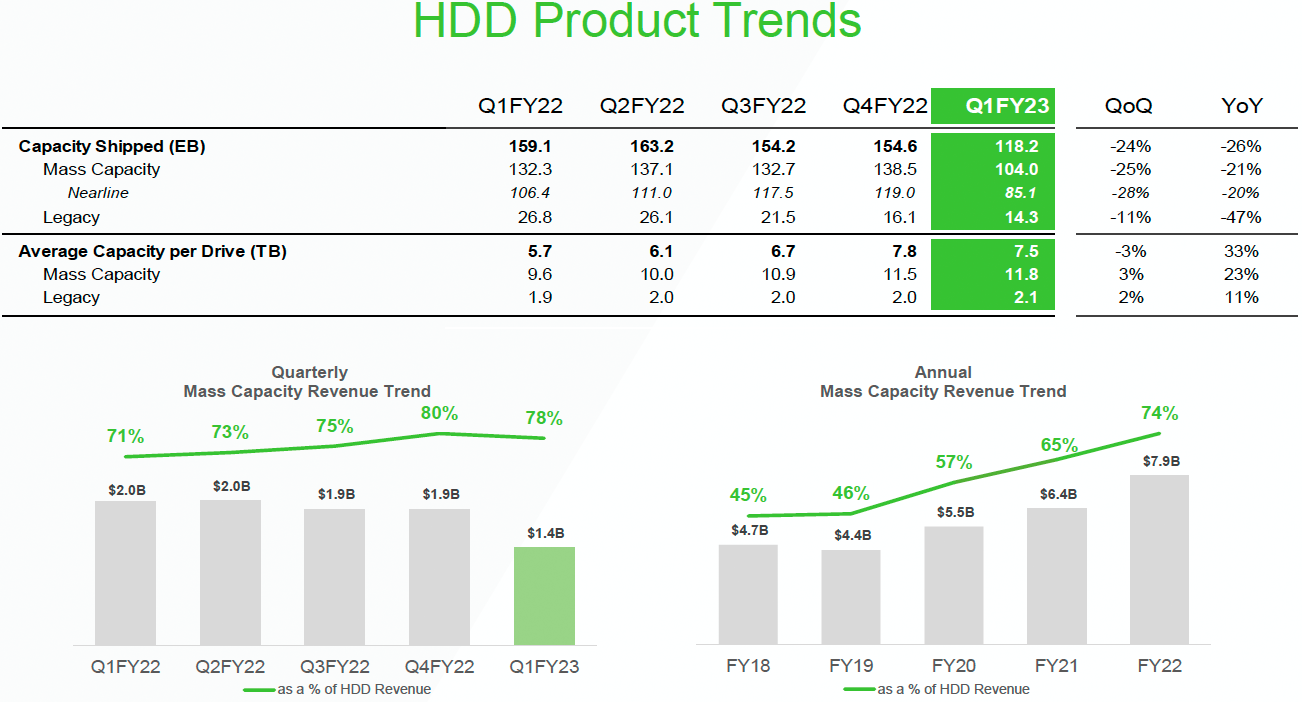

Seagate does not disclose the number of hard drives it ships per quarter, but unit sales of HDDs have been gradually going down for years, while exabytes shipments have been growing. In Q1 FY2023 everything changed as Seagate's HDD capacity dropped to 118.2EB, down from 154.6EB in the previous quarter and 159.1EB from the same quarter a year ago.

There were several reasons why Seagate's shipments dropped and the company's financial situation changed drastically in the first quarter of its FY2023. First, COVID lockdowns in China caused an economic slowdown, which reduced demand for Seagate's products. Second, due to slowing economic growth, Seagate's customers initiated inventory adjustments, which further reduced the company's sales. Third, due to decelerating economy and increased logistics costs, CSPs began to ship hard drives and other on boats (as opposed to planes), which slowed down their procurement cycle. Finally, consumers cut down their spending amid inflation and geopolitical uncertainties.

Since Seagate tends to produce hard drive platters, heads, and some other HDD components internally and assembles drives on its own product lines, reduced number of drives and lower demand for its products requires it to adjust its production capacity and headcount. Consequently, it had to implement a restructuring plan to reduce its costs, which includes laying off 8% of its personnel, or approximately 3,000 employees. The plan will be completed by the end of Q2 FY2023, will cost from $60 million to $70 million, and will save Seagate about $110 million per annum starting Q3 FY2023.

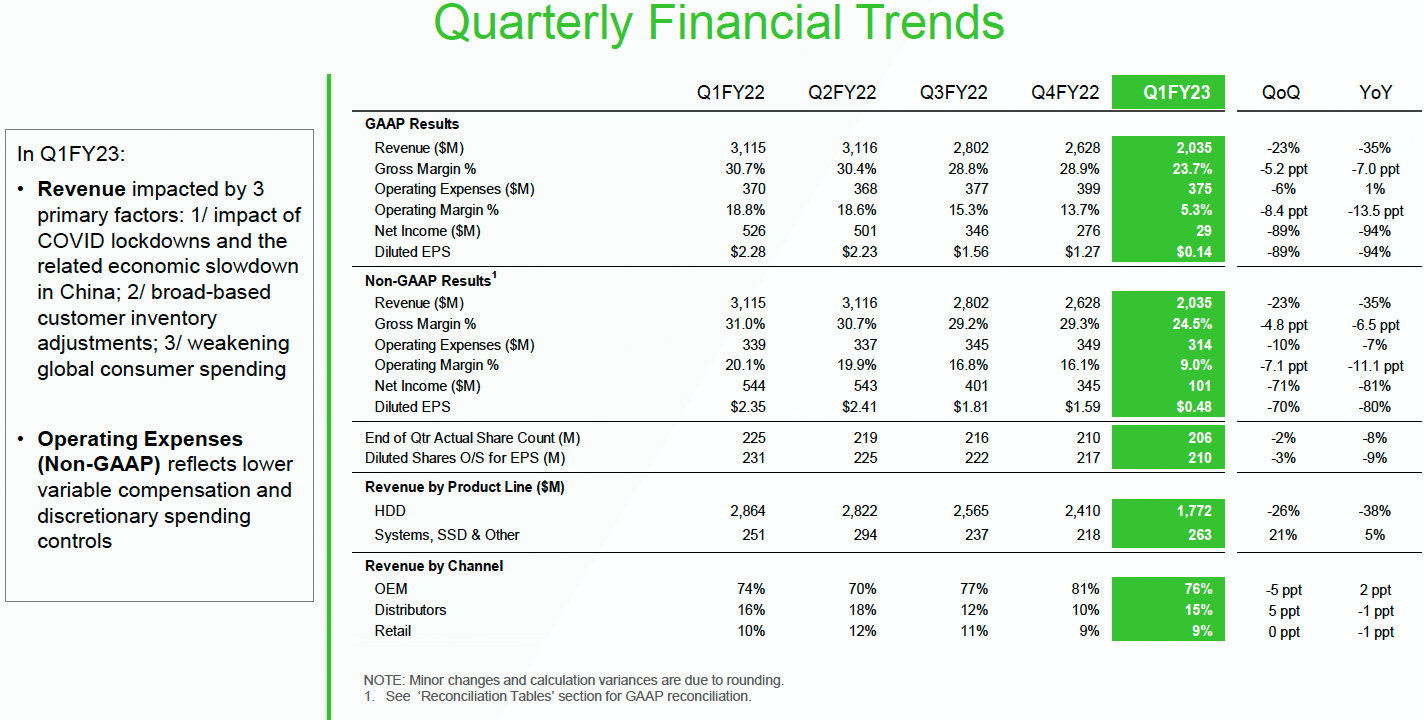

Seagate's revenue reached $2.035 billion in Q1 FY2023, down 35% year-over-year as well as a decrease of 23% quarter-over-quarter. Sales of hard disk drives dropped by 38% year-over-year and accounted for 87% of the company's sales, whereas sales of solid-state drives and systems were up 5% YoY and accounted for 13% of the firm's revenue. Seagate's net income totaled $29 million down, down from $529 million in Q1 FY2023 when the company's results were fueled by unprecedented demand for hard drives by cloud service providers (CSPs) as well as Chia miners.

What is even worse for Seagate is that given weakening demand from server makers and cloud service providers, Seagate expects its Q2 FY2023 to drop ever further to $1.85 billion ± $150 million, which will be the first time the company's quarterly revenue be below $2 billion since 2005, reports Bloomberg.

Charges from SEC

In addition to decreasing sales of hard drives, Seagate also faces charges from the U.S. Commerce Department’s Bureau of Industry and Security (BIS). Seagate said this week that in late August it received a proposed charging letter (PCL) from the U.S. DoC BIS alleging violations of the U.S. export regulations by shipping hard drives a company from the Entity List in 2020 – 2021. The company is believed to be Huawei.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Under the rules imposed by the U.S. DoC in August, 2020, companies that ship products subject to U.S. export control that was developed or made using U.S. IP, software, technology or equipment to Huawei or any of its affiliates must obtain an export license from the BIS. Seagate believes that it did not violate any rules as its products were not subject the U.S. Export Administration Regulations (EAR).

Technically, the limitations against Huawei mostly concern semiconductors, but since Seagate's hard drives use controllers and memory designed using electronic design automation tools developed by American companies and produced using equipment made in the U.S., they fall into the category of export-controlled items.

If Seagate and the DoC cannot resolve the matter, the HDD maker will have to pay charges for violating export rules.

Bright Spot: 30TB HDDs on Track for 2023

While Seagate definitely has hard times, it looks like there is some light at the end of the tunnel for the company as it says it is on track to deliver its first 30TB hard drives featuring its heat assisted magnetic recording technology in 2023.

"We continue to meet our development milestones for the 30+ terabyte product family, which is based on industry leading HAMR technology," said Dave Mosley, Seagate’s chief executive officer. "Our team is executing well on our innovation roadmap, and we are seeing strong engagement from cloud customers."

Anton Shilov is a contributing writer at Tom’s Hardware. Over the past couple of decades, he has covered everything from CPUs and GPUs to supercomputers and from modern process technologies and latest fab tools to high-tech industry trends.

-

Amdlova The scandals of smr and cmr drive make people lost faith on hardrive companies, no one builds a computer anymore with hard disk. And the cloud got dirty cheap to invest. Seagate and WD rest in peace.Reply -

Amdlova Reply

Yes, but have another 300 company to take your share lolhotaru251 said:you know WD makes m.2 ssd right? -

cyrusfox Like Tapes and others, HDD is cheap reliable longterm storage, likely to continue to diminish but here to stay (Unlike VHS and floppies).Reply -

bit_user Reply

Cloud & datacenter still place the vast majority of their data on HDDs. SSDs are not suitable for cold storage and still offer inferior $/GB.Amdlova said:no one builds a computer anymore with hard disk.

Like it or not, we depend on HDDs for the foreseeable future. -

bit_user I'd love to see a comparison of Seagate's sales volume vs. WD, over the same time period. I wonder if Seagate might get disproportionately affected by demand slackening, due to its inferior reliability (i.e. according to my experience & BackBlaze's data).Reply