AMD outsells Intel in the datacenter for the first time in Q4 2024

But sales of Instinct GPUs disappoint.

AMD on Tuesday announced its financial results for the fourth quarter of 2024 and for the whole year. As expected, the company managed to post impressive results driven by its client and datacenter CPUs. Perhaps AMD's biggest achievement in the quarter is that the company managed to outsell Intel in the datacenter space for the first time in history. Yet, sales of AMD's datacenter GPUs somewhat disappointed market observers.

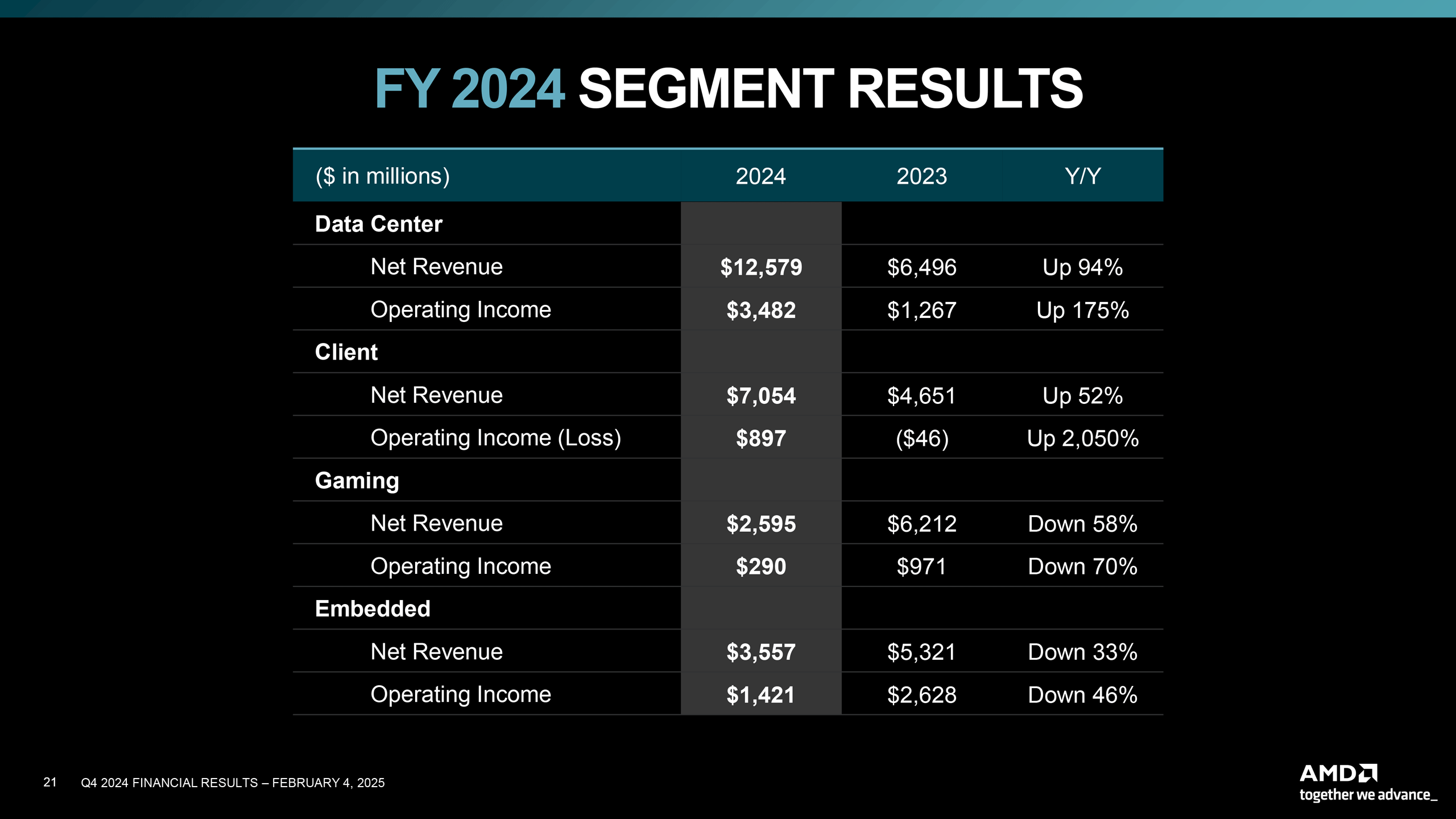

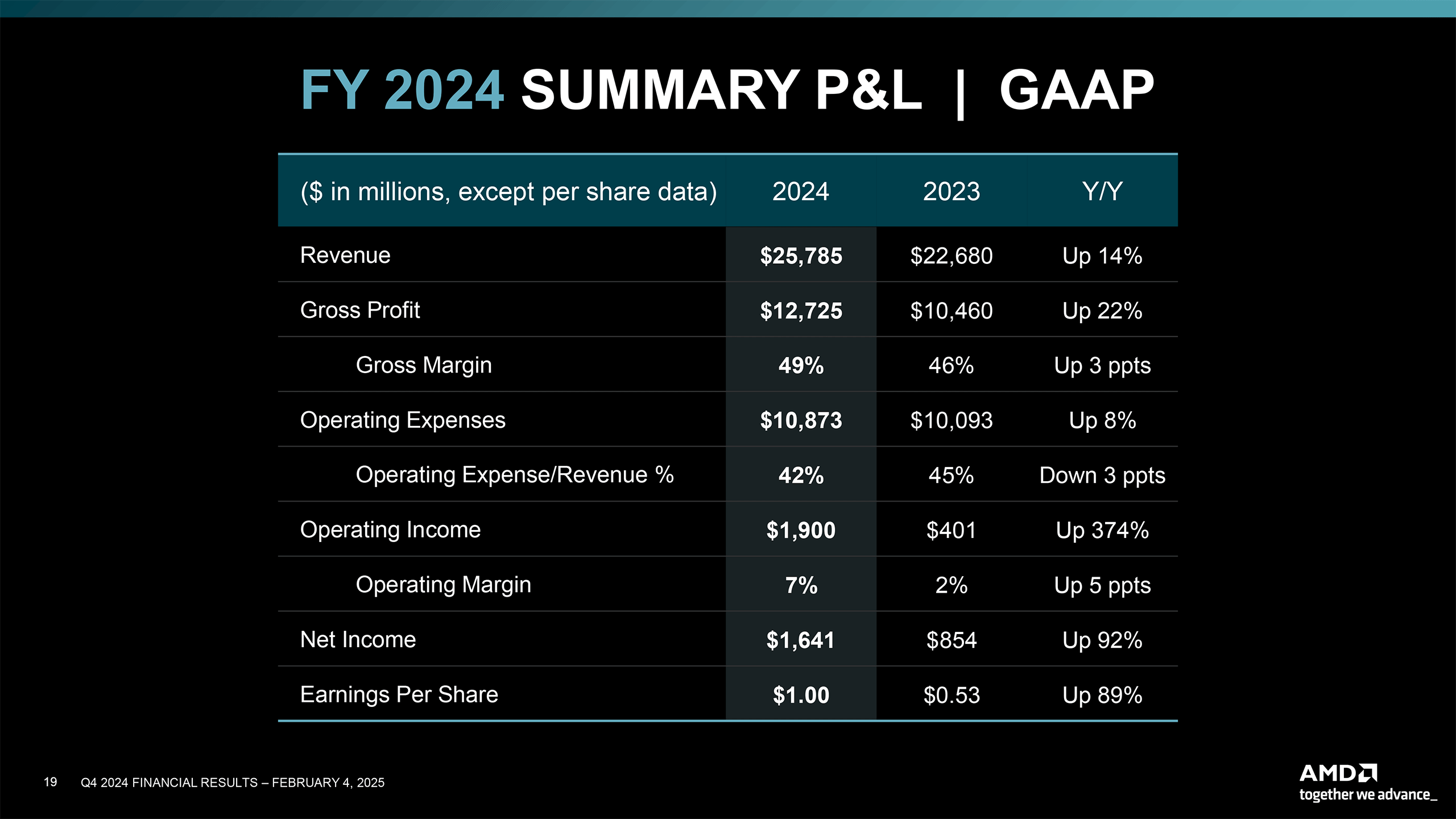

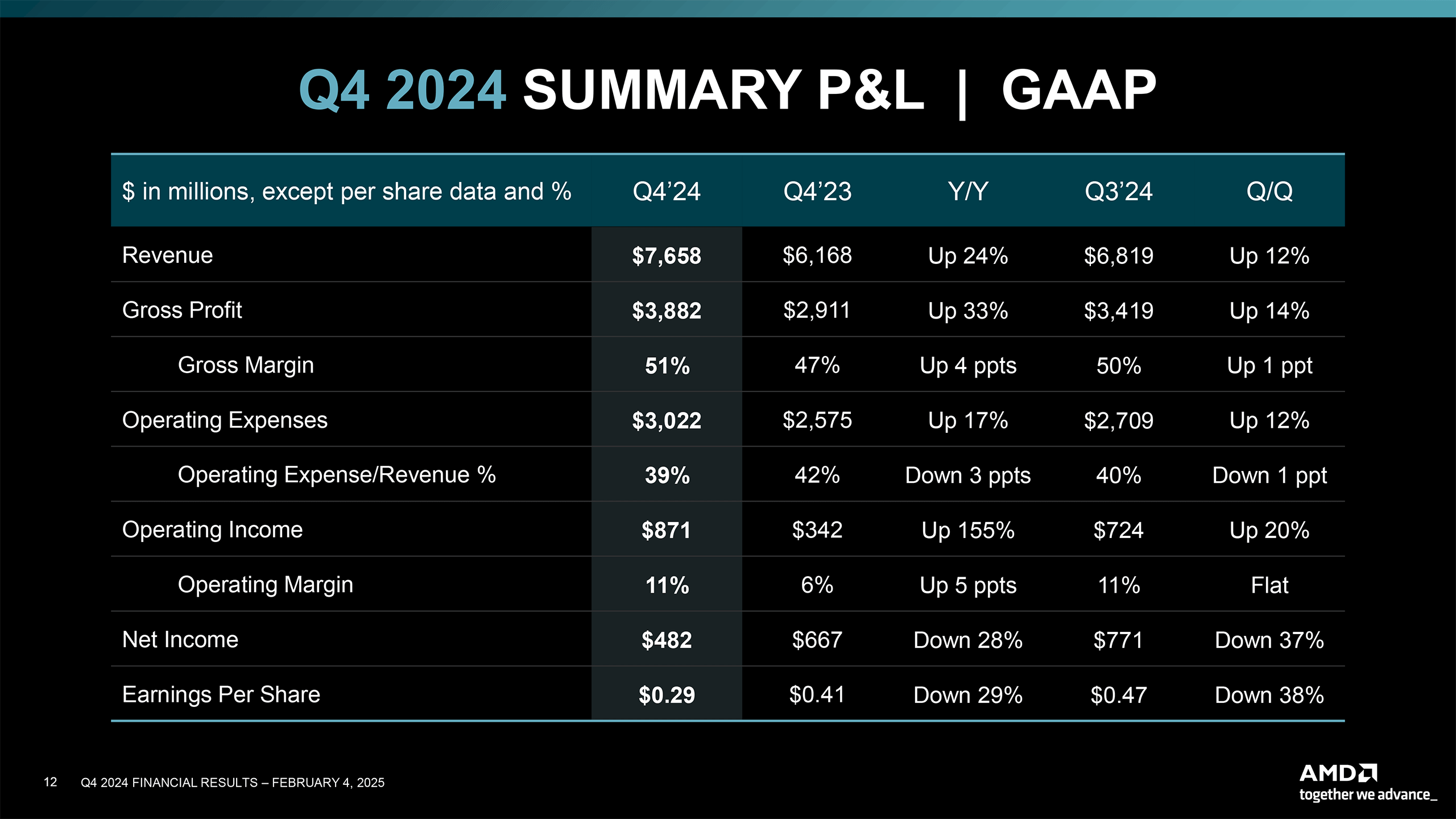

AMD's revenue in Q4 2024 totaled $7.658 billion, up 24% year-over-year. The company's gross margin hit 51%, whereas net income was $482 million. On the year basis, 2024 was AMD's best year ever as the company's revenue reached $25.8 billion, up 14% year-over-year. The company earned net income of $1.641 billion as its gross margin hit 49%. But while the company's annual results are impressive, there is something about Q4 results that AMD should be proud of.

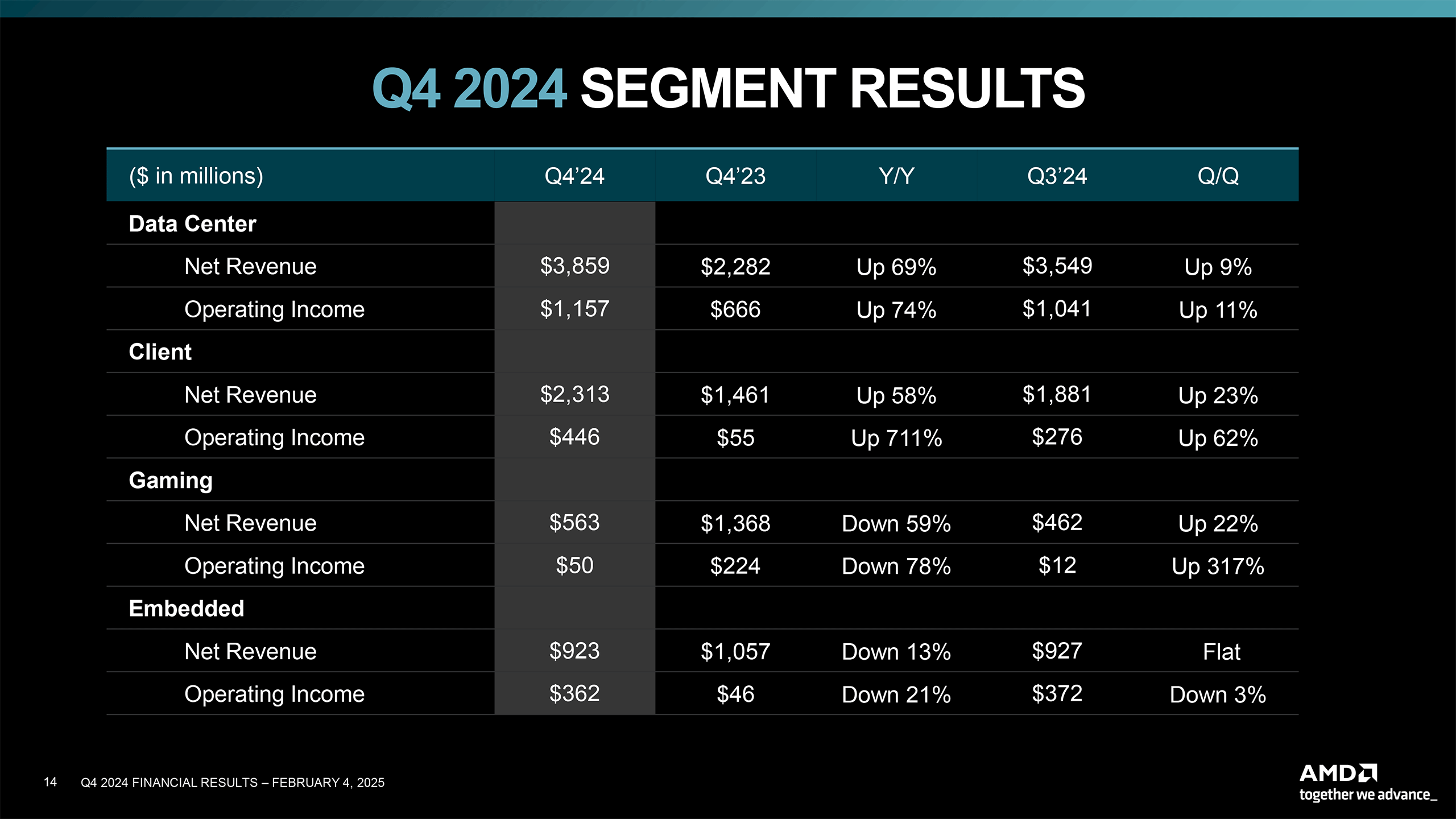

Datacenter business was the company's primary source of earnings, with net revenue reaching record $3.86 billion in Q4, marking a 69% year-over-year (YoY) increase and a 9% quarter-over-quarter (QoQ) rise. Operating income also saw substantial improvement, surging 74% YoY to $1.16 billion. By contrast, Intel's datacenter and AI business unit posted $3.4 billion revenue, while its operating income reached $200 million. But while the quarter marked a milestone for AMD, market analysts expected AMD to sell more of its Instinct MI300-series GPUs for AI and HPC.

AMD's client business unit, which includes CPUs for desktops and laptops, showed exceptional growth in Q4. Net revenue climbed 58% YoY to $2.31 billion and 23% QoQ. However, the standout figure was the 711% year-over-year surge in operating income, reaching $446 million.

Unfortunately for AMD, its gaming business struggled in the fourth quarter, with net revenue declining to $563 million, or 59% less compared to the same timeframe in the previous year. The operating income of the unit plunged 78% year-over-year to just $50 million. The major decline being the result of lower sales of Radeon discrete GPUs as well as system-on-chips for Microsoft's Xbox and Sony's PlayStation game consoles.

AMD's embedded segment saw a moderate decline in the fourth quarter with net revenue falling to $923 million, or by 13% compared to Q4 2023, while operating income dropped 21% to $362 million. On a quarter-to-quarter basis, revenue remained flat, but operating income declined 3%.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Anton Shilov is a contributing writer at Tom’s Hardware. Over the past couple of decades, he has covered everything from CPUs and GPUs to supercomputers and from modern process technologies and latest fab tools to high-tech industry trends.

-

TerryLaze ...Reply

But only if you exclude the additional 1.6bil sales Intel did in Network and Edge which is a big part of datacenter operations....

AMD made more net money from datacenter than intel did, but the article says outsells not outprofits. -

tamalero Reply

isnt that a completely different segment?TerryLaze said:...

But only if you exclude the additional 1.6bil sales Intel did in Network and Edge which is a big part of datacenter operations....

AMD made more net money from datacenter than intel did, but the article says outsells not outprofits.

AMD does not sell network devices. -

oofdragon AMD > IntelReply

They won't ever beat Nvidia the way things are stacked already, but they could do much better if they stopped playing catch up. Just Give gamers a great rasterization card for a great price and we are good -

salgado18 Reply

"They won't ever beat Intel" is a phrase that was used a lot 10 years ago, and look where we are. Not saying they can pull a Ryzen trick on GPUs, since these are more evolutionary than revolutionary, and Nvidia is in a very good shape unlike quad-core-max-Intel, but one mistake from green team and one hit from red team could sure turn the game around.oofdragon said:AMD > Intel

They won't ever beat Nvidia the way things are stacked already, but they could do much better if they stopped playing catch up. Just Give gamers a great rasterization card for a great price and we are good -

YSCCC Reply

Actually right till now some are still claiming the Arrow lakes are the best available and AMD only is second best, and evidence is that datacenters and coporate still very lean to intel chips, now waiting for the fake news claimers chime insalgado18 said:"They won't ever beat Intel" is a phrase that was used a lot 10 years ago, and look where we are. Not saying they can pull a Ryzen trick on GPUs, since these are more evolutionary than revolutionary, and Nvidia is in a very good shape unlike quad-core-max-Intel, but one mistake from green team and one hit from red team could sure turn the game around. -

hotaru251 Reply

in past sure, but now? thats likely not going to work.oofdragon said:Just Give gamers a great rasterization card for a great price and we are good

Indiana jones game is showing that devs are going to RT as a base req for future and raster is no longer going to be good enough.

and what exactly would a mistake be?salgado18 said:but one mistake from green team and one hit from red team could sure turn the game around.

AMD gave up high market.

even a "mistake" likely wouldnt do much at this point.

AMD's only real advantage is they don't skimp on VRAM like nvidia does.

on CPU side AMD is effectively untouched as Intel's the 1 playing catch up (thoguh nvidia might enter that field as they are supposedly working on ARM cpu's) -

TheOtherOne Reply

There are many gamers out there (including me!) who do NOT care about Raytracing and other new fancy crap like fake frames and other AI stuff. Make cards for those gamers that won't cost a leg and an arm. There's a reasonable, maybe even HUGE market out there for them!oofdragon said:AMD > Intel

They won't ever beat Nvidia the way things are stacked already, but they could do much better if they stopped playing catch up. Just Give gamers a great rasterization card for a great price and we are good -

DS426 Reply

Intel is still cutting labor and restructing; they've always been a much larger company than AMD (although it's the smallest gap ever now), so when revenues are similar between the two, you bet AMD will have better margins on that revenue. Next fiscal year should show better margins for Intel, assuming they can stop the DCAI hemorrhaging .jp7189 said:To me the real shocker is AMD's gross margins beating out Intel's.

I'm still surprised that they were able to turn a profit on the much lower gaming GPU sales. Also impressive to see the gains in client, even if not entirely impressive.

As for MI300... nVidia has long won the hearts of minds of every kind of GPU buyer, whether AI, general datacenter, enterprise & professional, or gamer, so... yup, this will continue to be an uphill battle for the foreseeable future. Now, I'd like to think MI325 and 355 will help gain a tad bit of traction, but we'll have to see. -

magbarn Nvidia has a horrible 5080/5090 launch and guess what? All 7900XTX are sold out except scalped/overpriced models. Is AMD even making them anymore? Unlikely the 9070XT can compete given that AMD already has admitted it'll be slower than their flagship.Reply