AMD's desktop PC market share skyrockets amid Intel's Raptor Lake CPU crashing scandal — AMD makes biggest leap in recent history

Though Intel says it was an inventory adjustment at one of its customers.

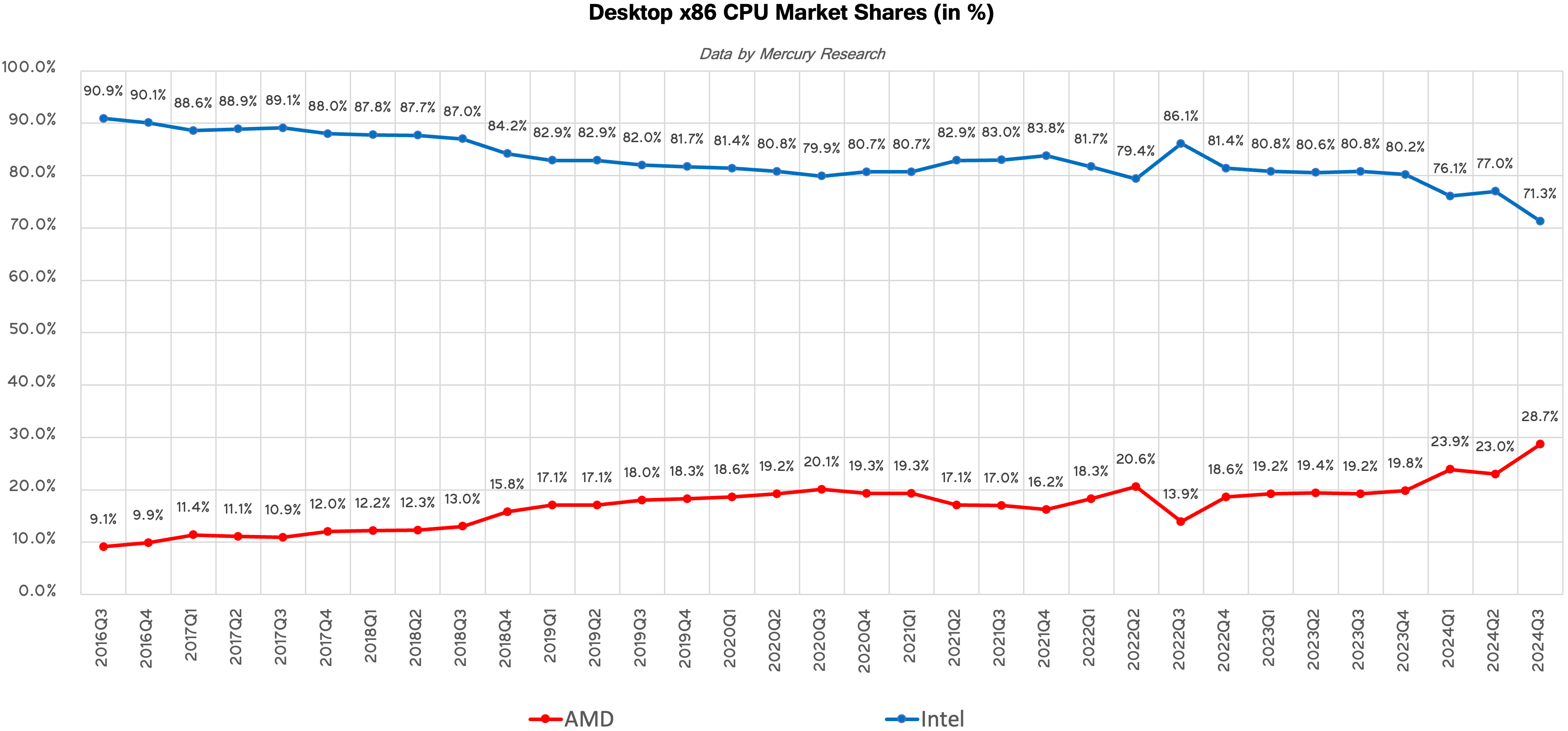

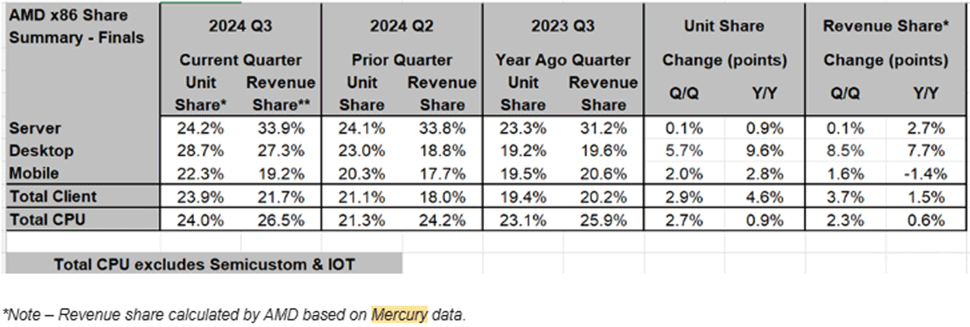

AMD has gained a substantial 5.7 percentage points of share of the desktop x86 CPU market in the third quarter compared to Q2, the largest quarterly share gain since we began tracking the market share reports in 2016. It also represents an incredible ten percentage point improvement over the prior year. AMD also raked in a strong increase in revenue share, jumping 8.5 percentage points over the prior quarter, indicating that it is selling a strong mix of higher-end CPU models.

During the quarter, AMD launched its new Ryzen 9000-series family of processors amid a scandal related to stability issues with Intel's Raptor Lake chips, which generated a flood of negative press for the company over the course of several months, and inventory adjustments for one of Intel's customers. AMD now commands 28.7% of the desktop processor market. AMD also continued to gain share in the laptop and server markets, though its gains on the desktop side of the business were the most impressive, according to Mercury Research.

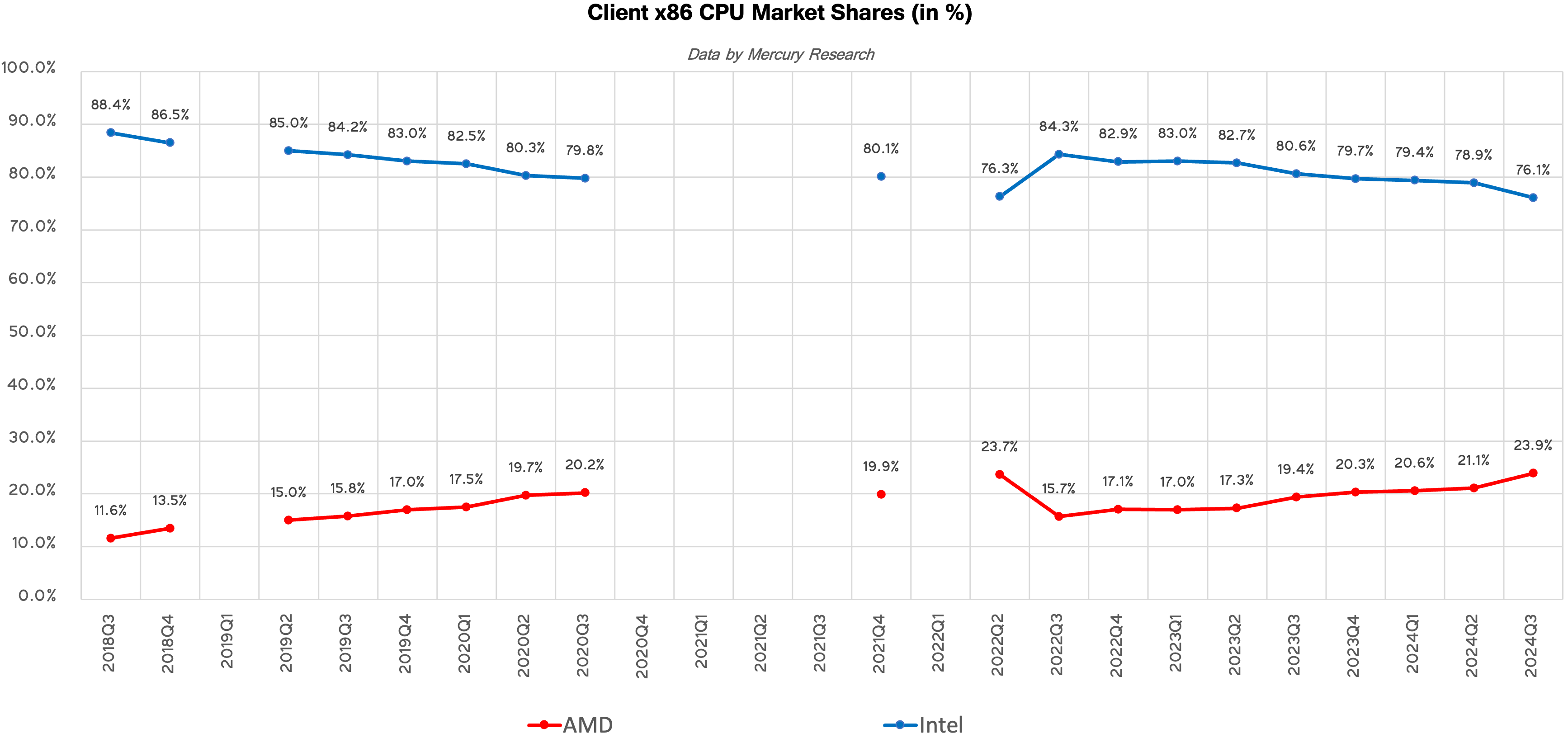

In Q3 2024, Intel maintained a strong lead in the client PC market, commanding 76.1% of the market in terms of units, while AMD held a smaller 23.9% share. However, the dynamics are not in Intel's favor, as AMD gained 2.9 percentage points (pp) quarter-over-quarter and 4.6 pp year-over-year, which are significant achievements. Intel will, of course, continue to lead in client PCs for the foreseeable future as the company has extensive and diverse product offerings for client PCs, an entrenched position in the corporate PC sector, and access to its vast manufacturing capacities.

Desktop PC, Mobile, Client Revenue / Unit Share

| Row 0 - Cell 0 | 3Q24 | 2Q24 | 1Q24 | 4Q23 | 3Q23 | 2Q23 | 1Q23 | 4Q22 | 3Q22 | 2Q22 | 1Q22 | 4Q21 | 3Q21 | 2Q21 | 1Q21 | 4Q20 | 3Q20 | 2Q20 | 1Q20 | 4Q19 | 3Q19 | 2Q19 | 1Q2019 | 4Q18 | 3Q18 | 2Q18 | 1Q18 | 4Q17 | 3Q17 | 2Q17 | 1Q17 | 4Q16 | 3Q16 |

| AMD Desktop Unit Share | 28.7% | 23.0% | 23.9% | 19.8% | 19.2% | 19.4% | 19.2% | 18.6% | 13.9% | 20.5% | 18.3% | 16.2% | 17.0% | 17.1% | 19.3% | 19.3% | 20.1% | 19.2% | 18.6% | 18.3% | 18% | 17.1% | 17.1% | 15.8% | 13% | 12.3% | 12.2% | 12.0% | 10.9% | 11.1% | 11.4% | 9.9% | 9.1% |

| Quarter over Quarter / Year over Year (pp) | +5.7% / +9.6% | -1% / +3.6 | +4.1 / +4.7 | +0.6 / +1.2 | -0.2 / +0.5 | +0.1 / -1.02 | +0.6 / +0.9 | +4.7 / +2.4 | -6.6 / -3.1 | +2.2 / +3.4 | +2.1 / -1.0 | -0.8 / -3.1 | -0.1 / -3.1 | -2.3 / -2.1 | +0.1 / +0.7 | -0.8 / +1.0 | +0.9 / +2.1 | +0.6 / +2.1 | +0.3 / +1.5 | +0.3 / +2.4 | +0.9 / +5 | Flat / +4.8 | +1.3 / +4.9 | +2.8 / +3.8 | +0.7 / +2.1 | +0.1 / +1.2 | +0.2 / +0.8 | +1.1 / +2.1 | -0.2 / +1.8 | -0.3 / - | +1.5 / - | +0.8 / - | - |

AMD's biggest breakthrough in the third quarter was, of course, gaining 5.7 pp of unit share of the desktop x86 CPU market. The company now commands 28.7% of the market, up a whopping 9.6 pp compared to the same quarter a year ago, which is likely the highest share the company has had in at least 15 years. AMD's desktop CPU revenue share also increased by 7.7 pp year-over-year to 27.3%.

Intel's desktop share dropped to 71.3%, and Dean McCarron with Mercury Research tells us Intel explained the decline was caused by an inventory correction at one of its customers. If this is true, then Intel's share may bounce back in Q4 2024.

| Row 0 - Cell 0 | 2Q24 | 2Q24 | 1Q24 | 4Q23 | 3Q23 | 2Q23 | 1Q23 | 4Q22 | 3Q22 | 2Q22 | 1Q22 | 4Q21 | 3Q21 | 2Q21 | 1Q21 | 4Q20 | 3Q20 | 2Q20 | 1Q20 | Q419 | 3Q19 | 2Q19 | 1Q2019 | 4Q18 | 3Q18 | 2Q18 |

| AMD Mobile Unit Share | 22.3% | 20.3% | 19.3% | 20.3% | 19.5% | 16.5% | 16.2% | 16.4% | 15.7% | 24.8% | 22.5% | 21.6% | 22.0% | 20.0% | 18.0% | 19% | 20.2% | 19.9% | 17.1% | 16.2% | 14.7% | 14.1% | 13.1% | 12.2% | 10.9% | 8.8% |

| Quarter over Quarter / Year over Year (pp) | +2% / 2.8% | +1 / +3.8 | -1 / +3.1 | 0.8 / 3.9 | 2.9 / 3.8 | 0.3 / -8.3 | -0.2 / -6.3 | +0.8 / -5.1 | -9.1 / -6.4 | +2.3 / +4.8 | +0.9 / +4.4 | -0.4 / +2.6 | +2.0 / +1.8 | +1.9 / +0.01 | -1.0 / +1.1 | -1.2 / +2.8 | +0.3 / +5.5 | +2.9 / +5.8 | +0.9 / +3.2 | +1.5 / +4.0 | +0.7 / +3.8 | +1.0 / +5.3 | +0.9 / ? | Row 2 - Cell 24 | Row 2 - Cell 25 | Row 2 - Cell 26 |

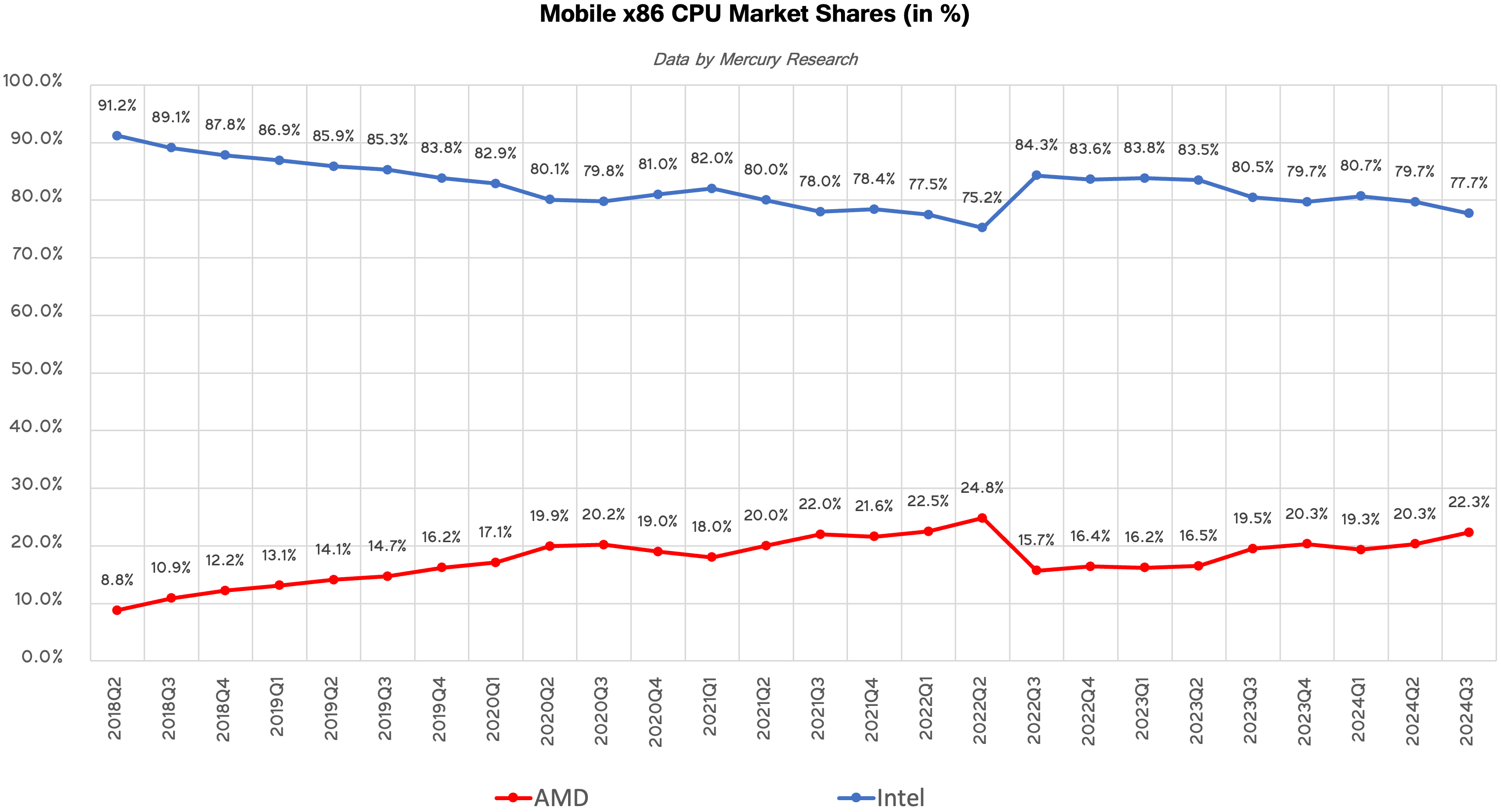

In the laptop segment, AMD saw steady growth compared to both the previous quarter (+2 pp) and the same period last year (+2.8 pp), perhaps because the company launched its Ryzen AI 300-series products slightly ahead of Intel's Lunar Lake and could sell more of these new products to early adopters of x86-based Copilot+ PCs. In Q3 2024, AMD held 22.3% of the x86 laptop processor market, whereas Intel's share decreased to 77.7%.

22.3% is not exactly AMD's record mobile CPU market share, as the company commanded 24.8% in Q2 2022.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Server Revenue / Unit share

| Row 0 - Cell 0 | 3Q24 | 2Q24 | 1Q24 | 4Q23 | 3Q23 | 2Q23 | 1Q23 | 4Q22 | 3Q22 | 2Q22 | 1Q22 | 4Q21 | 3Q21 | 2Q21 | 1Q21 | 4Q20 | 3Q20 | 2Q20 | 1Q20 | 4Q19 | 3Q19 | 2Q19 | 1Q2019 | 4Q18 | 3Q18 | 2Q18 | 4Q17 |

| AMD Server Unit Share | 24.2% | 24.1% | 23.6% | 23.1% | 23.3% | 18.6% | 18% | 17.6% | 17.5% | 13.9% | 11.6% | 10.7% | 10.2% | 9.5% | 8.9% | 7.1% | 6.6% | 5.8% | 5.1% | 4.5% | 4.3% | 3.4% | 2.9% | 3.2% | 1.6% | 1.4% | 0.8% |

| Quarter over Quarter / Year over Year (pp) | +0.1% / +0.9% | +0.5 / + 5.6 | +0.5 / +5.6 | -0.2 / 5.5 | 4.7 / 5.8 | 0.6 / 4.7 | +0.4 / +6.3 | +0.1 / +6.9 | +3.6 / +7.3 | +2.3 / +4.4 | +0.9 / +2.7 | +0.5% / +3.6 | +0.7 / +3.6 | +0.6 / +3.7 | +1.8 / +3.8 | +0.5 / +2.6 | +0.8 / +2.3 | +0.7 / +2.4 | +0.6 / 2.2 | +0.2 / +1.4 | +0.9 / +2.7 | +0.5 / +2.0 | -0.3 / - | +1.6 / 2.4 | +0.2 / - | Row 2 - Cell 26 | Row 2 - Cell 27 |

When it comes to servers, AMD's share totaled 24.2% as the company gained 0.1 pp unit share sequentially and 0.9 pp year-over-year, which is a rather modest increase but reflects the company's gradual market share gain. However, the company also increased its revenue share to 33.9%, a 2.7 pp gain year-over-year. Typically, AMD advances its share amid the ramp-up of its latest EPYC processors when its server partners roll out products based on them, so it is reasonable to expect the company to post a market share gain in the coming quarters.

Intel, of course, retained its volume lead with a 75.8% unit market share. Yet, as it usually happened in the recent quarter, AMD managed to sell more higher-end CPU models than Intel, which is reflected by its revenue share, which is higher compared to its unit share. It is also noteworthy that for the first time, AMD's data center business unit outsold Intel's data center and AI group in Q3 2024 ($3.549 billion vs $3.3 billion).

Anton Shilov is a contributing writer at Tom’s Hardware. Over the past couple of decades, he has covered everything from CPUs and GPUs to supercomputers and from modern process technologies and latest fab tools to high-tech industry trends.

-

-Fran- The biggest thing that baffles me is this: Intel is a behemoth and commands (still) 70%+ of the market (check note 1) and it still is in this much trouble. Like... How can you have such bad management that with this much of a lead in size and market share you just can't get things into a proper grip and get out of the hole.Reply

Pat has been doing a terrible job, sorry. He needs the boot, for sure, but then again I think: who would even want to try here? Sure, internal candidates would flock over to just have "Intel CEO" in their CVs, but would leave for stupid reasons (like having office affairs... ugh) when they realize they're over their heads.

Several reports say Intel's biggest enemy is itself, not anyone else, which is baffling. In-fighting for petty political reasons is the worst that can happen.

Note1: X86, but X86 vs ARM in PC and Server is almost 95%+ for X86. I'm leaving mobile (phones and tablets) completely out.

Regards. -

stuff and nonesense Reply

Big business needs big money to service its outgoings. If they can’t sell enough parts then at a threshold point the company loses money.-Fran- said:The biggest thing that baffles me is this: Intel is a behemoth and commands (still) 70%+ of the market (check note 1) and it still is in this much trouble

Shareholders want their cut of the profits, if they aren’t getting their cut there is the option to sell and “invest” elsewhere. This forces forces the share price down. Share prices determine the market cap and how much the company can borrow so less money is available for investment..

If Intel can’t cover its costs with its income then outgoings, staff, gets cut and all too often the accountants will try to reduce investment in engineering and invention. I hope Intel doesn’t go down that path. -

Jimbojan Intel wasn't able to produce product ahead of AMD’s in the 3Q24, but now, Intel got its instability issue solved, plus, its server chips is again ahead of AMD’s, Intel should get back to its volume leader again. No more losing share from here on.Reply -

qwertymac93 Reply

In what way have Intel's latest server parts leapfrogged AMD's? I think momentum in the enterprise/datacenter is a big deal and it's why AMD has in the past had such a hard time gaining share there; it's going to work in their favor now as Intel will likely be affected by their recent performance/scandals for the next couple years.Jimbojan said:Intel wasn't able to produce product ahead of AMD’s in the 3Q24, but now, Intel got its instability issue solved, plus, its server chips is again ahead of AMD’s, Intel should get back to its volume leader again. No more losing share from here on.

I work with a lot of customers and for years I would get pushback for recommending AMD parts, either because the guys had never heard of AMD, or they'd only heard that their parts are slow, power hungry, and incompatible with Intel's (for the purposes of live migrations/virtualization for example). It wasn't until maybe 2022 that I'd finally convinced most of my clients that AMD's parts are as good or better than Intel's when the price is right. That's despite the fact that they've been at least competitive long before then. -

Neilbob Reply

It's just Jimbojan. Jimbojan has been Jimbojan'ing almost every quarter for several years now with the exact same or similar proclamations. Every new Intel Xeon about to be released will be all-powerful. Every Intel product is impeccable and every AMD product is a failure. AMD market share is about to collapse/Intel market share about to burgeon. Intel makes more money, so AMD is both useless and doomed. Intel has amazing products coming that I know about but no-one else has even seen leaks of, AMD has nothing coming ever again.qwertymac93 said:In what way have Intel's latest server parts leapfrogged AMD's? I think momentum in the enterprise/datacenter is a big deal and it's why AMD has in the past had such a hard time gaining share there; it's going to work in their favor now as Intel will likely be affected by their recent performance/scandals for the next couple years.

It could almost be a dictionary entry. To Jimbojan: to engage in the act of blind fanboy bias, with fingers planted firmly in ears and going 'la-la-la'.

Maybe it could be a procedure at the optometrist: laser eye Jimbojannation - a procedure to have the phrase 'Intel iz da winnar' burned on to the corneas.

For myself, I'm assuming that Intel will return to being competitive at some point in the future, and that'll hopefully be sooner rather than later, because AMD is NOT our friend, and WILL become major money-grubbers without decent competition. -

Mattzun I'm not seeing anything showing a change in market share that would be in line with the severity of Intel's issues.Reply

That huge last quarter gain brings AMD market share back to the point where it was back in 2022 when Zen3 and the 5800X3D were competing with Intel 11th gen.

It looks like the five percent of the market that is build your own PCs has swung completely back to AMD but that OEMs are still buying mostly Intel at the level they did in 2022.

Either the 13th/14th gen issues didn't impact the OEMs much (likely - lots of 75 watt parts) and/or they are getting great prices and reimbursement for excess RMA expenses from Intel (also likely)

Given that Intel has NO gaming CPUs in its current lineup, the 5 percent change have happened in Q1 2025 even if 13th and 14th gen i7 and i9's weren't massively flawed. -

Ogotai Reply

are you sure about that ? can you prove it ? cause no one will know, at all, for at last 6 months, if 13th and 14th gen are fixed, or if the new ultra ( 15th gen ???? ) will or will not have the same issues....Jimbojan said:Intel got its instability issue solved

either way, no one i know, is risking their money on buy intel now, at all, they have all gone with amd, and will probably stay with amd for 2-3 years cause if the issues with 13th and 14th gen, they just dont trust intel... -

SunMaster ReplyJimbojan said:Intel wasn't able to produce product ahead of AMD’s in the 3Q24, but now, Intel got its instability issue solved, plus, its server chips is again ahead of AMD’s, Intel should get back to its volume leader again. No more losing share from here on.

Intels server chips ahead of AMD? I think you've been cherrypicking information. -

YSCCC Reply

I think that's the big brand effects which kept intel dominating the market for the years, where once a while AMD did take a considerable lead in performance department, just because they think intel is more stable.qwertymac93 said:In what way have Intel's latest server parts leapfrogged AMD's? I think momentum in the enterprise/datacenter is a big deal and it's why AMD has in the past had such a hard time gaining share there; it's going to work in their favor now as Intel will likely be affected by their recent performance/scandals for the next couple years.

I work with a lot of customers and for years I would get pushback for recommending AMD parts, either because the guys had never heard of AMD, or they'd only heard that their parts are slow, power hungry, and incompatible with Intel's (for the purposes of live migrations/virtualization for example). It wasn't until maybe 2022 that I'd finally convinced most of my clients that AMD's parts are as good or better than Intel's when the price is right. That's despite the fact that they've been at least competitive long before then.

Which, after the headline catching instability issue for the RPL degradation, have changed quite a bit, even non gaming/tech geek people heard that intel is unstable maybe going to kick in for some time -

Kamen Rider Blade Reply

Another Intel fanboy denying reality and substituting his own.Jimbojan said:Intel wasn't able to produce product ahead of AMD’s in the 3Q24, but now, Intel got its instability issue solved, plus, its server chips is again ahead of AMD’s, Intel should get back to its volume leader again. No more losing share from here on.

Sorry, Intel's sinking slowly but surely.

It's "Itanic 2: Electric Boogaloo" time.