Nvidia is the 'kingmaker,' says analyst firm Omdia — company projected to make $87 billion from data center GPUs alone in 2024

AI is moving lots of Nvidia GPUs.

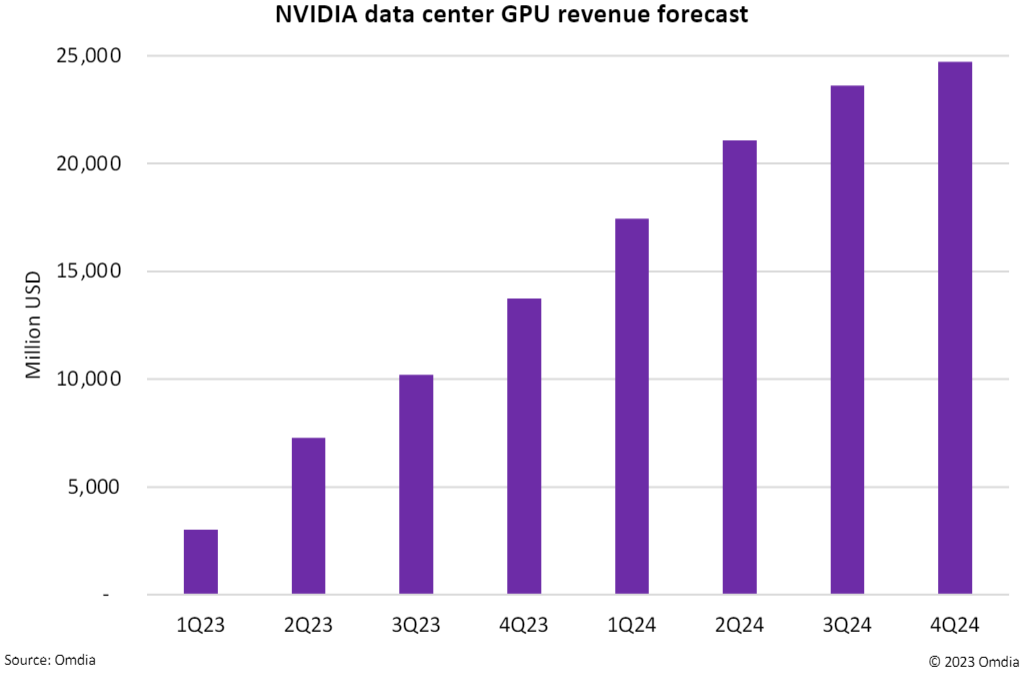

Nvidia could make $87 billion from its data center GPUs alone in 2024, according to market research firm Omdia. The firm's latest report shows estimates for how much money Nvidia made with its AI- and server-focused GPUs in 2023 and how that momentum may make 2024 an even bigger year for Nvidia. Omdia also highlights how Nvidia's massive sales figures directly impact market share between OEMs, with Nvidia being termed a "kingmaker."

Though it's been clear that Nvidia's rapidly rising data center revenue is thanks to its GPUs, the company doesn't report precisely how much its Ampere and Hopper server cards make. The data center segment on Nvidia's earnings sheet includes GPUs, CPUs, and networking hardware, which obfuscates revenue from GPUs specifically. Omdia's Cloud and Data Center Market Snapshot report for February, which is based on the firm's analysis, seeks to make that more clear.

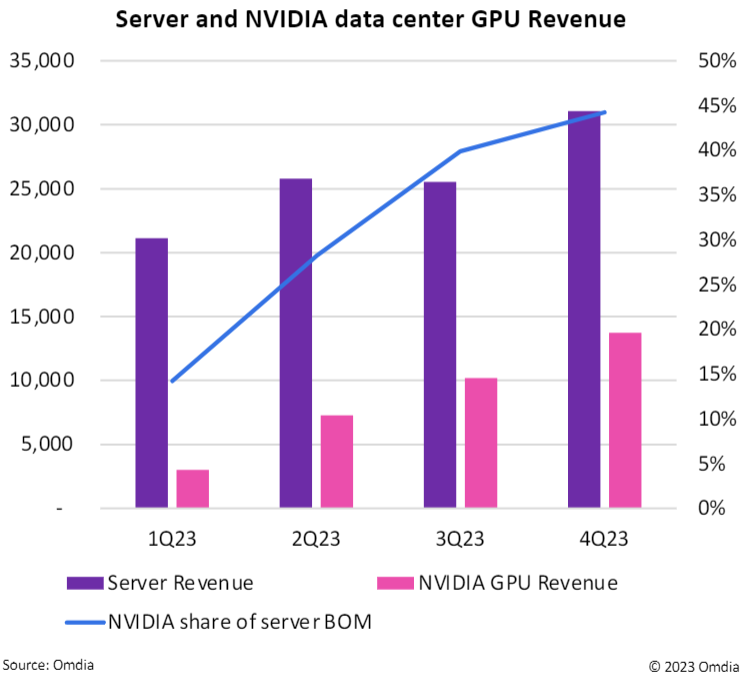

Overall, server and data center revenue in Q4 of 2023 was up 21.5% compared to Q3, and also 12.7% higher than in Q4 2022. This growth has at least been partially fueled by Nvidia, which saw its share of the server BOM Q4 reach 44% in Q4. In Q1 of last year, Nvidia's BOM share only stood at 15%, indicating that data centers are putting more and more of their budgets into Nvidia GPUs than ever before, and at a fast rate too.

In fact, it seems data centers are prioritizing buying more Nvidia GPUs over refreshing older servers equipped with previous-generation CPUs, RAM, and storage. Omdia expected about 3.4 million servers to be shipped in Q4, but the actual figure was only about 2.8 or 2.9 million, or half a million under expectations. The whole year saw about 11 million servers shipped, which is 22% lower than 2022 and 5% lower than 2018. Omdia says the usable life for hyperscalers is now 6.6 years, and other segments, like telco, can reach up to 7.6 years.

As expected, AI is a big part of this. The report estimates that in 2023, 40% of Nvidia's data center GPU revenue was thanks to demand for AI inference alone. Omdia expects that AI will be responsible for most of Nvidia's server GPU revenue in 2024, further pushing the company toward an AI-powered business model.

In all, Omdia says Nvidia made $34 billion in 2023 thanks to its data center GPUs, and Omdia expects that to keep going up in 2024 with an estimated revenue of $87 billion, or 150% more than in 2023.

What's particularly interesting is that Omdia thinks GPU demand will continue to outstrip supply for this year, as it predicts Nvidia's H100 GPUs will still be supply-constrained. Supply issues for H100 have gradually declined, with wait times for the popular data center card dropping to around four months today from nearly 11 months in late 2023. However, a single H100 GPU can still command high pricing, which implies demand is still high and supply is lagging behind.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Because of Nvidia's high importance in the server market, OEMs that have strong ties with the green giant have improved their standing, while those that aren't as close fell in the rankings. For instance, SuperMicro hit over 10% market share and surpassed HP Enterprise. In Q4 of 2022, HP Enterprise actually had over double the market share but saw a gradual decline over the year while SuperMicro expanded. This has led to Omdia calling Nvidia a "kingmaker" in the market.

In China, it's a somewhat different story since Nvidia has struggled to reestablish its GPU business there after multiple sanctions. The company only has the H20, L20, and L2 (and perhaps two other upcoming models) available for sale in China after the H800 and A800 were banned in October. But because it has taken Nvidia some time to restart shipments to China, its OEM partners there have suffered, such as IEIT Systems, which dropped to about 7% share in Q4, compared to about 12% in Q3.

Matthew Connatser is a freelancing writer for Tom's Hardware US. He writes articles about CPUs, GPUs, SSDs, and computers in general.