Wait times for Nvidia's AI GPUs ease to three to four months, suggesting peak in near-term growth — the wait list for an H100 was previously eleven months: UBS

Enough capacity due to China restrictions?

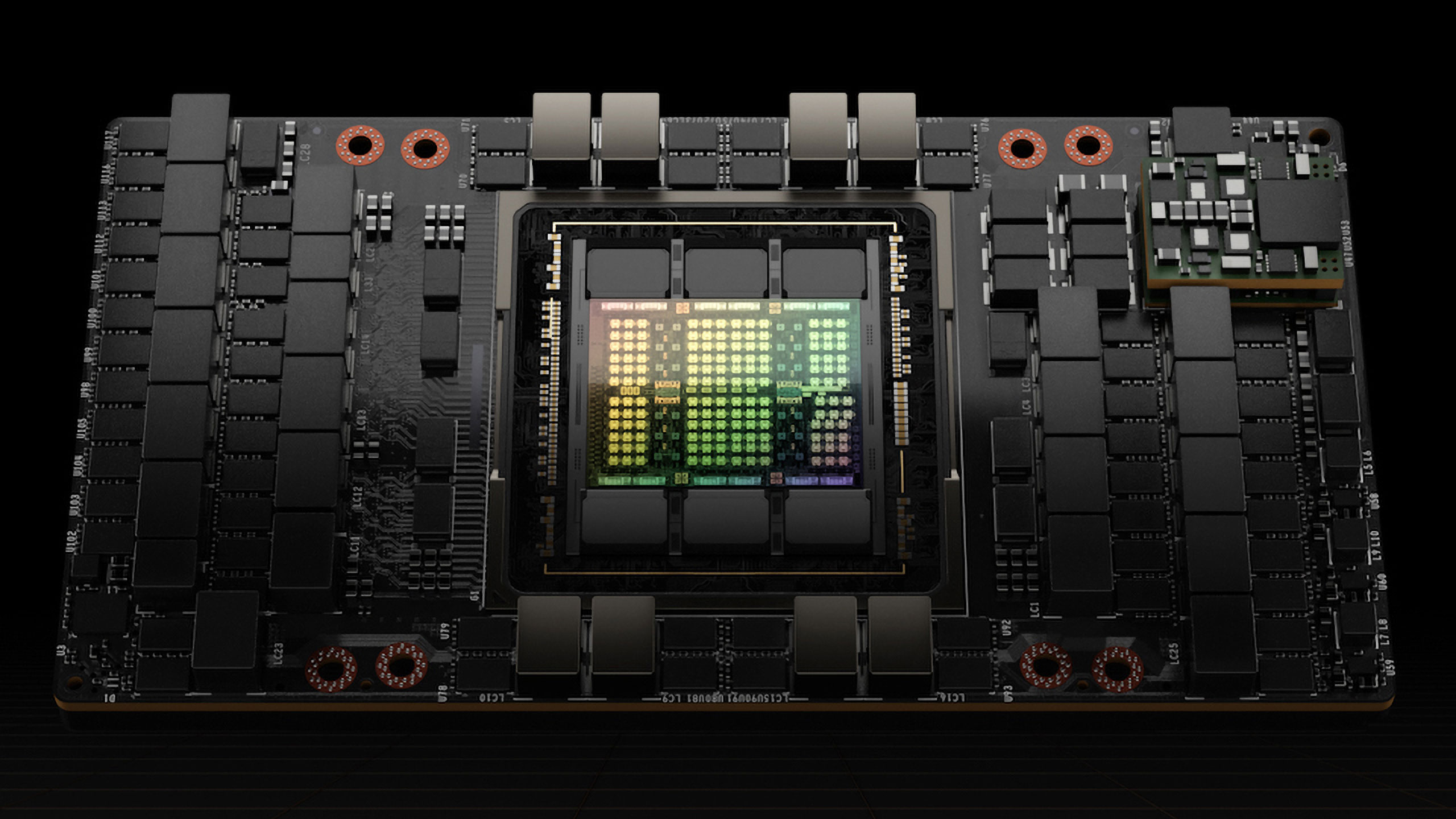

In a new note to its clients, analyst firm UBS says that the lead time (wait time) for Nvidia's hugely popular H100 80GB GPU for AI applications has shortened from 8-11 months to just 3-4 months (via SeekingAlpha). According to the firm, this shift suggests a potential peak in near-term growth but could signal trouble for Nvidia's future growth prospects. However, UBS still upgraded its outlook on Nvidia, increasing its earnings forecasts and target price to $850.

The reduction in lead times is a double-edged sword. On the one hand, it indicates that Nvidia's production partner TSMC (or its chip-packaging subcontractors) is expanding its CoWoS packaging production capacity (which limited the supply of H100 and other advanced processors used for AI applications), which means better supply and quicker fulfillment of orders. This efficiency could lead to short-term revenue and earnings boosts as the company can ship more products within a shorter timeframe. On the other hand, as lead times approach zero, Nvidia will transition from shipping against both backlogs and new orders to solely new orders, likely resulting in a decline in revenue.

TSMC said it would expand CoWoS capacity by the end of 2023 and double capacity from mid-2023 levels by the end of 2024. Perhaps the expansion of CoWoS capacity at TSMC or one of its OSAT partners is proceeding faster than expected, leading to the reduction in H100 lead times.

On the other hand, now that Nvidia cannot ship fully-enabled H100 to China due to U.S. restrictions, reportedly leading to lower demand in China, it might simply have plenty of 'spare' H100 silicon to ship elsewhere. While China accounts for a significant portion of Nvidia's revenue, it isn't clear if its reduced shipments could cause H100 lead times to shrink from 8-11 months to just 3-4 months.

The market currently anticipates continued growth for Nvidia, with no expected quarter-on-quarter drops in revenue up to January 2026. However, the rapid decrease in lead times suggests that this growth might cool off much sooner, potentially within the next two or three quarters. Analysts note this scenario is not reflected in the stock's current valuation, which assumes uninterrupted growth.

Despite the potential for a slowdown in Nvidia's growth, it's important to note that the overall AI capacity will continue to expand. Nvidia's shipments will contribute to the growing install base of GPUs, and other competitors will add to this growth. Therefore, while Nvidia's sequential growth may face challenges, the broader AI industry will continue to advance.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Anton Shilov is a contributing writer at Tom’s Hardware. Over the past couple of decades, he has covered everything from CPUs and GPUs to supercomputers and from modern process technologies and latest fab tools to high-tech industry trends.

-

watzupken That’s because Chinese companies were hoarding these AI GPUs in anticipation of further sanctions. This is similar to Huawei hoarding 7nm chips from TSMC just before the sanction. That’s why it’s expected that sales won’t sustain.Reply -

DavidLejdar I know, that there is value in improved technology for data processing. In particular improved RAM helps a lot with that, as a data process doesn't need a back and forth of terabytes of data with usually slower storage device.Reply

But with all the hype about autonomous AI, I am a bit worried, that Nvidia in particular may have an AI, which goes rogue and overtakes or makes all of their networks unusable (such as by basically frying them). Something which wouldn't be good for the share price, I suppose.

And I am just an average worker, who, unlike institutional investors, doesn't have the time to constantly keep checking for such news, to then quickly sell. That's why I am somewhat reluctant to purchase Nvidia shares, even if it may sure still have some potential nice return within a relatively short time frame.