Threadripper 7000 outsells Intel Xeon 10 to 1, but Intel's mainstream PC chips dominate Ryzen 7000 in Puget Systems 2024 Hardware Trends report

Ryzen 7000 wasn't a big hit for Puget customers.

Puget Systems has released its 2023 Hardware Trends survey, which details the CPUs, GPUs, storage, and operating systems that Puget's customers order. Since Puget builds workstations in particular, its annual Hardware Trends surveys show vastly different data than the Steam Hardware Survey, which is gaming-focused, thus giving us insight into a different market segment.

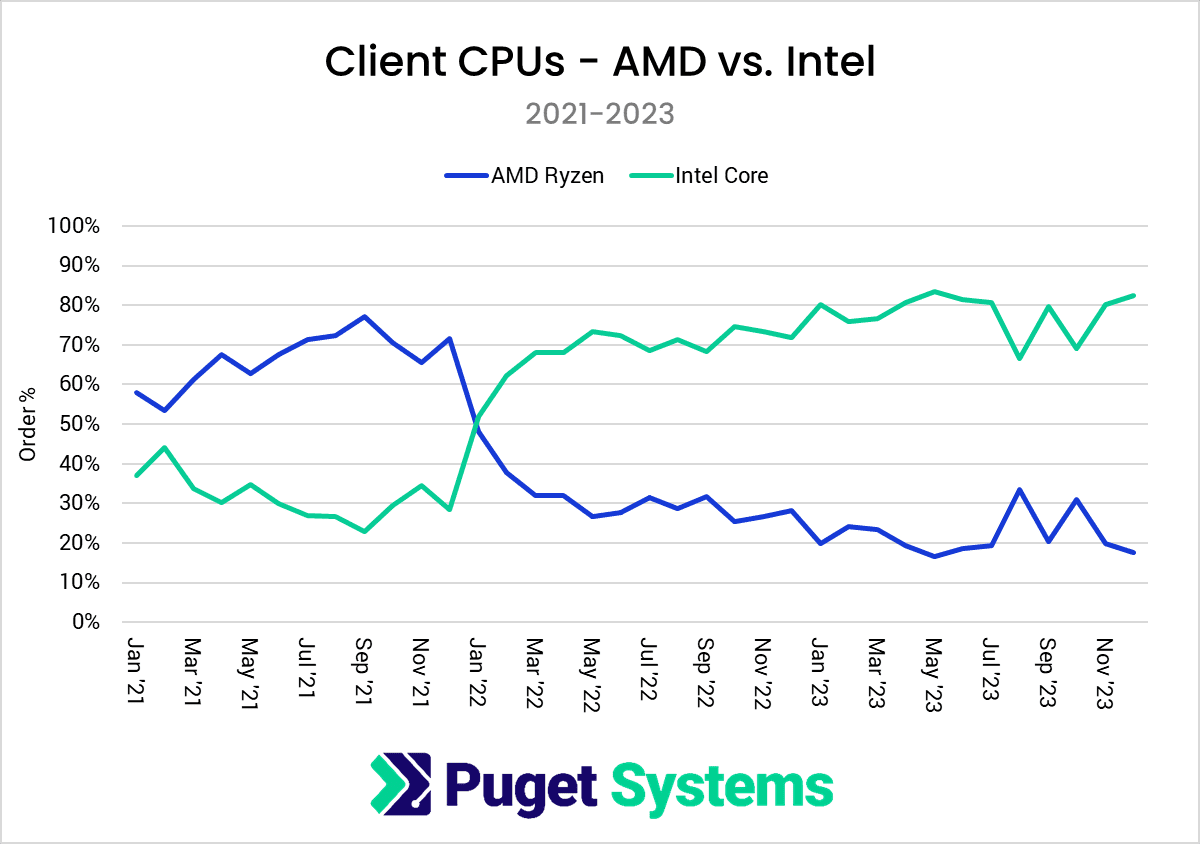

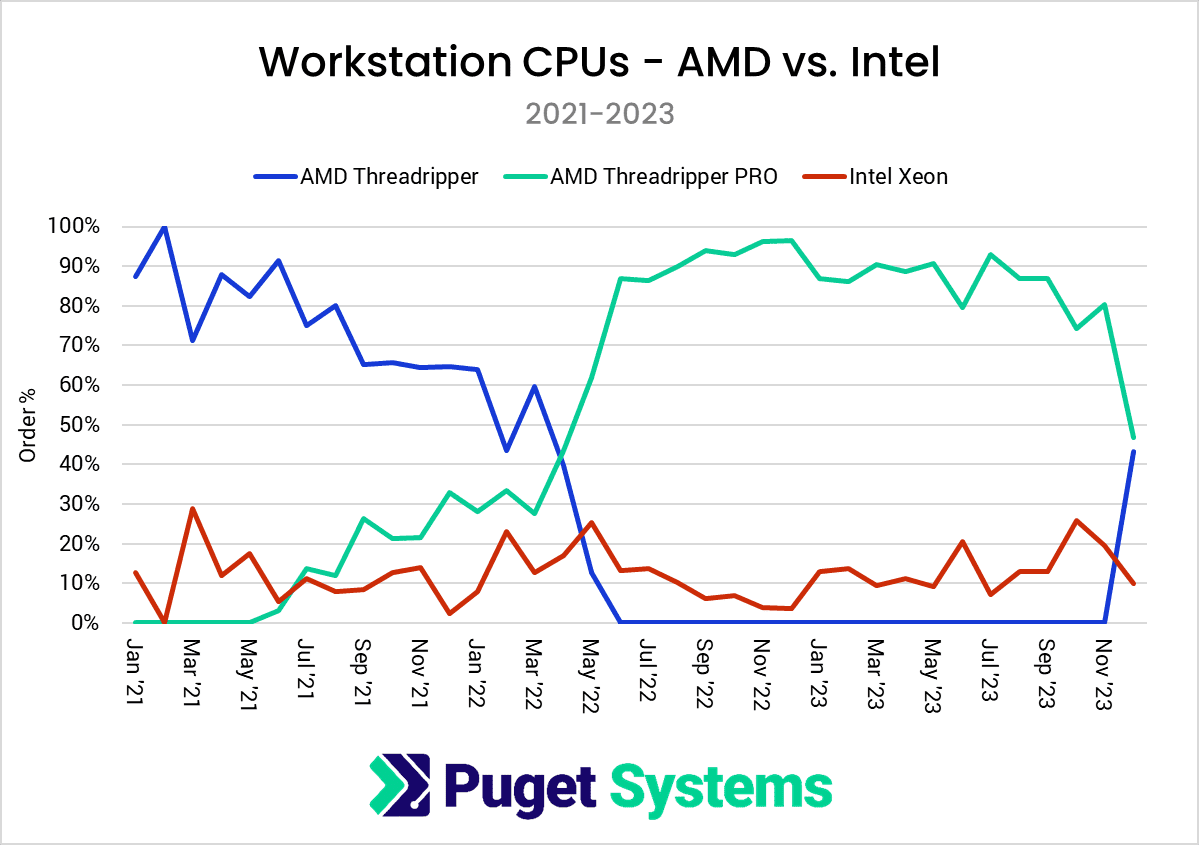

The survey found that Intel outsold AMD about four to one in client CPUs, while AMD outsold Intel ten to one in workstation CPUs. Neither Ryzen 7000 nor 4th Gen Xeon have made much of an impact in their respective markets, though Threadripper 7000 did make a splash in the workstation numbers. We've included further analysis of the CPU sales, along with Puget's findings for GPUs, storage, and OSes, below.

Intel continues to dominate in client CPUs despite Ryzen 7000

AMD's Ryzen 5000 was the top choice for Puget's customers in 2021, given how slow Intel's competing 11th-Gen CPUs were by comparison, but 2022 saw the tables flip thanks to Intel's 12th-Gen Alder Lake chips.

In 2023, you might have expected AMD to take the lead again or at least narrow the gap thanks to the launch of Ryzen 7000, but Intel's rival actually lost more ground in 2023.

Clearly, Puget's customer base prefers Intel's 13th-Gen to Ryzen 7000, and since 13th-Gen does have some advantages, it's not surprising that it has a lead. The size of Intel's lead is surprising, though, with AMD sitting below 20% and Intel at just over 80%. In terms of performance, Puget's 13th-Gen content creation performance testing showed that Ryzen 7000 trades blows overall.

Whatever the case is, mainstream workstation users clearly like Intel these days, and it will be interesting to see whether AMD can make a comeback with Ryzen 8000. However, Intel will also launch its Arrow Lake CPUs, and although we don't know exactly what to expect with Intel's next generation, it's unlikely it will trail as badly as it did in 2020 and 2021.

Users ditch Threadripper Pro for Threadripper 7000

While Intel's turf is client CPUs, AMD's is hardcore workstation CPUs, where in 2023, the read team had a market share of 90% to Intel's 10%. Threadripper's market share actually slipped a bit compared to 2022, which saw AMD's workstation chips hit 95% share, indicating that Sapphire Rapids took a little bite out of AMD. However, AMD is by far number one in workstation processors, which more than makes up for Ryzen 7000's disappointing performance in 2023.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

For workstations, the single biggest launch of the year was Threadripper 7000, including not just expensive Pro models but also regular "HEDT" models, which were thought to be gone for good when Threadripper 5000 only offered Pro CPUs. Although the regular Threadripper 7000 only has four memory channels and up to 1TB of RAM compared to the eight channels and 2TB of memory on the Threadripper Pro 7000, the non-pro CPUs are about half the price per core.

Despite the Threadripper 7000 only being on the market in December, it's already nearly overtaken the Threadripper Pro 5000 and 7000, combined. If we had numbers for January, we'd certainly expect Threadripper to be back on top like it was before the launch of Threadripper Pro 5000. Clearly, workstation users don't want to pay nearly twice the price for the same amount of cores, even if that means double the memory channels and supported amount of RAM.

For the 2024 survey, it will be interesting to see whether Intel can take yet more market share from AMD. Emerald Rapids launched at the end of 2023, so this year, Puget will presumably be able to build Emerald Rapids-powered workstations. Despite not offering many cores and using the same Intel 7 process seen in Sapphire Rapids, Emerald Rapids is actually quite potent, especially for AI workloads.

GPU, storage, and operating system statistics

The rest of Puget's Hardware Trends 2023 data focuses on GPU, storage, and OS usage, all of which haven't really changed much and are probably unlikely to change much in 2024. Given Nvidia's dominance in workstation graphics cards, Puget's GPU market share is divided between gaming GeForce cards and workstation (formerly Quadro) cards; Puget's customers just don't order very many AMD or Intel GPUs. GeForce stands at about 80% market share despite not having driver-level optimizations for certain workloads, which is a key selling point of Nvidia's professional GPUs.

When it comes to storage, NVMe unsurprisingly continues to have a nearly 100% share of primary drives. Of primary drives, half are 1TB, and about a third are 2TB, though 4TB and 8TB models are ticking up in usage. Even for secondary storage, NVMe clearly is still the number one choice, as it represents over 80% of all storage devices sold by Puget in 2023, with SATA SSDs sitting at around 10% and hard drives at roughly 5%.

Operating system usage was about as you'd expect: Windows 11 continued to replace Windows 10, which stood at about 80% and 10% share, respectively. However, Linux finally overtook Windows 10 for the first time with just over 10% usage. Though Linux is obviously not used nearly as much as Windows in general, Puget's data indicates it has been gradually gaining momentum since 2021.

Matthew Connatser is a freelancing writer for Tom's Hardware US. He writes articles about CPUs, GPUs, SSDs, and computers in general.

-

MBOO7 AMD is capacity limited, why should they reallocate plenty of capacity into ryzens when products with much higher margins and basically no competition are selling like hot cakes. This doesnt have to do anything with the customer side but mostly AMD controlling its supply channels and naturally focusing on enterprise and data center... its simple economics, stupid.Reply -

SSGBryan Not really a surprise about the client side - if your workload is heavily multi-threaded, you will tend to go with the system that gives you more cores (even if some of those are efficiency cores), if the price is the same (or nearly the same).Reply

Matt - spell check won't notice if you use the wrong word.

Hint: read isn't the same as red. -

tamalero Reply

Agree.MBOO7 said:AMD is capacity limited, why should they reallocate plenty of capacity into ryzens when products with much higher margins and basically no competition are selling like hot cakes. This doesnt have to do anything with the customer side but mostly AMD controlling its supply channels and naturally focusing on enterprise and data center... its simple economics, stupid.

Intel played the long play back then and killed Ruiz's (then CEO that tried to expand too much with the Athlon 64 , X2 and Opterons) without having a newgen chip on the horizon.

They ended paying a lot back then.. -

digitalgriffin Not surprising. Puget is still kind of a niche player in the system builder market. Yet they charge a premium for their systems.Reply

Clients who are building desktop AMD systems are looking for value, not a premium price tag. However deeper pocket investors (Large Corporate Entities) often look past initial price tag when it comes to TCO.

The sales history of top selling CPU's on Amazon and NewEgg says it all. -

Trantor2020 Reply

I've never heard of them here (Europe) and I think your comment "niche player in the system builder market"digitalgriffin said:Not surprising. Puget is still kind of a niche player in the system builder market. Yet they charge a premium for their systems.

Clients who are building desktop AMD systems are looking for value, not a premium price tag. However deeper pocket investors (Large Corporate Entities) often look past initial price tag when it comes to TCO.

The sales history of top selling CPU's on Amazon and NewEgg says it all.

is correct.

I'm not even sure why this is worth an article?

The headline sounds like it is a big deal, but it really isn't.

Their customers in the "Media & Entertainment" need most likely multi-core performance = Intel for mainstream, or Threadripper, where AMD is outselling Intel.

Government & Education are slow to change or want to cover their back to 100% anyway = they stick with what they have.

So, as non-US reader, I'm not sure what to make out of this article and the report from Puget,

and the point of it.