All About Bitcoin Mining: Road To Riches Or Fool's Gold?

By now, you've probably heard all about Bitcoins. But what are they? And are people actually striking it rich "mining" these things? Today, we'll find out with a first-hand look into the world of this crypto-currency, straight from a Bitcoin miner.

Confessions Of An Accidental Bitcoin Miner

It’s a Long Way to the Top If You Want to Mine the Coin

I first heard about Bitcoins in June 2011, two years after Satoshi wrote his paper. At the time, I had already been renting a small commercial office in the San Francisco Bay area to use as a “man cave”, a place to have some peace and quietness. After reading up on Bitcoins, I hoped that Bitcoin mining could pay the office lease. Notably, it was an all-inclusive lease, with utilities included. For a Bitcoin miner, free (or more accurately, complimentary) electricity has a better ring to it than even free beer.

So, I bought a few Radeon HD 7790 graphics cards (not ideally suited for Bitcoin mining, as I later realized), two motherboards, two inexpensive Athlon CPUs, some RAM, and two 750 W power supplies and started mining at the mining pools Deepbit.net and, as a backup, the now defunct MtRed.com.

Soon after, like any true gambler, I decided to double down and bought more graphics cards. This time, they were better-suited Radeon HD 5830 cards. Certain motherboards, like the Bitcoin miner’s favorite, the MSI 890FXA-GD70, can accommodate four double-wide graphics cards across four PCIe slots. Thus, two mining rigs could accommodate eight 5830s and achieve a hash rate of almost two GH/s (Gigahash per second). Finally, using a total of eight motherboards and approximately twenty graphics cards, I achieved slightly more than 4 GH/s.

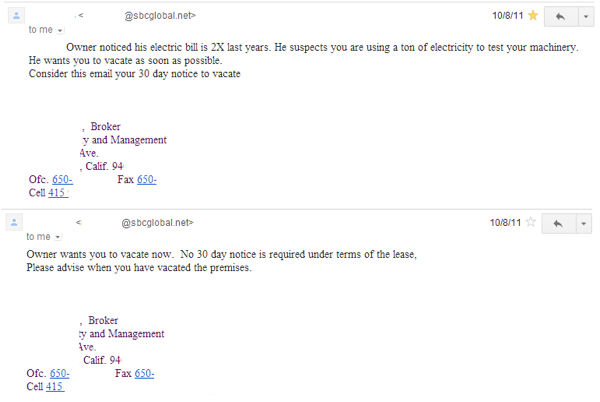

Unfortunately, an office A/C is designed for two people and two PCs, not for multiple 750 W mining rigs running at full throttle. Noticing that the office was getting quite hot, I created some air ducts out of cardboard to funnel the waste heat exhausted by the graphics cards right to the windows’ mosquito screens. Each air duct had a 120 mm LED fan at the end, and it was these fans that proved to be my downfall. They shone mesmerizing circles of intense blue light into the peaceful California night. Eventually, the owner of the office building saw the blue circles, walked up to the ground floor window, and felt a blast of hot air in his face. Shortly thereafter, I was evicted.

A few weeks later, I found a new office in another city. But because the windows could not be opened there, I could only run three Radeon HD 5830-based mining rigs at a time without super-heating the place.

By that point, field-programmable gate array miners started to become available. Butterfly Labs (BFL), a then-unknown company out of Kansas City, announced the Single, an Altera FPGA-based miner sporting a hash rate of more than 800 MH/s for a mere $600. I ordered one immediately. Addicted, I kept ordering them in packs of four, reaching a grand total of 25.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

By summer 2012, Butterfly Labs was selling the $15,000, 25.2 GH/s miniRig, a huge box sporting 18 PCBs and just as many fans. I bought one, and it brought my total hash rate to 46 GH/s.

Then BFL announced that it would start shipping ASIC-based products in October or November, and owners of the company's FPGA-based products would be able to trade them in for the full purchase price. I knew that once the ASIC-based products started to ship, mining difficulty would explode, quickly obsoleting the FPGA-based products and cutting off my revenue stream. Grudgingly, I sold some long-term investments and wired almost $30,000 to BFL for two ASIC-based miniRigs, hoping to ensure a continuous flow of Bitcoin-based funds. However, BFL missed the promised shipping date of October/November 2012 and, at the time of writing, only a few dozens of its 5 GH/s, entry-level ASIC-based devices have been shipped.

Current page: Confessions Of An Accidental Bitcoin Miner

Prev Page The Basics Of Bitcoin Next Page The Mining Algorithm And CPU Mining-

esrever How does mining new coins make sense if there will ever only be 21 million? I am so confused by that point.Reply

Another thing is, with an economic system like this, a billionaire can easily manipulate market prices and make extremely large amount of money and still be completely fine due to this being in a grey area of the law. You can't pump and dump stocks legally but it seems pretty easy for something like this considering you can dump the bit coins off as currency in any country. -

s3anister Reply10943052 said:How does mining new coins make sense if there will ever only be 21 million? I am so confused by that point.

To quote the Bitcoin wiki page: "The last block that will generate coins will be block #6,929,999 which should be generated at or near the year 2140."

So to directly answer your question, the whole reason for mining bitcoins is because you'll most definitely be dead before the last block chain is even completed. -

vmem Reply10943126 said:Shitcoins definitely = fools gold!

Huge waste computing power IMO

someone needs to rewrite the algorithm and somehow hook up block generation to folding@home or some similar constructive use of the computational power.

-

smeezekitty Reply

That would be a great idea. Verifying a relatively small hash to screen out the cheaters then perform something useful like F@H.10943157 said:10943126 said:Shitcoins definitely = fools gold!

Huge waste computing power IMO

someone needs to rewrite the algorithm and somehow hook up block generation to folding@home or some similar constructive use of the computational power.

-

dannyboy3210 A very interesting read. I had been reading about Bitcoins (mainly because I just couldn't figure out what they were exactly), but this clears a lot of things up.Reply

Also, at the bottom of page 5, in the Comparison of FPGA and ASIC Chips table it says "Power Fraw". -

slomo4sho Fiat currencies... I guess for some people the dollar wasn't worthless enough.Reply

It is amazing how you can lose your "wallet" and your funds permanently disappear from the pool. -

toarranre Never heard of this and I'm quite confused by it. Use graphics cards to find units of a currency that from what I can tell must be extremely succeptable to artificial inflation or all out collapse.Reply