All About Bitcoin Mining: Road To Riches Or Fool's Gold?

By now, you've probably heard all about Bitcoins. But what are they? And are people actually striking it rich "mining" these things? Today, we'll find out with a first-hand look into the world of this crypto-currency, straight from a Bitcoin miner.

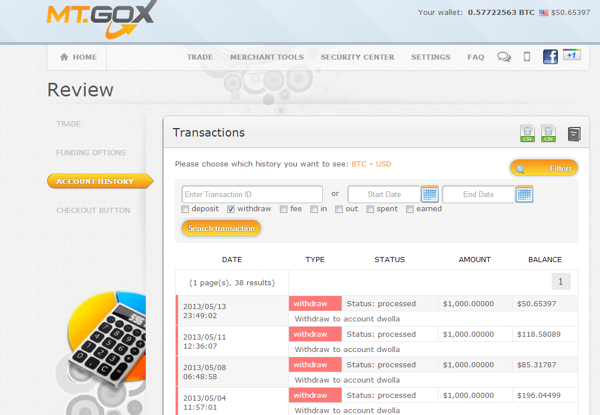

Financial Aspects: Income And Profitability

Income = Revenue Minus Expenses

Don’t neglect your costs when calculating income. As explained above, what you pay out of pocket includes one-time charges (typically, what you pay for the mining hardware) and recurring costs, like electricity and/or rent on a dedicated space.

More important, don’t forget to anticipate the relentless rise in mining difficulty, and thus dwindling revenue. A profitability calculation should be done at least once a month. After all, it doesn’t make sense to keep mining at a loss, unless of course you expect the exchange rate for Bitcoins to rise in the future. Since the latter is far from certain, you’re then gambling.

Efficiency (Power Draw vs. Hash Rate)

As the mining difficulty increases, mining efficiency becomes more and more important.

| Header Cell - Column 0 | HD 5830 | HD 6990 | BFL Single | BFL miniRig | Avalon Box | BFL Jalapeno | ASICminer USB | ASICminer Blade |

|---|---|---|---|---|---|---|---|---|

| Hash Rate | 250 MH/s | 700 MH/s | 830 MH/s | 25.2 GH/s | 66 GH/s | 5 GH/s | 300 MH/s | 10 GH/s |

| Power Draw | 153 W | 357 W | 80 W | 1200 W | 620 W | 30 W | 2.6 W | 100 W |

| MH/s Per W | 1.63 | 1.96 | 10.4 | 21 | 106 | 167 | 115 | 100 |

Upgrading from GPUs to FPGAs reduced the power draw by an order of magnitude. Likewise, upgrading from FPGAs to ASICs again slashes power consumption by another order of magnitude.

Is the Bitcoin Currency Experiencing a Bubble?

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Surprisingly, there isn’t an easy answer to this question. Generally, in economics, the money supply should keep pace with economic growth or a society’s productivity gains, and neither outpace it nor lag behind. If the money supply is increased faster than the economic growth, this results in too much money chasing too few goods, and consequently prices for goods will rise. This is called inflation, and more than a few percentage points of annual inflation is generally considered harmful to an economy, leading to gradual loss of savings, impoverishment of retirees, and even social unrest. However, some slight inflation is generally considered beneficial for an economy, acting as a disincentive to hoard money (as opposed to investing savings back into the economy), and as a gradual reduction of labor costs. On the other hand, if the money supply is increased slower than the economic growth, this tight monetary policy leads to less demand for goods, and hence it can harm the economy. Worse, if a glut of goods develops, the price of goods will inevitably drop due to the law of supply and demand, and a deflationary spiral can result.

Satoshi opted for a slowly paced increase of the money supply. And when 21 million Bitcoins have been minted, the money supply will come to a halt. New blocks are generated every 10 minutes, on the average. While the reward for finding a block was initially 50 Bitcoins, the block reward was halved to 25 Bitcoins in late November 2012. This reward halving will happen every four years, thus gradually reducing the money supply to a trickle.

This leads us to the conclusion that the Bitcoin currency is intentionally deflationary. If Bitcoins become more and more adopted, while on the other hand the money supply faucet is gradually turned off, the Bitcoin exchange rate to the dollar can go nowhere but up. While the incredibly quick run-up to $266 in the second week of April was, in fact, a speculative bubble, a gradual rise in the value of Bitcoins is almost assured.

There is one element of uncertainty: if all governments were to outlaw Bitcoin exchanges, it would become impossible to exchange normal currency into Bitcoins and vice versa. But there are almost 200 countries in the world, and it seems unlikely that all countries will outlaw Bitcoin exchanges.

Current page: Financial Aspects: Income And Profitability

Prev Page Financial Aspects: Costs Next Page Other Crypto Currencies-

esrever How does mining new coins make sense if there will ever only be 21 million? I am so confused by that point.Reply

Another thing is, with an economic system like this, a billionaire can easily manipulate market prices and make extremely large amount of money and still be completely fine due to this being in a grey area of the law. You can't pump and dump stocks legally but it seems pretty easy for something like this considering you can dump the bit coins off as currency in any country. -

s3anister Reply10943052 said:How does mining new coins make sense if there will ever only be 21 million? I am so confused by that point.

To quote the Bitcoin wiki page: "The last block that will generate coins will be block #6,929,999 which should be generated at or near the year 2140."

So to directly answer your question, the whole reason for mining bitcoins is because you'll most definitely be dead before the last block chain is even completed. -

vmem Reply10943126 said:Shitcoins definitely = fools gold!

Huge waste computing power IMO

someone needs to rewrite the algorithm and somehow hook up block generation to folding@home or some similar constructive use of the computational power.

-

smeezekitty Reply

That would be a great idea. Verifying a relatively small hash to screen out the cheaters then perform something useful like F@H.10943157 said:10943126 said:Shitcoins definitely = fools gold!

Huge waste computing power IMO

someone needs to rewrite the algorithm and somehow hook up block generation to folding@home or some similar constructive use of the computational power.

-

dannyboy3210 A very interesting read. I had been reading about Bitcoins (mainly because I just couldn't figure out what they were exactly), but this clears a lot of things up.Reply

Also, at the bottom of page 5, in the Comparison of FPGA and ASIC Chips table it says "Power Fraw". -

slomo4sho Fiat currencies... I guess for some people the dollar wasn't worthless enough.Reply

It is amazing how you can lose your "wallet" and your funds permanently disappear from the pool. -

toarranre Never heard of this and I'm quite confused by it. Use graphics cards to find units of a currency that from what I can tell must be extremely succeptable to artificial inflation or all out collapse.Reply