AMD grabs GPU market share from Nvidia as GPU shipments rise slightly in Q4

AMD sold 1.43 million units in Q4, its strongest result for 2024

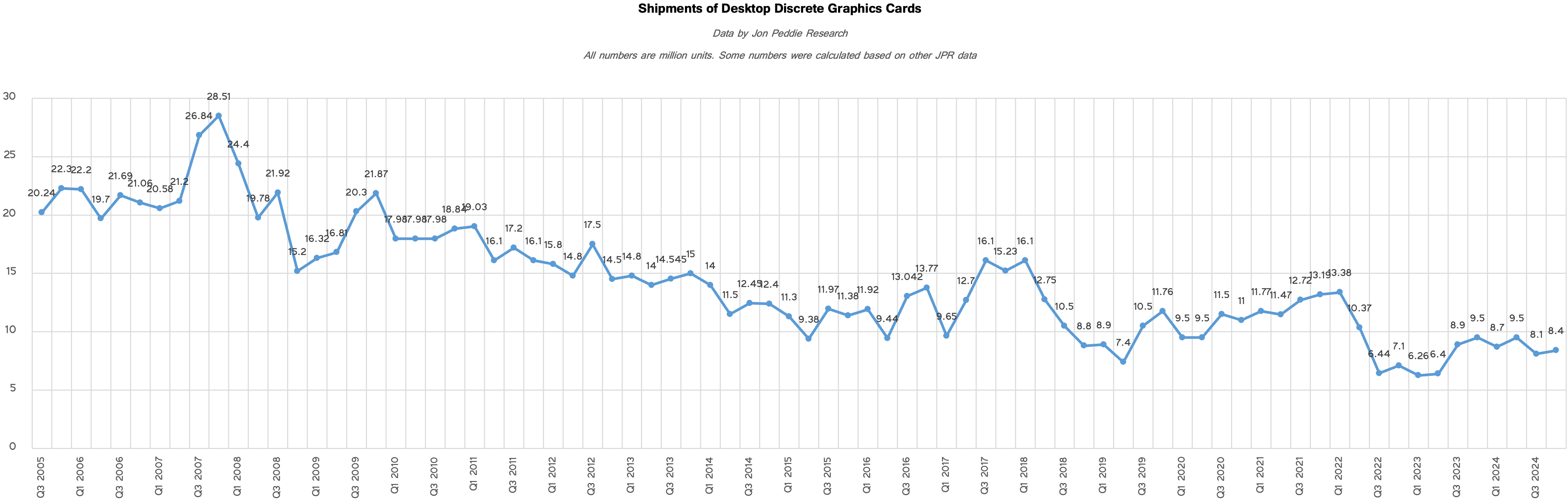

Shipments of standalone GPUs for desktop PCs increased slightly in the final quarter of 2024 compared to the previous quarter but declined by over a million units compared to the same quarter in 2023, according to Jon Peddie Research. However, the market for graphics add-in boards (AIBs) for desktops rebounded quite significantly in 2024 compared to the previous year. While AMD managed to grab a chunk of Nvidia's market share in Q4 2024, sales of its standalone GPUs for desktops dropped to a historic low for the whole year.

A modest quarter

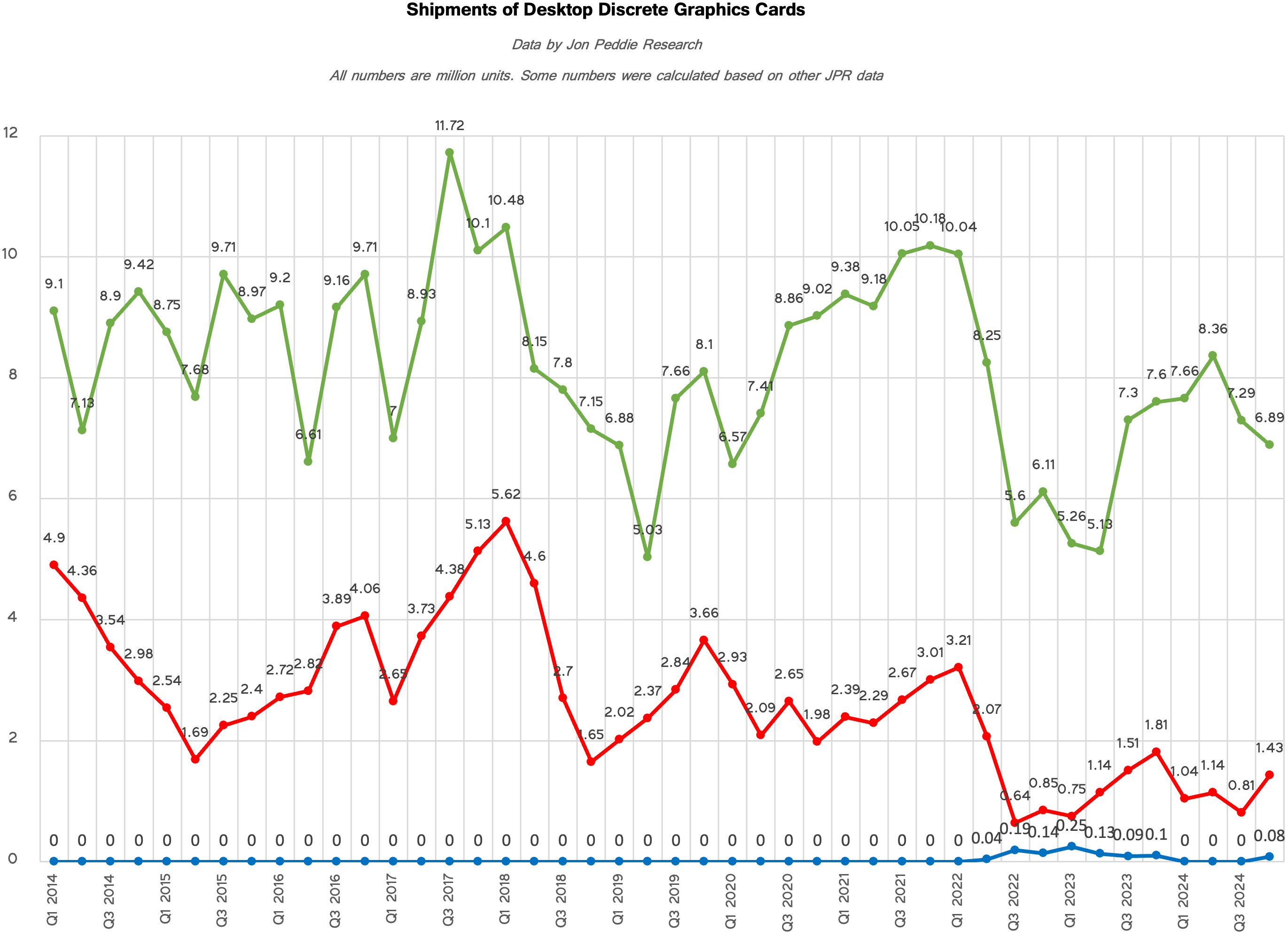

The industry shipped 8.4 million discrete graphics boards for desktop PCs in Q4 2024, up from 8.1 million in the previous quarter but down from 9.5 million units, according to JPR. Nvidia allegedly reallocated some of its production capacity from client GPUs to datacenter GPUs, which is why its shipments contracted both sequentially and year over year to around 6.89 million units in the fourth quarter. By contrast, AMD managed to increase sales of its Radeon graphics cards for desktops to 1.43 million units, its strongest result of 2024. However, it was still lower than the 1.81 million shipped in Q4 2023.

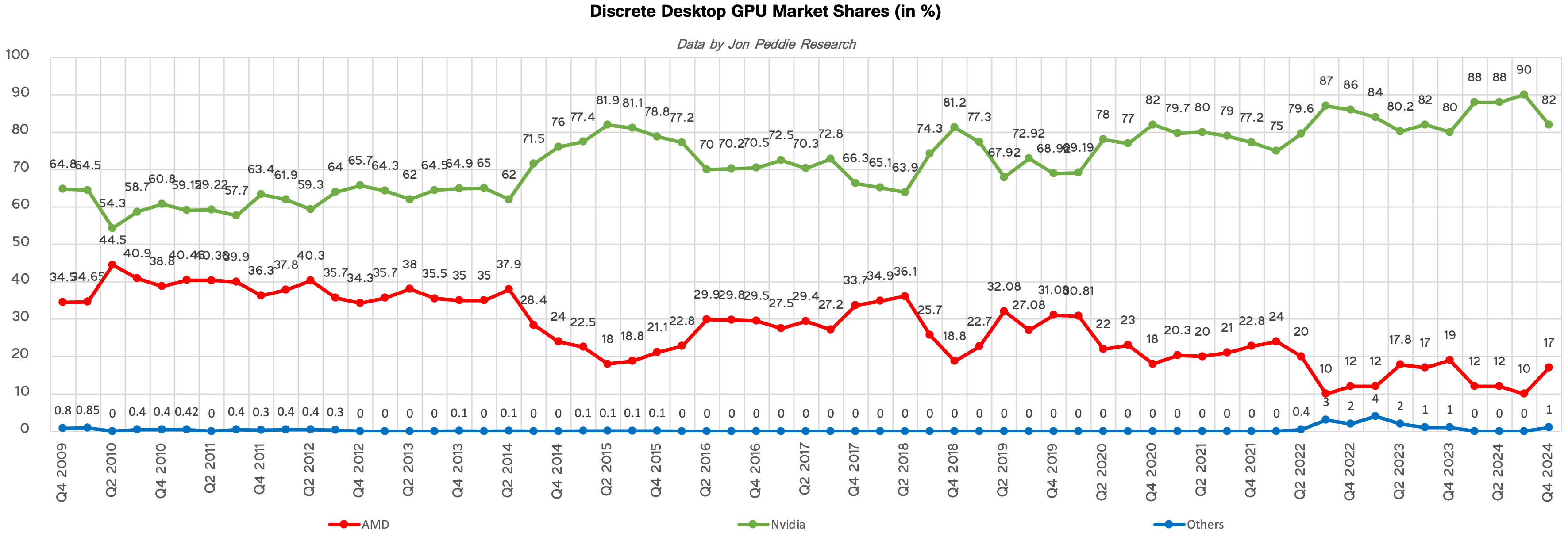

As a result of constrained production capacity, Nvidia lost around 8% of the discrete desktop GPU market in the final quarter of 2024, while AMD gained approximately 7% and Intel gained around 1.2%, according to Jon Peddie Research. Nvidia still dominated the market with an 82% share, but AMD commanded 17% of shipments, which was a positive outcome for the company.

As demand for graphics cards exceeded supply in the fourth quarter, and because both AMD and Nvidia delayed the volume ramp-up of their latest products to 2025, suppliers ended the quarter with a solid queue of pending orders heading into the first quarter of 2025, setting the stage for an unusually strong shipment volume during that period, according to Jon Peddie Research. However, with new tariffs set to take effect in the second quarter, the usual seasonal decline in desktop AIB shipments in Q2 could be even steeper unless some of the backlog carries over.

A good year (but not for AMD)

While the fourth quarter of 2024 was modest for standalone graphics AIBs for desktops due both to Nvidia supply constraints and the postponed ramp-up of the GeForce RTX 50 and Radeon RX 9000 series to 2025, the entire year 2024 was rather good for discrete desktop GPUs.

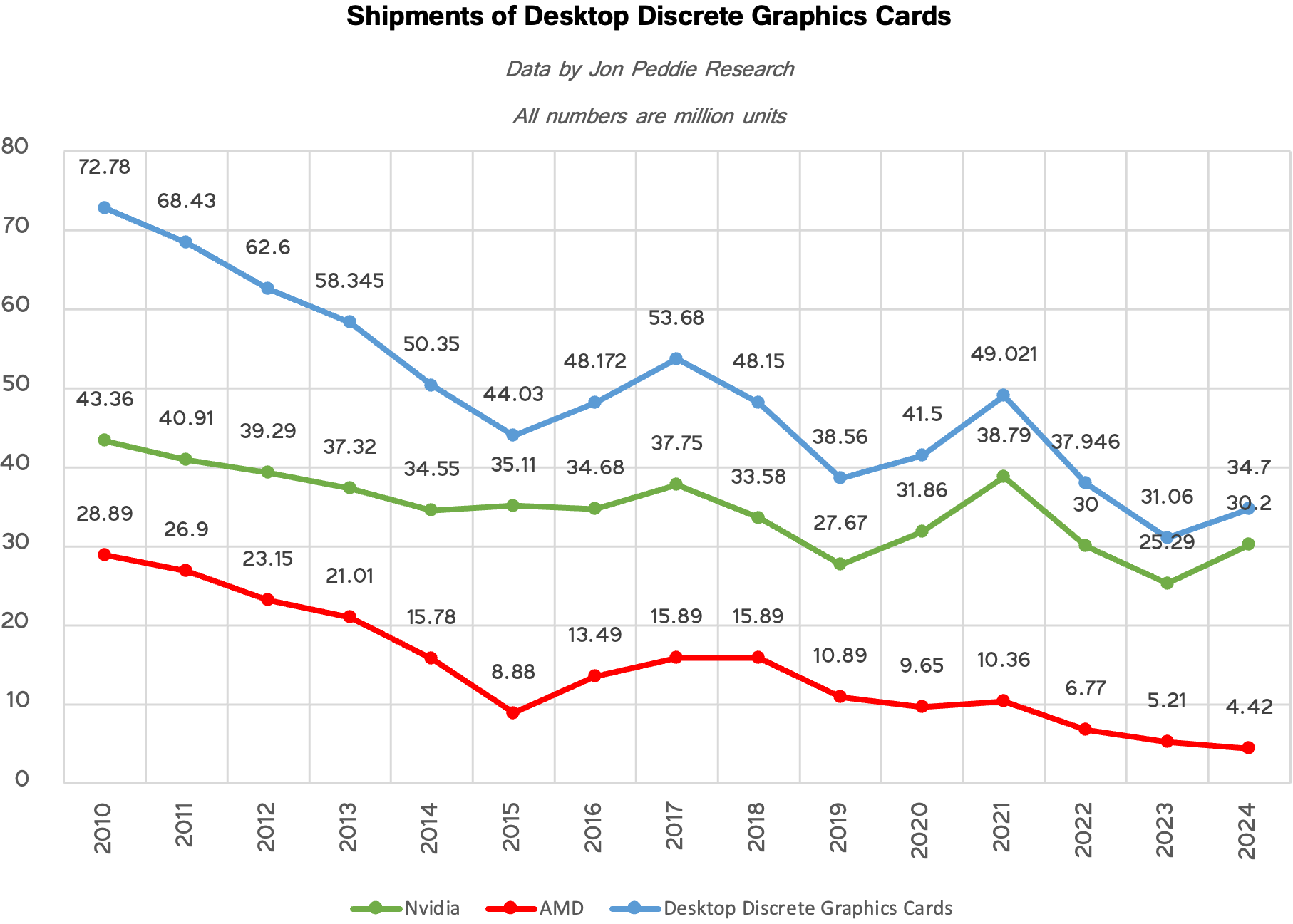

The industry shipped 34.7 million graphics AIBs for desktops in 2024, up from around 31 million in 2023 but down from nearly 38 million in 2022, according to JPR. However, keep in mind that there were no major product launches last year, and only Nvidia refreshed its lineup with several GeForce RTX 40 Super models.

For the whole year, Nvidia shipped 30.2 million discrete GPUs for desktops, which was a significant increase from 2023 and aligned with its results in 2022, based on data from Jon Peddie Research. By contrast, AMD shipped 4.42 million standalone graphics processors for desktop PCs, marking the company's worst result ever.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Given continued constraints of Nvidia GeForce RTX 50-series shipments in the first quarter of 2023, it remains to be seen whether AMD manages to sustain its market share and increase its shipments compared to the fourth quarter of 2024.

Anton Shilov is a contributing writer at Tom’s Hardware. Over the past couple of decades, he has covered everything from CPUs and GPUs to supercomputers and from modern process technologies and latest fab tools to high-tech industry trends.

-

thisisaname Over 15 years the number of Discrete Graphics Cards has fallen by over 50% that is rather surprising to me, or is this down to the increase in using integrated GPUs?Reply

Edit: Not been a good 15 years for AMD :( -

magbarn “Nvidia allegedly reallocated some of its production capacity from client GPUs to datacenter GPUs, which is why its shipments contracted both sequentially and year over year to around 6.89 million units in the fourth quarter.”Reply

Here’s your answer why Microcenter got hundreds to a thousand 9070 cards yesterday while Nvidia has been slowly dripping 10 cards a week like water torture -

spongiemaster Reply

RDNA4 was supposed to be released in January, and product had already shipped to retailers in preparation for that. AMD gave themselves an additional 2 months to build up stock by delaying. Knowing that, they should have had more than they did.magbarn said:“Nvidia allegedly reallocated some of its production capacity from client GPUs to datacenter GPUs, which is why its shipments contracted both sequentially and year over year to around 6.89 million units in the fourth quarter.”

Here’s your answer why Microcenter got hundreds to a thousand 9070 cards yesterday while Nvidia has been slowly dripping 10 cards a week like water torture -

A Stoner As integrated graphics improves, the need for dedicated graphics for most computer users disappears completely. So, it makes sense that fewer dedicated graphics cards are sold over the last 15 years. I think in the current market, AMD could easily reach 30% market share this generatorion if they factually could produce the silicon (someone corrected my spelling) to supply the market. But as someone else said, they make more profit selling CPUs instead of GPUs just like nVidia makes more money selling AI silicon rather than GPU silicon.Reply

$2000 graphics cards are crazy, until you note that the same silicon in that $2000 graphics card could be sold for $15,000, $20,000 and more as an AI processor. -

DS426 The gaming dGPU numbers dropping over the years surprised me as well, but also consider that we used to have SLI and CrossFire. AMD's APUs have proven sufficient for many light and modest gamers, yes. I know of several of those folks, whether coworkers, old college buddies, and so on. Intel's iGPUs have now become really competitive and usable in gaming as well, though it'll take some time for those to saturate down in the market.Reply

I'm guessing the #PCMasterRace crowd is disturbed on this trend. I, for one, welcome beefier integrated graphics as we can all see that gaming dGPUs are becoming less affordable and therefore less accessible to many. -

Manumarblanc If DGPU were so good for gaming, NVIDIA which is the monopoly in gaming would not be what it is, Nvidia's supply problem is that its market is already AI not gaming, AMD has to fight for offering gpu at MSRP price because it is its potential sale, Nivida has no need for that because 90% of the GPU market is theirsReply

Nvidia does not need to talk to an AIB to create more gpu at msrp price knows very well that sooner or later the user will buy nvidia even if the GPU has a higher cost overrun and if they cannot buy a lower range one, this is not the case with AMD. -

Shiznizzle Reply

Last time AMD had any meaningful GPU market share was during the 6000 series. I had a 6850 and it cost me just over 300 pounds when i bought this in the early 2010's. It was to play LOTRO with. 330 pounds for an upper range card in the mid tier section. Now the same "power" card costs 5 times that much.thisisaname said:Over 15 years the number of Discrete Graphics Cards has fallen by over 50% that is rather surprising to me, or is this down to the increase in using integrated GPUs?

Edit: Not been a good 15 years for AMD :(

Since the 6000 series AMD have been on a downward spiral. Due to change this year. I cant see people forking over that kind of money for the borked from the start nvidia 5000 series. No way.

Why would you spend 1000 pounds for a flawed and defective, fake frame, house fire starter? -

thestryker Reply

Just going to use nvidia as a reference because I only had their cards during that era but if you look at the peak that would be GTX 400/500 time. The cards released then were quite good and relatively affordable. I know I had a 200, 400, 500 and 600 series mid tier card during that time. This is also when performance jumps started slowing down a bit so people were holding onto cards longer. The jumps after 2015 are the respective crypto booms otherwise I imagine there would be more of a linear decline. I'm certain that pricing is also having an impact on both people getting into the market and upgrades.thisisaname said:Over 15 years the number of Discrete Graphics Cards has fallen by over 50% that is rather surprising to me, or is this down to the increase in using integrated GPUs?

Edit: Not been a good 15 years for AMD :(

The other part I didn't address is the slowing down of GPU releases. They'd been mostly yearly through the GTX 7 series. The GTX 9 series wasn't far off that, but the wait for the GTX 10 was around a year and a half and then RTX 20 was over 2 years. This wait also coincided with a nebulous value proposition due to the raised prices. Since then we had a crypto boom, shortages and even worse value options so it's not really surprising the market is contracting. I'd bet if they showed a revenue line it wouldn't be so far down though.

Here's an example of my card history (assuming I'm remembering right of course):

GTX 275

GTX 460

GTX 560 Ti

GTX 660 Ti

GTX 970

GTX 1660 Ti

RTX 3080 12GB

The first 5 were all bought in a period of about 6 years and the last two would have been in the 7 that followed and the only reason I got the 1660 Ti at all was the crypto boom (though I am very happy having a 12GB 3080 rather than 10GB I'd have ended up with without it).