Intel expects paltry $500 million in Gaudi 3 AI sales for the rest of the year — Nvidia to rake in $40 billion for data center AI this year

Intel provides uninspiring guidance for its Gaudi 3 AI accelerator.

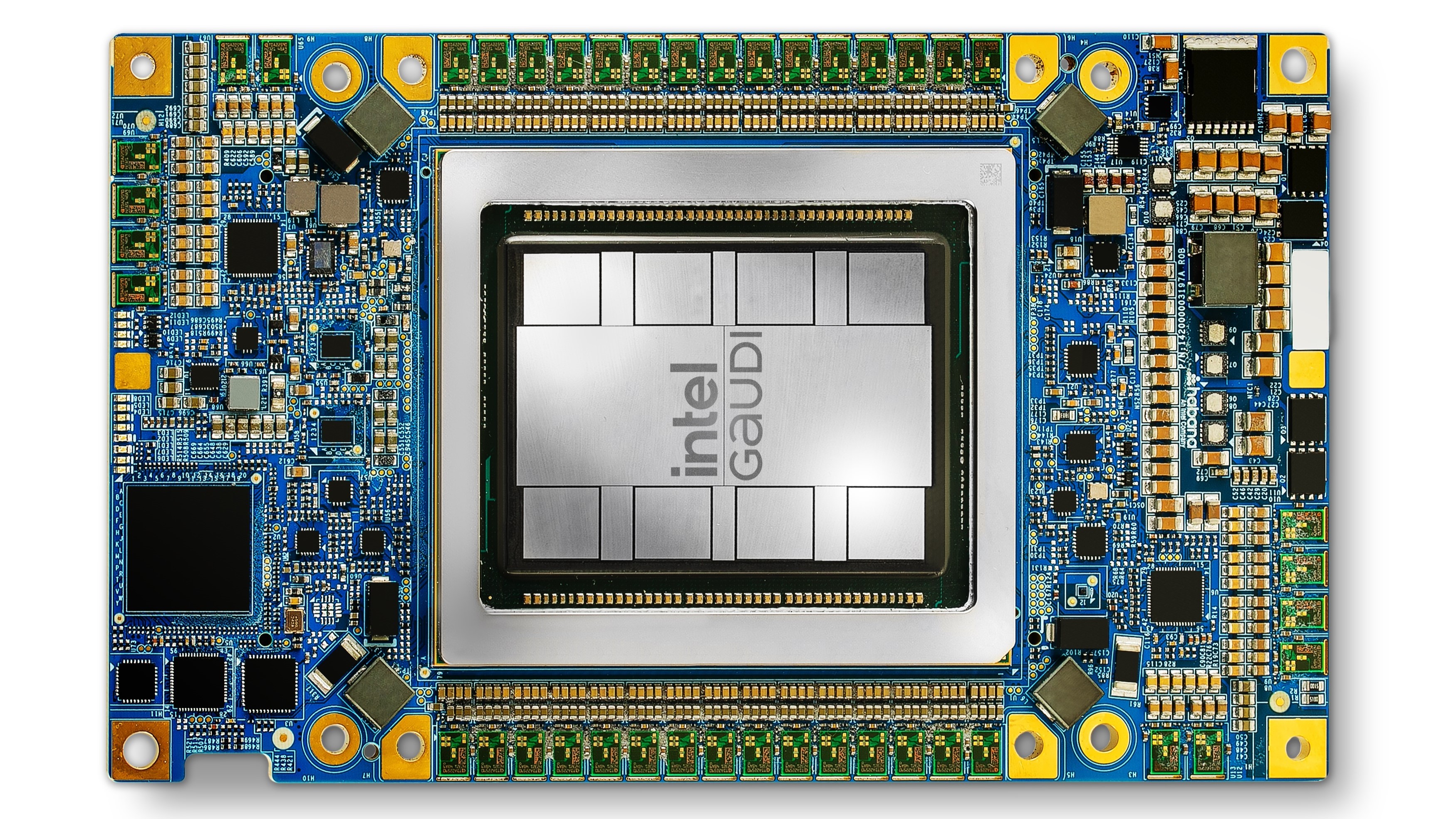

Intel's Gaudi 3 processor for AI applications is significantly faster than its predecessor, which makes this offering significantly more competitive against rivals. However, the company gave a rather uninspiring guidance for Gaudi 3 sales this year: the company expects Gaudi 3 to generate $500 million in revenue in 2024. Compared to AI-related expectations of AMD and Nvidia, this looks like a negligible sum.

"Our Gaudi 3 launch gave us a strong offering to improve our position in accelerated computing for the data center and cloud," said Pat Gelsinger, Intel's chief executive, at the earnings call last week. "We now expect over $500 million in accelerated revenue in the second half of 2024 with increasing momentum into 2025 based on Gaudi 3's vastly superior TCO as well as our own expanding supply."

AMD expects its Instinct MI300-series offerings to generate about $3.5 billion in revenue this year, which is a modest expectation compared to Nvidia, whose data center GPU revenue — dominated by GPUs for AI and HPC applications — is expected to hit around $40 billion this year. In fact, keeping in mind that Nvidia is now focusing on shipping machines based on its Blackwell compute GPUs rather than individual processors, it is likely that Nvidia's data center revenue will be significantly more than $47 billion in 2023.

There could be several reasons why Intel has such humble expectations for Gaudi 3's business performance in 2024. Perhaps the company will start shipping Gaudi 3 in meaningful volumes only very late in the year and will not have enough time to ship tens of thousands of processors for revenue in 2024. It is also possible that Intel will be supply-constrained or that it expects sales of Gaudi 3 to take off slowly because customers yet have to tailor their AI software for Intel's hardware.

Based on Intel's claims, the interest in Gaudi 3 is significant, so the product should be quite popular, which means that over time, it will generate much more than $0.5 billion for the company.

"At our Vision event, we had over 20 customers publicly describing their embrace of Gaudi 2 and Gaudi 3," said David Zinsner, Intel's chief financial officer, at the conference call. "I was super pleased to see the breadth of those customers. It was CSPs like Naver and Ola and IBM Cloud. It was ISVs like Seekr, right, coming on board. But maybe most importantly, enterprise customers."

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Anton Shilov is a contributing writer at Tom’s Hardware. Over the past couple of decades, he has covered everything from CPUs and GPUs to supercomputers and from modern process technologies and latest fab tools to high-tech industry trends.

-

rtoaht It is coming late in 2024. Most volume would be in 2025. So half a billion in 2024 isn’t bad for a product releasing near the end of the year. If anything, it indicates that 2025 would be much better considering it will have full 12 months to sell it.Reply -

Alvar "Miles" Udell It's not that unexpected, remember:Reply

https://www.tomshardware.com/pc-components/gpus/rival-firm-says-nvidias-ai-customers-are-scared-to-be-seen-courting-other-ai-chipmakers-for-fear-of-retaliatory-shipment-delays-report -

JRStern It's not Intel's fault that some of the hyperscalers are spending billions on NVDA chips simply to horde them.Reply

I wish I had a product that was going to move a paltry $500m in the fourth quarter. -

jheithaus The low sales are probably because Gaudi3 is the last of its kind. There will never be a Gaudi4. Developers are not going to create AI platforms for a chip architecture with no future. Gaudi3 will supposedly be succeeded by Falcon Shores. But Falcon Shores is not a successor. Falcon Shores is simply the next enterprise Arc GPU launch. Gaudi as a platform is end of life by 2H2025.Reply