Intel says it will miss its AI goals with Gaudi 3 due to unbaked software — Intel's $500 million AI goal unachievable as competitors rake in billions

But Gaudi 3 will probably hit it next year.

Intel says it will now be unable to meet its goal of $500 million in Gaudi 3 sales due to software issues. Meanwhile, AMD plans to rake in $3 billion from its AI GPUs, and while Nvidia doesn't specifically state the amount it makes from AI GPUs for the data center, it is expected to be well north of $80 to $90 billion.

Intel claims its Gaudi 3 accelerator for AI offers tangible performance improvements compared to its predecessors, and given its claimed advantages amid relatively low prices, Intel expected sales of these products to exceed half a billion dollars this year. However, the new unit was formally launched in late September, and Intel now says the software was not fully baked. Still, some Gaudi 3 accelerators will be available at IBM Cloud.

"While the Gaudi3 benchmarks have been impressive, and we are pleased by our recent collaboration IBM to deploy Gaudi 3 as a service on IBM Cloud, the overall uptake of Gaudi has been slower than we anticipated, as adoption rates were impacted by the product transition from Gaudi 2 to Gaudi 3, and software ease of use," said Pat Gelsinger, chief executive of Intel, at the company's earnings call with analysts and investors. "As a result, we will not achieve our target of $500 million in revenue for Gaudi in 2024."

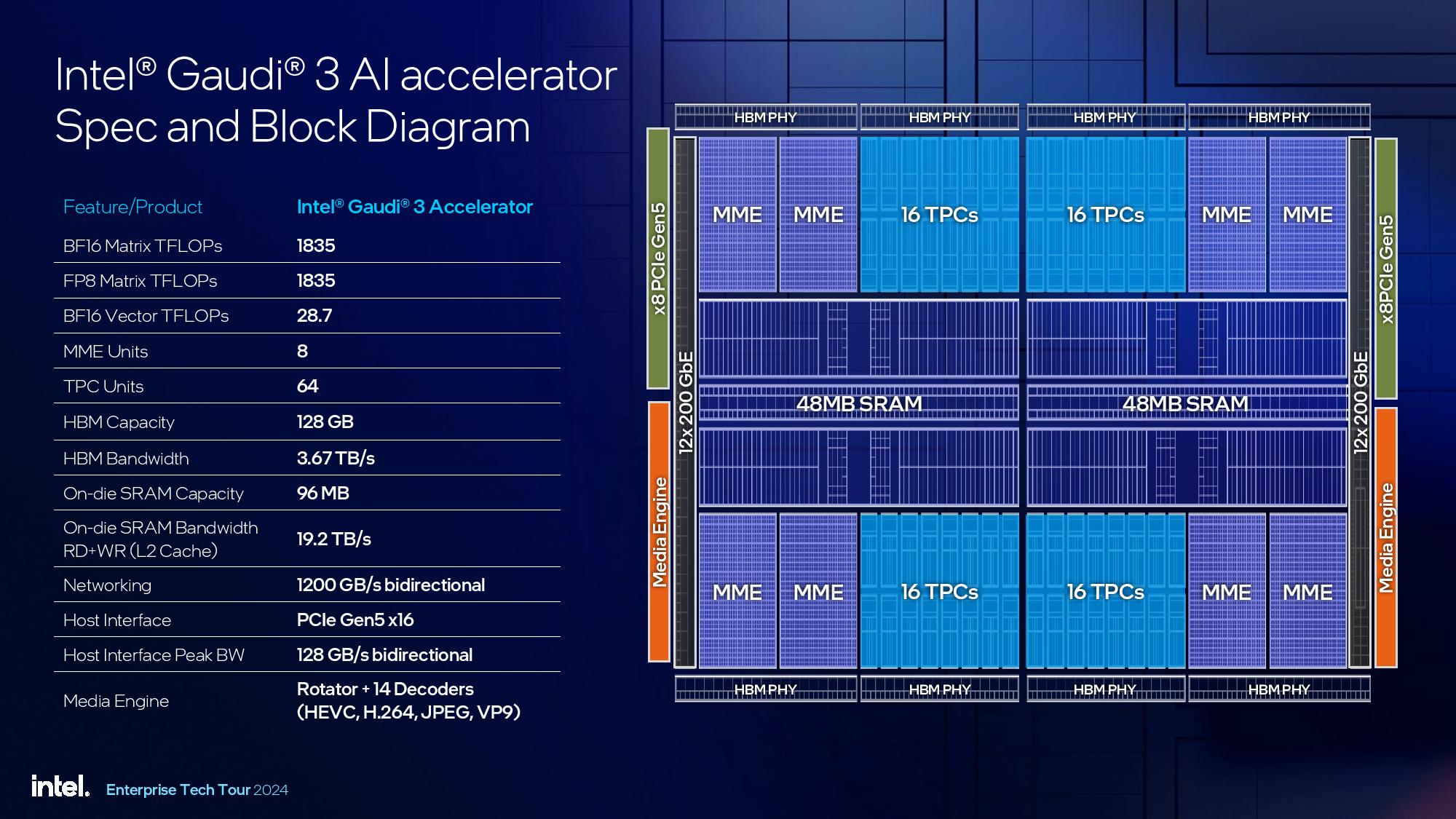

Intel's Gaudi 3 relies on two interconnected chiplets housing 64 tensor processing cores, designed with a 256x256 matrix structure that uses FP32 accumulators and eight matrix engines using 256-bit wide vector capabilities. It also includes 96MB of internal SRAM cache, offering data transfer rates up to 19.2 TB/s.

Additionally, Gaudi 3 has 24 networking interfaces running at 200 GbE and 14 media processors capable of handling video and image formats like H.265, H.264, JPEG, and VP9 for visual data processing. The chip has 128GB of HBM2E memory across eight stacks, delivering a high bandwidth of 3.67 TB/s. Compared to its predecessor, Gaudi 3 marks a substantial leap forward as Gaudi 2 contained only 24 tensor cores, two matrix engines, and 96GB of HBM2E memory.

Intel says the new Gaudi 3 accelerator offers tangible performance advantages over Gaudi 2 and can even challenge Nvidia's H100 (at least when this GPU does not use sparsity) in some cases. It is just as important that Gaudi 3 is significantly cheaper than the H100. Earlier this year, Intel disclosed that a kit featuring eight Gaudi 3 chips on a baseboard would be priced at $125,000, roughly $15,625 per chip. In comparison, a single Nvidia H100 card is currently priced at $30,678, around two times higher.

However, despite all the advantages that Gaudi 3 has, it looks like Intel's software was not exactly ready for prime time, which slowed down hardware purchases. Now, Intel expects Gaudi 3 sales to ramp up in 2025.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Anton Shilov is a contributing writer at Tom’s Hardware. Over the past couple of decades, he has covered everything from CPUs and GPUs to supercomputers and from modern process technologies and latest fab tools to high-tech industry trends.

-

Pierce2623 As cheap as Gaudi was, even compared to AMD instinct parts, the software must have been monumentally bad. I mean if you could easily run the standard well known LLMs on it, that would’ve been enough to meet their sales targets. According to their benchmarks, two $2000 dollar chips should’ve been roughly competitive with a $10,000 chip from AMD or a $50,000 chip from NvidiaReply -

JRStern Reply

Typically the problem is not that it's monumentally bad but monumentally unfinished, often not actually started, or perhaps they have no actual idea of how to go about it, aka vaporware.Pierce2623 said:As cheap as Gaudi was, even compared to AMD instinct parts, the software must have been monumentally bad. I mean if you could easily run the standard well known LLMs on it, that would’ve been enough to meet their sales targets. According to their benchmarks, two $2000 dollar chips should’ve been roughly competitive with a $10,000 chip from AMD or a $50,000 chip from Nvidia -

JRStern "unbaked", is that how we say it now?Reply

Intel: SMH

I'm actually just the kind of code monkey they need on something like this, maybe I should have volunteered, like five years ago, even before they acquired Habana. Especially now that we can do stuff remote. Harrumph. But even I couldn't turn it out in two weeks, LOL. -

Pierce2623 Reply

Fair enough.JRStern said:Typically the problem is not that it's monumentally bad but monumentally unfinished, often not actually started, or perhaps they have no actual idea of how to go about it, aka vaporware. -

baboma Those interested in Intel's business issues should peruse Ian Cutress' Substack piece covering INTL's latest quarter call. It provides a more professional and comprehensive analysis than the clickbait hit pieces here on THW or typical blogs. (Yes, there's a reason why Gaudi 3 software was delayed.)Reply

https://morethanmoore.substack.com/p/intel-q32024-financials-halloween

Ian Cutress & Ryan Smith's coverage of AMD's 3Q finacials:

https://morethanmoore.substack.com/p/amd-q32024-financials

Be sure to read the analyst Q&A portion at the bottom of each piece for additional insight. -

KraakBal Intel just can't focus on future tech. They haven't started anything cool since Optane, and that was killed. Stop trying to compete, come up with ehat people want in 3-5 yearsReply -

Pierce2623 Reply

The most interesting part of that article is where Cuttress says 10nm/7 can’t be used for outside customers. Why? It’s the most performant process in the world basically, if you take efficiency out of the equation. I also noticed Pat said Xeon is in 70% of AI clusters. Three years ago it would’ve been 90%, so I probably would’ve just kept that number to myself as it’s basically advertising market share losses. It’s crazy to think that AMD went from basically 0% market to 30% in a few years.baboma said:Those interested in Intel's business issues should peruse Ian Cutress' Substack piece covering INTL's latest quarter call. It provides a more professional and comprehensive analysis than the clickbait hit pieces here on THW or typical blogs. (Yes, there's a reason why Gaudi 3 software was delayed.)

https://morethanmoore.substack.com/p/intel-q32024-financials-halloween

Ian Cutress & Ryan Smith's coverage of AMD's 3Q finacials:

https://morethanmoore.substack.com/p/amd-q32024-financials

Be sure to read the analyst Q&A portion at the bottom of each piece for additional insight. -

jheithaus Reply

I think this is the big open question. It hangs over the IDM 2.0 model, and it is likely why Pat was fired. Why can’t intel 7 be used by outside customers. This process sizzles with the 14900k at or near chart top in the most demanding realm of logic semi. You bought the equipment. The fabs are stocked. You should be dumping excess wafers to mediatek, Sony, microchip, analog, Broadcom, whoever will have them. Only TSMC has a better commercial process on offer. Intel foundry should be taking market share, against GF, Samsung, and the remainder. However, as a TSMC customer, I know why Intel 7 has no customers. When you call Intel for pricing…..it’s always crazy unrealistic. The foundry at Intel doesn’t want the work.Pierce2623 said:The most interesting part of that article is where Cuttress says 10nm/7 can’t be used for outside customers. Why? It’s the most performant process in the world basically, if you take efficiency out of the equation. I also noticed Pat said Xeon is in 70% of AI clusters. Three years ago it would’ve been 90%, so I probably would’ve just kept that number to myself as it’s basically advertising market share losses. It’s crazy to think that AMD went from basically 0% market to 30% in a few years.