Softbank founder reportedly aims to raise $100 billion to build AI chip company that would rival Nvidia — Project Izanagi might leverage Arm design

Softbank will allegedly set up an AI processor company to complement Arm.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

You are now subscribed

Your newsletter sign-up was successful

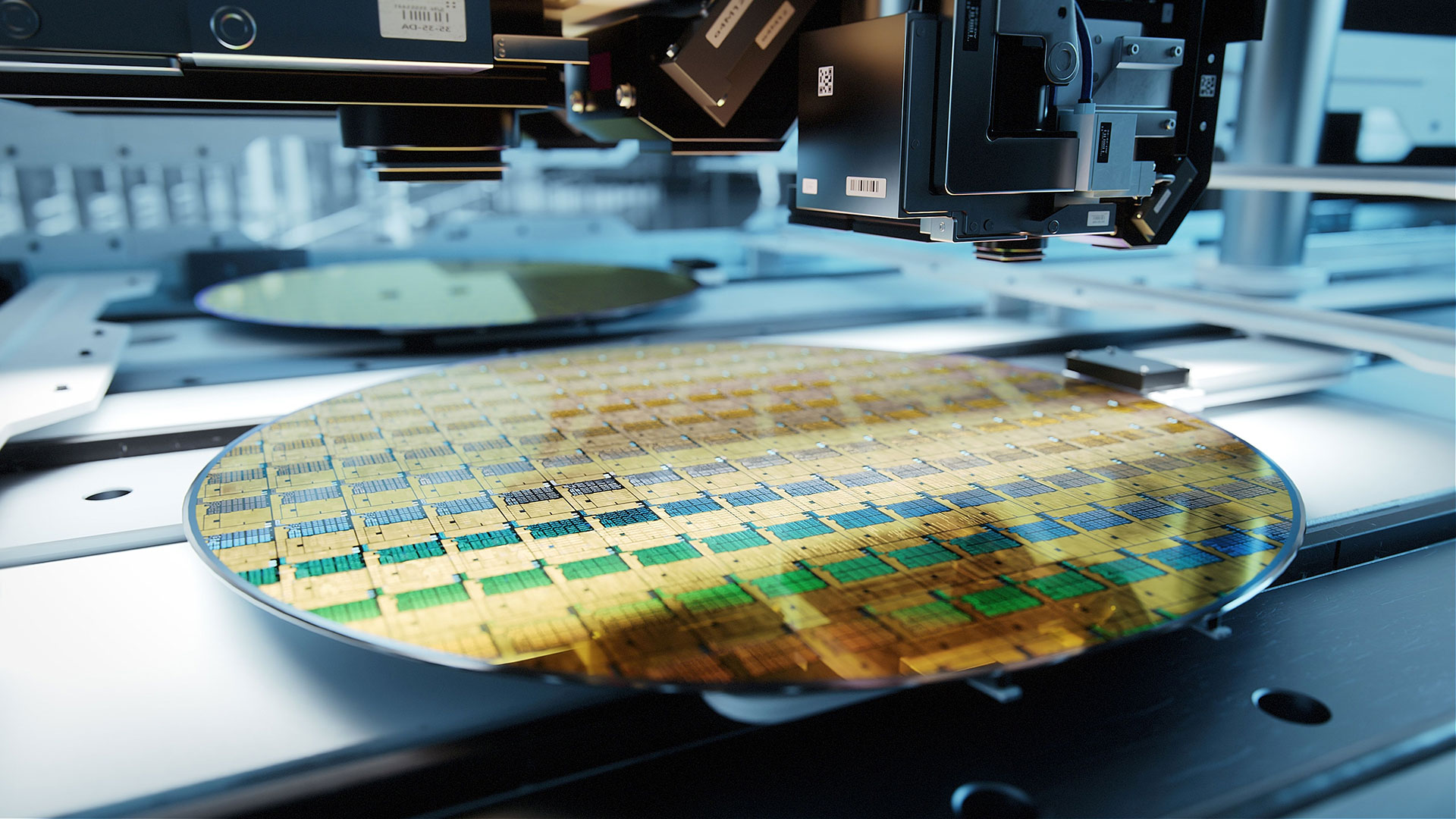

Masayoshi Son, the founder of SoftBank Group, plans to raise $100 billion for a new chip venture called Project Izanagi, aiming to rival Nvidia in artificial intelligence processors, reports Bloomberg, citing sources with knowledge of the matter. Son envisions this initiative as contributing to the development of artificial general intelligence (AGI), leading to a future where machines surpass human intelligence.

The project seeks to complement SoftBank’s Arm Holdings, which designs processor architectures. But it is unclear whether the AI processors designed by Project Izanagi will rely on technologies such as instruction set architecture (ISA) developed by Arm. Furthermore, how the venture will co-exist with Arm’s purported plans to create reference chip designs for various workloads remains to be seen. An interesting wrinkle is that the venture is named after the Japanese god of creation and life, reflecting Son’s ambitious vision for the project.

Building a company that could compete against Nvidia successfully is challenging. The green company not only has plenty of talented hardware engineers and highly competitive hardware, but it also has a ubiquitous CUDA software stack. It is tough to compete against something that has been evolving for well over 16 years now.

Project Izanagi is part of Son’s broader focus on AGI, which he believes will be realized within the next decade. He has consistently advocated for adopting AI, leading to a safer, healthier, and happier world. Son’s enthusiasm for AGI is intense, to say the least, despite facing numerous setbacks in his startup investments. He told a group of Japanese enterprise clients to embrace AI or risk being left behind, emphasizing the transformative potential of AGI.

“AGI is what every AI expert is after,” Son is reported to have said by Bloomberg. “But when you ask them about a detailed definition, a number, the timing, how much computing power, how much smarter AGI is than the human intelligence, most of them don’t have an answer. […] I have my own answer: I am convinced AGI will be real in 10 years.”

SoftBank’s financial position is strong, with ¥6.2 trillion ($41 billion) in cash and cash equivalents as of December 31. According to the report, Son intends to invest $30 billion from SoftBank, with the remaining $70 billion potentially sourced from Middle Eastern institutions. The specifics of the funding and execution are still being determined, and the project may evolve further as plans solidify, according to Bloomberg. Son’s approach to investment is dynamic, and he is known for abruptly changing his mind.

The initiative is separate from any collaboration with OpenAI’s Sam Altman, although Son and Altman have reportedly discussed joining forces in semiconductor manufacturing.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Anton Shilov is a contributing writer at Tom’s Hardware. Over the past couple of decades, he has covered everything from CPUs and GPUs to supercomputers and from modern process technologies and latest fab tools to high-tech industry trends.

-

ThomasKinsley I suppose I will have to get used to this AI fad coming everywhere. I certainly find it useful (DALL-E2 just saved me a few hours worth of work), but I'm concerned software companies are chasing AI to the detriment of everything else. Take Android, for example. People are panning the latest updates and noting that nothing has been fundamentally changed since Android 10. A minority of Windows users have transitioned to 11 because 10 works just as well for them. It's not like we have reached the pinnacle of software. There are updates and refreshes that can easily be done, yet companies aren't considering them.Reply -

bit_user This feels like at least 5 years late... the AI chip startup fad is so "late 2010"s. I wonder what proportion of them already failed... probably in the high 90% range.Reply

If they were serious, I'd imagine they could buy Cerebras or Tenstorrent for a lot less than $100B!