ASML triples order bookings in Q4 2023 thanks to demand for EUV tools

Chipmakers ordered $5.6 billion in EUV tools in Q4 2023.

As chipmakers are gearing up for inevitable increase of demand for logic and memory chips in 2024 and 2025, they're procuring more wafer fab equipment to increase their capacity. As a result, ASML's Q4 2023 revenue jumped to $7.237 billion — a 12.5% increase year-over-year — while its order intake reached a record €9.186 billion ($10.036 billion) — more than tripling YoY — as makers of memory and logic ordered additional extreme ultraviolet (EUV) lithography tools.

"After a few soft quarters, the order intake for the quarter was very, very strong," said Roger Dassen, chief financial officer of ASML. "Actually, a record order intake at €9.2 billion. If you look at the composition of that, it was about 50/50 for Memory versus Logic. Around €5.6 billion out of the €9.2 was related to EUV, both Low-NA and High-NA."

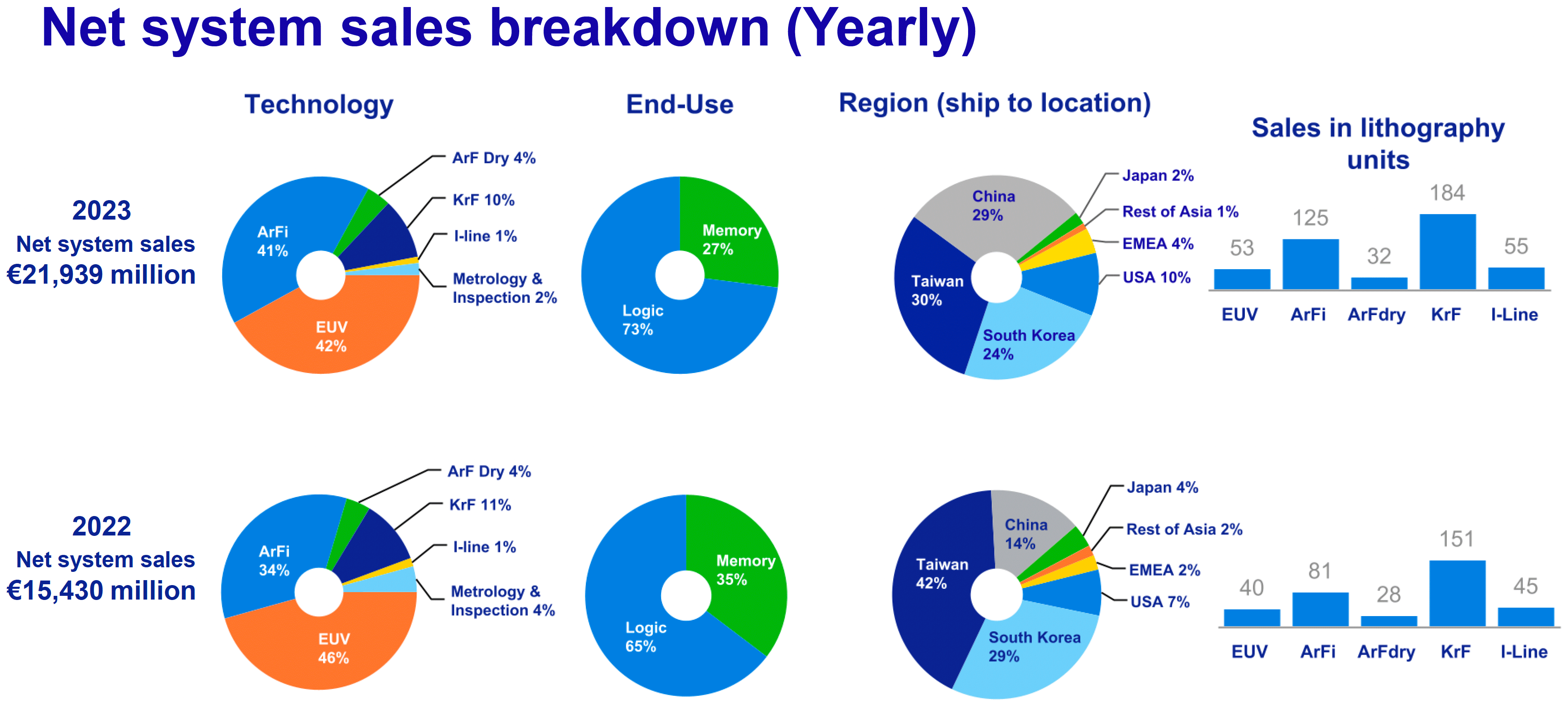

ASML's revenue for last year totaled €27.6 billion, its total net income hit €7.8 billion, and its gross margin reached 51.3%. The company recognized revenue for 53 EUV lithography tools, 125 immersion deep ultraviolet (DUV) lithography systems, 32 dry DUV litho machines, 184 KrF steppers, and 55 I-Line steppers.

ASML is the only maker of EUV lithography machines, which are going to be used widely by all leading chipmakers, including Intel, Micron, Samsung, Samsung Foundry, SK Hynix, and TSMC. So it's not surprising that ASML's order intake hit record levels. It should be noted that the majority of the machines ordered in Q4 2023 will not be shipped in 2024 but in 2025. The company plans to boost its own production capacity in 2024 (which is insufficient), but its revenue will be more or less flat with 2023 this year.

"So, we would keep our guidance as we articulated it last quarter, which is that we believe that 2024 will be similar in revenue as 2023," said Dassen. "That said, we also said 2024 is very much a transition year and a year in which we are really building up capacity. We are making good investments into our capacity because we believe 2025 is going to be a year of strong growth and that's what we're preparing for in this year as well."

One of the reasons ASML expects its 2025 revenue to be significantly higher in 2025 than in 2024 is because the company expects to significantly increase output of its leading-edge Low-NA EUV tools as well as next-generation High-NA EUV tools next year, which will help to increase sales of the company quite significantly.

Although ASML cannot ship EUV lithography tools to China, shipments of its systems to the People's Republic accounted for 29% of its revenue in 2023 — a bit behind Taiwan (30%) and noticeably higher than South Korea (24%). Sales to Chinese entities contributed to 46% and 39% of TSMC's sales in Q3 and Q4 2023 as Chinese entities accelerated their buying, making China the largest source of ASML's revenue. Now that ASML cannot ship its range-topping DUV tools to China, it remains to be seen whether the country will continue to be its top source of revenue going forward.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Anton Shilov is a contributing writer at Tom’s Hardware. Over the past couple of decades, he has covered everything from CPUs and GPUs to supercomputers and from modern process technologies and latest fab tools to high-tech industry trends.

-

JamesJones44 The most shocking thing about the report is there were no measurable shipments of chip equipment in Europe?? Seems crazy to me that that none of the fabs in Europe took delivery from ASML.Reply