Nvidia is now the world's most valuable company by market cap, ahead of Apple, Microsoft, and Google

AI frenzy drives Nvidia's market capitalization to $3.34 trillion.

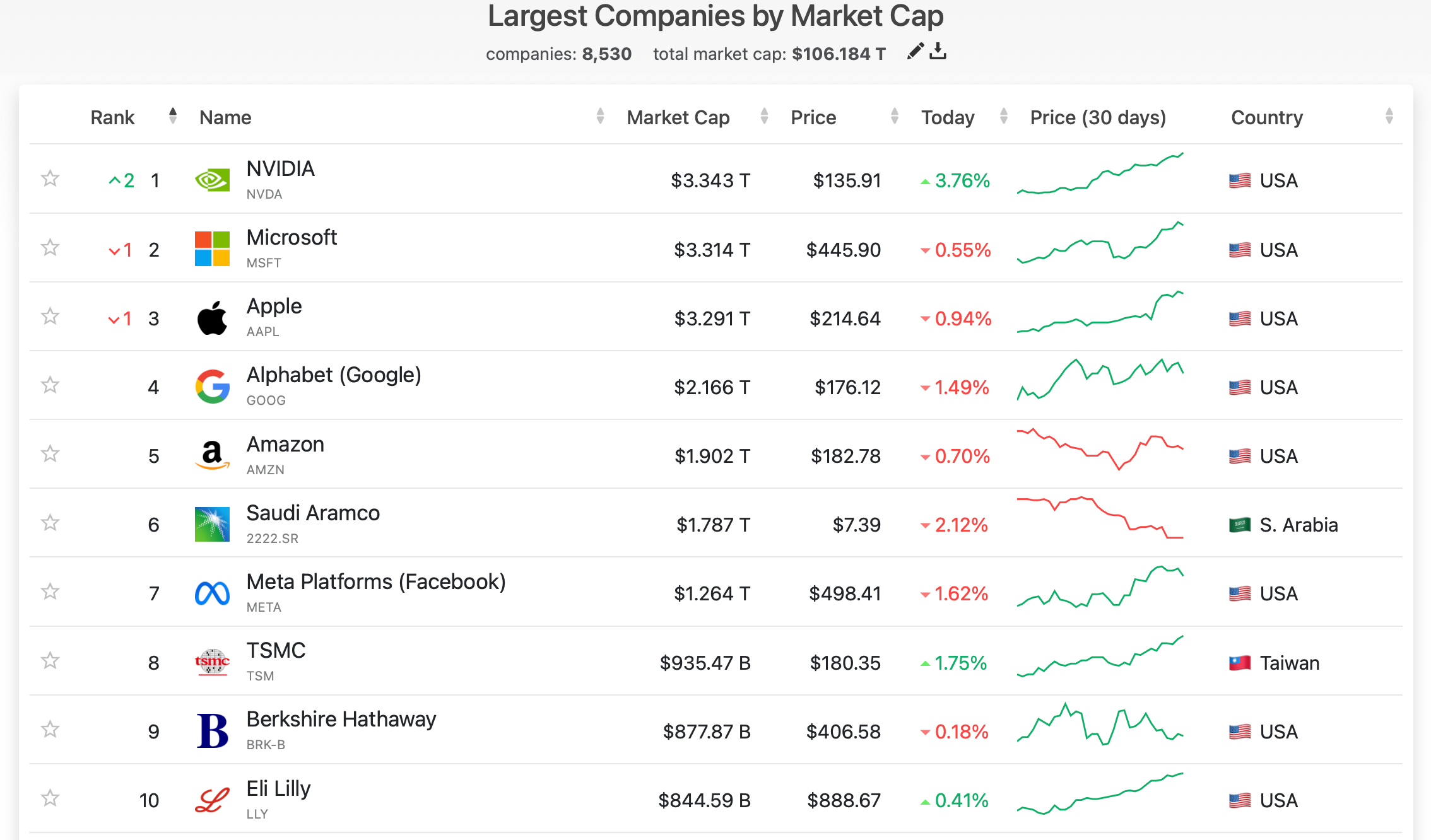

Nvidia on Tuesday became the world's most valuable company, with a market capitalization of $3.34 trillion surpassing Microsoft and Apple. Driven by the global AI frenzy and rising demand for AI processors, Nvidia is the first semiconductor firm ever to become the world's most valuable company.

Just a few months ago Nvidia's market capitalization was around $2.2 trillion and the company was behind Microsoft and Apple, but ahead of Saudi Aramco and Amazon in the Top 5 largest companies by market cap list. Then Nvidia announced its Q1 FY2024 financial results, posting revenue of $26.044 billion and earning a net income of $14.881 billion. Nvidia said it expected to earn $28 billion in the second quarter, greatly increasing investors's confidence and the company's market capitalization.

Nvidia's co-founder and chief executive Jensen Huang then took a tour around the world to discuss the company's prowess at AI, as well as Nvidia's next-generation Blackwell hardware, which further increased confidence. Nvidia's stock has gained over 160% in 2024 alone, adding more than $2 trillion to its market cap. Fast forward to June 18 and Nvidia is now the world's most valuable company by market capitalization.

Nvidia's remarkable growth is fueled by the surging demand for its processors for AI and HPC, particularly the Nvidia H100 and Nvidia H200. And its bench is deep: The company already has its Blackwell B200 family of products set to enter the market later this year and is currently ramping up for that release — that's in addition to anticipated Blackwell RTX 50-series GPUs for client and professional workspaces. With Blackwell, Nvidia will offer not only processors and servers but entire data centers in essence, which is likely to further increase the company's earnings.

Analysts polled by Bloomberg believe that market capitalizations for the most successful technology companies could pass the $4 trillion mark, a truly stunning level. For now, all three contenders to be the first $4 trillion company — Nvidia, Microsoft, and Apple — are well positioned to take advantage of the AI frenzy, albeit on different levels.

"We believe over the next year the race to $4 trillion market cap in tech will be front and center between Nvidia, Apple, and Microsoft," Daniel Ives, an analyst with Wedbush Securities wrote in a note published by Bloomberg. Elon Musk tweeted about his desire to purchase 300,000 Blackwell B200 GPUs once those become available, and he won't be alone in lining up to buy them.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Anton Shilov is a contributing writer at Tom’s Hardware. Over the past couple of decades, he has covered everything from CPUs and GPUs to supercomputers and from modern process technologies and latest fab tools to high-tech industry trends.

-

Thus spake Jensen: "See, I told ya guys ! The More You Buy, The More You Make".Reply

https://preview.redd.it/nvda-over-400-is-he-gona-get-a-new-tattoo-v0-ms7b5i5o243b1.jpg?auto=webp&s=ee9129a4d8b487adabf32f00132c0bbb8c66e047 -

Blastomonas This makes me wonder if it'd possible for any company to compete against such resources.Reply

It seems crazy that a company that is not a household name and only offers gpus and Ai chips is now more valuable than Microsoft, Amazon and Apple. -

ThomasKinsley I can't complain since I ditched TeamRed after ATI was eaten by AMD, but man, I wish there was more competition.Reply -

Blastomonas Oh dear, perhaps this valuation came too soon:Reply

https://www.bbc.co.uk/news/articles/c722gne7qngo

AI is over :P -

Yebemather "Analysts polled by Bloomberg believe that market capitalizations for the most successful technology companies could pass the $4 trillion mark, a truly stunning level."Reply

Truly a world financial crisis that affects small AND big.

And there's always Bloomberg to put salt on injury. Stunning! -

Murissokah Reply

Oh, do complain, because this is in nobody's best interest except Nvidia's shareholders. Nvidia consumers do not benefit from this in any way (I'm one).ThomasKinsley said:I can't complain since I ditched TeamRed after ATI was eaten by AMD, but man, I wish there was more competition. -

NeoMorpheus Reply

Maybe i’m the only one not drinking the greedy company koolaid, but besides the 4090, everything else has direct competition from AMD.ThomasKinsley said:I can't complain since I ditched TeamRed after ATI was eaten by AMD, but man, I wish there was more competition.

Granted, you pull the RT nonsense that all influencers love to bring out but conveniently fail to mention that perhaps only 2 games makes some good use of it (cyberpunk and control) and AMD is not that good.

Hell, in many benchmarks, the 7900xtx is maybe 15% slower, yet cost 50% less.

But cant compete with bribed reviewers aka influencers and fanbois.

Anyways, i am really curious how this capitalization is sustainable when the revenue is so far behind, compared to apple and ms.

This is giving me some serious early 2000’s dejavú. -

DavidLejdar From the ETFs I put some money in since several months ago (via savings plan), the semiconductor ETF is currently performing best, followed by a Taiwan ETF, as TSMC and, also e.g. ASML, have been performing quite well recently too.Reply

Not meant as financial advice. Past performance is not an indicator of future performance, and there is risk, etc. (And even if one still assumes long-term growth, it may dip a bit in or for a few weeks.)

But it is nice, to be able to worry less about the price of GPUs, when part of the cost can be covered by a bit of potential extra income.