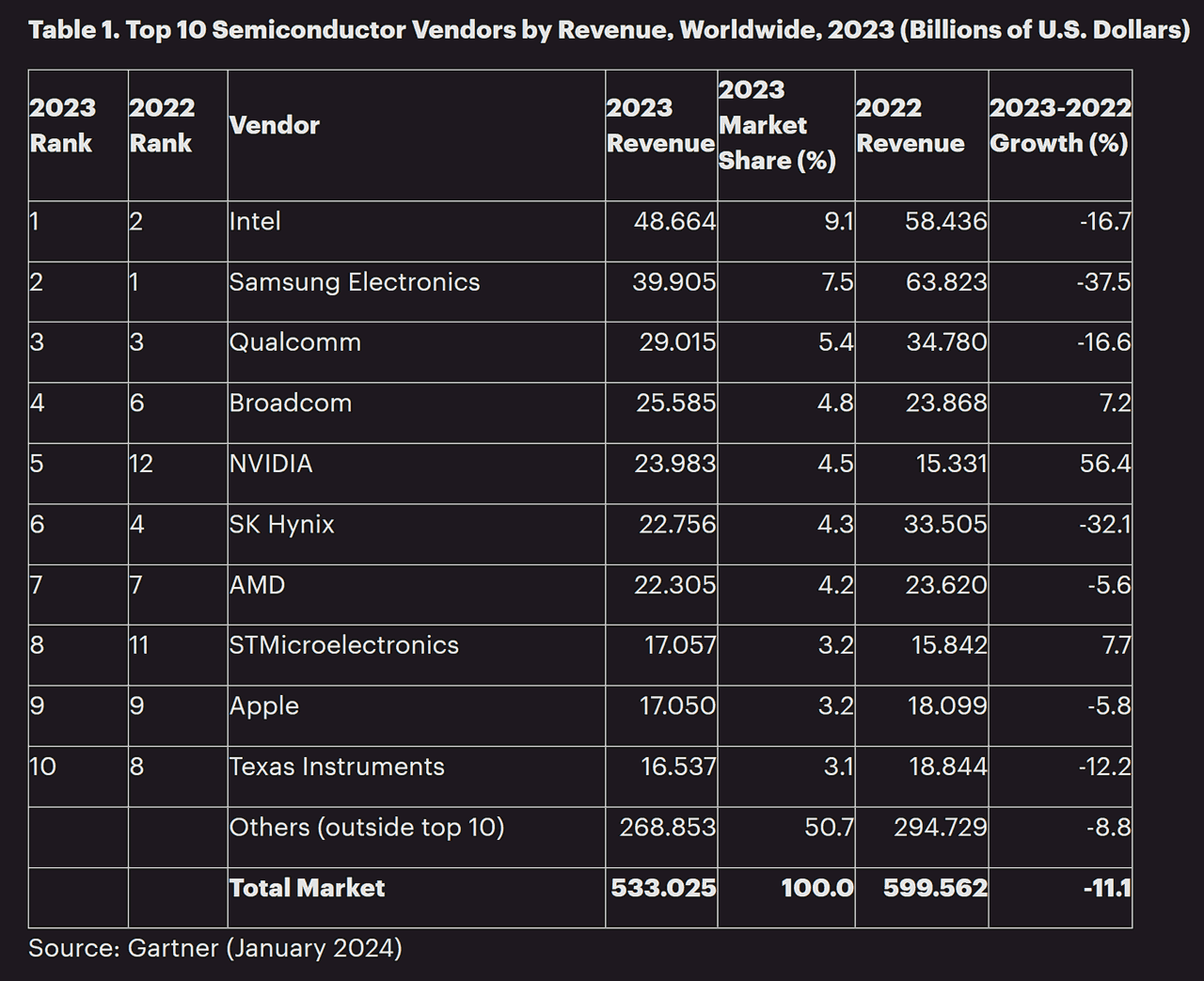

Nvidia smashes, Samsung crashes — Gartner charts big changes in semiconductor business revenue in 2023

Revenue for the sector as a whole declined 11%.

Gartner has published its preliminary worldwide semiconductor revenue charts for 2023. Revenue for the sector as a whole declined by 11%, and the year appears to be characterized by big winners and losers.

Nvidia is one of the winners, it broke into the top five semiconductor vendors for the first time and raked in over $15B in revenue — up over 56% year-over-year. Samsung, by contrast, lost its pole position: its revenue decreased by over 37%. This allowed Intel to regain the semiconductor vendor crown (though Intel's figures decreased by double-digit percentage points as well).

Looking at the big picture, Gartner noted that worldwide semiconductor revenue totaled $533B in 2023. Alan Priestley, a VP analyst at the firm, said the 11% decline over last year is evidence of the cyclical nature of the industry. Priestly also highlighted that 2023 was a "difficult year" with "memory revenue recording one of its worst decades in history."

We aren't surprised to hear memory revenue declined, as all last year the major manufacturers talked about cutting production of ICs to try and control the seesaw of supply and demand (in their favor, of course), with plans to fire up production once prices started to improve. This strategy appears to have hurt both Samsung and SK hynix quite a bit, as the two companies saw revenue declines of 37.5% and 32.1%, respectively.

Some might argue memory makers would have suffered less if they had simply kept running at capacity, as they would have benefitted from economies of scale, fully utilized plants, and customers eager to snap up cheap components. And without the foot-dragging of memory makers, maybe the PC industry could reach the new norms of 32GB of RAM and 2TB of base storage faster. There are indications that memory production will start to be ramped up again shortly.

Gartner provides an overview of the issues memory makers faced: some of the biggest memory markets saw reduced demand, which resulted in memory revenue declining by 37% overall in 2023. Semiconductor players without a hand in the memory business fared much better, seeing revenue declines of just 3% on average.

Intel, which finished extracting itself from the memory business in 2022, is one of the companies that benefitted. Although its yearly revenue dropped by 16.7%, it still managed much better than last year's leader of the pack, Samsung.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Probably the biggest splash in the 2023 rankings came from Nvidia, the current darling of the AI industry. It soared to position number five, up several steps from last year's 12. It's no secret that Nvidia chips are in high demand: the company established a leading position in the burgeoning and lucrative AI market in 2023, and it doesn't look like its position will do anything but improve. Perhaps a more timely question — given the stock market news today — is whether AMD can climb out of position number seven (which it's held for two years).

Last but not least, STMicroelectronics deserves a nod for its steady climb up the charts. It's improved its standing to position number eight — up from last year's 11. The company enjoyed a revenue growth of 7.7% in 2023.

Mark Tyson is a news editor at Tom's Hardware. He enjoys covering the full breadth of PC tech; from business and semiconductor design to products approaching the edge of reason.