Analysts warn China's aggressive chip fab expansion could lead to future price war

Could make chips made on mature nodes cheaper, but will probably make some companies disappear.

With dozens of fabs being built in China and coming online over the next few years, China is poised to expand its chipmaking capacities dramatically. Most of these fabs will produce chips using mature process technologies, enabling China to flood the chip market on these nodes. Meanwhile, experts from market research company TrendForce warn that this could lead to an oversupply of capacity, making foundries cut their quotes, and some may go bankrupt.

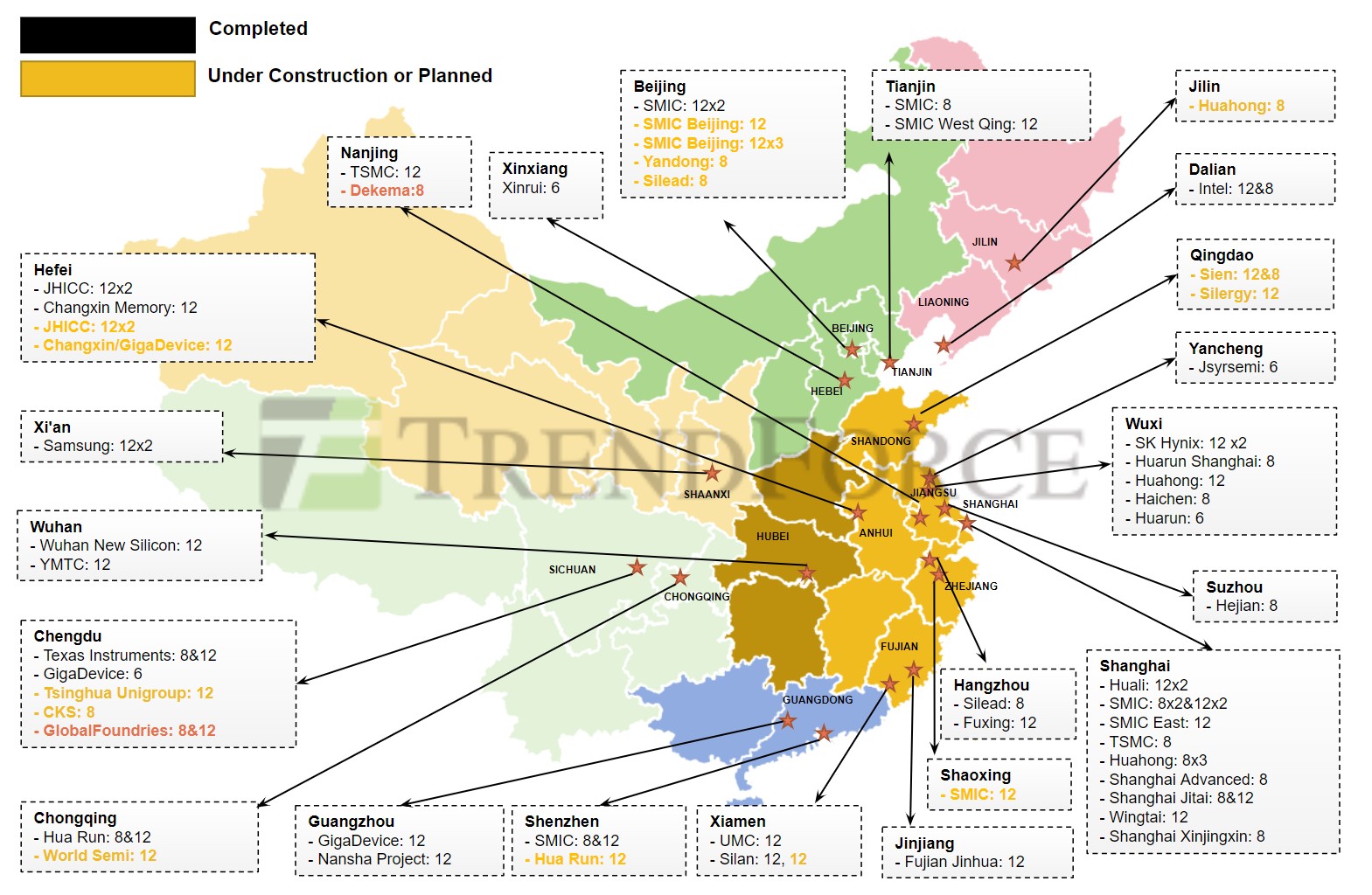

China currently has 44 wafer fabs, excluding seven inactive ones. Among these, 25 are 300-mm fabs, five process 200-mm wafers, and four process 150-mm wafers, according to TrendForce. By the end of 2024, companies like SMIC, HuaHong, Nexchip, CXMT, and Silan aim to add ten more wafer fabs to this list, comprising nine 300-mm fabs and one 200-mm facility. There are 23 more fabs under construction, including 15 300-mm and eight 200-mm facilities, bringing the total new wafer fabs to 32, and all of them are expected to come online in the coming years.

These new and upcoming fabs focus primarily on mature process technologies, specifically 28nm and thicker. To build those fabs, Chinese companies acquired hundreds of lithography tools from ASML, and importing lithography equipment from the Netherlands saw a 1050% surge in 2023. This indicates a concerted effort by China to ramp up its chip manufacturing capabilities, particularly in mature technologies that are used to build chips for a wide range of applications, including consumer electronics and Internet-of-Things.

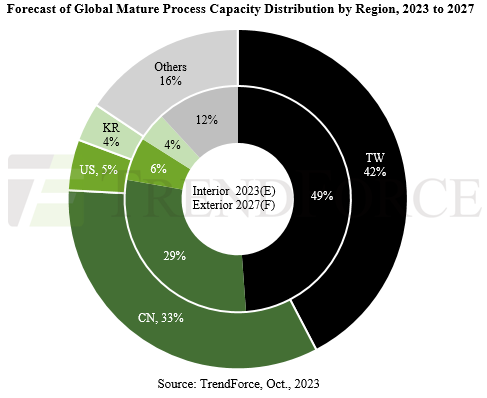

TrendForce forecasts a global ratio of mature (greater than 28nm) to advanced (less than 16nm) semiconductor processes at around 7:3 from 2023 to 2027. With China's capacity in mature processes expected to grow from 29% to 33% by 2027, there's potential for a significant influx of these chips into the global market, potentially triggering a price war. This growth also indicates a trend towards increased localization in sectors like display driver IC (DDIC), CIS/ISP, and power management ICs (PMICs), posing risks of client erosion (i.e., smaller fabless chip designers go bankrupt) and pricing pressures for smaller foundries with similar processes.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Anton Shilov is a contributing writer at Tom’s Hardware. Over the past couple of decades, he has covered everything from CPUs and GPUs to supercomputers and from modern process technologies and latest fab tools to high-tech industry trends.

-

phead128 US: nothing personal, but I can't let you build bleeding edge nodes.Reply

China: Alright, I'm focused to build legacy nodes, which will reduce global supply shortages I guess

....

US: nnnnnoooo.... I didn't mean like that!! ***Embargo, sanction, tariffs***This essentially is protectionism through and through, none of this "National Security" bs. -

bit_user Reply

Why do you think they wouldn't flood the market on bleeding edge nodes, too, if they could?phead128 said:US: nothing personal, but I can't let you build bleeding edge nodes.

China: Alright, I'm focused to build legacy nodes, which will reduce global supply shortages I guess

Agree to disagree.phead128 said:This essentially is protectionism through and through, none of this "National Security" bs. -

TCA_ChinChin Reply

I'd be even happier if they did, since it would mean cheaper higher tech stuff too instead of just cheaper electronics that can rely on older nodes.bit_user said:Why do you think they wouldn't flood the market on bleeding edge nodes, too, if they could? -

phead128 Reply

oh, so you prefer a monopoly or a global shortage of chips with sky high prices instead?bit_user said:Why do you think they wouldn't flood the market on bleeding edge nodes, too, if they could? -

bit_user Reply

But the old playbook applies: corner the market and jack up the price. Once the other fabs go out of business, do you really think China won't raise their prices? It's not like they haven't done it before, in other industries, but I guess people keep getting lured in to their trap by short-term greed.TCA_ChinChin said:I'd be even happier if they did, since it would mean cheaper higher tech stuff too instead of just cheaper electronics that can rely on older nodes. -

bit_user Reply

That's a false dichotomy.phead128 said:oh, so you prefer a monopoly or a global shortage of chips with sky high prices instead? -

bit_user Reply

The US has no sanctions against Taiwan or fabs in most countries around the world, whether they're operated by an American company or not. That doesn't fit the definition of protectionism I'm familiar with.RedBear87 said:if you disagree with the idea that this is, essentially, protectionism, it might be nice to elaborate on that point. -

ThomasKinsley Reply

You're absolutely right. The sanctions being applied against China are because of geopolitics, not protectionism. Arguably the CHIPS Act is a form of protectionism and a desire for greater national security in the event of a Taiwan invasion.bit_user said:The US has no sanctions against Taiwan or fabs in most countries around the world, whether they're operated by an American company or not. That doesn't fit the definition of protectionism I'm familiar with.

But before this gets too political, I will bring it back to tech by saying maybe now GM will finally have enough chips for their vehicles. They kept making excuses for well over a year saying they could not procure enough chips for heated seats and blind-spot monitoring when other companies (e.g., Ford, VW, Tesla) had more than enough. It's up to American companies to find novel uses for these chips, especially with an ensuing price war that will make them more affordable than ever. -

Notton Counterpoint: Some companies have already fallen far behind, release trash products, and deserve to disappear.Reply

For instance, I don't want a product that uses...

Mediatek wifi

Killer NIC

AMD bluetooth

InnoGrit IG5236

etc. -

Rdslw Reply

I expect a flood of fake tech as well, those nodes make most of the 100TB pendrives on aliexpress.TCA_ChinChin said:I'd be even happier if they did, since it would mean cheaper higher tech stuff too instead of just cheaper electronics that can rely on older nodes.

The problem with china is how unreliable they are as a supplier.

You never know what you are getting in the end, and that is very annoying.