Intel and UMC team up on chip manufacturing — Intel will produce jointly developed new 12nm process node in its US fabs

IFS continues to gain momentum.

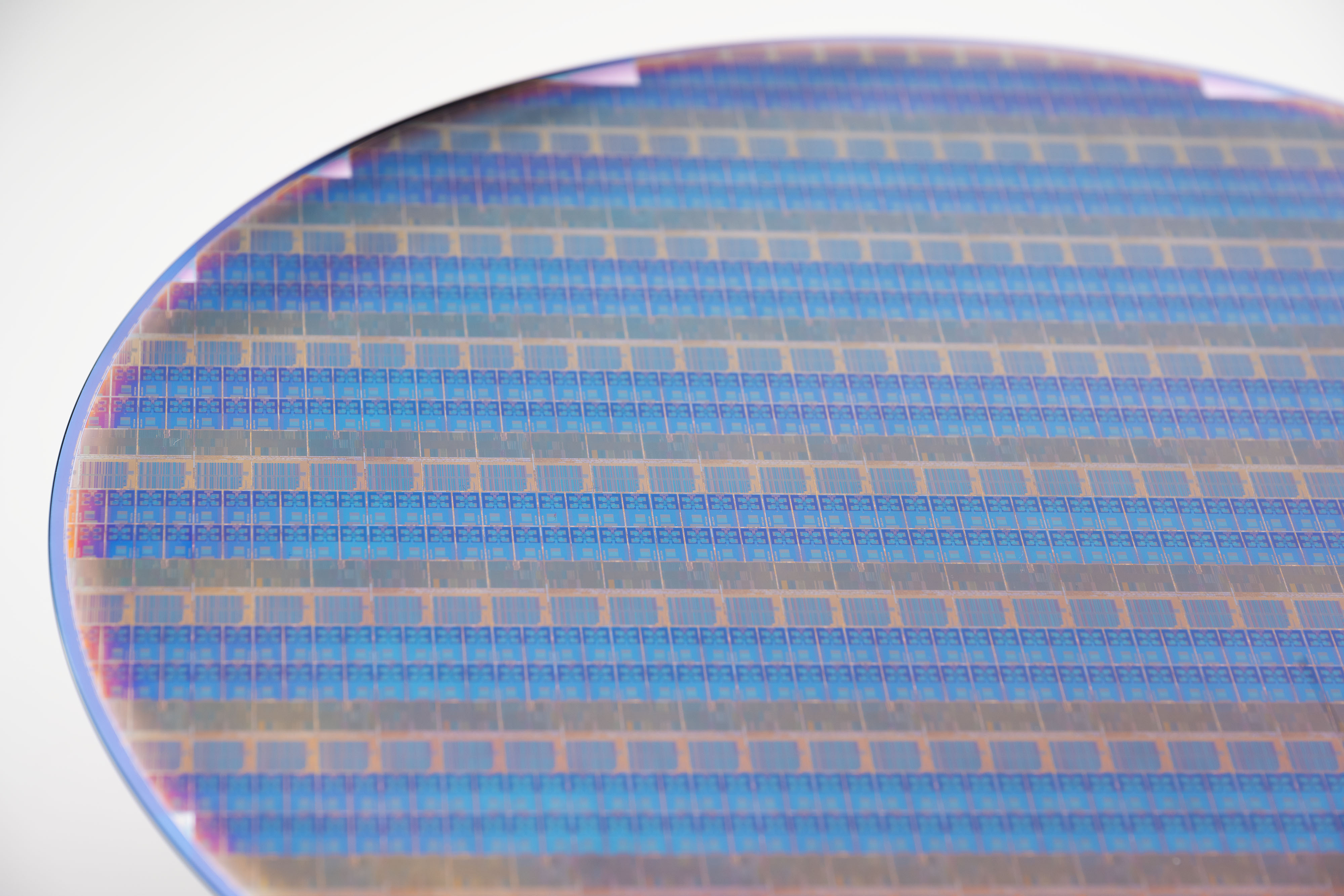

Intel and United Microelectronics Corporation (UMC), Taiwan's second-largest foundry behind TSMC, have announced a partnership to produce processors on a new 12nm node jointly developed by the two firms. The new 12nm node will be produced in three of Intel's Arizona fabs beginning in 2027, marking a big step towards the US's strategic goals of bolstering semiconductor self-sufficiency. We had an opportunity to speak with Stuart Pann, Intel's senior vice president and general manager of Intel Foundry Services, and learned several details about the agreement.

Intel Foundry Services (IFS) will produce the new node in its Fabs 12, 22, and 32, located at its Ocotillo Technology Fabrication site in Arizona, and the node will be made available to external customers. The new 12nm process, which will be used primarily for mobile communication infrastructure and networking applications, will feature industry-standard design tools (EDA) and process design kits (PDK), simplifying adoption for external customers.

These three fabs already produce Intel's existing 10nm and 14nm nodes, but both of these nodes leverage many of the same tools for production, and Intel will also leverage many of those tools for its new 12nm production (Intel has noted in the past that 90% of the tools were transferable between the 10nm and 14nm nodes). Given that these nodes have been in production for many years, the tools and fabs are mostly already depreciated (i.e., paid for), leaving room for Intel to employ many of these same tools for the production of the new 12nm node to help reduce additional CapEx and maximize profits. These three fabs will slowly roll off work on the 10nm and 14nm nodes as Intel moves towards production of the new Intel/UMC 12nm node in 2027, thus making capacity available for the new node.

UMC will bring some new capabilities to IFS that it currently doesn't have, such as RF and WiFi production technologies, thus expanding IFS's addressable market. As such, UMC will also install some of its specialized production tools at these sites.

For UMC, the deal gives it relatively fast access to Intel's tremendous production capacity, chipmaking tools, existing supply chains of external suppliers, and a workforce already in place, all right in the US — a region pining for an alternative to foreign-sourced chips produced on mature nodes.

UMC will handle the go-to-market activities of bringing the new node to market, thus leveraging its existing channel, customers, and relationships. However, Intel will inevitably also interface and engage with those customers during the manufacturing process, thus giving it much-needed experience and access to new potential avenues for its IFS initiative.

Intel already has chips on nodes comparable to 12nm, such as 14nm, 10nm, or even 22nm. In fact, the company's 22FFL process is now available in the form of the Intel 16 node produced by IFS with standardized design tools and PDKs. The new 12nm node will step in as a newer and more efficient node that also has more optionality due to the addition of UMCs' aforementioned special technologies.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Intel isn't disclosing the financial details of the agreement with UMC. The new deal will open up a new front of competition with the US-based GlobalFoundries, which also appeals to US customers looking for mature node production on a 12nm-class process. Naturally, it will also compete with TSMC's extensive arsenal of mature nodes.

The IFS collaboration with UMC is part of the company's broader strategy of entering into the market for mature nodes, a must for a third-party foundry, as it aims to become the world's second-largest foundry by 2030. Intel and Tower Semiconductor, a leading mature node foundry, also have a semiconductor production agreement. After the two attempted to merge, a deal scuttled by a Chinese regulatory agency's incessant delays, Intel agreed to produce 65nm chips for Tower in its 11X fab in New Mexico.

“Taiwan has been a critical part of the Asian and global semiconductor and broader technology ecosystem for decades, and Intel is committed to collaborating with innovative companies in Taiwan, such as UMC, to help better serve global customers,” said Stuart Pann, Intel senior vice president and general manager of Intel Foundry Services (IFS). “Intel’s strategic collaboration with UMC further demonstrates our commitment to delivering technology and manufacturing innovation across the global semiconductor supply chain and is another important step toward our goal of becoming the world’s second-largest foundry by 2030.”

Intel has long lived on the leading edge of process technology, designing and producing chips only on the latest nodes, and then quickly moving to new technologies. Moving to a third-party foundry model with IFS requires keeping its current nodes alive and in production for much longer, thus maximizing its investments in both tools and facilities. This means its current leading-edge IFS nodes, like Intel 3, 20A, and 18A, will eventually transition to production as mature nodes in the future. However, Intel won't have a readily apparent "dual-track" roadmap with both Intel/UMC and Intel-only nodes on offer. Intel tells us it will continually refine its existing nodes as they transition to mature nodes, thus offering differentiated options for the mature node business.

For now, Intel doesn't have any firm commitments with UMC for future engagements beyond the jointly developed 12nm node and is focused solely on filling the production capacity for the project, but it isn't ruling out that possibility in the future.

IFS is slated to reveal its roadmap at its IFS Direct Connect conference next month. We'll be sure to learn more at the event; stay tuned.

Paul Alcorn is the Editor-in-Chief for Tom's Hardware US. He also writes news and reviews on CPUs, storage, and enterprise hardware.

-

elforeign This is good for diversification of production. I wonder what the supply chain is like for US based manufacturing of advanced chips, not to mention these fabs are in AZ? Hope they can continue to rely on their water supply.Reply -

TerryLaze Reply

Well, that's how you make chips be still profitable while everybody else constantly raises their prices....WarWolverineWarrior said:10+++++++2 nm

But also these will be for other things and not CPUs.

The new 12nm process, which will be used primarily for mobile communication infrastructure and networking applications, will feature industry-standard design tools (EDA) and process design kits (PDK), simplifying adoption for external customers.

-

gg83 Is arizona the best state for chip production? Don't you need loads of clean water? Maybe reclamation tech has improved a bunch. I really think upstate New York is one of the best places for chip production. Good rail, air, sea, and road access. Also tons of fresh water and other financial incentives.Reply -

TCA_ChinChin Reply

I assume its because of the proximity of existing and other planned chip related sites. But I agree, there are other areas in the US that could be better like NY, Pacific Northwest, places in the Midwest.gg83 said:Is arizona the best state for chip production? Don't you need loads of clean water? Maybe reclamation tech has improved a bunch. I really think upstate New York is one of the best places for chip production. Good rail, air, sea, and road access. Also tons of fresh water and other financial incentives. -

thestryker Reply

It's a combination of regulatory benefits, space availability and already existing infrastructure. In the case of this partnership it's using existing fabs, and I'd assume the 2027 timeline is that they will likely be drawing down Intel 7 manufacture to make room for it.gg83 said:Is arizona the best state for chip production? Don't you need loads of clean water? Maybe reclamation tech has improved a bunch. I really think upstate New York is one of the best places for chip production. Good rail, air, sea, and road access. Also tons of fresh water and other financial incentives.

In Oregon where their most advanced fabs are (fab R&D is largely there) there simply isn't enough land available for them to expand for adding large scale fabs. Ohio gave them extremely good terms and had a huge swath of land available which is why their next big US fab location is there. -

gg83 Reply

Excellant point. It probably is a lot cheaper to build in AZ, no trees and less rocky earth to excavate.thestryker said:It's a combination of regulatory benefits, space availability and already existing infrastructure. In the case of this partnership it's using existing fabs, and I'd assume the 2027 timeline is that they will likely be drawing down Intel 7 manufacture to make room for it.

In Oregon where their most advanced fabs are (fab R&D is largely there) there simply isn't enough land available for them to expand for adding large scale fabs. Ohio gave them extremely good terms and had a huge swath of land available which is why their next big US fab location is there. -

shady28 Unexpected, but good. The major chip shortages we had were mostly not CPUs, but things like LCD drivers and automotive embedded chips. Repurposing these older nodes for those purposes makes a lot of sense.Reply -

kjfatl These fabs are being set up in Arizona because they are already built up and full of expensive equipment. Instead of selling the equipment to China, Malaysia and others, they are reconfiguring it for a high-volume process that will likely stay in high volume production for at least 15 more years. There are many 28nm designs than can be ported to 12nm saving a lot of money for the customers.Reply

Converting these old fabs to 2 nm and smaller is not cost effective. The high-NA EUV equipment will not fit in the buildings. A better approach is build new fabs in a location on the eastern side of the US where water and labor are plentiful, located within 1 day's driving distance to the band of automobile plants which strings from Georgia to Michigan. There are also at least 10 great engineering universities located within a day's drive from this location.

I would not be surprised to see another player add this common process, quite possibly Samsung and Global Foundries. -

Eskimou Reply

At this point the biggest hold up to building new fabs is finding enough highly trained workers. Water, electricity,transportation and regulatory environment are helpful as well. You generally see fab sites announced near existing ones (poach people) or near major universities and manufacturing hubs (train/retrain).gg83 said:Is arizona the best state for chip production? Don't you need loads of clean water? Maybe reclamation tech has improved a bunch. I really think upstate New York is one of the best places for chip production. Good rail, air, sea, and road access. Also tons of fresh water and other financial incentives.