Blacklisted Huawei and SMIC to Reportedly Build Chip Fab

Backlisted Huawei and SMIC team up for a fab.

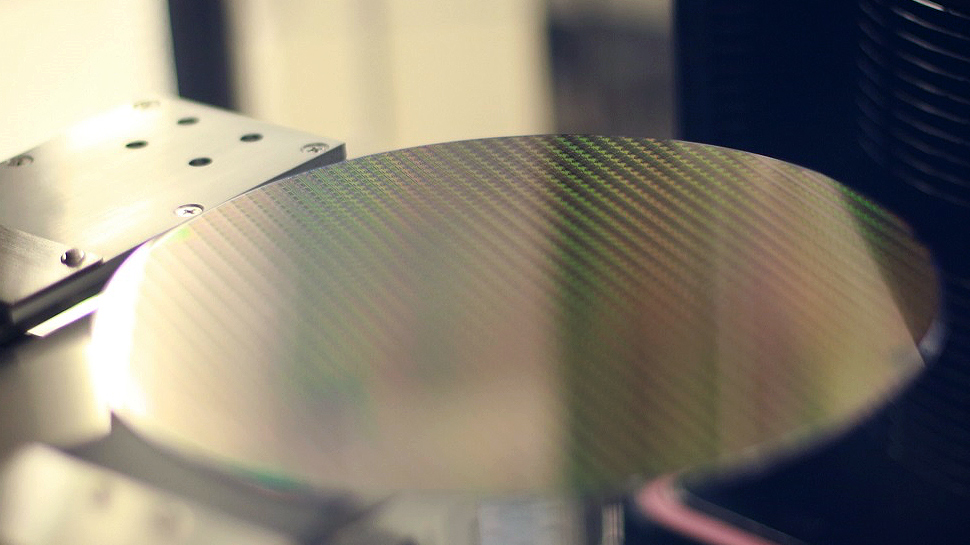

Huawei is reportedly teaming up with SMIC to build a semiconductor manufacturing facility in mainland China that will serve its needs either exclusively, or almost exclusively, helping it to avoid the impact of US sanctions that have severely limited its access to crucial chip technologies. Huawei intends to spend as much as $10 billion on the fab, according to reports by Huawei Central and UDN.

The Fab

The new fab is expected to be built near Shenzhen, and it will be used to manufacture Huawei's HiSilicon chips, presumably using process technologies developed by SMIC. We can make an educated guess based on Huawei's $10 billion investment that this will be a fairly advanced 300mm fab, so it will likely be at least 28nm-capable (though we would speculate that Huawei is probably looking at 14nm FinFET capabilities). Unfortunately, there is no reliable information about the process technologies planned for the fab.

At present, SMIC's most advanced fabrication process is N+1, which is believed to be a low-cost 7nm-like node. Meanwhile, the most advanced manufacturing technology that SMIC uses for high volume production (HVM) is its 14nm node. HiSilicon can design leading-edge system-on-chips (SoCs) for TSMC's N5-series nodes, but it also has loads of SoCs for legacy processes, so the fab will undoubtedly be quite busy.

HiSilicon's Needs

Huawei is one of the largest chip consumers in China that also happens to have its own chip design arm (HiSilicon). However, being blacklisted by the U.S. government, Huawei has severe difficulties securing chip production capacities for HiSilicon chips that it uses for tens of millions of products. Currently, foundries must obtain a license from the U.S. Department of Commerce for any contract with Huawei involving an American technology (which means 99.9% of them).

HiSilicon was founded in 1991, and in 30 years it has developed hundreds if not thousands of SoCs, processors, modems, controllers, and accelerators for the diverse needs of its owner. Given HiSilicon's huge product portfolio, it has very diverse needs for process technologies, so the new fab will have to offer numerous nodes and probably some advanced packaging capabilities (we are speculating) to meet the needs of its key customer.

For Huawei, one of the ways to ensure a steady supply of HiSilicon chips is to build its own semiconductor production facility that will serve its needs either exclusively, or almost exclusively. As it turns out, it has found a way to get the chips it needs — build a dedicated fab. Yet frankly, there are more questions than answers at this point.

Different Options

At present, the structure of the deal is unclear. Huawei could own the fab, and then SMIC will license its process technologies and lend some engineers and workers. Conversely, it could be co-owned by Huawei and SMIC but operated by SMIC, and therefore inherit the latter's nodes and personnel.

Considering SMIC's typical business model (build a fab in a joint venture with local governments and then operate it), it is likely that China's largest foundry will manage the fab. Still, Huawei will either own a controlling stake or co-own the fab. Here's what that might look like.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Option 1: Huawei Goes IDM

Suppose the fab is 100% owned by Huawei through a subsidiary (which means that Huawei is set to adopt an integrated device manufacturer [IDM] business model). In that case. In that case, it might be very hard for the company to obtain production tools and then ensure a steady supply of components and consumables. The U.S. government has sent a clear message about limiting Huawei's access to as many advanced technologies as possible.

Being one of the world's largest high-tech companies, Huawei has very deep pockets, so spending $10 billion on a fab is hardly a problem for the giant. But building it and then ensuring that it operates smoothly is a completely different task.

While Huawei is a mighty company, developing process technologies will take years (assuming that Huawei has appropriate scientists and engineers). But since SMIC is in play, Huawei could license manufacturing processes from its partner, but this might require an appropriate export license from the U.S. government since these nodes were developed using American technologies. In addition, Huawei will need experienced personnel to work at the fab, so it remains to be seen where it plans to get the staff.

Furthermore, even if the IDM model is the case here, the fab will likely need a license to supply chips to its parent company. Yet, if the fab is dedicated solely to Huawei, the company's chip supply will be somewhat more predictable. Meanwhile, it remains to be seen whether Huawei can utilize the whole fab because an underutilized fab generates substantial losses.

Option 2: Co-Owning a Fab

If Huawei, SMIC, and other possible parties co-own the fab, it will perhaps be somewhat easier to build and operate it. Yet, it will still have to obtain a license from the U.S. government to produce chips for Huawei. Furthermore, while the fab is probably meant to give priority to HiSilicon chips, it will be natural for SMIC to land additional orders to increase the utilization of the fab. This begs the question of how exactly the parties will share the output of the fab.

Since Huawei and SMIC are both blacklisted, it will be interesting to see how hard it will be for them to obtain necessary export licenses from the U.S. government (hundreds, if not thousands, of licenses will be required). The US reviews license applications involving these two companies with a presumption of denial.

One Important Benefit

All of Huawei's semiconductor options involve obtaining licenses from the U.S. government: whether it is outsourcing production, co-owning a fab, or even owning a fab. So, what benefits do the latter two options bring?

The location in China and lack of any actual control from the U.S. government. While Huawei and SMIC will have to obtain technology export licenses required by the U.S. government, they might produce some of the chips before they get appropriate authorizations, or even without the said permissions at all since North America's authorities cannot control what happens in Shenzhen. It remains to be seen what happens if the U.S. govt finds out about the violations, but it is highly likely that only the fab (or rather the company owning the fab) will suffer the consequences.

Summary

Rumors about Huawei's plans to build its own fab and even fab equipment have been circulating for quite some time. With information about the fab as well as details like location and planned investment coming from two sources, the rumor now looks far more credible.

While it will be inherently hard for Huawei and SMIC to build a new fab (remember that even SMIC itself has problems obtaining all the equipment it needs for its fabs), the benefits in the forms of steady chip supply and lack of actual control of the U.S. government will outweigh all difficulties.

Anton Shilov is a contributing writer at Tom’s Hardware. Over the past couple of decades, he has covered everything from CPUs and GPUs to supercomputers and from modern process technologies and latest fab tools to high-tech industry trends.

-

vinay2070 I have a feeling that US will make sure this will go nowhere or will be limited to old gen fabs like the 14nm ones.Reply -

shady28 Article speculates 28nm or maybe 14nm.Reply

Keep in mind SMIC 14nm is even by SMICs data (dubious) around 30MT/mm2 which makes it like TSMC 16nm and inferior in density to every other '14nm' node. Intel 14nm for example is about 20% more dense at over 36MT/mm2. There is also some speculation that it is really closer to 20nm than 14/16nm nodes.

This would be more newsworthy if it they were advancing beyond 8-10 year old fab tech. -

lilzz That's a very BAD BAD assumption that huawei or SMIC needs license from US.Reply

Huawei can acquire a set of equipments from domestic or non US origins and then have SMIC fine tune or modify its 28nm or 14nm or N+1 8nm technology to fit those non US equipments.

That's the reason Huawei bring SMIC onboard, to do the fine tuning.

The author making a very BAD assumption Huawei will use US equipments and just slap SMIC tech ontop of it. -

shady28 Replylilzz said:That's a very BAD BAD assumption that huawei or SMIC needs license from US.

Huawei can acquire a set of equipments from domestic or non US origins and then have SMIC fine tune or modify its 28nm or 14nm or N+1 8nm technology to fit those non US equipments.

That's the reason Huawei bring SMIC onboard, to do the fine tuning.

The author making a very BAD assumption Huawei will use US equipments and just slap SMIC tech ontop of it.

Yeah it is actually in some other articles that SMIC 14nm was mostly using indigenous tech. I would assume some or even most of it is stolen in terms of design, ofc good luck getting anywhere near the fab equipment to prove it. However it doesn't sound like they are going to AMSL for their equipment at 14nm. There was a lot of noise last year about them getting to 7nm, but that seemed to be more of a small time prototype, clearly not something they're ready to do in any volume.

Nevertheless a big high volume 14nm fab is itself a big deal. Most phones and PCs sold in the world are not the high end stuff talked about on sites like this one, 14nm is still pretty advanced for just about anything other than high end server/client/mobile compute. There's a huge laundry list of fabs outside of TSMC/Intel who still aren't below 28nm. -

systemBuilder_49 Reply

Where did you get this idea Apple A14 chips are using 5nm and qualcomm latest-generation chips are 5-7nm made at TSMC. Samsung is fabbing NVidia GPUs at 8nm. You have to go back 3Y to see 14nm (snapdragon 820). Global foundries is 12nm because they ran out of money for 10nm and below. Ryzen 1st and 2nd generation chips were fabbed at Global Foundries and I think some 3rd generation chips are also being made there. IBM is at 7nm or below. Micron Technology is between 11nm and 13nm. The phrase that "only TSMC/Intel is below 28nm" is utter BS.shady28 said:Nevertheless a big high volume 14nm fab is itself a big deal. Most phones and PCs sold in the world are not the high end stuff talked about on sites like this one, 14nm is still pretty advanced for just about anything other than high end server/client/mobile compute. There's a huge laundry list of fabs outside of TSMC/Intel who still aren't below 28nm. -

shady28 ReplysystemBuilder_49 said:Where did you get this idea Apple A14 chips are using 5nm and qualcomm latest-generation chips are 5-7nm made at TSMC. Samsung is fabbing NVidia GPUs at 8nm. You have to go back 3Y to see 14nm (snapdragon 820). Global foundries is 12nm because they ran out of money for 10nm and below. Ryzen 1st and 2nd generation chips were fabbed at Global Foundries and I think some 3rd generation chips are also being made there. IBM is at 7nm or below. Micron Technology is between 11nm and 13nm. The phrase that "only TSMC/Intel is below 28nm" is utter BS.

So I try to be cordial, but not to people who misquote me.

What I said was : "There's a huge laundry list of fabs outside of TSMC/Intel who still aren't below 28nm. ". I never said "only TSMC/Intel is below 28nm", that would be you lying about what I said.

Perhaps your reading comprehension needs a bit of work, aye?

This is a simple undeniable fact: The vast, vast, vast majority of fabs in use are not below 14nm. You probably should look inside that PC you are using and count the chips and try to figure out what node they're all using, you'd be suprised. While you're at it, maybe check up on what's inside your clock, your microwave, your car, and your fridge.

Perhaps what is misleading you is the concept of 'best selling phone', which is usually an iPhone (which I have bought 3 this year). Here's the thing - most people do not have iPhones. Nor do they have samsungs. There are quite literally hundreds of phone models for sale. Being #1 - #5 doesn't mean the majority are in those top 5. This is pretty basic math. Many MediaTek based phones are still using SoCs on 12-28nm.

This may help you get some perspective and step out of that bubble:

https://en.wikipedia.org/wiki/List_of_semiconductor_fabrication_plants