NAND Flash Vendors Struggled in Late 2018 - Research

DRAMeXchange, a division of the market research firm TrendForce, shared research today saying rising economic uncertainties have caused NAND flash customers to delay or cancel their recent orders. This situation led to revenue loss for NAND flash vendor Samsung and vendors overall seeing a 16.9 percent quarter-over-quarter (QoQ) revenue decline in Q4 2018.

As we’ve seen with the recent decline in DRAM orders, customers are starting to delay their restocking or may even cancel orders if they can’t afford them, due to their current financial situations or because they expected the prices to fall even further in the near future. DRAMeXchanges noted that NAND flash suppliers also suffered because Apple saw lower than expected sales in the new quarter as the customers’ desire to switch from previous iPhones to newer more expensive models declined. Laptops demand also fell primarily due to Intel’s CPU shortage and OEMs’ inability to switch to more available AMD chip alternatives in due time.

Despite flash vendors overall revenue decline, bit shipments saw a 40 percent increase for the whole of 2018. For the entire year revenue was also up, hitting a record high of $63.2 billion, a 10.9 percent increase from 2017.

Still, DRAMeXchange expects the "demand slump" to continue in Q1 2019.

Samsung

Samsung’s bit shipments for Q4 2018 fell by more than 7 percent QoQ as weak demand across the smartphone, server and laptop markets hit the company, while its revenue declined by 28.9 percent QoQ, down to $4.3 billion.

According to DRAMeXchange, Samsung intends to maintain its current production capacity for 3D NAND flash for 2019 but will shrink production for 2D NAND flash as products based on it start to become less popular.

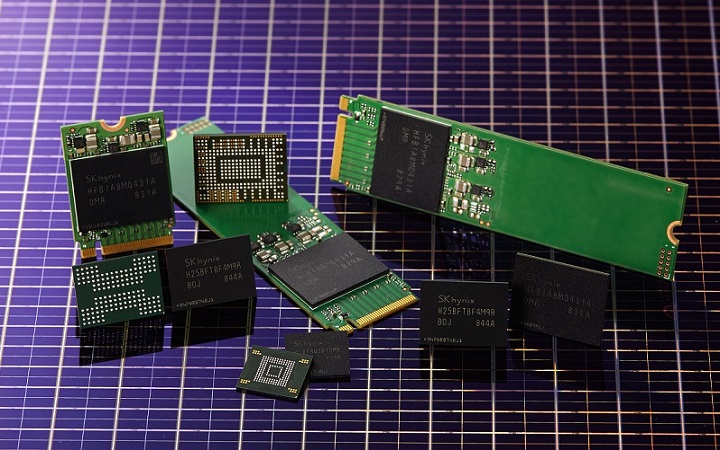

SK Hynix

SK Hynix saw 10 percent growth in bit shipments in Q4 2018, but the company still fell short of expectations as smartphones saw weak demand in the same time period. SK Hynix lost 13.4 percent revenue QoQ, down to $1.59 billion.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

The vendor intends to ramp up NAND flash production this year at the newly built M15 factory. It will mostly continue to sell 72-layer NAND flash storage this year but will also begin the mass production of 96-layer flash products.

Toshiba

Toshiba was also impacted by weak iPhone demand, as well as the Intel CPU shortage, but its NAND flash bit shipments remained steady QoQ. However, the company also saw a decline of 14.7 percent in revenue (down to $2.73 billion) compared to the previous quarter.

At Western Digital’s, request Toshiba will lower production this year. It will primarily manufacture 64-layer NAND flash chips.

Western Digital

DRAMeXchange noted that the U.S.-China trade dispute negatively impacted Western Digital. Despite a 5 percent growth in bit shipments QoQ, the company still saw a revenue loss of 14.2 percent (down to $2.17 billion).

Western Digital is expected to lower its production by 10-15 percent this year. The company is currently negotiating joint investment in Toshiba's latest factory in Iwate Prefecture, Japan.

Micron

Micron had a better quarter than most, primarily due to its strong enterprise SSD sales, as well as increased shipments of UFS (universal flash storage) and uMCP (UFS-based multi-chip package) products. However, due to market pressure to lower prices, the company also saw a revenue loss of 2.2 percent QoQ, down to $2.18 billion.

In 2019, Micron will focus on switching more of its product lineups to 96-layer technology, so its bit shipments growth should be closer to the industry average.

Intel

As the leader in server SSDs, Intel was the only vendor to see a revenue growth of 2.4 percent, reaching $1.12 billion in sales. Like everyone else, Intel’s unit prices also fell 10-20 percent in Q4 2018.

Most of Intel’s NAND flash products are manufactured with 64-layer technology, and this will remain unchanged in 2019. However, the company is expected to switch 30 percent of its production to 96-layers this year.

Lucian Armasu is a Contributing Writer for Tom's Hardware US. He covers software news and the issues surrounding privacy and security.