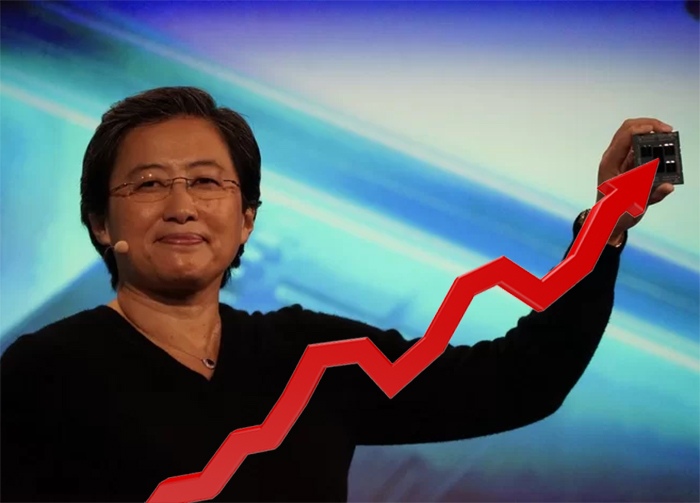

AMD Ends 2018 as Top Stock Performer, Nvidia Slides Hard in Q4

It’s been a rough year for the stock market in general, and both AMD and Nvidia have been hit hard in recent months by the cryptocurrency crash. But looking at 2018 as a whole, AMD ended the year as the top-performing stock on the S&P 500, up 79.6%, according to MarketWatch. And the company just recently landed on the Nasdaq-100 index.

The stock of AMD’s graphics-chip rival Nvidia, on the other hand, didn't do so well. After riding to record highs over the last couple of years, Nvidia stock crashed hard at the end of the year. According to CNBC, Nvidia stock’s 54-percent drop in the fourth quarter made it the worst-performing company on the S&P 500 over that time period.

To be fair, AMD also fell 40.2% percent off its September high as the year ended. But AMD is buoyed by its resurgent CPU division, with Ryzen on the consumer side and EPYC in servers, while Nvidia’s business is tied closely to demand for GPUs, whether they be for gaming, AI, or autonomous driving.

AMD is also getting a boost as of late by the numerous challenges facing its much larger CPU rival Intel, including (but not limited to) ongoing issues getting to mass production on its 10nm node, a resulting shortage in 14nm production, and spending the second half of the year searching for a new long-term CEO.

Interestingly, despite all its woes, Intel’s stock is pretty flat on the year, up less than a half a percent. Of course, not being heavily involved in graphics helped the company avoid the fourth-quarter woes that hit both AMD and Nvidia, although the companydoes plan to be in the dedicated graphics game by 2020 with its Xe line. Intel was also buoyed by healthy data center growth, although it’s still unclear how much the US/China tariff battle will hurt the market there—and elsewhere.

As for AMD, the company appears to have a strong opening in 2019 to gain market share on the CPU side while Intel sorts out its multiple issues. And the upcoming Navi architecture could help it fight back against Nvidia on the mainstream/mid-level graphics front (which is where most of the volume and profit is).

But make no mistake: AMD is still fighting an uphill battle against both of its primary rivals, primarily due to its comparatively small size. Being the David fighting two Goliaths is certainly good for a company’s public image. But AMD’s market cap of $18.45 billion pales in comparison to Nvidia’s $81.44 billion. And Intel’s $219.55 billion market value is in another league.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

In other words, while AMD may have clawed its way back from bankruptcy in recent years thanks in large part to its Zen architecture, it has much less to invest in research and development than its competitors, much of its high-level talent has defected to Intel, and it needs to keep stringing together successes if it wants to get to a level of dominance—where both Nvidia and Intel sit confidently at the moment, despite their own issues.

Both Nvidia and, particularly, Intel are better situated to weather market fluctuations and product issues. Nvidia is more vulnerable due to its ties primarily to the GPU market, it’s been broadening its focus within that field for several years, while AMD has had less success in growing areas like AI, enterprise graphics, and automotive. While AMD clearly has the momentum, one serious trip-up could still knock the underdog out of the running.

After a rough start with the Mattel Aquarius as a child, Matt built his first PC in the late 1990s and ventured into mild PC modding in the early 2000s. He’s spent the last 15 years covering emerging technology for Smithsonian, Popular Science, and Consumer Reports, while testing components and PCs for Computer Shopper, PCMag and Digital Trends.

-

shabbo Mid-end gaming, anything below a 1080Ti, AMD Radeons RXs are the performance leaders. AMD also has better drivers, cooler software and lower cost. This will continue into 2019.Reply -

hannibal That is not the problem part. The problem is that competition have more money to reseach and development. More money to here tallented persons...Reply

We really have to hope that AMD manages to beat the odds or the market situation to the customers van get really ugly. But it is still uphill fight just like the article says! -

BulkZerker "While AMD clearly has the momentum, one serious trip-up could still knock the underdog out of the running."Reply

-Intel can't into smaller CPUs, has yeild issues from their big AF chips

-Cant into the below $400 GPU market (right now. What's the 2060 or whatever it's called going to actually retail for?)

AMD needs to push hard in the sub $120 CPU market and goven time their Epyc line will gain adoption in Enterprise markets as they are more efficient that the current monolithic designs that Intel currently uses. (Boss we can get a ROE of 8 months on a new server closet by power savings alone.) -

salgado18 Reply21632750 said:Mid-end gaming, anything below a 1080Ti, AMD Radeons RXs are the performance leaders. AMD also has better drivers, cooler software and lower cost. This will continue into 2019.

I don't think so. Right now, Nvidia has lower-tdp cards, and a better market perception. Radeons are great, but GeForces are one step ahead.

Don't get me wrong, they have good cards, but AMD is what it is today because of their Zen lineup.

If they keep this momentum in CPUs and bring something awesome in GPUs, that will make them grow a lot more. -

JamesSneed Reply21632750 said:Mid-end gaming, anything below a 1080Ti, AMD Radeons RXs are the performance leaders. AMD also has better drivers, cooler software and lower cost. This will continue into 2019.

Seriously? This is not the case at all. Would be lovely if Navi makes your delusion reality but today Nvidia dominates every single price segment. I'm pulling for AMD but what you said is simply 100% wrong.