Crypto Mining GPU Pricing Plummets as Demand Cools

Impacting both AMD and Nvidia

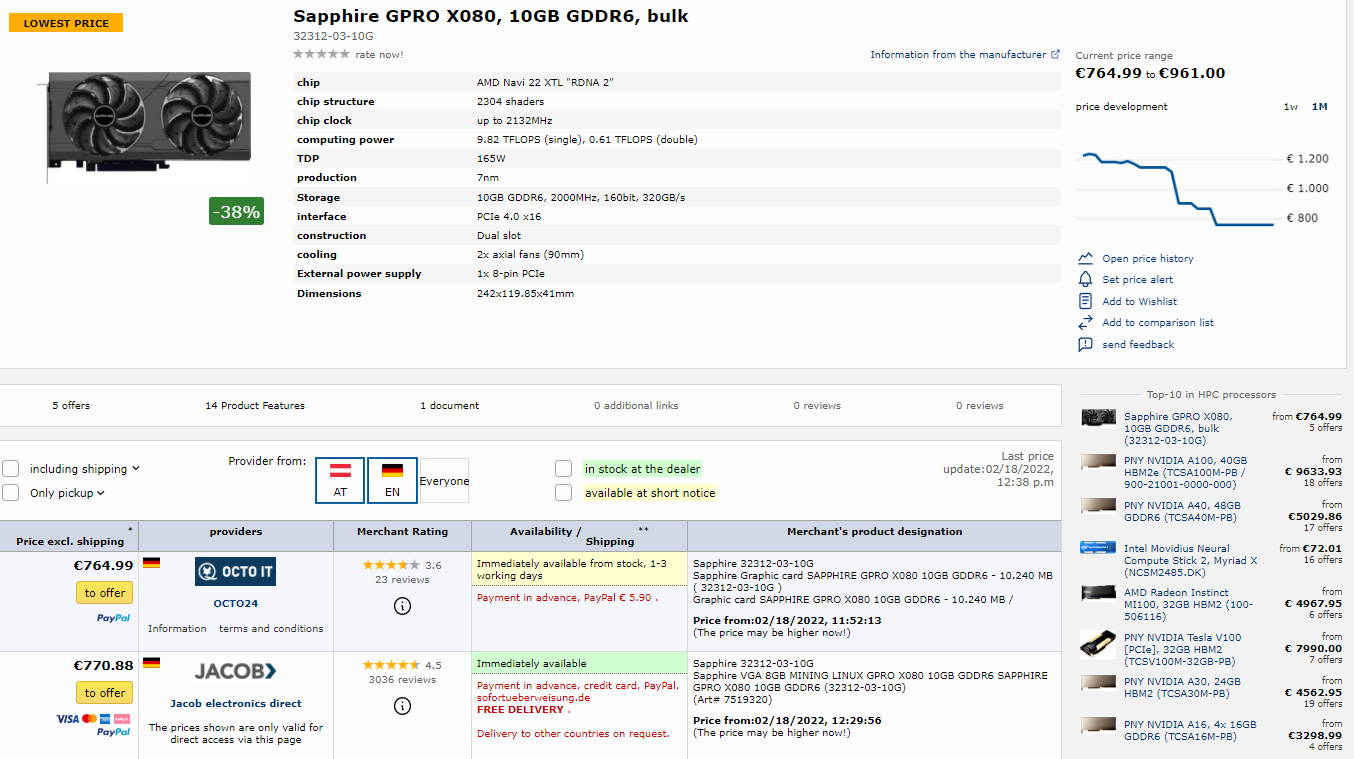

Multiple signs in the industry indicate that interest in cryptomining-specific GPUs is waning as mining profitability plummets. Nvidia reported that its revenue from crypto mining plunged 77% in the last quarter of the year, and now we're seeing signs that AMD-based cryptomining GPUs are also beginning to lose value. For instance, the Sapphire GPRO Radeon's price tag has fallen nearly 40% over the last month.

Sapphire secretly launched its GPRO series of cryptocurrency-specific graphics cards last November. Based on Navi 22 and Navi 23 silicon, the Sapphire GPRO Radeon X080 and X060 accelerators proved themselves impossible to find in mainstream outlets - and even the manufacturer's website. However, the cards have been listed on the price comparison website Geizhals (via VideoCardz) for a month now, giving us a glimpse at the GPU's pricing evolution in that time-frame.

The data is eye-opening: the cards have seen their value plummet closer towards their purported $846 MSRP, falling by almost $600 from $1415 down to $867 — a 38% decrease.

Since December, the overall cryptocurrency market has been on a downtrend, making it more difficult for miners and cryptocurrency-minded gamers to recoup their investment in the improving but still hotly expensive GPU market. This comes as the transition to Proof of Stake draws closer for the Ethereum blockchain, which in itself is likely the single most pressing element gatekeeping miners from further graphics cards acquisitions.

Yes, other Dagger-Hashimoto-based cryptocurrencies can be mined after Ethereum transitions to Proof of Stake - but none of them are nearly as profitable as Ethereum mining, owing to their low overall price per coin.

As we've recently seen, mainstream GPUs from both Nvidia and AMD have been dropping in pricing since December 12th as well, owing to the cooling demand, increasing stock levels, and highly inflated pricing. This is likely putting off users still looking to upgrade their graphics cards to the latest AMD and Nvidia products.

This seems to have naturally extended to cryptocurrency-specific products, such as the Sapphire GPRO X080 - and the writing is likely on the wall for Nvidia's Crypto Mining Processor (CMP) products as well. For example, the price comparison platform Geizhals currently has a single, top-of-the-line Nvidia CMP170HX card currently listed for pre-sale, at an eye-watering €4,699 (~$5,332).

Interestingly, the price reduction of around 38% seems to fall within the same decline levels witnessed for the mainstream RX 6000 series and RTX 3000-series from both AMD and Nvidia. One would expect cryptocurrency-specific graphics card pricing to fall quicker, however, considering how their headless design (meaning there are no video outputs) renders these cards useless as main system drivers.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Francisco Pires is a freelance news writer for Tom's Hardware with a soft side for quantum computing.

-

btmedic04 Hey, prices dropping just in time for the next cycle of product launches to start the whole ordeal over again! :rolleyes:Reply -

jkflipflop98 Remember gang, you might be desperate for a GPU upgrade - but DO NOT buy a 2nd hand clapped-out mining card. You'll be sorry.Reply -

OldManYellingAtClouds Reply

This is just bad information and has been proven as such with literally hundreds of videos and sites with explanations as to why from some of the highest profile tech users on the planet.jkflipflop98 said:Remember gang, you might be desperate for a GPU upgrade - but DO NOT buy a 2nd hand clapped-out mining card. You'll be sorry.

The only people who believe this are idiots who don't want to pay a miner for something they want.

wtf happened to my post count and join date? I've been a member of this site for the last 12 years. -

asmodyus The fact is the mining cards are overpriced and nvidia tried to make more money by limiting the game cards but not enough to warrant people to buy the mining cards for the cost over the gaming cards. Demand has not changed nobody want there damm mining cards.Reply -

shady28 Noticed the same thing in the last week. Using stockx as a guide, I'd say prices have dropped 5% and the spread between bid/ask has increased markedly, with recent sales on 3060 / 3060Ti indicating more like a 10% drop in scalper prices.Reply

I'm also seeing supplies suddenly pop up, still at elevated prices but at least there, in places like Microcenter. Much of this may be due to AMDs 6500XT which seems to be selling fast with steady supply. However I'm also seeing over-priced 6700XT / 6800XT / 6900XT / 3080 / 3090s, and even a fairly good supply of 1650 Supers and so on.

Crypto bubble also has taken some big hits, after peaking 4 months ago then declining some 60%, its recent rally appears to have failed and at the moment at least is in yet another down move.

Add to this we now have impending release of Intel Arc dGPU on laptop platforms, plus dGPU on desktop this summer, and we should see continuous downside pressure on GPUs of all kinds. If these trends continue we might actually see normalized (MSRP) prices by summer.

Now que the bitcoin addicts to rant. -

watzupken Prices of cryptocurrencies is unlikely to deter people from buying new GPUs for mining. We’ve seen for sometime that cryptocurrency value fluctuates a lot. In fact when there are less miners, it is easier to mine. I think the main reasons are, (1) Ether complete migrating to POS, though the dates can change, and, (2) expected release of new GPUs later this year. It makes no sense to drastically overpaying for a soon to be obsolete GPU.Reply -

Truckinupga No one is even mentioning that the US has several teams investigating Crypto and soon will be pushing strong regulation with owning it. Also the US has a new tax laws in place that's going to hurt third party sellers (Scalpers) right where it hurts most, in the wallet. Places like eBay are now forced to report every penny that's earned through their marketplace to the IRS. Companies that handle payments like PayPal and others are also reporting directly to the IRS every dime that's sent and received. Then you have that deal in Canada where the Government is blocking buying and selling Crypto for some, a currency that was supposed to be safe from Govt intervention. I'm not saying I agree with all this but things are changing.Reply -

escksu Replybtmedic04 said:Hey, prices dropping just in time for the next cycle of product launches to start the whole ordeal over again! :rolleyes:

Not quite. At least not yet. Pple are on a wait and see approach right now due to eth. Also, the whole crypto market (not just eth) is moving towards a staking instead of mining one.

So, right now, if you have $1000, you can put in a staking farm and possibly earn more than mining (depends on what you stake). Of course there are risk involved but its certainly much easier than mining.