AMD, Nvidia GPU Pricing Trends Lower as Supply Improves

Still holding way above MSRP, however.

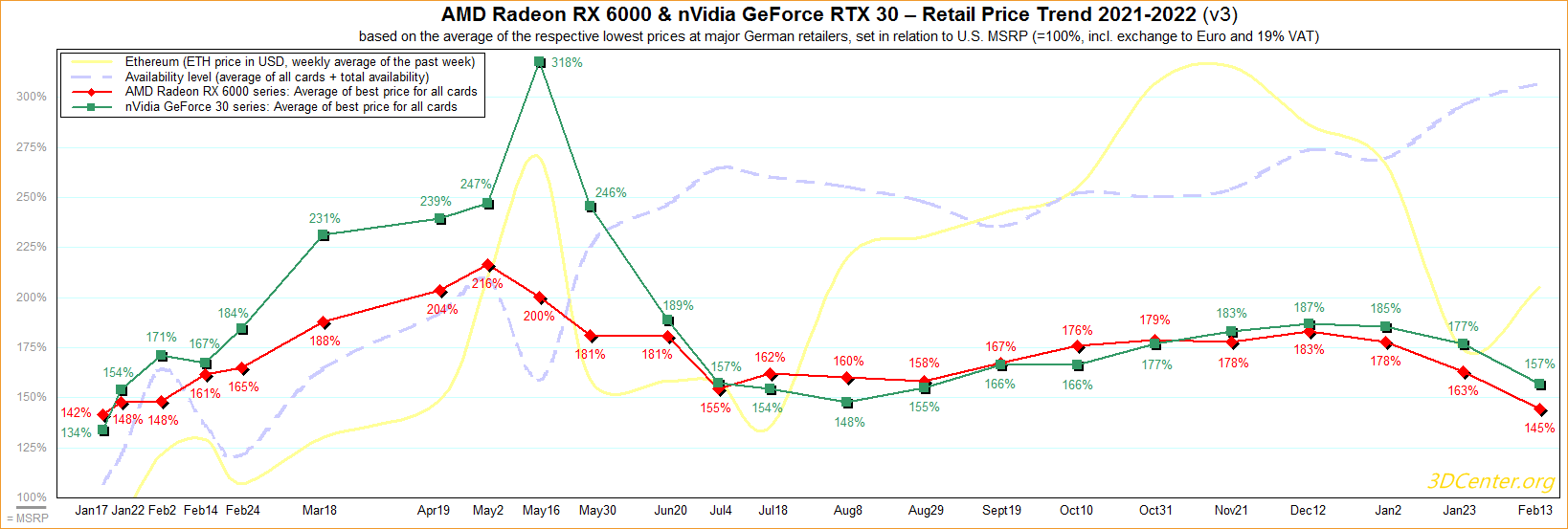

For the past three months, graphics card pricing seems to be on a consistent down trend, according to the latest price analysis conducted by 3D Center for the Austrian and German markets. Pricing for the Best Graphics cards still lingers way above MSRP - the median price for AMD graphics cards sits at around 145%, while Nvidia's are still trading above that at 157% of launch pricing. This, of course, for those models whose MSRP was disclosed in the first place.

Prices are currently still trending slightly above the first data point on the price analysis, set at January 2021. However, they are a far cry from the peak pricing nightmare for current-gen graphics cards: we saw Nvidia's 3000-series selling for around 318% their MSRP in May of last year. AMD's cards didn't soar as high (the company's lesser market share certainly contributed to this), but still hit a historic high at 216% MSRP around the same time.

While the current median pricing for both AMD and Nvidia is still a far cry from optimal, prices seem to be accelerating their descent. Nvidia's median pricing dropped 30% since December, where they sold for around 187% MSRP - starting with a 2% decline from December 12th to January 2nd, followed by a 8% decline through January 23rd - and an extremely significant, further 20% decline up to February 13th. Pricing for AMD graphics cards seems to be following this trend, albeit at a more accelerated rate: price declines stand at 5%, 15%, and 18% respectively, for a total drop of around 37% in the same period.

| Row 0 - Cell 0 | December 12th | January 2nd | January 23rd | February 13th |

| AMD | 183% | 178% (-5%) | 163% (-15%) | 145% (-18%) |

| Nvidia | 187% | 185% (-2%) | 177% (-8%) | 157% (-20%) |

Interestingly, AMD's budget-minded RX 6500 XT graphics card currently stands as the card closest to its $299 MSRP - average listing prices for it currently stand at 117% MSRP, following a significant, 26% reduction compared to January 23rd. Perhaps AMD did cut too much on that card's design and performance for it to be an appealing option for PC gamers - demand being below expectations likely stands as the reason for this price action. AMD's second most "discounted" card in the intervening time stands as the RX 6800, with a 25% reduction. On the green fields of Nvidia, the RTX 3080 stands as the most "discounted" card, with average selling prices declining by a significant 26% since January 23rd - closely followed by the RTX 3070 Ti and RTX 3060 Ti, which saw declines to the tune of 24%.

While we have to be cautious in generalizing this data to worldwide supply and pricing, the latest analysis ties in with our previous in-depth report of increasing amounts of graphics cards standing on retailers' and etailers' shelves. As demand from gamers is likely abating in wake of the impending Intel Arc Alchemist series launch and this year's expected new graphics card families from both AMD and Nvidia, consumers willing (and able) to pay the currently practiced prices are increasingly fewer. Paired with lower demand from supply-guzzling Ethereum miners - following its recent price slump and the chain's ever-approaching move from mining towards Proof of Stake (PoS) - retailers are being forced to lower pricing in order to meet new demand levels.

A caveat, as always: looking at the price evolution for graphics cards compared with Ethereum's valuation, a correlation is clear. while the current price-action is welcome (and coming late as it is), we're still mostly on the hands of miners. A positive enough price-action for Ethereum could bring down the timing needed to achieve return on investment (a currently abhorrent scenario according to our own math), which is already helped by the declining GPU prices. We can, however, always hope for a smooth return to normalcy.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Francisco Pires is a freelance news writer for Tom's Hardware with a soft side for quantum computing.

-

King_V ReplyInterestingly, AMD's budget-minded RX 6500 XT graphics card currently stands as the card closest to its $299 MSRP - average listing prices for it currently stand at 117% MSRP, following a significant, 26% reduction compared to January 23rd.

Wasn't that a $199 MSRP?

So, are the average listing prices of the 6500XT at 117% of $199, or at 117% of $299? -

InvalidError Reply

MSRP is only for the base model. Many AIB variants launched at much higher prices and now they may end up discovering most of the market doesn't want anything to do with such an under-powered under-featured product anywhere near $300.King_V said:Wasn't that a $199 MSRP? -

digitalgriffin ReplyAdmin said:As global graphics card supply improves and demand abates in wake of expectation of Intel's discrete GPU launch and next-generation AMD and Nvidia graphics cards, prices are consistently trending downward - but are still far from MSRP.

AMD, Nvidia GPU Pricing Trends Lower as Supply Improves : Read more

You guys quoted the 6500XT as $299 MSRP. It's $199 blah ha ha ha And still trash at that price. -

InvalidError Reply

$200 is AMD reference models. Custom models like GB's WindForce 3X OC are around $300 MSRP. Completely overkill but what is $15-20 worth of extra parts and materials when you can attempt to charge $100 extra for something you expect to be perpetually sold-out based on nothing else being available new?digitalgriffin said:You guys quoted the 6500XT as $299 MSRP. It's $199 blah ha ha ha And still trash at that price. -

digitalgriffin Reply

And they are sitting on the shelves...collecting dust. They shot themselves in the foot on this one.InvalidError said:$200 is AMD reference models. Custom models like GB's WindForce 3X OC are around $300 MSRP. Completely overkill but what is $15-20 worth of extra parts and materials when you can attempt to charge $100 extra for something you expect to be perpetually sold-out based on nothing else being available new?

A RX570 4GB could be had for ~ $100 at one point. The RX580 4GB< $200 MSRP and was faster. The RX580 8GB could be had @ $120 after rebates at the low point. And that card is vastly superior. To charge almost 3x's as much for 50 cents more aluminum is horse manure.

Are GloFo's 12nm fabs tied up? Shoot just go back to making 580's for $200 -

spongiemaster Reply

Supply hasn't improved. Demand has decreased.Admin said:As global graphics card supply improves and demand abates in wake of expectation of Intel's discrete GPU launch and next-generation AMD and Nvidia graphics cards, prices are consistently trending downward - but are still far from MSRP.

AMD, Nvidia GPU Pricing Trends Lower as Supply Improves : Read more -

InvalidError Reply

They may have sold that low but only because manufacturers ramped up production thinking the crypto bubble would keep going. Then the market crashed, the used market got flooded with dirt-cheap retired mining cards and AMD/AIBs were stuck with a large commit of no longer sellable parts they had to get rid of at severely discounted prices. Not only were the 8GB RX580s retailing as low as $120 but that also included a promo for your pick of one free game out of three offered, so knock another $40-70 if you were going to buy any of the three games for anywhere close to retail.digitalgriffin said:The RX580 8GB could be had @ $120 after rebates at the low point. And that card is vastly superior. To charge almost 3x's as much for 50 cents more aluminum is horse manure.

Probably can't do that due to GDDR5 being discontinued by most memory manufacturers. If AMD is going to re-spin a chip just to accommodate the fact that GDDR5 is no longer an option, "Big Navi 204" with all of its worst handicaps resolved would make more sense. Give it encoders/decoders, 4.0x8 at a minimum and 6GB/96b memory.digitalgriffin said:Are GloFo's 12nm fabs tied up? Shoot just go back to making 580's for $200 -

digitalgriffin ReplyInvalidError said:They may have sold that low but only because manufacturers ramped up production thinking the crypto bubble would keep going. Then the market crashed, the used market got flooded with dirt-cheap retired mining cards and AMD/AIBs were stuck with a large commit of no longer sellable parts they had to get rid of at severely discounted prices. Not only were the 8GB RX580s retailing as low as $120 but that also included a promo for your pick of one free game out of three offered, so knock another $40-70 if you were going to buy any of the three games for anywhere close to retail.

Probably can't do that due to GDDR5 being discontinued by most memory manufacturers. If AMD is going to re-spin a chip just to accommodate the fact that GDDR5 is no longer an option, "Big Navi 204" with all of its worst handicaps resolved would make more sense. Give it encoders/decoders, 4.0x8 at a minimum and 6GB/96b memory.

The idea was to alleviate 7nm supply constraints similar to how NVIDIA did with respinning the 2000 series. -

InvalidError Reply

Reviving older products doesn't do much with VRAM, VRM, substrates and support components shortages. Doesn't help much with other packaging and testing bottlenecks either. The bare dies are only a tiny part of the overall manufacturing bottleneck situation.digitalgriffin said:The idea was to alleviate 7nm supply constraints similar to how NVIDIA did with respinning the 2000 series. -

digitalgriffin ReplyInvalidError said:Reviving older products doesn't do much with VRAM, VRM, substrates and support components shortages. Doesn't help much with other packaging and testing bottlenecks either. The bare dies are only a tiny part of the overall manufacturing bottleneck situation.

I understand substrate mfg right now is under constaint, but supply is improving. That said substrates are qualified based on node size also. So you have certain substrates certified for certain node A use. And other substrates certified for node B use.