Worldwide Graphics Card Supply Improves, But High Prices Linger

Supplies have been improving, but prices are taking the long road down.

The precarious supply situation on some of the Best Graphics cards from AMD and Nvidia seems to be improving somewhat. After months of supply shock with demand outstripping supply to the point that all stock sold within minutes, hundreds of AMD RX 6000 and Nvidia's RTX 30 cards are now available to order throughout the PC hardware retailer and etailer chain. This is a far cry from months of supply conditions that offered themselves to "blink and you'll miss it" comparisons. And yet prices haven't evolved on par with the supply.

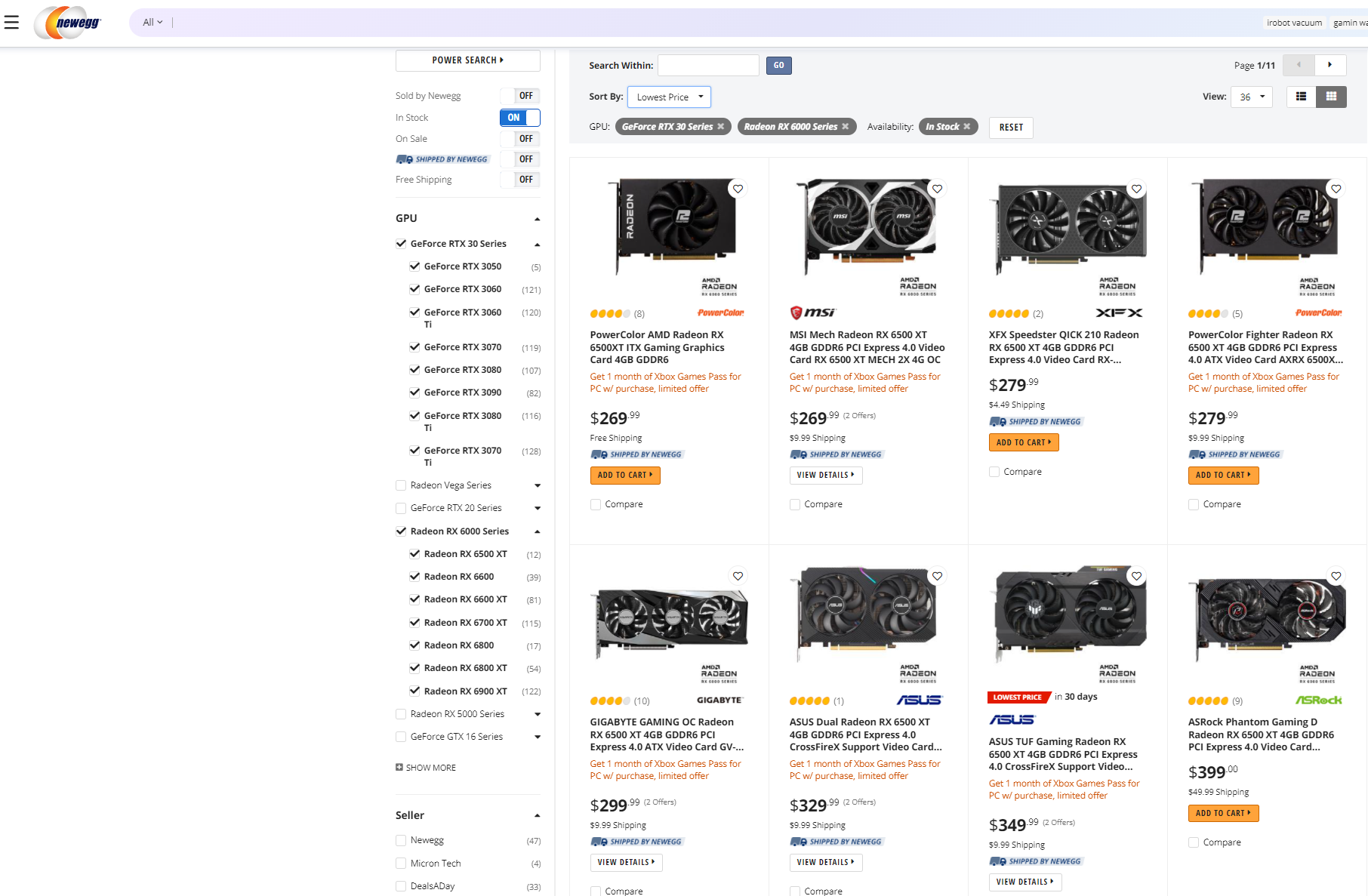

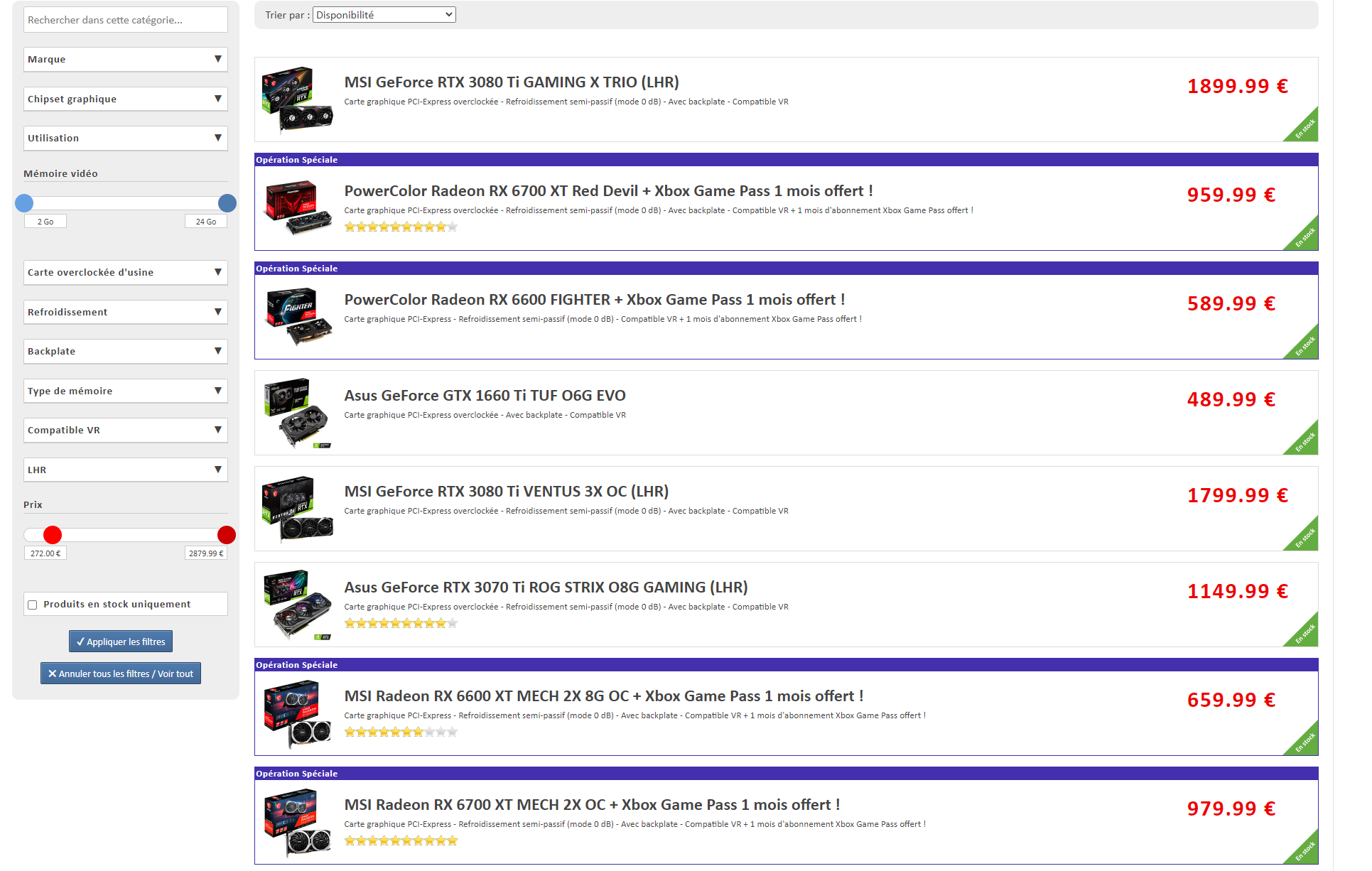

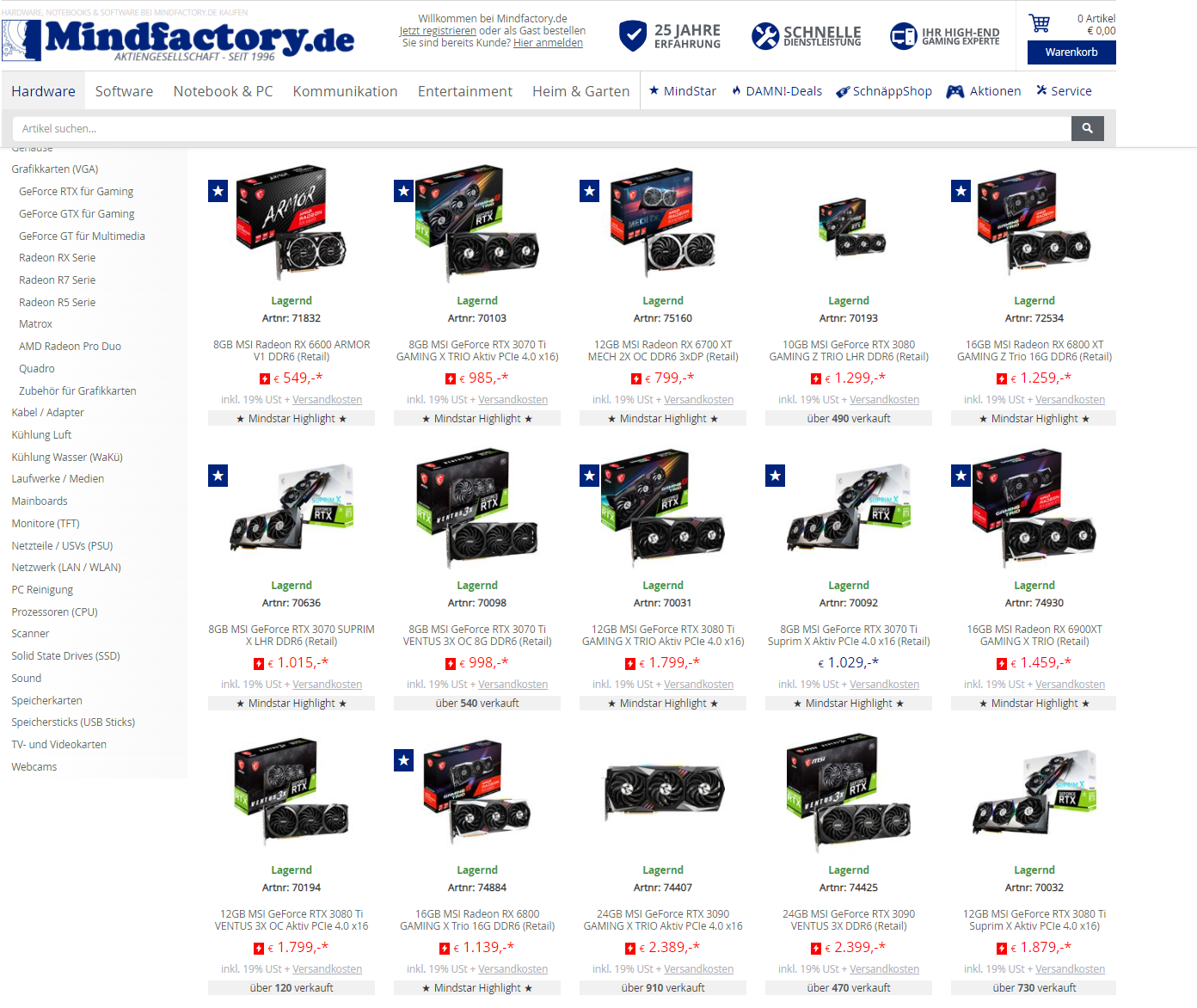

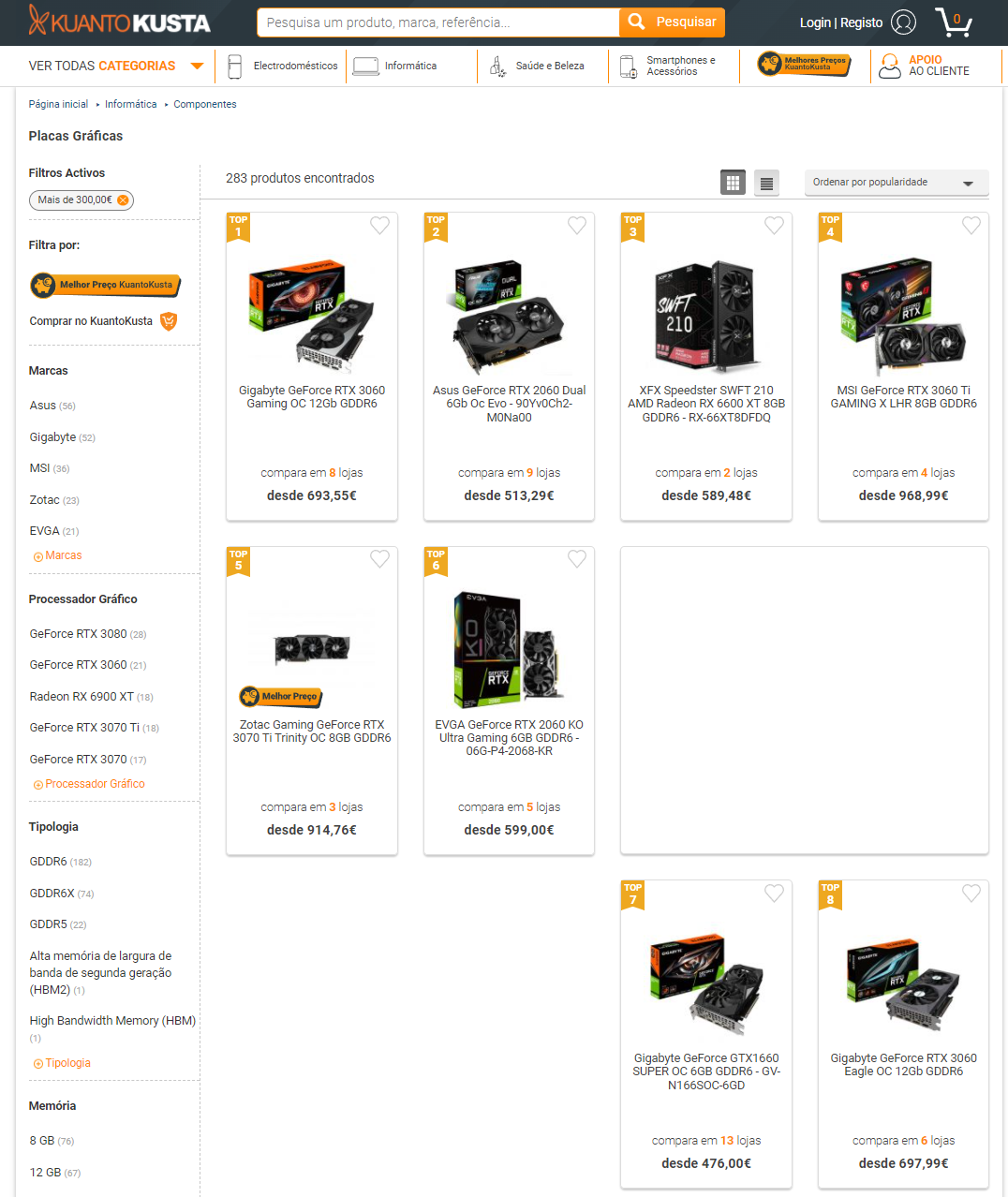

PC hardware retailers and price comparison sites in France, Germany and Portugal (on the EU side of the equation) all showcase the same trend, with hundreds of individually referenced graphics cards available in variable quantities from various retailers. The case seems to be the same in the United States: Newegg sees multiple graphics cards listed across manufacturers, and yet stocks aren't being immediately emptied. In fact, we've just reported on supply levels for PC components and consumer electronics that are actually 29% and 55% higher than pre-pandemic levels - there's seemingly no immediate threat of undersupply. We can infer that thousands of cards are sitting in storage rooms from these four distributors alone. So what gives?

The single most important reason for the stock improvement is likely related to the recent cryptocurrency market crash, which saw a severe drop in Ethereum's valuation. Lower cryptocurrency values mean that any new investment will take longer to recoup: we've recently done the math for you, arriving at 500+ days of mining to break even in the best-case scenarios. In addition, the Ethereum ecosystem is slowly moving away from mining Proof of Work (PoW) as a reward mechanism in favor of Proof of Stake (PoS), which doesn't instill much confidence in time-locked mining investments. And as always, we have to mention the caveat of how fickle (and explosive) cryptocurrency pricing can be. But the apparent absence of the crazy demand for graphics cards that mining brings to the table hasn't translated much into graphics card pricing yet.

However, the global supply chain is still reeling from the COVID-19 demand spike: silicon designers such as AMD and Nvidia retailers were hit by higher wafer prices. In general, companies prefer to keep their margins steady and pass the additional costs over to the next step in the chain. Distributors, in turn, also charge higher prices for each graphics card to retailers.

It can be the case that retailers are now starting to sit on graphics card inventory that isn't moving due to a lack of demand at the currently-practiced pricing structure. It can certainly be argued that since neither AMD nor Nvidia has introduced new graphics cards families recently, users that could and were willing to pay above sticker price for their GPUs are already mostly served by the market. The fact that both companies will introduce their next-gen graphics products later this year also doesn't lead savvy customers to buy graphics cards routinely priced at above 100% markups.

It seems that retailers are now starting to accumulate unsold inventory, which should mean we are entering a period where the supply/demand equation can kick in again. If this happens, then graphics cards pricing should decline as retailers slowly bring them down - in turn attracting those remaining buyers.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Francisco Pires is a freelance news writer for Tom's Hardware with a soft side for quantum computing.

-

hotaru251 not a shock.Reply

3rd party sellers know they are hot and will keep price gouging em (scalpers and the stores themself)

This is why you can expect next gen to be costlier as currently there is no desire for lower prices (as anyone involved in it make more this way) -

bigdragon I took a quick look around at online retailers. Some of them have several GPUs in stock and listed as shipped and sold by the retailer. The prices are about the same as the scalpers though. Looks to me like the retailers and/or AIBs just decided to cut out the scalping middlemen and do it themselves. The GPU crisis continues.Reply -

watzupken Prices are unlikely to drop drastically in my opinion. The reasons are because,Reply

1. Crypto prices fluctuates - Just like what we saw in around June to July last year, crypto prices fell briefly and went right back up. Graphic card prices also dropped briefly and shot back even higher

2. Because manufacturers, distributors and retailers know that there is a pent up demand by gamers, they are in no hurry to lower prices. All the AIB partners made record profits despite the supposed "supply chain disruption" because they likely sold highly inflated GPUs to miners from their backdoors, and drop a few GPUs in retail, also at a marked up price. -

spongiemaster Reply

GPU's sitting on a shelf don't make anyone money. Without more profitable mining, it looks like current prices are too high for the market. Retailers will need to come to their senses quickly and drop prices. I'm not talking fire sales, but the first retailers to hit price points down the pole will maximize their profits. First to 90% over MSRP will get the sales, then someone will have to hit 85% to get the next group and so forth.bigdragon said:I took a quick look around at online retailers. Some of them have several GPUs in stock and listed as shipped and sold by the retailer. The prices are about the same as the scalpers though. Looks to me like the retailers and/or AIBs just decided to cut out the scalping middlemen and do it themselves. The GPU crisis continues. -

btmedic04 sadly, i dont believe prices will drop and if they do, it wont be much. ive been saying this since november 2020 that amd and nvidia will be raising msrp after seeing what consumers were willing to pay scalpers. amd and nvidia want that piece of the pie and thats why we didnt get a launch price for the 3080 12gb or vaporware 3090 ti. Those were market tests to see how much the consumer was willing to spendReply -

Darkbreeze ReplyWorldwide Graphics Card Supply Improves, But High Prices Linger

Of course they linger. Because AMD and Nvidia figured out that they can RAPE board partners, and board partners will pay it, because board partners can RAPE the public. They learned this from the scalpers but upped the game. If these resellers can command these prices for them, we can too.

It's shameful and to be honest I'll ride my current card until the wheels fall off before I give any of these companies another cent that I don't absolutely have to. -

InvalidError Reply

Prices will drop by however much they need to for retailers to move inventory. The only reason prices are so high is because crypto miners bought everything they could. Now that miners are taking a break from cleaning out shelves, cards sitting on shelves are a liability: the retailer likely got their cards at a premium themselves and those cards need to go while they can still make a profit over whatever they got them for from their distributor. If they don't, they'll have to eat losses to clear inventory. Same goes for distributors who themselves may have bought inventory at inflated prices from manufacturers and manufacturers who bought their parts at inflated prices, rinse and repeat for every other rung of the supply chain ladder.btmedic04 said:sadly, i dont believe prices will drop and if they do, it wont be much.

At the extreme end of sales slow-downs, you start having issues with AMD and Nvidia still having to eat the cost of their wafer supply agreement even if their sales drop to zero, so they cannot allow sales to drop that low either, same for AIBs whose contract likely include mandatory minimums too. If demand slows down too much, warehousing costs and inventory liabilities will pile up.

There is supply-side pressure to keep inventory moving smoothly. If you don't price your inventory to sell while inventory is starting to pike up everywhere, someone else will and then your chances of recovering the inflated prices you may have paid for your stock are gone which will only get worse as next-gen launches get closer and ETH PoS threatens to unleash a torrent of retired cards on the used market at substantially discounted prices. -

Endymio Replyretailers are now starting to accumulate unsold inventory, which should mean we are entering a period where the supply/demand equation can kick in again....

The law of supply and demand never stopped working, Mr. Pires. Why do you think prices rose so sharply in the first place? -

Endymio Reply

Step off a high cliff, and you'll get raped by the law of gravity. Slam your Prius into a tractor-trailer and you'll get raped by Newton's laws of motion. Touch a hot stove, and you'll get raped by the laws of heat transfer. Ah, those pesky laws of nature.Darkbreeze said:Of course they linger. Because AMD and Nvidia figured out that they can RAPE board partners, and board partners will pay it, because board partners can RAPE the public.