Ethereum Sell-Off Inspired by Bitcoin, Inflation and High Transaction Fees

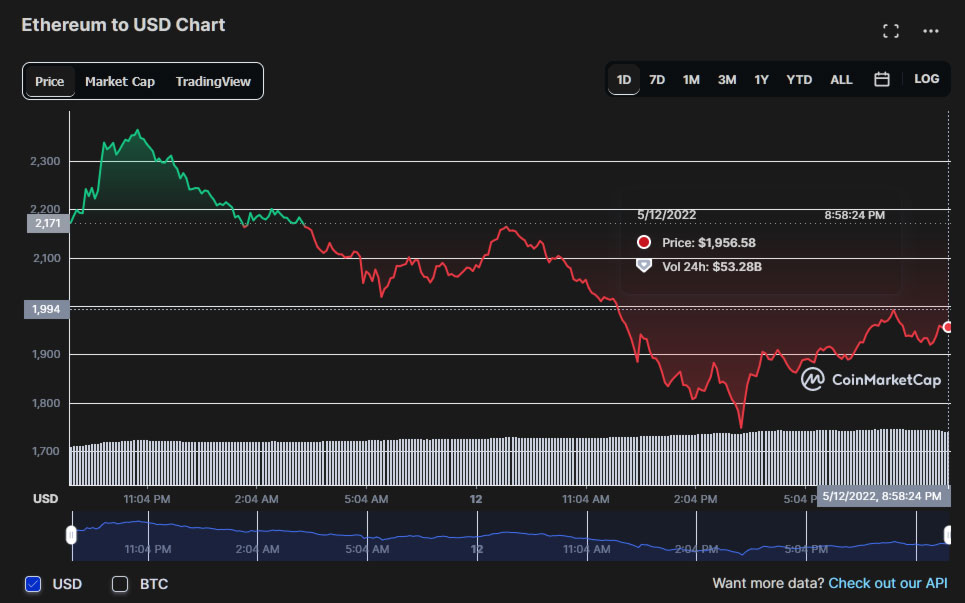

ETH ducked under $2,000 for first time since last July.

The market valuation of Ethereum (ETH) dipped below $2,000 today. This is the first time this popular cryptocurrency, with a, um, special place in the heart of PC enthusiasts, has dropped below this milestone value since July 2021.

On Monday as Bitcoin's (BTC) price was collapsing. we noted that ETH usually shadows its bigger brother. This is indeed the case — BTC dropped below $26,500 for a short period earlier. Ethereum and Bitcoin were priced at $2,385 and $32,790, respectively, when we covered their prices on Monday. At the time of writing, ETH is down 12.5% in the last 24 hours, while BTC is down 4.1% in the same period.

Many of the woes of the BTC is facing are also inflicted on ETH, as they are similarly speculative assets. Key pressures on both cryptocurrencies include the high inflation around the globe, high fuel pricing, worries about recession and stagnation and banks increasing interest rates to encourage savings. The stock market is also feeling the ill effects from all of those factors. As value goes down, people are pulling out of speculative assets and moving them into safer, less volatile investments.

The last time we saw a significant drop in cryptocurrency prices, miners offloaded graphics cards, which caused a glut of used GPUs. This brought prices down quickly and impacted the sales of new graphics cards for several months.

Yuga Labs Bored Apes Bash ETH

ETH has had another, more unique issue over the past few days. Yahoo Finance reports that demand for virtual pieces of Yuga Labs' Otherside Metaverse Land on was so high at launch that there was a massive spike in transaction fees. There were 55,000 lots put up for sale for around $7,000 each. Yuga Labs is best known for the success of its Bored Ape Yacht Club NFTs.

One sale of a single $7,000 piece of Yuga virtual land attracted $44,000 in transaction fees, reports Yahoo. If this wasn't a damaging enough statistic regarding the efficacy of ETH as a useful cryptocurrency for the masses, there was worse news to come. Yuga was unhappy with the way ETH performed on its big land sale day, and has subsequently decided to take its Apecoin cryptocurrency off the Ethereum mainnet and onto its own native chain. This one act will drain $2.5 billion of capital from the Ethereum ecosystem.

Yuga sold out of Otherside Metaverse real estate, raising over $200 million. Some individuals flipped their purchases quickly for a fast profit. However, Yahoo observes that many virtual plots of land are now valued at below original sale price.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Mark Tyson is a news editor at Tom's Hardware. He enjoys covering the full breadth of PC tech; from business and semiconductor design to products approaching the edge of reason.

-

Co BIY Cryptocurrency (even Dogecoin) seems like a conservative investment when compared to "real estate" on an ape island in a "metaverse".Reply

Imaginary money need not be managed in a serious way. -

InvalidError ReplyYuga sold out of Otherside Metaverse real estate, raising over $200 million. Some individuals flipped their purchases quickly for a fast profit. However, Yahoo observes that many virtual plots of land are now valued at below original sale price.

Smells like a classic pump-and-dump scheme: sell something as a collectible with a sales pitch promising seemingly guaranteed profit, liquidate your stake in the make-believe estate, then walk away laughing maniacally as you watch the whole thing crash and burn once people realize what sort of con they bought into. -

Math Geek once it got past "the drop in price should cause a glut of used cards on the market", i pretty much have no clue what anything after that means.Reply

sounded like a mad libs page to me....