JPR: Discrete GPU Sales Bumped as iGPUs See Decline

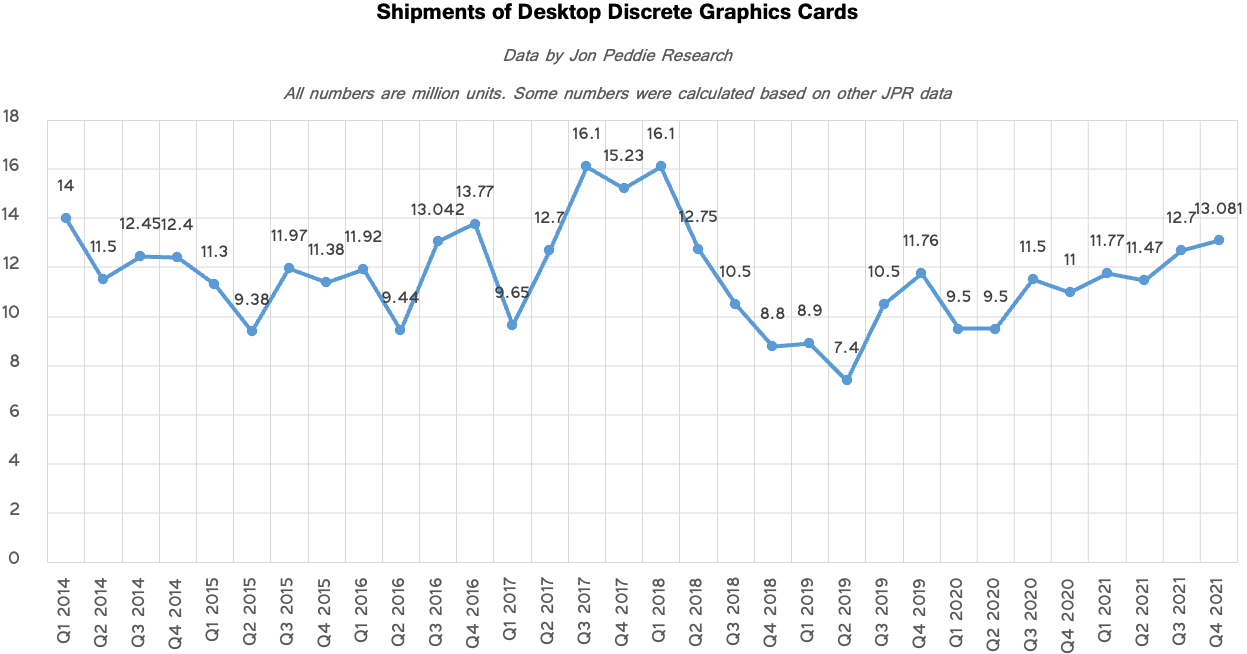

13 million of desktop graphics cards shipped in Q4 2021.

According to a new report by Jon Peddie Research, Q4 2021 sales of CPUs with integrated graphics were down 15% year-over-year. By contrast, sales of discrete graphics boards for desktops increased during the fourth quarter.

The industry shipped approximately 101 million discrete and integrated GPUs for PCs in Q4 2021*, which is an increase of around 0.8% sequentially (this essentially means flat), but a decrease of 15% year-over-year. By contrast, sales of standalone graphics cards for desktop PCs (such as those featured in the best graphics cards for gaming) reached around 13 million units in the fourth quarter of 2021, a 3% growth sequentially and an 18% surge from the same quarter in 2020.

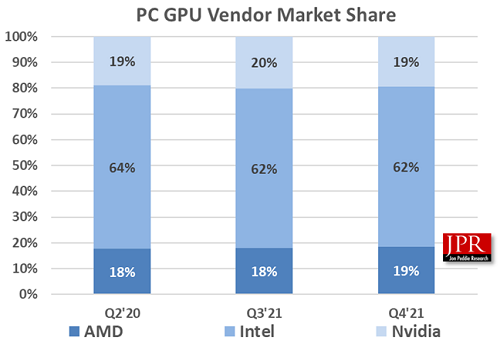

Being the world's largest supplier of CPUs with built-in GPUs, Intel continued to lead the market in terms of GPU units sold as it retained control of 62% of the market. AMD and Nvidia controlled about 19% each. Meanwhile, AMD's shipments rose 4.7%, Intel's shipments increased 0.6%, and Nvidia's shipments dropped by 2.2%.

As for shipments of discrete GPUs for desktops and laptops, Nvidia had a market share of 81%, whereas AMD controlled 19% of the market. Intel did not report sales for its entry-level DG1 GPUs to Jon Peddie Research.

Discrete Desktops and Laptops GPU Shipment Market Shares

| Row 0 - Cell 0 | Q2 2020 | Q3 2021 | Q4 2021 |

| AMD | 18% | 17% | 19% |

| Nvidia | 82% | 83% | 81% |

While demand for CPUs was down 21% YoY in Q4 2021 -- as PC makers were preparing for Intel's high-volume launch of 12th Generation Core 'Alder Lake' processors in Q1 2022 -- demand for discrete desktop graphics cards remained strong.

"Penetration of Nvidia's latest Ampere generation (with avg. ASP of $475, 15-80% above prior Turing/Pascal[generations]) is still just 15% of total Nvidia gamers (per Steam's January hardware survey), meaning there is still plenty of room for ASP expansion as Nvidia gamers upgrade to latest [generation] once SKUs become available (still completely sold out and re-selling at 2x MSRP)," wrote Vivek Arya, an analyst with Bank of America, in a note to clients (via SeekingAlpha). "We expect supply could remain constrained into the 2H 2022 which, in our view, could drive stronger for longer sales growth."

*Sales of graphics adapters — discrete and integrated — reported by JPR represents sell-in numbers, which means that the actual chips yet have to be sold to the end-user.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Anton Shilov is a contributing writer at Tom’s Hardware. Over the past couple of decades, he has covered everything from CPUs and GPUs to supercomputers and from modern process technologies and latest fab tools to high-tech industry trends.

-

BILL1957 Personally one of the additional reasons I always buy an Intel "k" chip is for the integrated graphics which I use to initially set up the new systems and while I download and update windows.Reply

Not to mention it also gives an onboard tool to use to narrow down or diagnose possible problems with a graphics card down the road if needed and the additional cost at purchase is so minimal.

I really do not want to buy a CPU that does not include onboard graphic capability. -

cryoburner ReplyAccording to a new report by Jon Peddie Research, Q4 2021 sales of CPUs with integrated graphics were down 15% year-over-year. By contrast, sales of discrete graphics boards for desktops increased during the fourth quarter.

Well of course discrete graphics card sales were likely to be up over Q4 2020, since crypto miners were not yet buying as many of them at that time. And while prior-generation graphics cards were readily available, a number of end-users and system builders may have been holding off on purchasing them in expectation of the new cards from Nvidia and AMD becoming readily available, as they were supposedly going to offer substantially better value, even though that never actually happened, and the value situation instead got substantially worse in 2021.

I wouldn't be surprised to see a reversal this quarter though. Q1 2021 saw graphics cards flying off the shelves as miners and resellers scooped up all available supply, but in Q1 2022, the mining market appears to be in something of a downturn, and third-party resellers don't want to get stuck with stock they might lose money on. And with retailers still asking high prices for cards, many of those who held out for prices to drop probably won't be upgrading yet either.