Seagate Remains HDD King, But Western Digital is Approaching

Unit sales up, exabyte shipments up.

For the first time in recent years unit shipments of hard disk drives (HDDs) demonstrated a positive dynamic in Q2 2022. In terms of exabytes, three makers of HDDs — Seagate, Toshiba, and Western Digital — shipped an all-time record of 350.7 exabytes due to demand from operators, exascale datacenters and Chia miners. While Seagate remained the No.1 producer of HDDs both in terms of units and in terms of exabytes shipped, Western Digital almost caught up with its arch-rival in the second quarter.

67.6 Million HDDs sold in Q2 2021

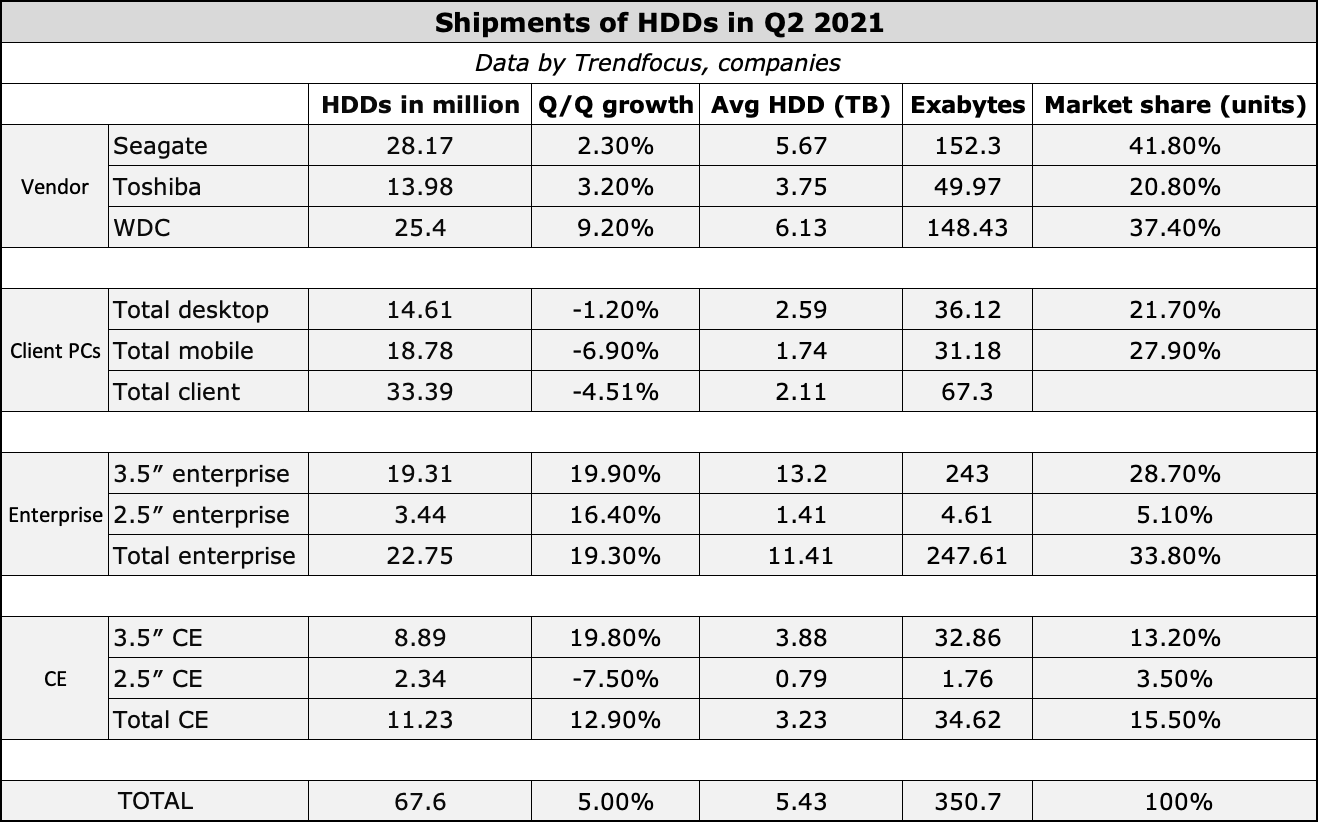

Hard disk drive shipments in the second quarter of 2021 totaled 67.6 million units, according to Trendfocus (via Storage Newsletter) and data by companies. Nidec, the world's largest independent producer of motors for hard drives, estimates that the industry shipped 64 million units in Q2 2021, up from 63 million units in Q1 and flat with Q2 2020. The different between estimates is unexplainable at this point. Keep in mind that since the two out of three HDD suppliers do not publish their detailed unit shipments and only one publishes exabytes shipments, the numbers disclosed by analysts are generally educated guesses. This is why we use data from companies where possible.

Seagate maintained its position on the No.1 spot with 28.17 million drives and 152.3 exabytes shipped in Q2 2021. Yet, Seagate's sales were only 2.3% up from the previous quarter. By contrast, Western Digital posted an impressive 9.2% increase in unit shipments (25.4 million) and almost caught up with it rival in terms of exabytes with 148.43EB suppled, based on Trendfocus data.

In fact, Western Digital's achievements look even more impressive in terms of an average HDD capacity. In Q2, it was at 6.13TB per drive (vs. Seagate's 5.67TB), up from 4.72TB in Q1. This is an indicator that Western Digital has significantly increased shipments of its nearline/enterprise-grade drives and gained market share. By contrast, Toshiba's hard drives featured a 3.75TB capacity on average.

Exabytes shipments totaled a record 350.7EB, based on data from Trendfocus and companies.

High-Capacity HDD Sales Hit Record

It is not a secret that many client devices have already moved on to solid-state storage, so sales of all client HDDs have dropped. Therefore, there was nothing surprising in a 4.51% decline of PC HDDs sales in the second quarter of 2021. What was surprising was an almost 20% uptick in sales of 3.5-inch drives for consumer electronics. While we could attribute this to the growing popularity of Chia farming (and cheap SMR drives for that reason), an average capacity of such HDDs is around 3.88TB makes us a little pessimistic about such an attribution.

A notable value are the number of sold 3.5-inch HDDs for nearline and enterprise applications. At 19.31 million, this is a record shipment, up almost 20% quarter over quarter. What is even more impressive is that capacity of nearline HDDs is now at almost 70% of exabytes shipments.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Another noteworthy thing is that it looks like big customers had finished qualification of Western Digital's energy-assisted HDDs and the company started their high-volume shipments. This explains the jump of Western Digital's sales both in terms of units and (mostly, given the context) exabytes.

Summary

Unit shipments of hard drives are growing, a good thing for HDD makers. Executives from Seagate and Western Digital are not making predictions about further unit growth because Chia demand is unpredictable. Nidec, a maker of HDD motors is also pessimistic about HDD total available market.

Exascalers now consume over two thirds of HDD capacity produced at a whopping 243EB, according to Trendfocus. There is a small caveat with the numbers here. A part of these drives ends up in the channel, which is why we are able to buy Seagate's Exos and Western Digital's Ultrastar at Amazon, albeit at an inflated price.

Consumer-grade PC-bound HDD sales are continuing to decline. This is not surprising as SSD makers are doing pretty much everything to costs (including transitioning existing products to 3D QLC NAND) and prices (not that HDD makers are not keeping up with drive-managed SMR). With prices on this level, consumers and PC makers prefer SSDs over HDDs due to performance and other factors.

Anton Shilov is a contributing writer at Tom’s Hardware. Over the past couple of decades, he has covered everything from CPUs and GPUs to supercomputers and from modern process technologies and latest fab tools to high-tech industry trends.