HDD Shipments Set All-Time Capacity Record

Shipped HDD capacity hit 351.4EB in Q2 2021.

It is not a secret that unit shipments of hard drives are on the rise this year due to demand from exascale datacenters, typical users, and Chia farmers. In Q2 2021, three HDD makers not only increased unit sales of their products, but also set an all-time record in terms of hard drive capacity they shipped.

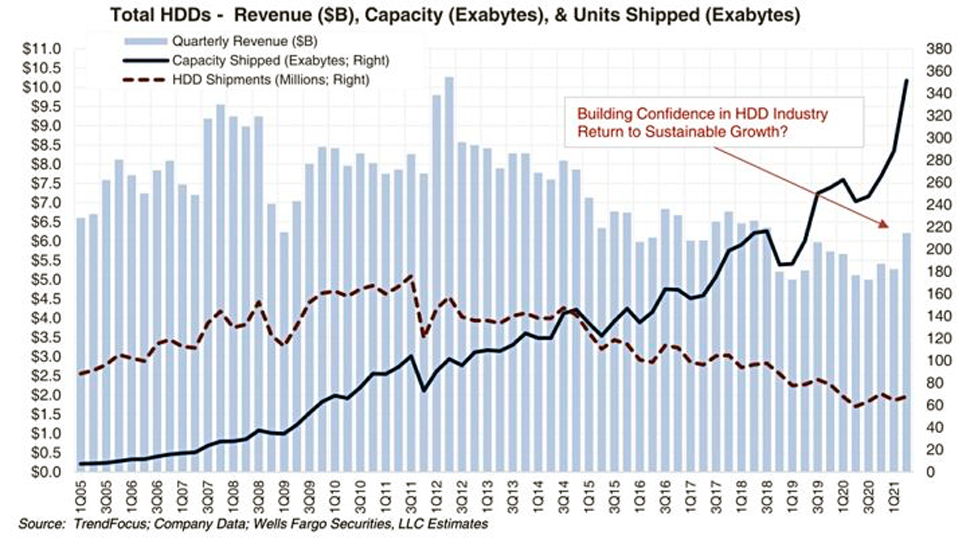

Seagate, Toshiba, and Western Digital sold 67.6 million HDD units in the second quarter, 19 million of them were nearline/enterprise-grade drives. That's up 8.8 million from 58.8 million Q2 2020 and up 3.4 million from 64.2 million in Q1 2021, according to data by TrendFocus cited by Wells Fargo (and published by Blocks & Files). While HDD unit shipments are higher than they were in the recent quarters in the last couple of years, they are massively lower compared to around 160 million ~ 180 million HDDs sold every quarter a decade ago, back in 2011.

But while unit shipments of hard drives are massively down, their capacity is massively up compared to 2011. Total HDD capacity supplied in Q2 was around 351.4EB, up 45% year-on-year as well as 22% quarter-on-quarter. A decade ago, three manufacturers shipped less than 100EB of hard drive capacity per quarter.

High capacity nearline and enterprise drives (with an average capacity of around 12.8TB) accounted for 243EB, so capacity of the remaining 48.6 million drives for client applications totaled 108.4EB (which means that their average capacity was 2.33TB). Meanwhile, a capacity of an average HDD totaled 5.45TB in Q2 2021.

High-end HDDs for nearline and enterprise applications help to uplift Seagate's, Toshiba's, and Western Digital's revenue. Since demand for HDDs is dropping because of competition from SSDs, revenues of these three suppliers dropped from $8 billion ~ $9 billion per quarter 10 years ago to around $5 billion ~ $5.5 billion in 2020. Still, due to extraordinary demand for advanced drives, HDD sales of the three makers totaled $6.2 billion, an increase of 20% YoY.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Anton Shilov is a contributing writer at Tom’s Hardware. Over the past couple of decades, he has covered everything from CPUs and GPUs to supercomputers and from modern process technologies and latest fab tools to high-tech industry trends.

-

Colif Drive sizes are getting bigger, mining crazer using them also helped... but surely this record will always grow as drives are getting biggerReply -

Blairian Reply

Total Capacity = Capacity per drive x #drives. Capacity per drive is going up, but number of drives shipped is slipping.Colif said:Drive sizes are getting bigger, mining crazer using them also helped... but surely this record will always grow as drives are getting bigger -

Blairian ReplyAdmin said:Shipped HDD capacity hits 351.4EB in Q2 2021.

HDD Shipments Set All-Time Capacity Record : Read more

Sales over beers will tell you that Data is growing at 2X per year.

Marketing over scotch will scribble Data is growing at 2X every two years.

Your data seems to indicate a growth of 351% over 10 years, or less than doubling every 5 years, or 14% per year .. .. ...