IBM's Power9 CPU Could Be Game Changer In Servers And Supercomputers With Help From Google, Nvidia

Thanks to adoption from Google and Rackspace, IBM’s Power9 CPU could begin making a dent into the server chip market currently dominated by Intel. The partnership with Nvidia should also help IBM’s Power9 become popular in servers, as well as supercomputers.

Google, Rackspace To Use Power9-Based Servers

Google and Rackspace announced recently that they will be working on a new open architecture for data center servers that will be based on IBM’s upcoming Power9 CPU. Google joined the OpenPower Foundation in 2014, along with IBM, Nvidia and other companies looking to develop servers based on IBM’s OpenPower chips.

The new data center server specification is designed to fit into Facebook’s 48V open rack that Google has been helping design as part of the Open Compute Project, which is meant to standardize IT infrastructure.

Google has been a rather late entrant in a cloud computing market dominated by Amazon. However, it has lately scored some big contracts from companies such as Spotify and Apple. This should show other potential customers that Google now has a serious cloud computing business that’s likely only going to grow and mature.

Reducing Reliance On Intel

Right now, Intel dominates the server chip market almost completely, with 99 percent market share. When a company dominates any market to such a degree, that’s usually not a good sign for the customers, no matter how benevolent and reasonable said supplier has been in the past.

Google has recently shown some signs that it wants to diversify its chip suppliers. The company is now looking not just at the OpenPower architecture as a way to increase competition in the server chip market, but also at RISC-V, the new instruction set architecture that’s fully open source.

The two architectures likely won’t overlap too much for the time being, as RISC-V should become more of an ARM competitor in the medium term. Meanwhile, OpenPower is ready to become a serious competitor to Intel, starting with the Power9 CPU that’s due for release next year.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Nvidia Goes All-In With OpenPower

IBM, Nvidia and Wistron recently announced a new high-performance computing platform for servers based on IBM’s Power8 CPU and Nvidia’s latest Tesla P100, which is the company’s most powerful GPU yet.

Nvidia seems at least as committed to switching to a new CPU architecture as Google is, because Intel has been locking it out of various markets for years now. Intel did it first by bundling its GPUs with its CPUs in notebooks, making dedicated graphics cards less and less relevant in mainstream systems. Then Intel used the same strategy against Nvidia for supercomputers, where it started replacing Nvidia’s GPUs with its own Phi accelerators.

This is likely why we’ve seen Nvidia aggressively adopt ARM CPUs in its mobile chips, even making its own custom “Denver” core. The company is now partnering with IBM to combine OpenPower CPUs with its own GPUs so it doesn't have to worry about Intel anymore when selling its chips to customers.

Power9, The Game Changer

With Power9 right around the corner and with both Google and Rackspace promising to adopt it soon, Nvidia and IBM’s Power8-based chip likely won’t get too much traction this year. However, starting next year, we may see Power9-based chips make a dent into Intel’s market share in both the server and the supercomputer markets.

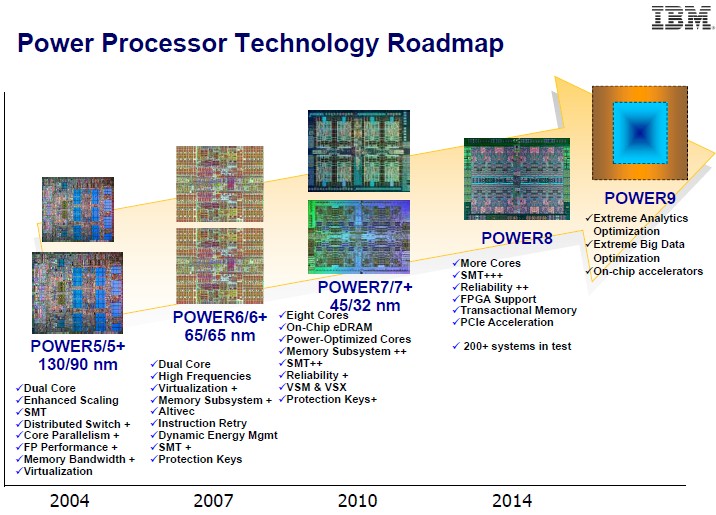

The Power9 CPU will be built on a 14nm FinFET process co-developed by IBM with Global Foundries. It will have on-chip accelerators and “extreme” optimization for analytics and “big data,” making it well suited for data centers and supercomputers. The Power9 CPU combined with Nvidia’s deep learning-optimized GPUs should also be well received by companies that are looking for fast AI training (such as Google, Amazon, Facebook, etc.).

Back in November 2014, Nvidia and IBM had already landed a contract with the U.S. Department of Energy to build two new supercomputers, one 100+ PFLOPS (5x more powerful than the one it replaced), and another called Summit that will have 150-300 PFLOPS and should be the most powerful supercomputer in the world when it launches.

Summit will displace China’s Tianhe-2 (34 PFLOPS), which uses Intel’s Xeon Phi processors, as the most powerful supercomputer in the world. Summit, which is supposed to come out in 2017, may even be more powerful than Intel's and Cray's 2018 Aurora supercomputer. Aurora was also contracted by the DOE and will have a performance of only 180 PFLOPS.

If IBM and its partners (mainly Google and Nvidia) can keep pushing the performance and adoption of OpenPower chips, then the OpenPower architecture may make a strong comeback in both the server and the supercomputer markets in the next few years, giving Intel a run for its money.

Lucian Armasu is a Contributing Writer for Tom's Hardware. You can follow him at @lucian_armasu.

Lucian Armasu is a Contributing Writer for Tom's Hardware US. He covers software news and the issues surrounding privacy and security.

-

hdmark Interesting read , but now it made me question something about Nvidia's strategy. Assuming they are selling large quantities of P100's for these super computers and large servers, and these P100's are not cheap at all, how large a segment is this for their company?Reply

Originally I thought that Nvidia and AMD made most of their money with consumer and workstation GPU's. But I'm thinking 1 of these P100's would probably net them more money than a ton of consumer cards. I also kind of figure that the big companies buy these high powered cards in bulk.

So do NVidia/amd make consumer/workstation cards almost as a side business? or is the market share ALOT bigger than im assuming -

InvalidError Reply

Those ultra-high-end chips may net AMD and Nvidia a $1000+ margin per sale but they sell only a few thousand of these per month. Mainstream GPUs on the other hand may only net them $10-50 in gross profit per sale but they sell millions of these a month.17782626 said:So do NVidia/amd make consumer/workstation cards almost as a side business? or is the market share ALOT bigger than im assuming

Mainstream sales may not be as appealing individually but they still account for a bigger chunk of revenue and gross profit. If they want to maximize their revenue from all the R&D they invested into architecture and die optimization with their fab partners, they need to produce chips for every slice of the market where it should be reasonably profitable to do so. -

JamesSneed The DGX-1 with 8 of these P100's is selling for $129,000.00 per. So they probably are making a good deal more than 1K however the mainstream / lower cost sales will more than make up for that in volume. Its not even remotely close either.Reply -

dgingeri Windows hasn't supported Power architecture since Windows NT 4.0. It sure would be nice to see them start that up again.Reply -

ZolaIII Software is not quite optimized for Open Power architecture yet & I am talking about Linux & from what I sow as a market offering so far it's not exactly much cheaper than making a costume Xeon server.Reply

Even the hardware have a potential & I am certain that with in the house built accessories & on the large scale it will cost significantly less software is not properly optimized yet.

Surce:

http://www.phoronix.com/scan.php?page=article&item=talos-workstation&num=1

Still the Power architecture is simply not more power efficient than current X86 offering & that should be a prime concern for the future as super servers are becoming the biggest power consumers in the world & they actually contribute most to climate changes & global warming mostly thanks to need for expensive & power un efficient additional cooling needs so it's a grim picture actually.

On the other hand Nv or GPU's for that matter certainly aren't the future of super computing no matter how much money Nv invests in marketing it with all of their dumb stuff claiming it on science conventions. For starters GPU's are only good for the single really massive parallel tasks & most server and good part of supercomputer tasks are not like that & even then they are in best effort 3x less power efficient than currently offered FPGA & or combined with DSP solutions.

Truth is Nv is making a good money on those computing cards as they actually cost almost the same as their comercial "Gaming" contraparts, actually they sell them for 10x+ price. Than again FPGA's & DSP's are much more reprogrammable & FPGA's are suitable for moderate number of simultaneous parallel tasks at once & that makes them also much more suitable for most server & super computer tasks not to mention actual less cost of software adaption (using new or optimized algorithms), less maintenance & power consumption cost & much better adaption of open source standards.

Simply not a way to go & who ever tries to convince you otherwise I hope at least he got paid good for doing so from Nv.

At the end just to mention how RISC V is not close to rival ARM on traditional mobile space (lack of software suport along with optimizations along with lack for now of more powerful ) but it certainly represents a large win, win for the emerging IoT market & it culd retake a larger part of embedded market over the time but we will see about that... -

pasow ReplyWindows hasn't supported Power architecture since Windows NT 4.0. It sure would be nice to see them start that up again.

while tantalizing, the main reason why windows for ARM flopped was because it couldn't run x86 software, so i suspect a Power architecture build would do similar in most markets. there's far to much legacy software for most businesses to do the switch and the consumer market seems oddly resistant to the change, despite generally not needing decade old software. -

InvalidError Reply

While the average consumer may not require decade old software, most PC users still have a software library that goes back a few years and expect to be able to reuse it on their new PC, which means there won't be an overnight transition there either no matter how hard the industry might push for it.17786049 said:there's far to much legacy software for most businesses to do the switch and the consumer market seems oddly resistant to the change, despite generally not needing decade old software.

Just before AMD dropped the AMD64 bomb on Intel, it seemed like Intel was on the verge of successfully pushing Itanium into the mainstream. I doubt PCs will ever come that close to getting a new mainstream architecture ever again unless you count ARM's on-going march on mobile platforms as a PC replacement. -

Mahesha Software availability will be a big challenge, not matter how good the new processor is. Unless IBM can build an x86 emulator into the Power9, it is going to be faced have difficulties. Not sure what google expects to get out of this x86 incompatible architecture (or ARM incompatible for that matter). NVIDIA partnering with IBM for Power9 is obviously politically right for them given what intel has done to them.Reply -

InvalidError Reply

Why would Google care about incompatible hardware? Google runs mostly on proprietary in-house software and have plenty of smart people who can fork the software and rebuild it for whatever new hardware Google chooses to use in the future. Also, IBM's Power9 should scale to performance and bandwidth levels for the datacenter, supercomputer and high-reliability markets that ARM is not going to scratch anywhere in the foreseeable future.17787447 said:Not sure what google expects to get out of this x86 incompatible architecture (or ARM incompatible for that matter).