Nvidia Increases Market Share as GPU Sales Explode: JPR

GPU sales explode

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

You are now subscribed

Your newsletter sign-up was successful

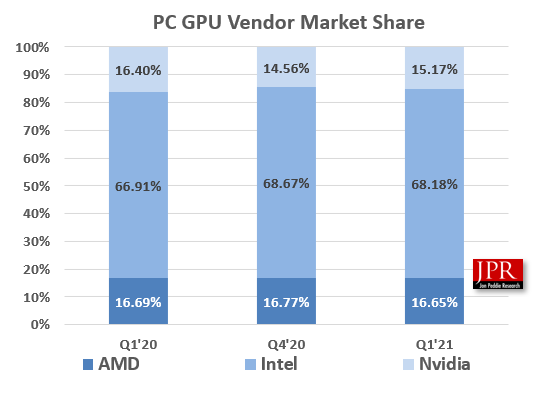

According to IDC, PC sales in the first quarter were up 55% year-over-year, and since the demand for personal computers is growing, component sales in Q1 2021 were high, too. Jon Peddie Research reports that shipments of integrated and standalone graphics processing units (GPUs) for PCs increased 38.74% year-over-year in the first quarter, but Nvidia was the only company that expanded its market share in the rapidly-growing market.

Discrete PC GPU Market Share

| Row 0 - Cell 0 | Q1 2020 | Q4 2020 | Q1 2021 |

| AMD | 25% | 18% | 19% |

| Intel | 0% | 0% | 0% |

| Nvidia | 75% | 82% | 81% |

Here's the tale of the tape for discrete GPU sales. Nvidia increased its discrete GPU share from 75% in Q1 2020 to 81% in Q1 2021.

In contrast, AMD's share decreased from 25% in Q1 2020 to 19% in Q1 2021. The good news for AMD is that its share actually increased by 1% from the prior quarter, so its discrete GPU shipments and earnings were up, too.

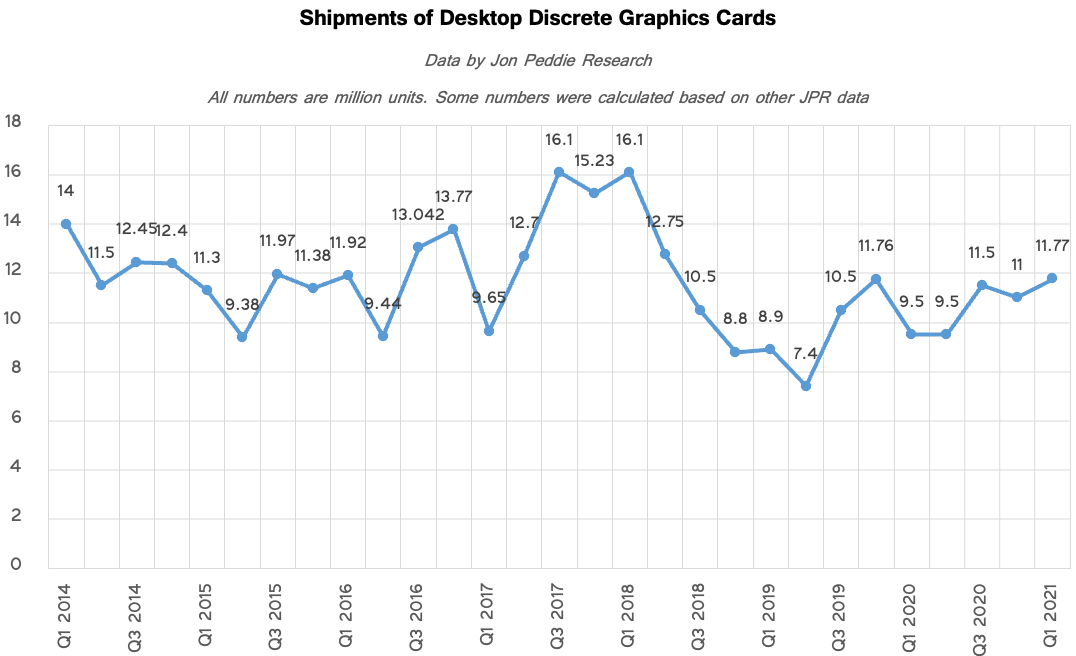

Sales of standalone graphics processors (such as those used for higher-end laptops and discrete graphics cards) were quite high in the first quarter and totaled around 22 million units, as we know from last week's report by Mercury Research. Jon Peddie Research clarifies that shipments of discrete graphics add-in-boards (AIBs) increased by 7% from the prior quarter, representing around 11.77 million units.

Although Intel started to ship its Iris Xe-branded standalone GPUs for low-end desktops and midrange notebooks in Q4, the company seems to report them as integrated graphics processors. As a result, it's hard to say if the company has gained any standalone GPU market share over the recent months.

The Overall GPU Market

Three companies shipped a total of 119 million discrete and integrated GPUs in Q1. The vast majority of graphics processors come as integrated graphics units in CPUs, so CPU market-leader Intel sells the most graphics processors. In Q1, the blue giant commanded 68.18% of the total GPU market, a decrease of 0.5% quarter-over-quarter.

AMD came in second with a 16.65% share (a decrease of 0.12%), while Nvidia ranked third with a 15.17% share (an increase of 0.62%), according to JPR.

Both AMD and Nvidia recently introduced their performance-mainstream and notebook GPUs based on their latest RDNA 2 and Ampere architectures, so the competition between the two companies is set to intensify in the coming months.

However, GPU shortages abound, restricting opportunities. If the GPU makers can get more chips from their suppliers, we can expect them to continue to focus on supplying premium GPUs to earn higher revenue.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Anton Shilov is a contributing writer at Tom’s Hardware. Over the past couple of decades, he has covered everything from CPUs and GPUs to supercomputers and from modern process technologies and latest fab tools to high-tech industry trends.

-

hotaru.hino Ah! Some numbers. So according to https://www.businesswire.com/news/home/20210329005150/en/Global-Gaming-PC-and-Monitor-Market-Hit-New-Record-High-in-2020-According-to-IDC, the number of "gaming" desktop and notebook shipments totaled 40.7 million in 2020.Reply

So if took the 2020 data in this article, it showed that 41.5 million discrete graphics cards were shipped. And since this includes laptop and desktop components... Well that doesn't seem to leave a lot for the retail market. -

Sleepy_Hollowed Unless AMD does something about scalping, and capitalizes that you really can’t find NVIDIA cards while you can find AMD cards at three times the mato, that’s something to think about.Reply

I know oem systems are a huge part (most) of the pie now but still. -

escksu Replyhotaru.hino said:Ah! Some numbers. So according to https://www.businesswire.com/news/home/20210329005150/en/Global-Gaming-PC-and-Monitor-Market-Hit-New-Record-High-in-2020-According-to-IDC, the number of "gaming" desktop and notebook shipments totaled 40.7 million in 2020.

So if took the 2020 data in this article, it showed that 41.5 million discrete graphics cards were shipped. And since this includes laptop and desktop components... Well that doesn't seem to leave a lot for the retail market.

Majority of the CPUs and GPUs goes to brands like Dell, Lenovo, HP etc.... These companies have a contract which pretty much guarantee their supply. Even in event of shortage, they are given priority.

Thats why I have been saying DIY market is a very tiny market segment. -

watzupken Reply

While I agree that this is a good opportunity for AMD to increase market share, but it is not as straight forward as what you mentioned. TSMC have limited capacity given the fact they mentioned they are overwhelmed with orders. So between producing CPU or GPU, I feel the former is more profitable to AMD and they are selling like hot cakes. GPU uses a lot more die space, and therefore, more costly to produce, and I suspect less profitable. So given the fab constraints, if they need to prioritize what to produce, they will likely choose CPU.Sleepy_Hollowed said:Unless AMD does something about scalping, and capitalizes that you really can’t find NVIDIA cards while you can find AMD cards at three times the mato, that’s something to think about.

I know oem systems are a huge part (most) of the pie now but still.

I am unsure how they get the stats on GPU sales, but it is not unexpected that Nvidia sells better. Nvidia Ampere cards are preferred by miners for their mining efficiency vs AMD's graphic solution. With 1 miner snapping up multiple cards, it is no surprise that Nvidia will outsell AMD. -

hannibal True. Also it seems that Samsung can provide more capasity to nvidia than tsmc to AMD so it all is about who can outproduce… and at this moment nobody can produce enough…Reply -

eichwana Is this shipped cards or cards installed in Pcs? If it’s shipped there’s a good chance that there’s a whole pile sitting around in scalpers back rooms, and sitting there mining.Reply -

bigdragon Nvidia's financials look great. I see a lot of buzz like this for them on financial sites. It's great to see the PC market uptick since older, slower computers are a complete and total pain.Reply

I do find it curious that financial news seems to be fixated on how much of an impact cryptocurrencies are making on Nvidia's (and AMD's) numbers, and whether or not gamers will be there to support both companies if crypto crashes hard. Nvidia insists that the gamers will still support their financials. Nobody is talking about the elephant (Intel) about to enter the GPU room. Personally, whatever brand loyalty I felt towards Nvidia prior to the 30-series is gone. -

spongiemaster Reply

AMD GPU's aren't MIA because of scalping. There is evidence indicating AMD is jacking up prices themselves to the point of making scalping unprofitable. Prices for AMD's GPU on Newegg shuffles have been absurd for weeks, typically about twice MSRP. That's way more than Nvidia cards. 6700 XT MSRP's at $479. They've been in the mid $900's on Newegg. The one on today's shuffle is $960. 6900 XT MSRP's at $999. One on shuffle today is $1719. If you look on Ebay, there is no profit to be made scalping either of those cards.Sleepy_Hollowed said:Unless AMD does something about scalping, and capitalizes that you really can’t find NVIDIA cards while you can find AMD cards at three times the mato, that’s something to think about.

In comparison, the 3060 is $330, one today is $400. Considering it is an AIB, it's barely marked up at all. The 3070 MSRP's at $500. The one today is $730. 3080 MSRP's at $700, one today is at $1070. There is significant profit to be made scalping all these cards on Ebay.

Considering how much better Ampere is at mining than RDNA2, it's not surprising that Nvidia cards are selling for more above MSRP than AMD cards on the second hand market. So it makes no sense that AMD cards are selling for so much more from Newegg. If it was Newegg or a distributor jacking up prices, they would be doing it equally for both brands, or if they were to choose one it would make more sense to increase Nvidia's more, not AMD's. Combine this with AMD having to find a way to financially justify continuing to produce GPU's in a market where it makes far more sense for them to be producing CPU's with their limited capacity, and there is ample evidence that AMD themselves has jacked up prices. Anyone thinking that AMD isn't trying to maximize their revenue just like all the other semiconductor companies has lost touch with reality. They're just being sneekier about it than the competition. -

hotaru.hino Reply

Yeah, despite how much the internet wants me to believe DIY gaming PCs are the majority, I've met plenty of people who would rather buy a laptop or a pre-built desktop than build their own.escksu said:Majority of the CPUs and GPUs goes to brands like Dell, Lenovo, HP etc.... These companies have a contract which pretty much guarantee their supply. Even in event of shortage, they are given priority.

Thats why I have been saying DIY market is a very tiny market segment.

I mean, if DIY gaming PCs were such a majority, why do Dell, HP, and heck even Lenovo continue to have a gaming focused segment? Why do companies like CyperPowerPC, iBuyPower, and others exist? Clearly there's a large market for pre-built gaming PCs if this space has so much competition.