Despite Shortages, PC Shipments Up 55 Percent in Q1

Shortages can't stop PC market growth.

News stories about chip shortages for various applications have become so common in the past few months that they now sound like background noise. It's no secret that demand for PCs and other electronics is high, but sales of personal computers have actually beaten all the expectations in the first quarter as they increased by 55% year-over-year, according to the latest data from IDC. Apple seems to be the biggest winner here since its shipments have more than doubled.

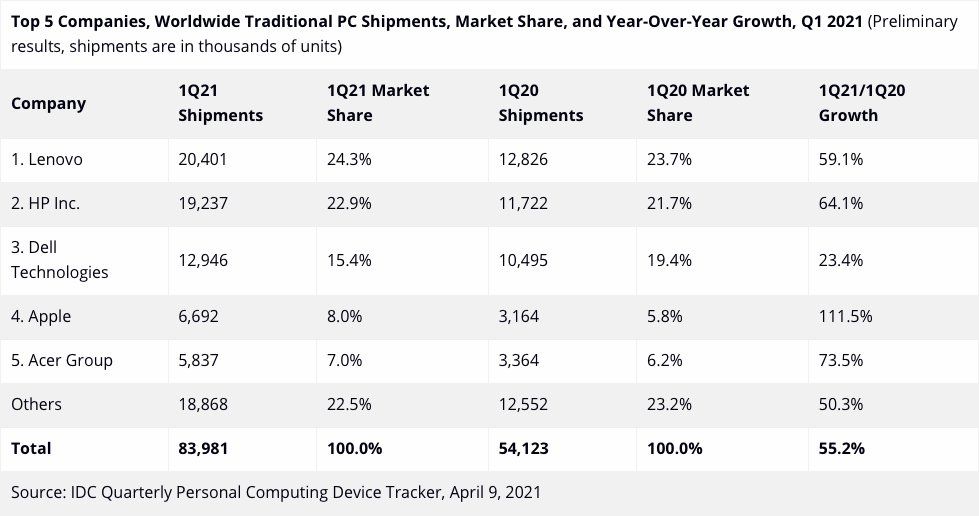

The industry shipped as many as 83.981 million PCs in Q1 2021, up 55.2% from the same quarter a year ago and a modest 8% decline from Q4 2020, which is a seasonally strong quarter. In fact, most Top 5 PC suppliers demonstrated over 50% year-over-year PC unit sales growth, an indication that they were eating the lunch of smaller players, which is not particularly surprising as they could procure more components and ship more machines.

Lenovo remained the market leader, selling 20.4 million computers and controlling 24.3% of the market. HP came in second with 19.237 million systems shipped and 22.9% market share. Dell landed in third with 12.946 million PCs and a 15.4% share.

Apple was in the distant fourth place, shipping 6.692 million Macs and owning 8% of the market. But Apple's sales were up a whopping 111.5% year-over-year, probably one of the biggest YoY jumps that the company has ever seen. Acer was the No. 5 PC maker in Q1 2021 with 5.837 machines sold and 7% of the market.

"Unfulfilled demand from the past year has carried forward into the first quarter, and additional demand brought on by the pandemic has also continued to drive volume," said Jitesh Ubrani, research manager for IDC's Mobile Device Trackers. "However, the market continues to struggle with setbacks including component shortages and logistics issues, each of which has contributed to an increase in average selling prices."

Demand for PCs began to skyrocket in Q1 2020 as many countries went into lockdown, sending hundreds of millions of employees and students home. All of these people had to buy new PCs for their remote work and learning, yet the supply chain was not ready, so shipments of PCs dropped year-over-year in Q1 2020 to 54.1 million units (from 59 million in Q1 2019), creating a large number of backorders. This differed demand has been affecting the supply chain since then, and shortages are expected to persist for quarters to come. But that decline in Q1 2020 created a low base effect for Q1 2021, which is why we can observe such tangible growth.

"There is no question when entering 2021 the backlog for PCs was extensive across business, consumer, and education," said Ryan Reith, program vice president with IDC's Worldwide Mobile Device Trackers. "The ongoing shortages in the semiconductor space only further prolong the ability for vendors to refill inventory and fulfill orders to customers. We believe a fundamental shift has occurred around the PC, which will result in a more positive outlook for years to follow. All three segments — business, education, and consumer — are experiencing demand that we didn't expect to happen regardless of many countries beginning their ‘opening up’ process. Component shortages will likely be a topic of conversation for the majority of 2021, but the more important question should be what PC demand will look like in 2-3 years."

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Anton Shilov is a contributing writer at Tom’s Hardware. Over the past couple of decades, he has covered everything from CPUs and GPUs to supercomputers and from modern process technologies and latest fab tools to high-tech industry trends.