Adata's Kevin Chen On The SSD Industry In Transition

We sat down with Kevin Chen, the Vice President of Adata, during Computex 2016 to discuss the trends and market forces that are driving the company and the industry at large. Adata produces a range of products that includes DRAM, SSDs, USB, memory cards and external storage devices, but our discussion focused on its flash-based products.

Not every meeting we have at a tradeshows is staffed by high-level product experts, but occasionally we get a chance to speak to the cream of the crop. In those meetings, though, we find that company representatives

are forthcoming and more open to sharing insight and opinions on various market forces.

Our recent discussions with Adata's Kevin Chen, like previous conversations we have had with him, provided us with insight into the inner workings of the industry. Chen is relaxed and personable, and his unrestrained responses to our questions are refreshing.

Adata Overview

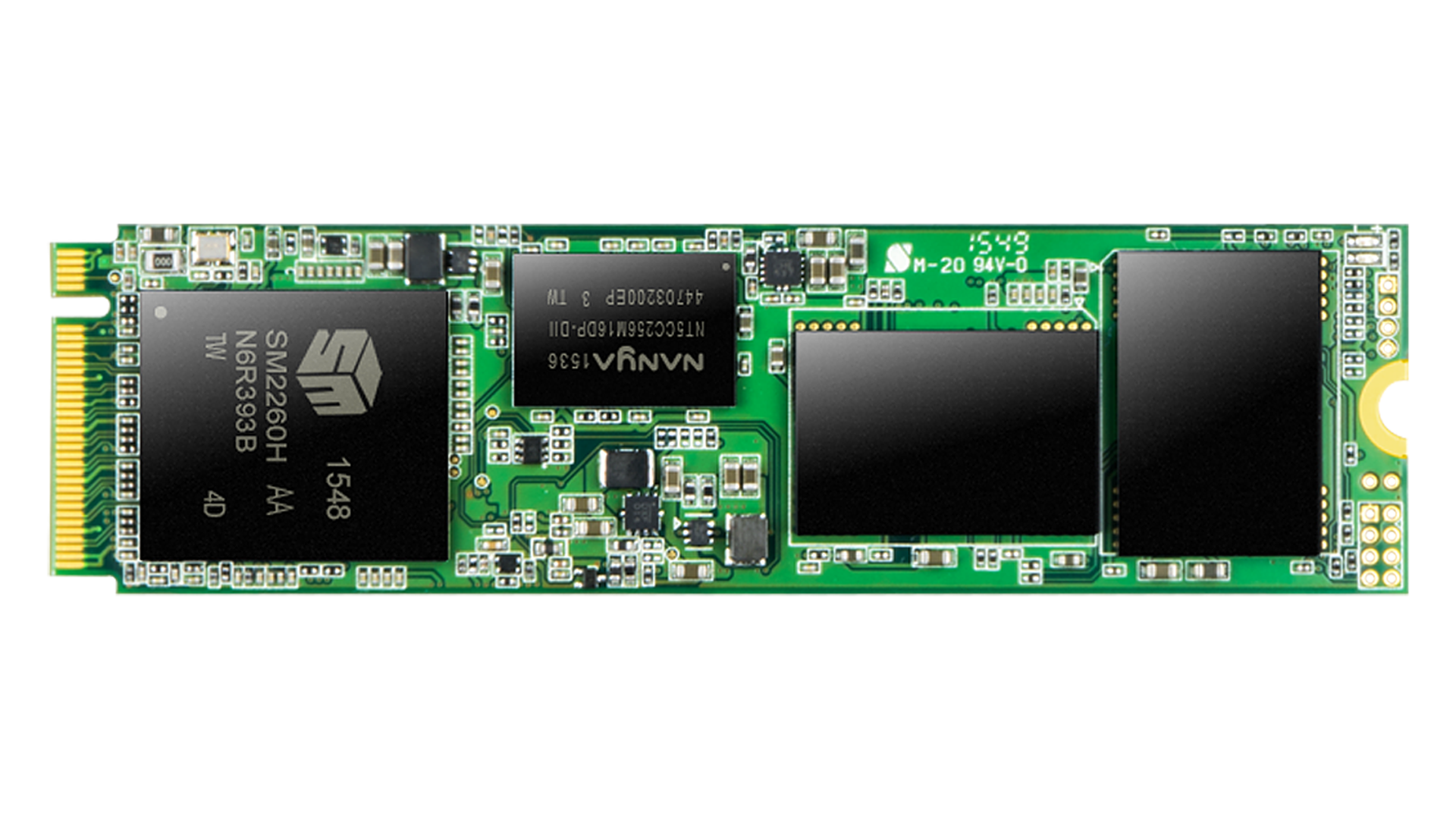

Adata is a third-party SSD manufacturer that utilizes more SSD controllers and flavors of NAND than any other company that we are aware of. The NAND fabs are the engines that pull the third-party SSD ecosystem down the track, and Adata utilizes flash from Micron, Toshiba, SK Hynix and Samsung. (If you're keeping track, this represents every major NAND supplier.) SSD controllers also play an integral part, and Adata offers Marvell, SMI, Seagate, Realtek and Maxiotek SSD controllers with its products.

Adata is experiencing a solid growth trend; the company's channel grew 65-70 percent last year, and the it projects a 40-50 percent growth trajectory per year for the next three years.

This broad spate of both NAND and SSD controller partners gives Chen a unique view of the market and emerging trends. We asked Chen why the company utilizes so many products, and if he foresees any overlaps. He indicated that Adata tailors the wide range of SSD controller and NAND pairings to address a wide range of workloads, such as mainstream and gaming use-cases, but that any potential overlap merely provides the customer with more choice.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Industry Transition To 2D TLC NAND

The industry transition from 2D MLC to 2D TLC flash is well underway. Chen noted that last year, the company sold 80-85 percent MLC NAND, whereas this year the mix has changed radically to 70-75 percent TLC NAND.

TLC enables a lower cost structure, which meshes well with the OEM and mainstream markets, but Adata does not target it for segments that require the best performance (such as gaming). Chen indicated that consumers have embraced TLC NAND because it has proven to provide enough endurance and performance for the majority of applications.

Adata is one of the few third-party SSD vendors that purchases NAND in wafer form; most simply procure the finished packages. Adata processes the wafers itself, which allows it to bin the flash die and assure that it adheres to its rigorous quality standards. The company indicated that the wafer processing and binning capability provides it with cost and quality benefits, and Chen noted that 2 to 5 percent of the die that are sold as "SSD grade" do not meet Adata's SSD requirements. Chen feels that the ability to control the NAND binning process provides Adata with an advantage over competitors, particularly when it comes to TLC NAND, which encounters more reliability challenges.

Transition To 3D NAND Beginning

Chen is bullish on the industry transition to 3D NAND. Adata will introduce its first 3D NAND SSDs in July 2016, but Chen noted that the fabs are experiencing growing pains as they grapple with the 3D NAND manufacturing process. Some NAND vendors are not providing 3D NAND wafers yet due to lower quality that stems from manufacturing difficulties as the process matures. As a result, Adata is buying and binning 3D NAND packages for the time being, but it will transition to 3D NAND wafer processing as wafers become available.

There have been industry reports of a looming NAND shortage in the second half of this year, and we have followed the topic closely. The difficulties with 3D NAND are common knowledge in the industry; many attribute difficulties during the transition to 3D NAND, which have most fabs one to two years behind schedule, as one of the key reasons that a shortage is looming. Some predict that prices will increases during the shortage, but Chen expects Adata's pricing to stabilize, as opposed to increasing, as a result of the shortage.

Other sources have also indicated that Apple is buying a tremendous amount of NAND as it prepares for the iPhone 7, which increases the base amount of storage from 16 to 32 GB and the maximum storage capacity to 256 GB. Apple is known to be a NAND vacuum of sorts when it ramps production for a new device, which adds additional supply pressure.

Chen indicated that the Adata strategy of using a pool of NAND vendors allows it to provide the most cost-competitive products and maintain a diversified supply. Adata produces its own SSDs, but it also assembles SSDs for OEM customers and other third-party SSD vendors, who merely resell the Adata SSDs under their branding. This increases the challenges associated with assuring the company has enough NAND, and the company has also increased its own NAND stockpile in anticipation of higher prices later in the year.

Emerging Trends

Chen cited 3D TLC and MLC NAND as the leading trends for the coming year, along with an increased commitment to PCIe 3.0 x4 SSDs in both M.2 and U.2 (2.5") form factors. Adata is expanding its NVMe offerings over the next year as the ecosystem continues to develop. The company is also experiencing solid growth trends in industrial automation, manufacturing and assembly, networking, security, and points of sale.

Chen also commented that DRAMless SSDs, which usually employ TLC NAND and no DRAM package, are going to be more common as OEMs increase adoption of the emerging "HDD replacement" segment. Endurance becomes more of a concern with DRAMless SSDs, and some vendors may choose to lower warranty periods to one year to 18 months, but Chen noted that Adata will continue to provide a three-year warranty.

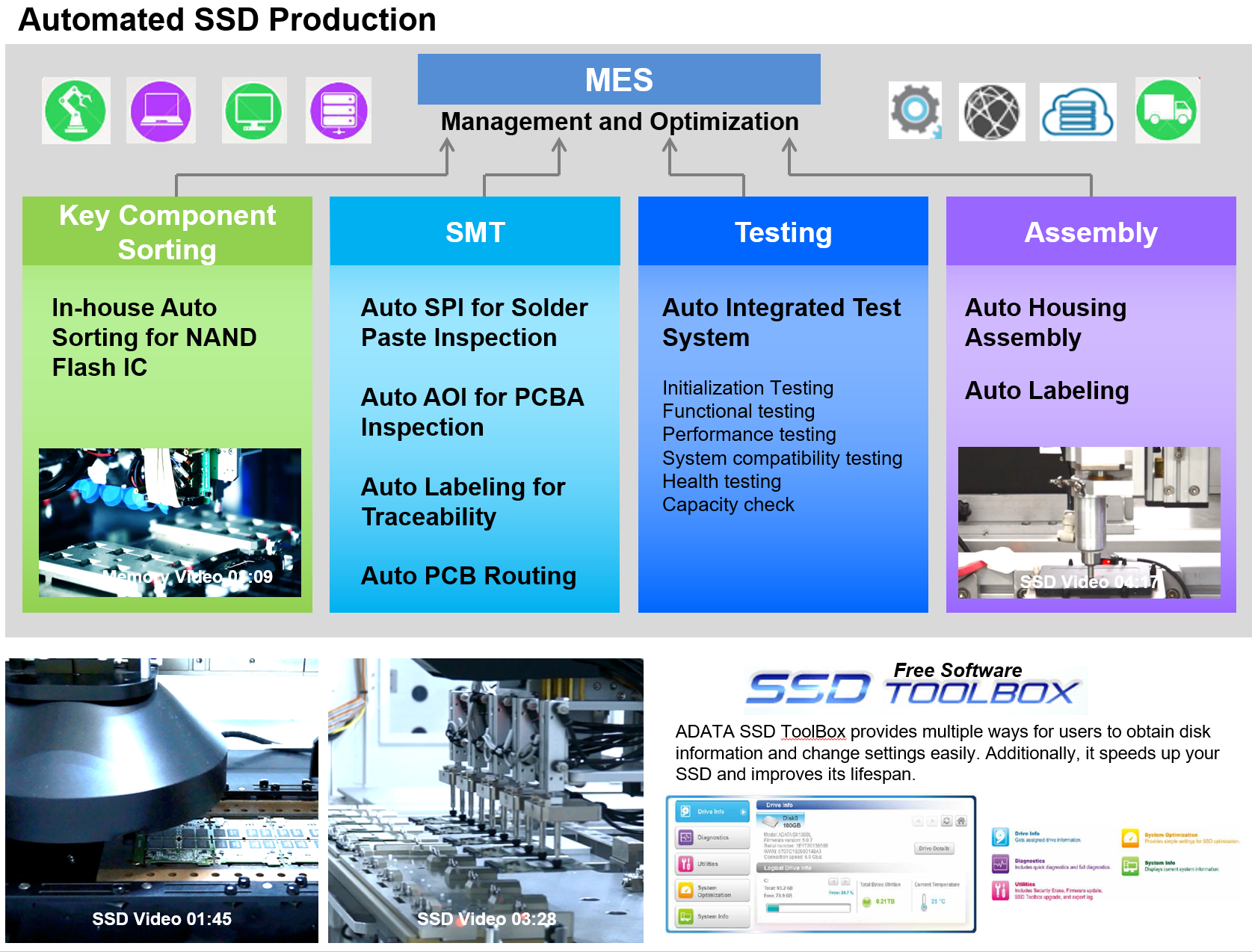

Production Capabilities

One area of considerable pride for Chen is the company's automated manufacturing process and rigorous quality control procedures. Adata's multi-layer quality assurance system employs heat ovens that help ensure quality (reliability, data retention) and allow the company to provide its OEM customers with quarterly quality control reports. I have been inside several SSD production facilities, and I have not encountered this capability elsewhere outside of the actual NAND fabs.

The company's Suzhou, China plant generates 500,000 finished products per month, and its Taipei facility produces 100,000 finished products per month. Adata has outstripped its production capabilities in recent months, so the company is doubling its automated line at its Suzhou facility to deal with the increased demand. Adata also touts the fact that its Suzhou facility has achieved the highest level of accreditation (AEO) from Chinese authorities, a mark only 16 of more than 4,000 facilities in the Suzhou Industrial Park have achieved.

Thoughts

Adata is one of several SSD vendors that are in the midst of explosive growth as SSDs continue to steal the performance and client markets away from HDDs. Many of the third-party SSD vendors are experiencing more pressure as the SSD market commoditizes, which reduces margins and profits.

Adata hopes that its investments in wafer production (along with diversified supply), IC sorting and binning, retention testing, quality control and automated production lines will assure its relevance in the 3D NAND era. If its growth trends are any indication, the company is headed in the right direction.

Paul Alcorn is a Contributing Editor for Tom's Hardware, covering Storage. Follow him on Twitter and Google+.

Paul Alcorn is the Editor-in-Chief for Tom's Hardware US. He also writes news and reviews on CPUs, storage, and enterprise hardware.

-

abbadon_34 I doubt I'd ever be comfortable using drive with an 18 month warranty, let alone 12 months. I find the comment on "HDD replacement" troubling and hard to believe.Reply

"Chen also commented that DRAMless SSDs, which usually employ TLC NAND and no DRAM package, are going to be more common as OEMs increase adoption of the emerging "HDD replacement" segment. Endurance becomes more of a concern with DRAMless SSDs, and some vendors may choose to lower warranty periods to one year to 18 months, but Chen noted that Adata will continue to provide a three-year warranty." -

JimmiG Yeah, the race to the bottom is becoming a serious issue for the SSD market. It used to be that you could buy any cheap SSD, because anything would be faster than an HDD. While this is generally still true, some TLC drives come close to HDD-level performance, with worse data retention and performance inconsistencies.Reply

DRAM-less SSD's is taking things too far. It will give SSD's a bad rep due to the risk of system hangs while writing data, poor endurance and questionable data retention. Sadly, most OEMs will love the concept, since they can save a few bucks per system while advertising "high performance SSD storage". -

Belardo Including a toolbox software, like intel's is a good idea that many vendors don't bother with at all. Seems like they learned something from Intel, especially when they used to sell SSDs manufactured by INTEL with an ADATA label. (bought some of these and saved 15% off the price of an intel - back then)Reply

What I find amazing is that the OLD HD companies which are **HUGE** companies, Seagate, WD, Toshiba don't have anything in the SSD market. For most biz and typical users, a 480~1TB SSD will handle everything they need.

For low-end work stations, I use a $90 240GB SSD and Linux (usually) and they work great.

TLC (tender loving care) drives seem... a bit too cheap. As long as they offer high end, then oh well. right? -

Caanis Lupus @BELARDO WD bought Sandisk, Toshiba has OCZ, Seagate has SSD offerings(don't know if who they are rebranding).Reply

I bought 3 of the S60 Adata drives when Amazon was selling them for under $40. Put them in some older 2nd/3rd gen I3/I5 systems that did quite a bit to help with responsiveness in Windows 7 and just 4gb of ram for work. -

Belardo Ah, I forgot about toshiba/OCZ. Didn't know about WD. But I would think for brand recognition, WD, Toshiba and Seagate would have their names on their products. WD, for example owns HGST for corp/enterprise market.Reply

My bigger issue with TLC drives (great marketing name, eh) is the performance. Of course OEMs will LOVE it as they'll sell computers with such drives and get an excellent markup on low-end drives. When I ordered Thinkpads from Lenovo, I would get them with the smalled HDs, and install intel drives. Why? Because the ONLY info you got was "100GB SSD" - not a brand or model or series or anything. Why spend $300 premium on an unknown when I could spend $240 and know what I am getting? Plus use the HHD unit as a back-up drive after its been cloned.

The typical custom won't know they have a low-end product. Going DRAMless to save a buck seems kind of stupid... but for some markets, a $1 is like $20 to us.

The life-span of the drives are not that big of a deal (for consumers and Small biz) compared to servers and enterprise. I was checking out a review comparing stress test of recent MLC and TLC drives to stress with the goal of hitting PB (1000TB of writes and beyond before failure). They all survived 700TB of writes, some hit 1000TB, including TLC. Those that died, gave SMART warning.

I checked my status on my intel 520 series 120GB drive from 2012 (My C: drive) and over the past 4 years of daily use, it only racked up 14.28TB writes! I typically run two broswers with 3 windows with about 50 tabs in use, photoshop and other tools. My SSD isn't close to death. Geez. my ancient intel X25-M 80GB (2009 tech) in my 2004 Thinkpad used to be my desktop drive, it has logged 7.54TB of writes... still works fine.