NAND Flash Makers to Cut Capex by 2% in 2019 - DRAMeXchange

DRAMeXchange has predicted that NAND flash manufacturers will continue to reduce their capital expenditure (capex) by 2 percent in 2019. The reductions are mostly expected to come from South Korean flash manufacturers, but the research group said that U.S. manufacturers will probably reduce their capex as well, despite global capital expenditure already declining by a reported 10 percent between 2017 and 2018.

The reason for these reductions is simple: there continues to be an oversupply of NAND flash memory. DRAMeXchange said this will probably continue to be the case despite manufacturer countermeasures, simply because "demand outlook for notebooks, smartphones, servers, and other end products remains weak." Tech companies probably aren't going to buy a bunch of memory to put in products they're struggling to sell.

Flash manufacturers have already felt the effects of these problems. The most notable example is Samsung, which revised its earnings guidance for the most recent financial quarter because of lower-than-expected demand for its memory and its smartphones. DRAMeXchange said that Samsung represents 30 percent of the market, so if it's struggling to reach its goals, odds are good that the other NAND flash manufacturers are as well.

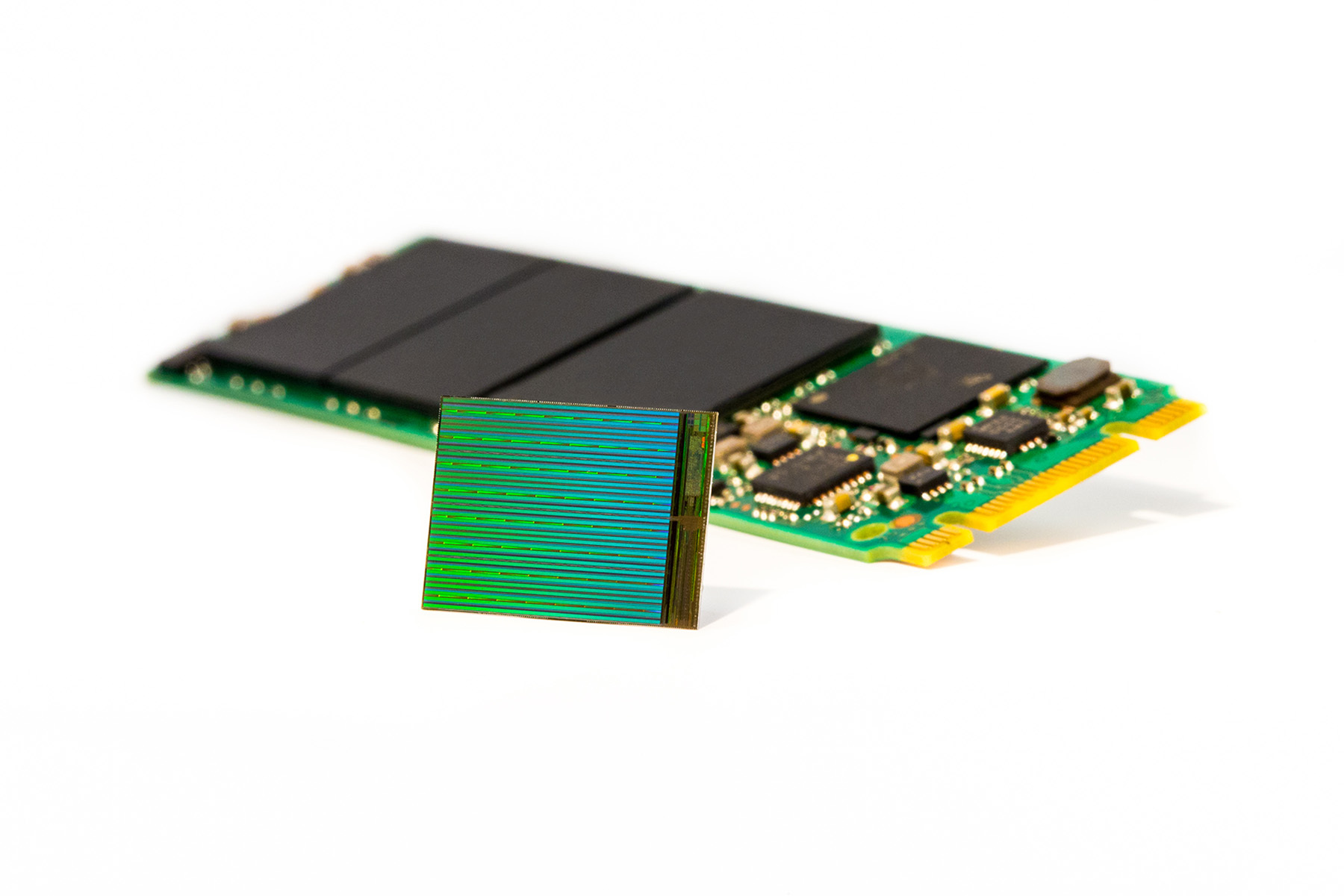

Samsung and other flash manufacturers will slow down their memory production throughout 2019 to combat these issues. (Hence the reduced capital expenditure.) Production was already expected to fall as companies switched to 92 and 96-layer 3D NAND products due to the need for more space in the fab. But now it's less "our bit output growth will fall because we're making new products!" and more "we need to cut costs."

Their loss could be our gain. DRAMeXchange said that it "expects a quarterly decline of 20% in 1Q19, higher than [the] previous forecast of 10%, and a further decline of nearly 15% QoQ in 2Q19" and that "for 2H19, the price decline may be slightly moderated considering the coming of peak season, but prices would continue to fall by around 10% each quarter." All told, the group's predicting a 50-percent drop in NAND flash prices over the coming year.

Previous estimates put the drop in memory pricing in 2019 anywhere from 10 percent to 25 percent. (Depending on the type of memory.) Watching the higher of those figures double over the course of a few months indicates that NAND flash manufacturers aren't likely to recover from their oversupply woes any time soon. But hey, at least from a consumer's perspective, who doesn't like it when prices fall?

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Nathaniel Mott is a freelance news and features writer for Tom's Hardware US, covering breaking news, security, and the silliest aspects of the tech industry.

-

TCA_ChinChin Thats nice for SSD pricing and stuff, but what about RAM memory? Is that going down as well?Reply