Gartner Shows PC Shipments Stagnating, Again

In an industry that is facing the perfect storm, only Apple, Asus and Lenovo are keeping their heads above the water.

There are not many positive signs for the PC industry in Gartner's latest sales charts. Most PC makers are barely hanging onto past sales successes, and numbers clearly reflect an environment of saturation in mature markets and a lack of innovation that would lure consumers into buying new PCs.

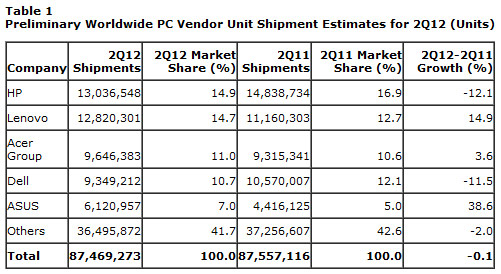

Globally, PC sales declined by 0.1 percent year-over-year in Q2 to 87.5 million units. HP kept the lead, but suffered a 12.1 percent drop in unit sales to 13.0 million PCs. Lenovo added 14.9 percent and ended up at 12.8 million systems. Lenovo is now close to overtaking HP as the world's leading PC maker with a market share of 14.7 versus 14.9 percent.

Acer, in number 3, added 3.6 percent to 9.6 million PCs. Dell lost 11.5 percent to 9.3 million. Asus jumped by 38.6 percent to 6.1 million.

In the U.S., the leading two manufacturers, HP and Dell, dropped by 12.5 percent and 9.5 percent, respectively. Apple was the only major computer maker to post unit sales growth (4.3 percent). The company solidified its positions as the third largest PC maker in the U.S. with 12.0 percent market share, but still trails Dell, with 21.7 percent, and HP, with 25.0 percent, significantly.

There is little hope that the market environment is changing in the current quarter. The rough economic environment is combined with a market in which consumers may be delaying their purchases until the release of Windows 8. Many consumers may be favoring a tablet or smartphone purchase or waiting until ultrabooks become much more affordable.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Douglas Perry was a freelance writer for Tom's Hardware covering semiconductors, storage technology, quantum computing, and processor power delivery. He has authored several books and is currently an editor for The Oregonian/OregonLive.

-

lunyone Most people are buying laptops and not spending a whole lot on them, from what I've seen from friends. I just bought a laptop, but my last PC purchase was in '06 time frame. I would probably buy more parts, but currently there isn't a real need for me and I also don't really have the $ to do it either.Reply -

Granter I have never manage to figure out how the `F.. the same applications just keeps using more and more RAM and cpu power for every year that goes, as if they were updating the programs to just consume more power making us buy new PC's.Reply

On another note, ofc there is little need to upgrade your 4-5year old computer when it can manage to play every game there is, yes even battlefield 3works great aslong as you play on laptop sized monitor 1280x720 highquality. Which is more than enough to have a great visual experience.

I can already see now utterly clueless people going like "PC is dying guys LUL", in 2years when the new consoles are releassed and new engines that can't run smoothly on todays computers (unreal engine 4, new cry engine? maybe a super upgraded quake engine, doom4 anyone) I'm sure that the PC market will ones again be king of the hill.

-

About 1 Billion People use the internet.... we still got 6 billion more people that will need to get on! :)Reply

-

theconsolegamer ReplyApple was the only major computer maker to post unit sales growth

I love how Apple add phone and tablet figures to a PC shipment table and get away with it. No way in hell is Apple MAC's/PC's market is growing. -

boiler1990 theconsolegamerI love how Apple add phone and tablet figures to a PC shipment table and get away with it. No way in hell is Apple MAC's/PC's market is growing.I wonder where Gartner pulls these numbers from. Technically these are Gartner's numbers, not Apple's.Reply -

CaedenV GranterI have never manage to figure out how the `F.. the same applications just keeps using more and more RAM and cpu power for every year that goes, as if they were updating the programs to just consume more power making us buy new PC's.Actually, the trend now is in de-bloating software. Everything from Windows, to Office, to even high end Adobe software runs faster now for the same tasks than they did 5 years ago, and with Win8 we are going to see an acceleration of this trend as software is going to be designed for tablets and phones as the primary medium instead of desktops.Reply

High end Adobe suites will ever require more hardware for the new features that they come out with (like automated motion blur removal in the new Photoshop), but for simple edits in Premiere or Photoshop, it will run faster on the same hardware compared to the older revisions because they are making the code tighter, and these new engines are more intelligent about resource handling. These new softwares are not so efficient that they are 'amazingly' faster than their previous revisions, but it is a trend that people enjoy, so software makers will continue it.

I do have a fear of the death of the PC though:

I think when the C2Duo/Quad came out we finally saw the first CPU that could in fact handle 90+% of people's CPU needs. Yes, to do anything exciting it needs to be paired with an SSD and a GPU, and have fast internet access, but for everything from web browsing, all the way up to mid-level gaming, and all the way in the other corner of light to moderate photo and video editing, these 4-5 year old CPUs are still enough for most people today, where as every generation of CPU before it hit a wall ~3 years in, so most people upgraded their PC every 3-5 years.

The way things stay cheap is if there is a huge demand for parts, and said parts can be made cheaper in larger mass. What we are looking at right now is the 'life extension' of the desktop, not the death of the form factor. But if a 5 year old machine can do everything that most people want to do (and likely will continue to be enough for the next ~3 years), and if current machines are easily 3x more powerful, then how long will current gen hardware hang around on the market? 12 years? 15 years? with only minor repairs for things that wear out like HDDs and power supplies (even cheap computers have solid caps, so even crap mobos last a long time)? If PCs begin to last so long, then we will begin to see a dramatic drop in PC sales, which means less production, which means more expensive parts, which then leads to even less sales.

My fear is that with the rise of the tablet and smartphone, that people who just purchased, or will soon purchase a computer, will never replace it. In 10 years these smaller form factor technologies will simply be enough, so the ATX form factor will be relegated to extreme game systems, high end workstations, and home servers, and all 3 markets combined is a very small fraction of today's PC market. With so little incentive for parts makers to continue making parts, the parts will have much higher price tags, and become much harder to come by, and that will be the death of the PC. I do not think the threat is imminent like some do, but I do think we will see it at some point in the next 5-10 years.

I think you are (unfortunately) wrong on the console end of things too. Yes, the PC will have a clearly better experience, but in reality, people buy things based to thresholds of experience based on their medium of choice rather than purchasing for bragging rights or to have 'the best' experience possible. Current consoles suck, not because they are not upgrade-able like a PC, but because console makers had no idea that 1080p would catch on like it did, and they are only designed for moderate 720p gaming. This next gen of consoles will be able to play high end 1080p games at 30fps very well. While the PC will offer faster load times (or no load times), better mods, and higher resolution/fps screens, the average joe will not care because they want to see their game on the big 55" high contrast TV, not the relatively small but higher quality 20-28" monitor. And for that 1080p 30fps environment they will choose the game console every time. The difference this time is that the console will be adequate for the medium, where the last gen frankly was not up to the task. The only real hope for the PC game rigs is for 2K and 4K TVs to come down the pipe in the next few years (which may happen as soon as this Christmas), or for multi screen gaming to take off (which is unlikely). -

sten_gn PC aren't dying.Reply

Try converting DVD movie to different format ... I bet that Your super ultra tablet or smart phone is unable to comply.

Try playing newest games in high res or try working with any advanced image editor on 4" or 10" screen ...

We don't buy new hardware every new year. Mostly we keep it as long it works properly.

-

spookyman Well most PC hardware is purchased by big business. Average lifespan for office PC's is about 5 years now.Reply -

tstng Here we go again. I dont know who "Gartner" is, never heard of them, but here's what's really going on:Reply

A) Laptops, Tablets, Smartphones, 'nough said;

B) PC components; if you need a faster PC you dont need to shell out a big bag o' cash, you just buy a couple of upgrades, done ;

C) Your average curent gen PC is powerfull enough for most people, you dont need a new one, only enthusiasts and hardcore gamers buy the big guns.

D) Nowadays, most people build their own PC's, they dont buy complete PC's anymore.

The PC market is just fine, Intel si doing fine, AMD is doing fine, Nvidia is doing fine, Gigabyte, MSI, etc, they are all doing just fine. HP, Lenovo, and whatnot are hurting because they buy their stuff from the above mentioned companies and try to sell you their PC's at a premium.