PC Market to Decline Steeply in 2022, Will Rebound in 2024: IDC

IDC says the PC market to decline in 2022 – 2023.

To those paying attention to the market, reports about softening demand for PCs by consumers have almost become background music in recent months. So for many, the important questions are how significantly the market will contract in 2022 and when it is set to rebound. IDC on Friday said that the market will contract by 43.5 million units year-over-year in 2022, and will not return to growth for another year.

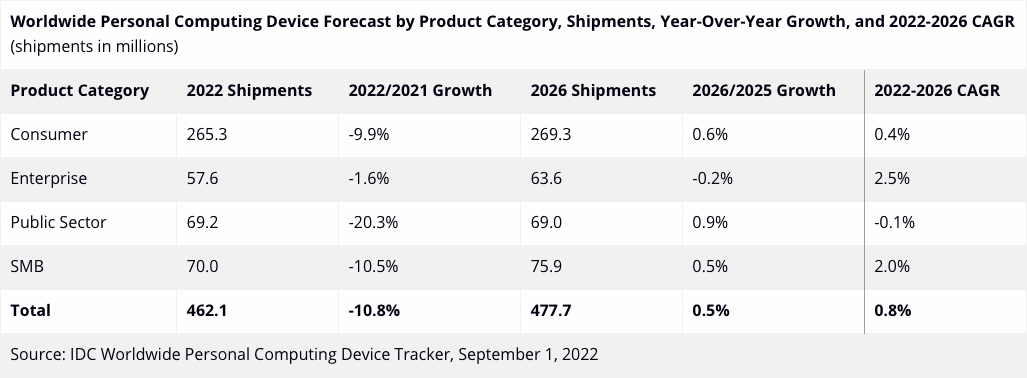

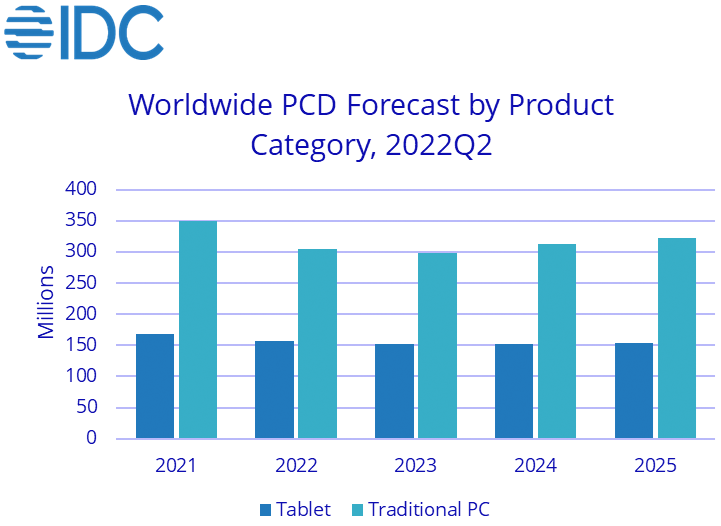

IDC believes that unit shipments of PCs will total 305.3 million units in 2022, down 12.8% from 348.8 million units in 2021. Tablet sales will drop to 156.8 million units, or by 6.8% from the previous year. In total, shipments of personal computing devices (PCs and tablets, or PCDs) will decline to 462.1 million units, by 10.8%, in 2022 compared to 2021. Sales of PCDs will contract further by 2.3% in 2023 before rebounding in 2024. But while shipments of PCs and tablets are higher than they were in pre-pandemic years, they are not going to return to pre-pandemic peaks, even in 2025.

IDC sees saturation of PCs in consumers' hands, a weaking global economy, and inflation as primary causes for the reduced outlook.

"Long-term demand will be driven by a slow economic recovery combined with an enterprise hardware refresh as support for Windows 10 nears its end. Educational deployments and hybrid work are also expected to become a mainstay driving additional volumes," said Jitesh Ubrani, research manager for IDC Mobility and Consumer Device Trackers.

One of the things that has been emphasized recently is that consumers are slowing their PC and tablet spending, whereas the enterprise market continues to buy new hardware. Indeed, IDC believes that consumers will buy 9.9% fewer PCDs this year, whereas enterprise purchases will be contracted by modest 1.6%. But apparently, consumers are not leading the pack here, as small businesses plan to reduce their procurements by 10.5% in 2022, whereas the public sector (government agencies, schools) will lower its consumption of PCDs by a whopping 20.3%.

"With economic headwinds gaining speed, we expect worsening consumer sentiment to result in further consumer market contractions over the next six quarters," said Linn Huang, research vice president, Devices & Displays, IDC. "Economic recovery in time for the next major refresh cycle could propel some growth in the outer years of our forecast. Though volumes won't hit pandemic peaks, we expect the consumer market to drive towards more premium ends of the market."

IDC's data is indirectly confirmed by Jon Peddie Research's report from earlier this week, which says that PC CPU shipments to PC makers declined by 33.7% year-over-year and sales of discrete desktop graphics cards decreased by 9.6% YoY in Q2 2022. Note that IDC counts PC boxes sold to distributors or end users, whereas JPR counts chips sold to hardware manufacturers. The fewer chips shipped to PC makers in Q2 2022, the fewer PCs will be sold in the next quarter or so.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Anton Shilov is a contributing writer at Tom’s Hardware. Over the past couple of decades, he has covered everything from CPUs and GPUs to supercomputers and from modern process technologies and latest fab tools to high-tech industry trends.

-

InvalidError Analysts predicting PC growth are ignoring 10+ years of steadily declining sales prior to COVID. The massive demand surge prompted by COVID in 2020-2021 is people and companies with long-overdue upgrades pulling the trigger on top of regular corporate and institutional fleet refreshes. Most of the people and companies who contributed to the demand spike likely have upgrade cycles much longer than the steady 3-4 years corporate and institutional baseline demand and won't be back on the market for a new PC or laptop within the next 5-7 years.Reply -

Heat_Fan89 Reply

But if crypto takes off again the industry could see some growth again. I purchased a prebuilt because I needed to upgrade my gaming PC and there were no GPU's available. If crypto comes back strong it could make PC buyers to just buy a prebuilt PC.InvalidError said:Analysts predicting PC growth are ignoring 10+ years of steadily declining sales prior to COVID. The massive demand surge prompted by COVID in 2020-2021 is people and companies with long-overdue upgrades pulling the trigger on top of regular corporate and institutional fleet refreshes. Most of the people and companies who contributed to the demand spike likely have upgrade cycles much longer than the steady 3-4 years corporate and institutional baseline demand and won't be back on the market for a new PC or laptop within the next 5-7 years. -

10tacle Well there's that and the fact that PC gaming is mostly on the GPU these days so people can skip many generations of CPU chipsets and just buy say every 2nd or 3rd generation of GPU - especially in higher resolutions and quality settings. An i7-8700K can run an RTX-3080 nearly just as well as an i7-12700K at 4K gaming resolution minus a minute FPS loss, but an RTX 1080 can't come close to a 3080 (or even a 3070 or 3060 Ti) as one example .Reply -

Heat_Fan89 Hopefully the Tom's article turns out to be true. IIRC, the RTX 4070 is supposed to hit similar performance to the 3090.Reply -

escksu COVID fuelled massive growth in PC market in 2020/2021. Of course we will be getting quiet times after that... It's normal.Reply -

InvalidError Reply

If we go by display resolutions on the Steam survey, a shocking number of people appear to still be running on 10+ years old potatoes and I bet a fair chunk of COVID upgrades were people previously using such potatoes. Yeah, not going to score repeat sales from those people any time soon and I can count myself among those, going from an i5-3470 to an i5-11400.escksu said:COVID fuelled massive growth in PC market in 2020/2021. Of course we will be getting quiet times after that... It's normal. -

KE=MV2 In other words...Reply

Under Brandon the economy, inflation, (i.e. people's available income), and everything else just sucks.

Once Brandon is gone in 2024, we can begin to recover, and hopefully people & companies can afford to update their equipment. -

Heat_Fan89 Reply

I'm definitely in that group as well. I went from an i7-3770K and RTX 780 which I built in 2013 to a 10900K, RTX 3080 back in 2021.InvalidError said:If we go by display resolutions on the Steam survey, a shocking number of people appear to still be running on 10+ years old potatoes and I bet a fair chunk of COVID upgrades were people previously using such potatoes. Yeah, not going to score repeat sales from those people any time soon and I can count myself among those, going from an i5-3470 to an i5-11400. -

bit_user Reply

The job market is currently very strong, which means some people are making more money. That's probably among the factors fueling inflation.KE=MV2 said:the economy, inflation, (i.e. people's available income), and everything else just sucks.

Also, in spite of the recent beating the stock market has taken, the Dow and S&P 500 are still higher than they were in mid-January, 2021. So, you can focus on everything that's going poorly, but it's certainly not all bad.

And most of the factors hitting the US economy are actually world-wide (e.g. shipping costs & supply chain issues). In fact, the US is actually doing better in several key areas, compared to most other countries, including energy & food prices. Even inflation isn't as bad in the US as in many other countries. I think that's a positive story, but people don't like to hear "it's even worse, elsewhere", when they're upset about something.

It might interest you to know that 2024 is an election year, but the new administration doesn't take over until January 2025. Specifically, the inauguration happens on January 20th and the Congress usually begins a new session on January 3rd.KE=MV2 said:in 2024, we can begin to recover