Reality Check: Sorry, AMD Hasn't Tripled Its Market Share (Yet)

The truth behind the numbers

We all love a good story, and AMD's phoenix-like rise from the ashes of the CPU market is a great one. AMD is truly making a wonderful comeback, earning our praise for many of its recent chips, but we have to temper the widespread recent reports of AMD's fantastical CPU gains in the Steam Hardware Survey.

No, AMD hasn't made a 2.5X improvement in two years in the Steam Hardware Survey. You shouldn't pay attention to those reports, and we'll explain why. We'll also touch a bit on recent reporting surrounding the bogus Passmark "Market Share Report."

Steam's False Hardware Survey Results

The Steam Hardware Survey tracks a portion of Steam's 125 million active users, so the media often uses it to track the hardware and software that gamers use most frequently.

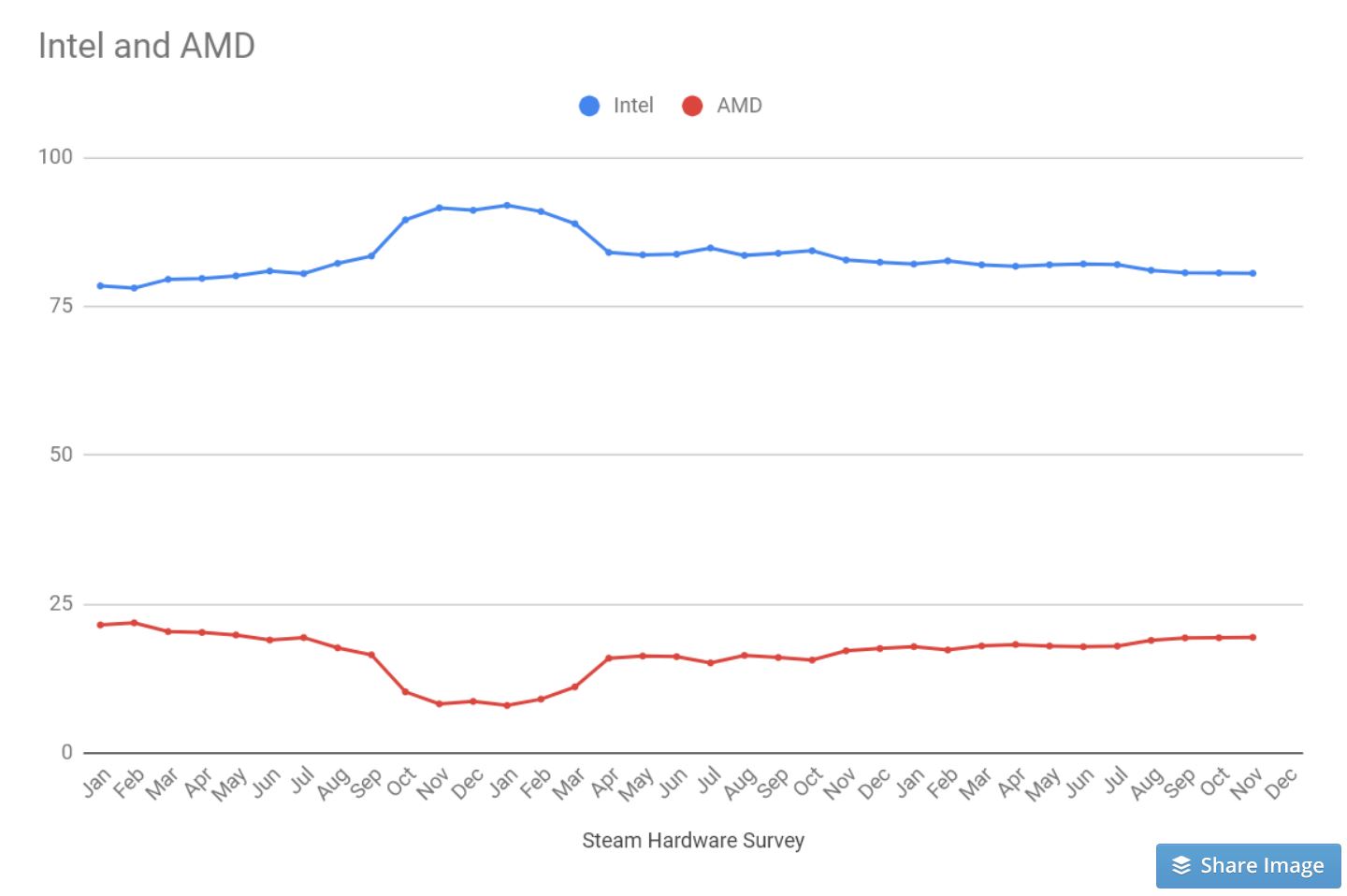

Simply put, by its own admission, Valve's Steam Hardware Survey was broken from September 2017 to May 2018, and the recent reporting outlines a 2.5X gain in AMD CPU usage on systems with Steam. Unfortunately, that reporting comes to that conclusion based on an increase from January 2018, which falls squarely in the middle of Steam's false survey results (as seen in the chart below). That means the recent reporting is wrong due to incorrect survey data.

During this time, the survey reported data from Chinese internet cafes that submitted multiple submissions per computer frequently, instead of yearly as the survey is designed. This happened so frequently on these Intel-powered systems that it skewed all Steam Survey results, including resolutions, operating systems, GPUs used, and so on. The results were so badly skewed that Valve announced it to the public.

However, even when the survey is working correctly, it isn't really indicative of the desktop PC market, which is where AMD is most competitive. Steam doesn't share much public information about its survey methodologies, such as how many systems it queries per year, or the percentage of laptops and desktop PCs in the surveyed data, so we can’t use these numbers as a direct comparison of AMD's penetration into desktop gaming rigs. Interesting data, sure, but it is irrevocably skewed due to laptops (which are ~60% of the overall CPU market) submitted into the same survey pool.

According to the survey, based on the correct reporting period beginning in April 2018, AMD's CPU use on Steam has gained roughly 3.48%. Again, this isn't particularly helpful data, but it highlights the massive divide between the reports and reality. Also, remember that these numbers quantify all of the processors in use worldwide, and considering the typical five- to seven-year refresh rate of desktop PCs, it includes an incredible amount of pre-Ryzen-era systems. That makes it hard to gauge current adoption rates accurately.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

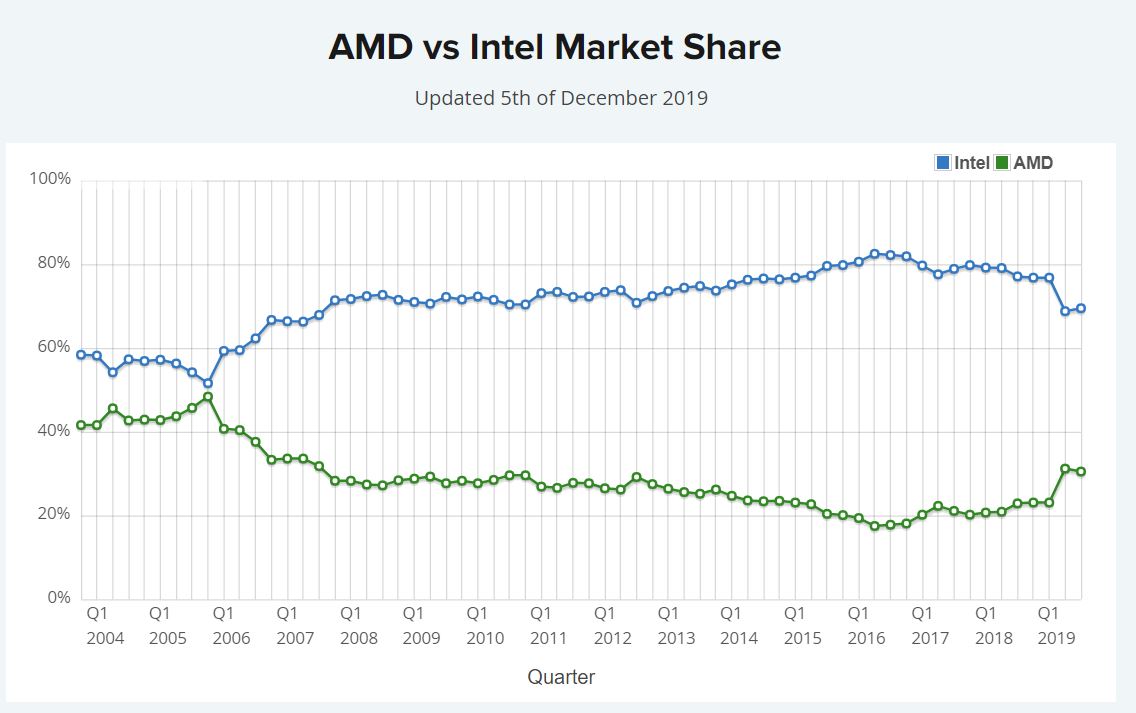

We turn to Mercury Research, the same agency that AMD and Intel (among many other semiconductor vendors) use for their competitive analysis reports, for real measurements of unit share. You can see those here. These numbers aren't nearly as exciting, but remember that each percentage point of gain in these numbers potentially equates to 100's of millions of dollars.

Passmark....Again.

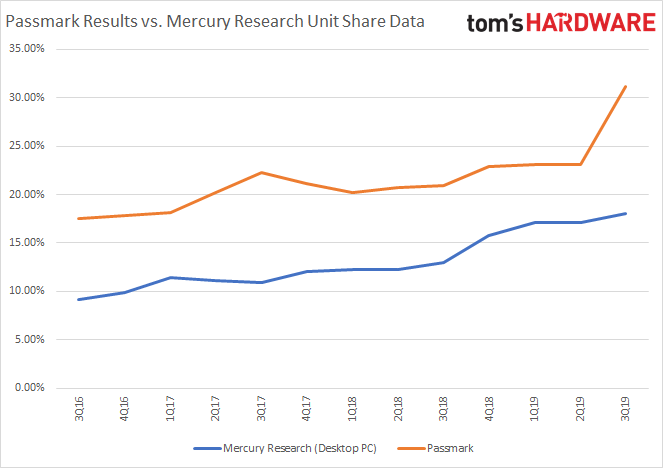

Finally, a quick note on Passmark. We frequently see analysis of these results crop up in articles, with fantastic claims like AMD achieving 30% of the market. Unfortunately, the Passmark 'report' is even more misleading.

Passmark posts quarterly updates that outline the number of benchmark submissions the company has received, but due to a horribly-named and incredibly misleading chart and article title, many mistake the results as an indicator of AMD's market share. The results do not represent actual sales figures, and certainly do not represent market share. Instead, it quantifies the number of times that users run the Passmark benchmark. If you're overclocking your system and running the test repeatedly to gauge performance improvements, each test counts on this chart.

The chart is also updated daily, so you have to eliminate the final data point from consideration, as it is never complete.

We threw this graph together with Mercury Research's desktop PC numbers compared to Passmark. There is some loose correlation to increasing adoption of AMD CPUs over time, but the problem lies in the deltas. Passmark is off by 8% on average, but sees spikes as high as 13.2% that don't correlate to actual share increases. In fact, they've even occurred during declines in AMD's CPU unit share.

Bear in mind, we're comparing strictly desktop processor unit share data from Mercury Research to the Passmark results, while the latter can include test submissions from laptops and servers. As we see in 3Q17 and 3Q19, there are large unexplained deltas, though its rational to assume the 3Q19 Passmark data point is the result of new Ryzen users measuring their boost clock speeds during the recent controversy surrounding the issue. Notably, this errant data point is the one used for recent reports.

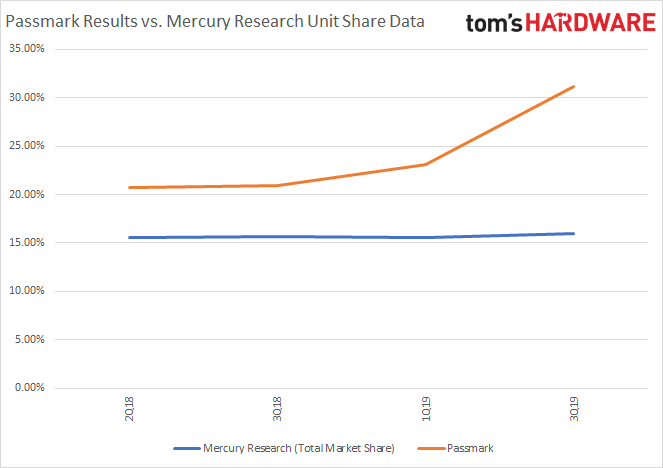

To be thorough, although we don't have as much historical data, we plotted the overall unit share numbers from Mercury to compare to the Passmark numbers. That doesn't help much.

In sum, neither Passmark or the Steam Hardware Survey are accurate indicators of CPU market share, especially if they are used to measure a single point in time. Broad trends, maybe, but not quarterly share figures.

Paul Alcorn is the Editor-in-Chief for Tom's Hardware US. He also writes news and reviews on CPUs, storage, and enterprise hardware.

-

jimmysmitty Steams Survey is only useful in terms of gamers and enthusiasts. That is the only market that it can even remotely represent.Reply

It takes time for market share to change and as well volume. While AMD finally has some very competitive products there is still more work to be done to take more market share. Of total sales they will need to sway the big OEMs more than anything as thats where the majority of common user sales are. -

ddcservices There has clearly been a surge in sales for AMD based products, no question about it. What I suspect when it comes to the Passmark results is that many people hear about new security vulnerabilities in Intel chips, so they run a benchmark to see how much performance they have lost due to the latest updates. There was the release of the 9900ks, which many were expecting to actually be better than the 9900k, so trying to tweak the new processor and failing to find it actually better than the 9900k would make people run benchmark after benchmark after benchmark to try to find a justification for buying the 9900ks.Reply -

ddcservices Replyjimmysmitty said:Steams Survey is only useful in terms of gamers and enthusiasts. That is the only market that it can even remotely represent.

It takes time for market share to change and as well volume. While AMD finally has some very competitive products there is still more work to be done to take more market share. Of total sales they will need to sway the big OEMs more than anything as thats where the majority of common user sales are.

The problem with the Steam Hardware Survey is that it is a survey, distributed randomly, and many people have never even had it pop up for them. Since AMD has only had 2.75 years worth of big growth from the release of the first Ryzen 7 processors in 2017, it stands to reason that if the new machines have never gotten a survey, the actual number of AMD users is being under-represented. Steam should have an auto-gather every month(with the option to opt-out) for all devices that connect to the service. Don't make it random if your machine gets a survey. -

jimmysmitty Replyddcservices said:The problem with the Steam Hardware Survey is that it is a survey, distributed randomly, and many people have never even had it pop up for them. Since AMD has only had 2.75 years worth of big growth from the release of the first Ryzen 7 processors in 2017, it stands to reason that if the new machines have never gotten a survey, the actual number of AMD users is being under-represented. Steam should have an auto-gather every month(with the option to opt-out) for all devices that connect to the service. Don't make it random if your machine gets a survey.

Except thats not what the Steam survey is saying. Its over representing due to an error.

And its pretty close. If you look though you can see a steady climb in the survey for AMD CPUs.

My only point is that it is not a way to look at CPU market share outside or gamers or enthusiasts since the mass majority of people rarely build a PC. -

drea.drechsler In the world of corporate finance 'market share' is defined very differently from what's used here. Since it's being so loosely used here you could also define it as 'number of CPU compute cores being sold'. I wonder what that would say for AMD's current 'market share'.Reply

But using the article's references even as a 'popularity index' is just wrong, for the reasons given. -

TCA_ChinChin Anybody expecting a tripling of market share needs to know that despite AMD having great gains so far, it still takes time for momentum to build up and stubborn larger companies to move to a new platform due to the perceived risk with migration. Also, doubling/tripling a small number is still a small-ish number.Reply

The bright side for AMD isn't that they are able to double/triple market share in 2 years, its the fact that they will continue to grow at a good rate for several more generations due to how they have developed their architecture and Intel's own misfortunes. -

jimmysmitty ReplyTCA_ChinChin said:Anybody expecting a tripling of market share needs to know that despite AMD having great gains so far, it still takes time for momentum to build up and stubborn larger companies to move to a new platform due to the perceived risk with migration. Also, doubling/tripling a small number is still a small-ish number.

The bright side for AMD isn't that they are able to double/triple market share in 2 years, its the fact that they will continue to grow at a good rate for several more generations due to how they have developed their architecture and Intel's own misfortunes.

AMD still needs a lot of work though to be able to really shine. Marketing is one of their biggest weaknesses. Outside of the enthusiast market AMD is relatively unknown but everyone knows Intel. Well not everyone but a much larger majority than do AMD.

I think if they can get that into a better spot they could easily keep the momentum going. So long as they keep a decently competitive product and don't have another Phenom or Bulldozer. -

BaRoMeTrIc AMD is dominating the DIY market. But the DIY market is small relative to laptops, prebuilts, and 2-1's. Give it a few years for more brands to start incorporating Ryzen into their low power and mobile devices, Ryzen is incredibly versatile especially on the 7nm node.Reply -

TJ Hooker Reply

What's wrong with taking a random sampling of the entire population? That's standard survey methodology. The fact that Ryzen is new-ish shouldn't make a difference, unless they're being really dumb and posting the current results as being cumulative from all past surveys*. The real issue is that the Steam survey has inherent sampling bias by being limited to people who have Steam installed. Plus I think there have been cases where Steam catches on with a whole new demographic and all of a sudden the results change, but in reality there's been no real change in market share just a change in who's all using Steam.ddcservices said:The problem with the Steam Hardware Survey is that it is a survey, distributed randomly, and many people have never even had it pop up for them. Since AMD has only had 2.75 years worth of big growth from the release of the first Ryzen 7 processors in 2017, it stands to reason that if the new machines have never gotten a survey, the actual number of AMD users is being under-represented. Steam should have an auto-gather every month(with the option to opt-out) for all devices that connect to the service. Don't make it random if your machine gets a survey.

* E.g. if one year they have 100% Intel, and the next year they get 50% Intel/AMD, and they were to then combine them and display the results as being 75% Intel/25% AMD, that would be dumb. But I don't have any reason to think they're doing that. -

digitalgriffin To be honest with you, I'm not sure benchmarks are the end all be all of the represented market. There's overall market share, and there is CURRENT market share. These benchmarks represent overall market share which might include systems that are over 10 years old.Reply

AMD's current market share we know is surging in the home brew market in both Europe and USA as evidenced by top sellers list. While the home brew market is relatively small, but it is a very important metric. Those who build their own systems are a little bit more tech savvy. This will eventually reflect in the professional market where these tech-savvy people typically work.

Will AMD achieve 30% current market share overall? Doubtful. TSMC doesn't have the capacity for that to happen any time soon, and Intel is willing to dump their products to keep AMD at bay. But I think AMD is in a very healthy position. They are shedding their debt quickly and sales are a very competitive alternative. If they keep innovating, then I think they will more than thrive.