Prices of Used Semi Tools Soar as China Ups Investments

China buys more semiconductor production equipment than everyone else.

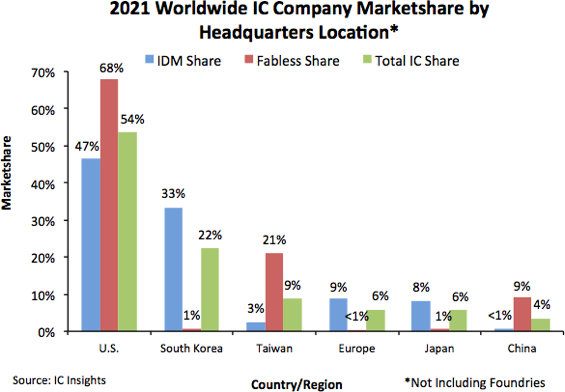

Chinese companies account for only 4% of global semiconductor revenue (according to IC Insights), but the country is increasing investments in new fabs and is projected to account for about 20% of global chip fabrication capacity this year. Since it is not easy to procure new equipment these days, especially for companies like SMIC, China-based semiconductor firms are actively buying used tools, so their prices are skyrocketing.

Demand for chips is setting records these days, which is why virtually all makers of semiconductors, as well as chip testing and packaging houses, are aggressively expanding production capacity. Makers of semiconductor manufacturing tools, such as Applied Materials, ASML, and KLA, cannot keep up with the demand for leading-edge equipment and relatively mature devices. Lead times for most new tools are now around a year or more. By contrast, used tools can be acquired within a month.

Brokers and leasing companies procure these tools from leading chipmakers that no longer use them and resell them to makers of semiconductors that use mature process technologies. As a result, demand for these machines is increasing along with prices. Nikkei reports that prices of used semiconductor equipment doubled in the last couple of years.

"At the upper extreme, there are items whose prices have quintupled," said a sales representative at Mitsubishi HC Capital, a leasing company.

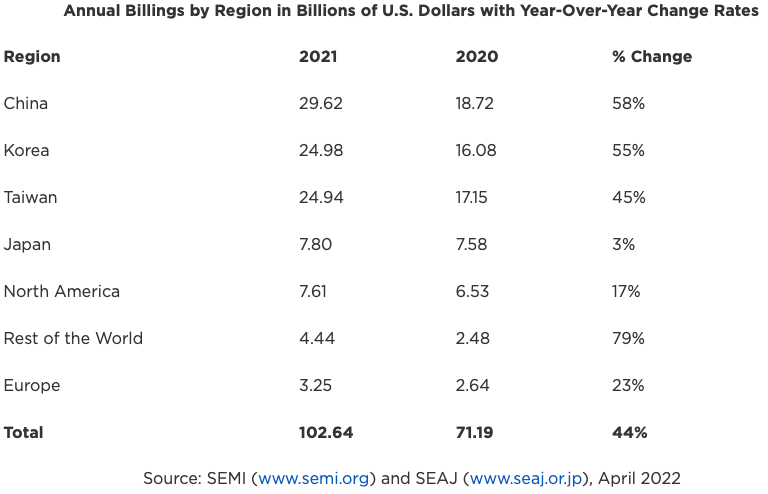

According to data compiled by SEMI, worldwide sales of chip production equipment in 2021 surged 44% to an all-time record of $102.6 billion from $71.2 billion in 2020. Chinese companies again led the market by procuring tools worth $29.62 billion, up from $18.72 in 2020. The country was followed by South Korea ($24.98 billion) and Taiwan ($24.94 billion), where Samsung, SK Hynix, and TSMC are based. Meanwhile, U.S. companies only bought semiconductor production machinery worth $7.61 billion, up from $6.53 billion in 2020.

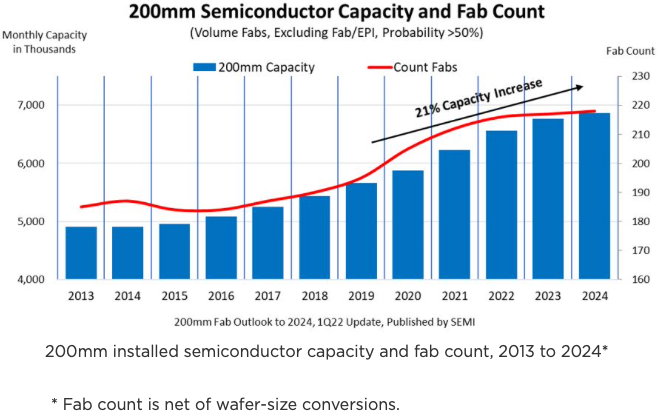

While companies like Intel, TSMC, Samsung, and SK Hynix are enthusiastically investing in leading-edge tools like ASML's Twinscan NXE extreme ultraviolet (EUV) lithography scanners required for leading-edge nodes, demand for chips made using mature fabrication processes is growing. Almost every chip has to be equipped with a power management IC (PMIC) and these units are made using mature technologies usually on 200-mm wafers. In fact, PMICs are just one example, there are hundreds of chip categories that are made on 200-mm wafers and which are in high demand.

Due to strong demand for 200-mm capacity, companies supplying appropriate tools are capitalizing on this demand. Last year spending on 200-mm equipment reached $5.3 billion, this year it is projected to total $4.9 billion, and stay at at least $3 billion in 2023. Chipmakers worldwide are on track to boost 200-mm fab capacity by 1.2 million wafers, or 21%, from the start of 2020 to the end of 2024 to hit a record high of 6.9 million wafers per month, according another recent report from SEMI. The number of 200-mm fabs will also increase, the organization believes.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

"Wafer manufacturers will add 25 new 200mm lines over the five-year period to help meet growing demand for applications such as 5G, automotive and Internet of Things (IoT) devices that rely on devices like analog, power management and display driver integrated circuits (ICs), MOSFETs, microcontroller units (MCUs) and sensors," said Ajit Manocha, SEMI president and CEO.

Anton Shilov is a contributing writer at Tom’s Hardware. Over the past couple of decades, he has covered everything from CPUs and GPUs to supercomputers and from modern process technologies and latest fab tools to high-tech industry trends.