eBay Pricing for All GPUs Continues to Rise Due to Mining (Updated)

Scalpers don't appear to be slowing down

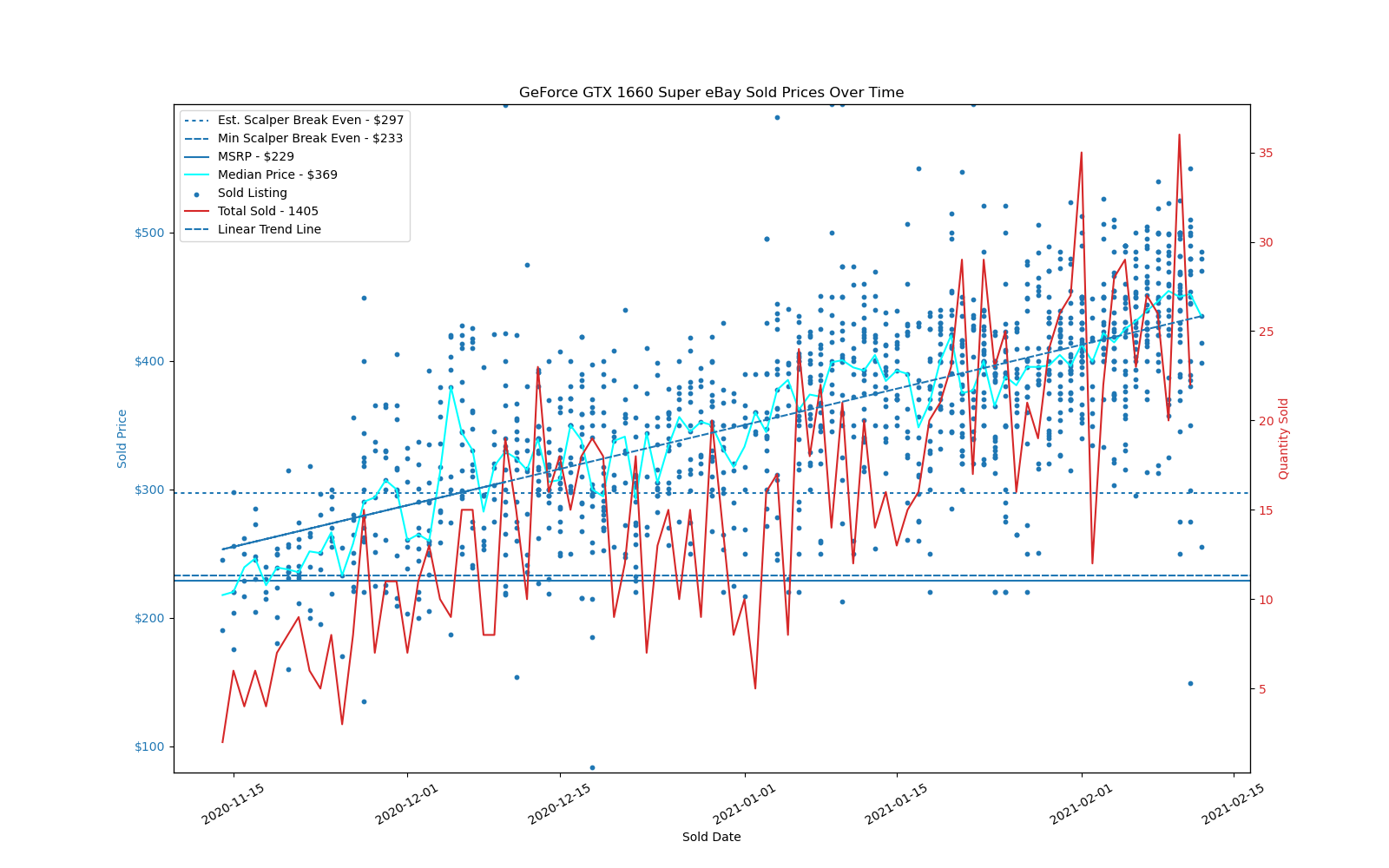

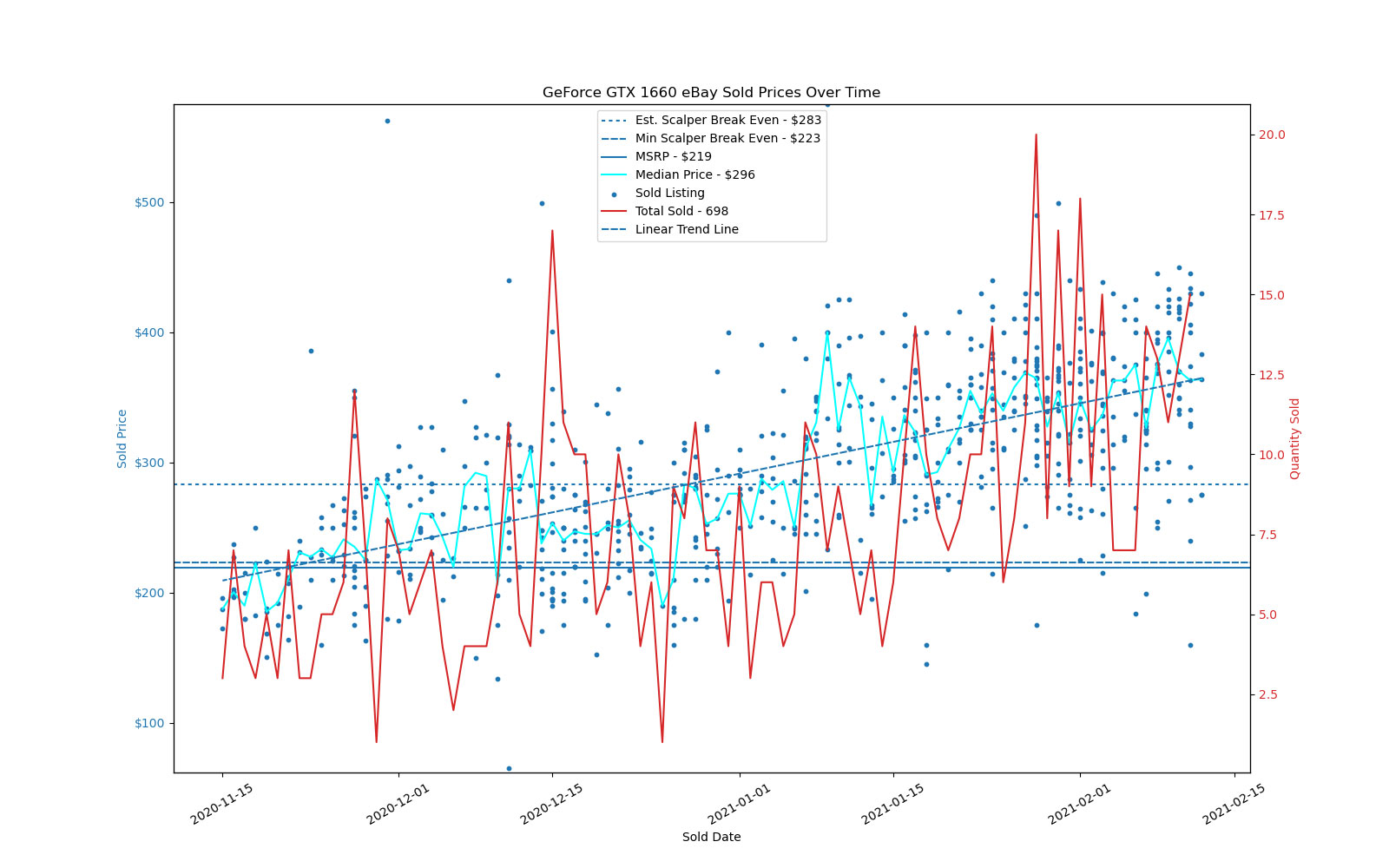

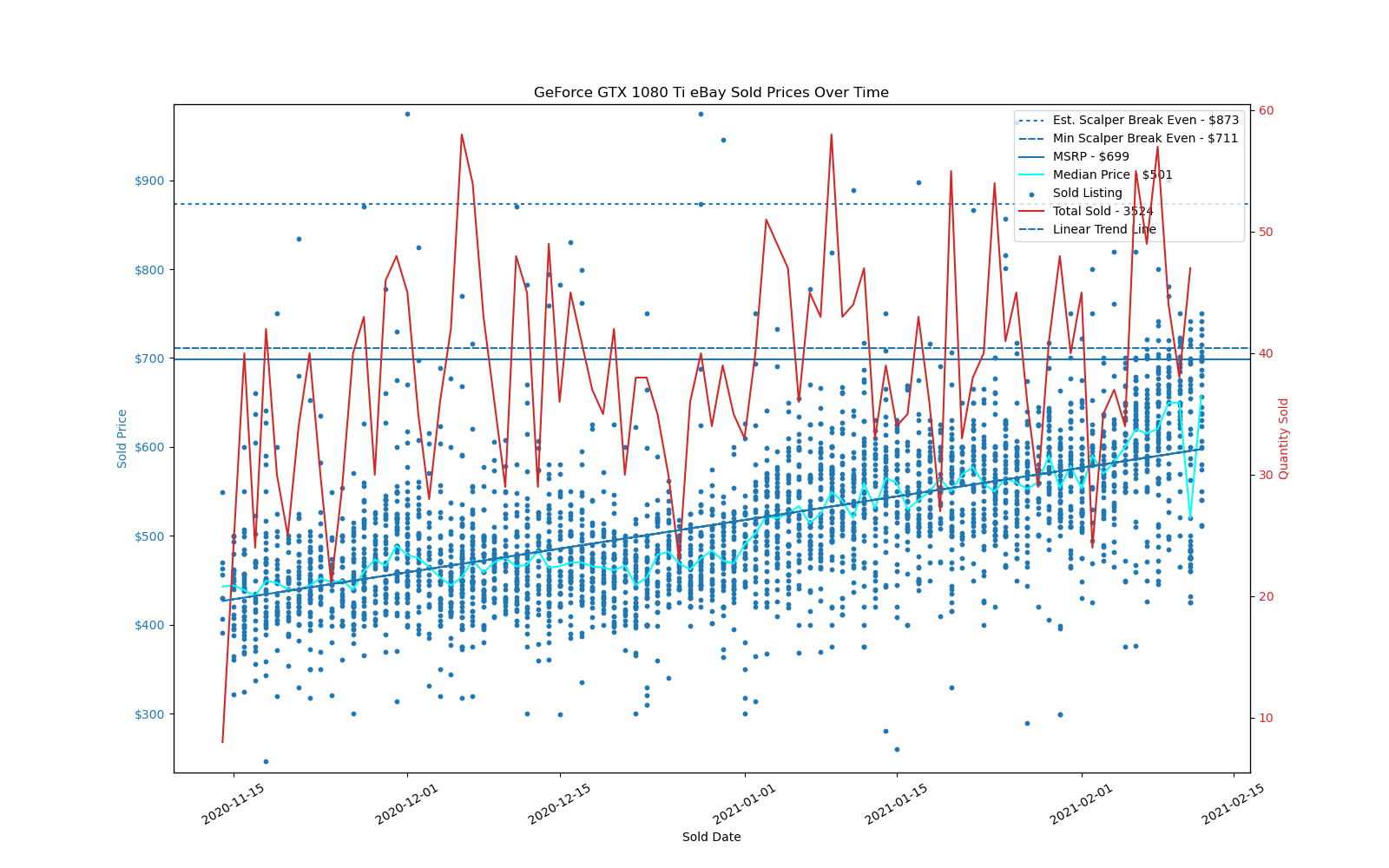

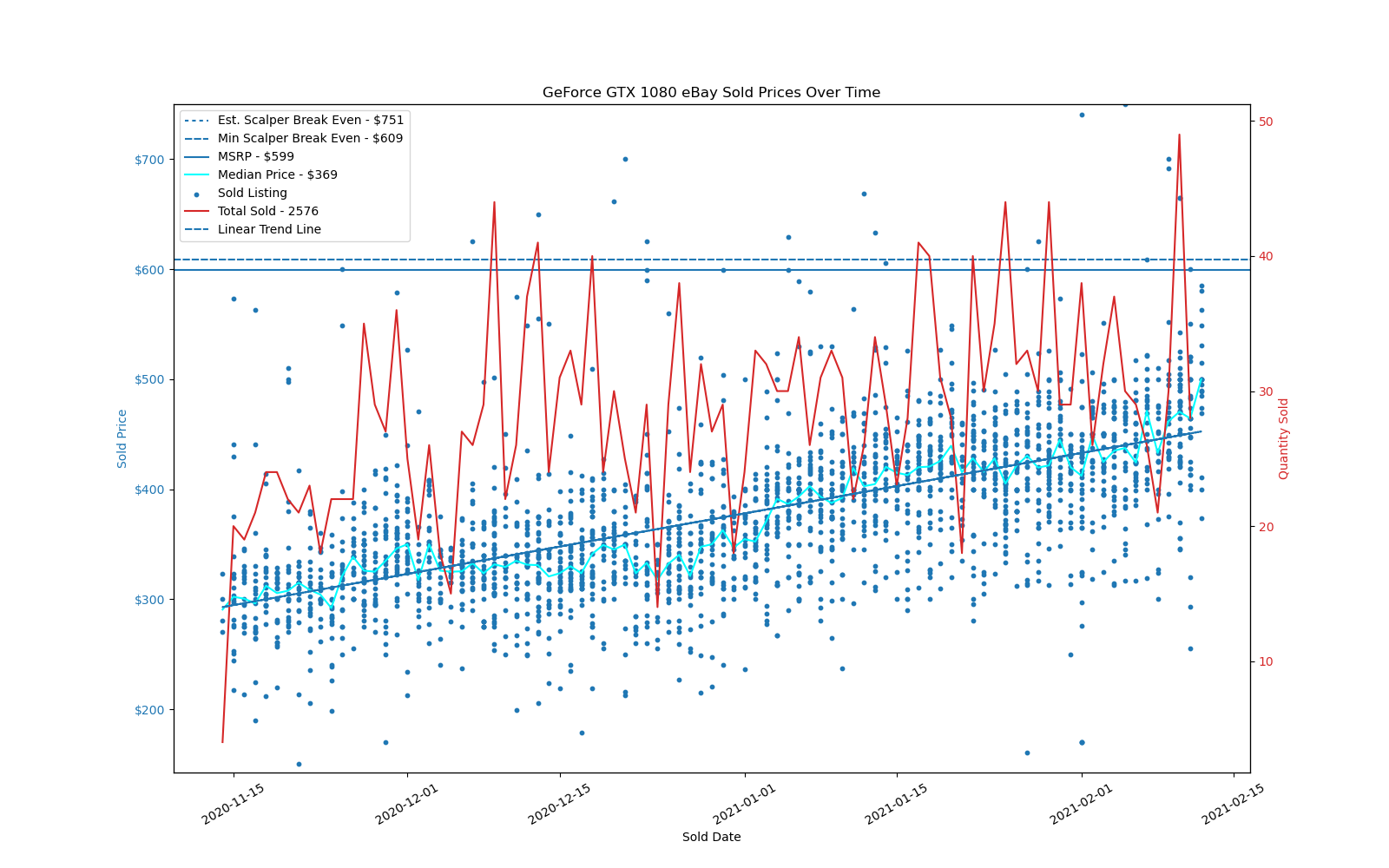

Finding the best graphics card at anything approaching reasonable pricing has become increasingly difficult. Just about everything we've tested in our GPU benchmarks hierarchy is sold out unless you go to eBay, but current eBay prices will take your breath away. If you thought things were bad before, they're apparently getting even worse. No doubt, a lot of this is due to the recent uptick in Ethereum mining's profitability on GPUs, compounded by component shortages, and it's not slowing down.

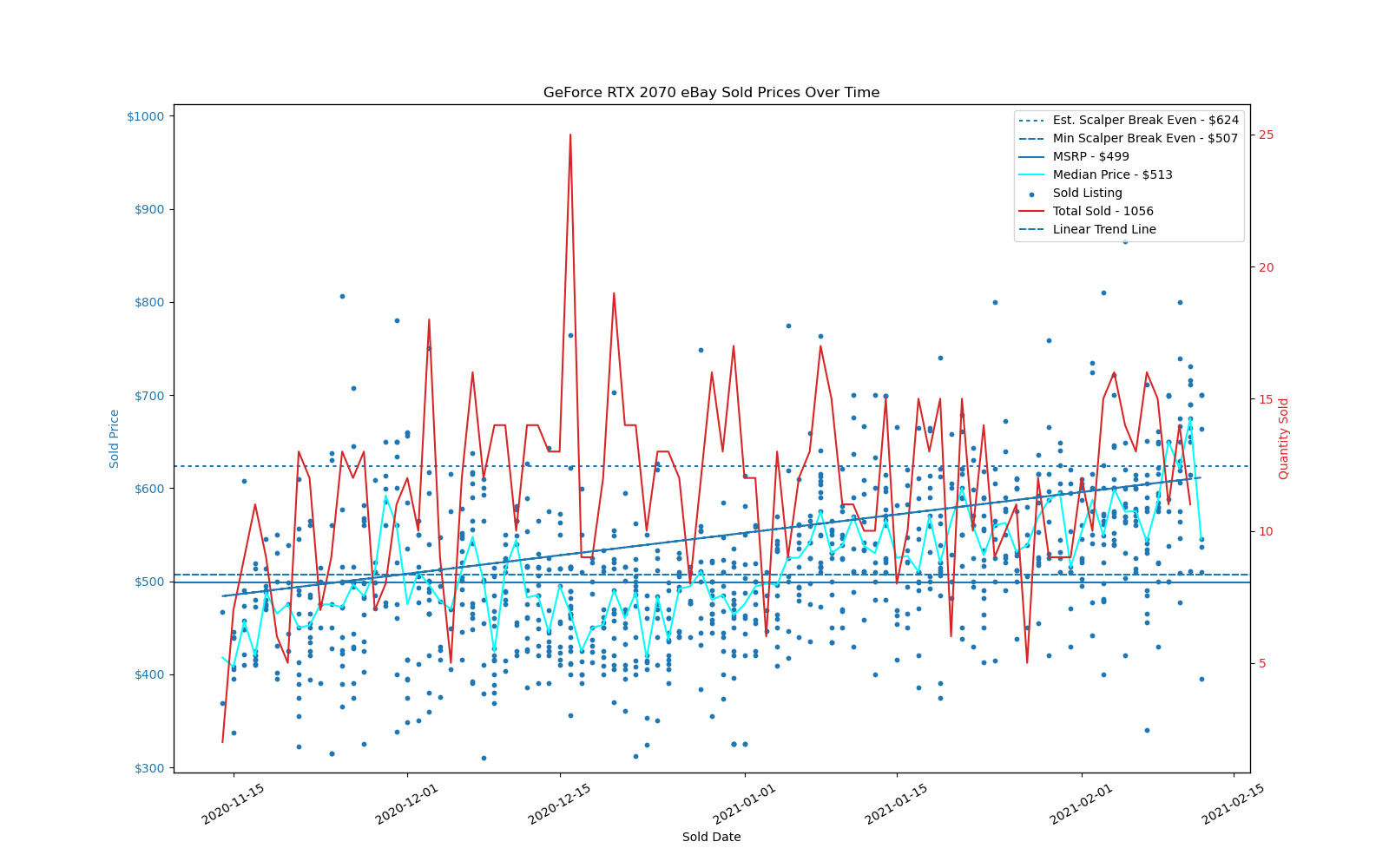

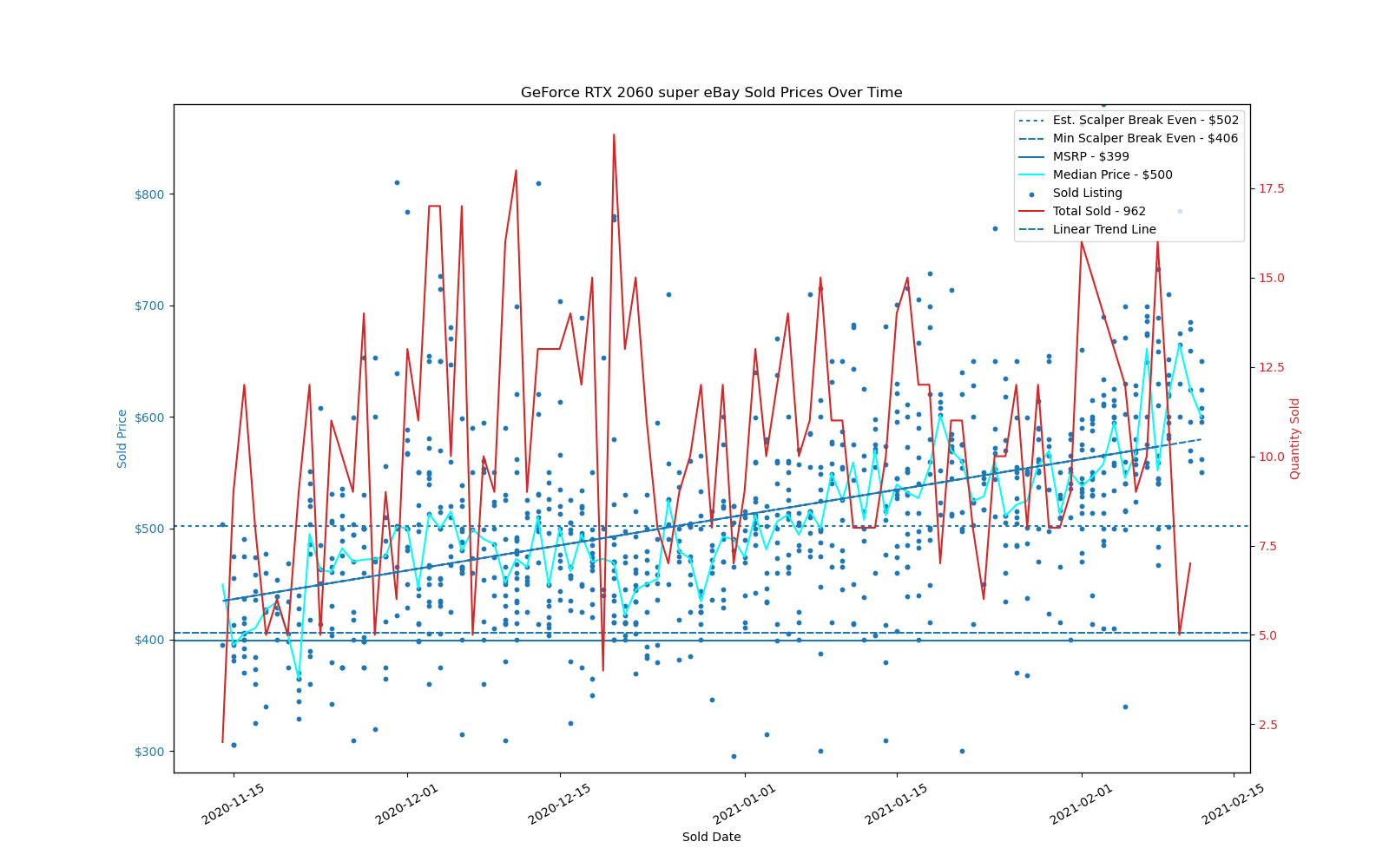

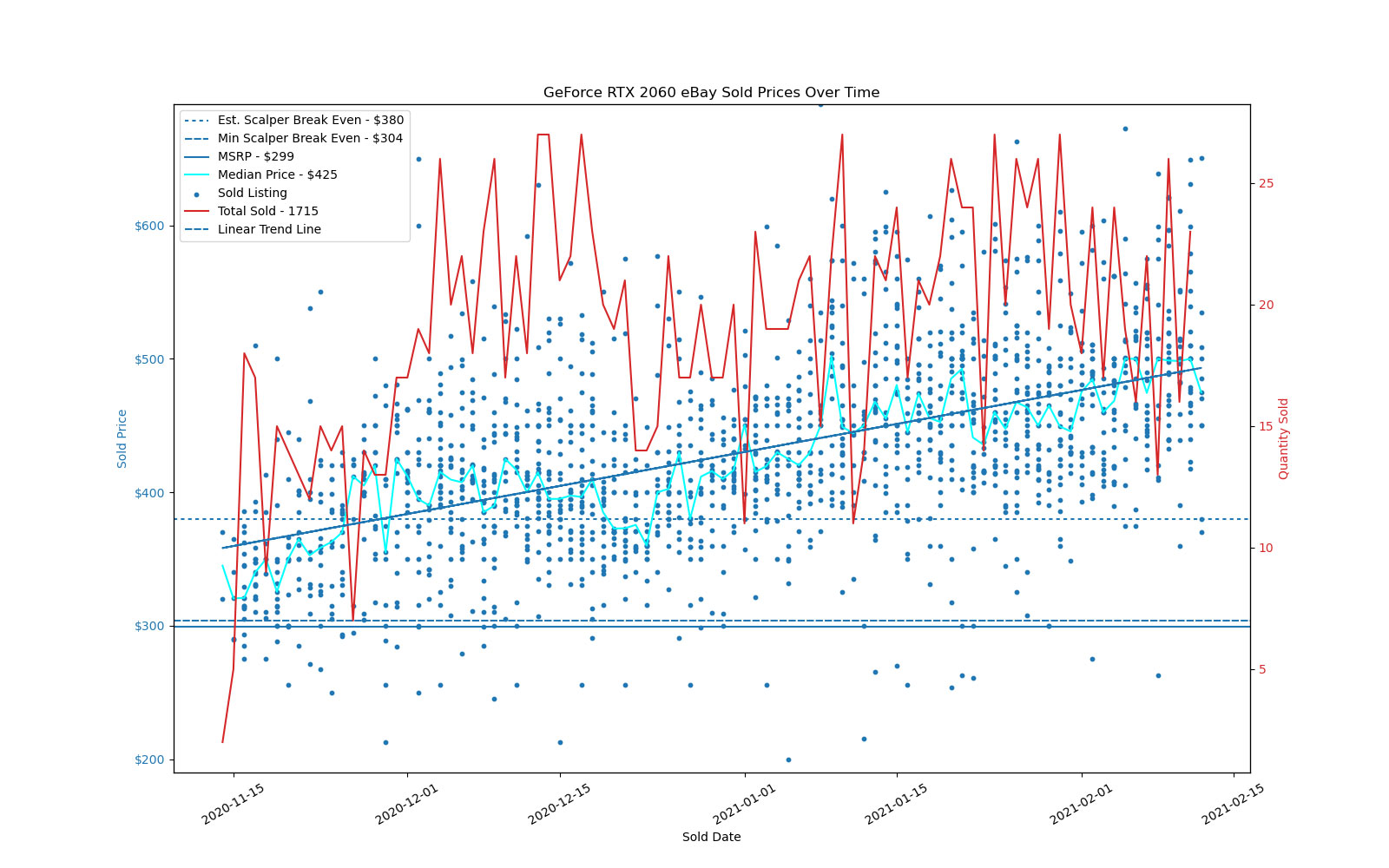

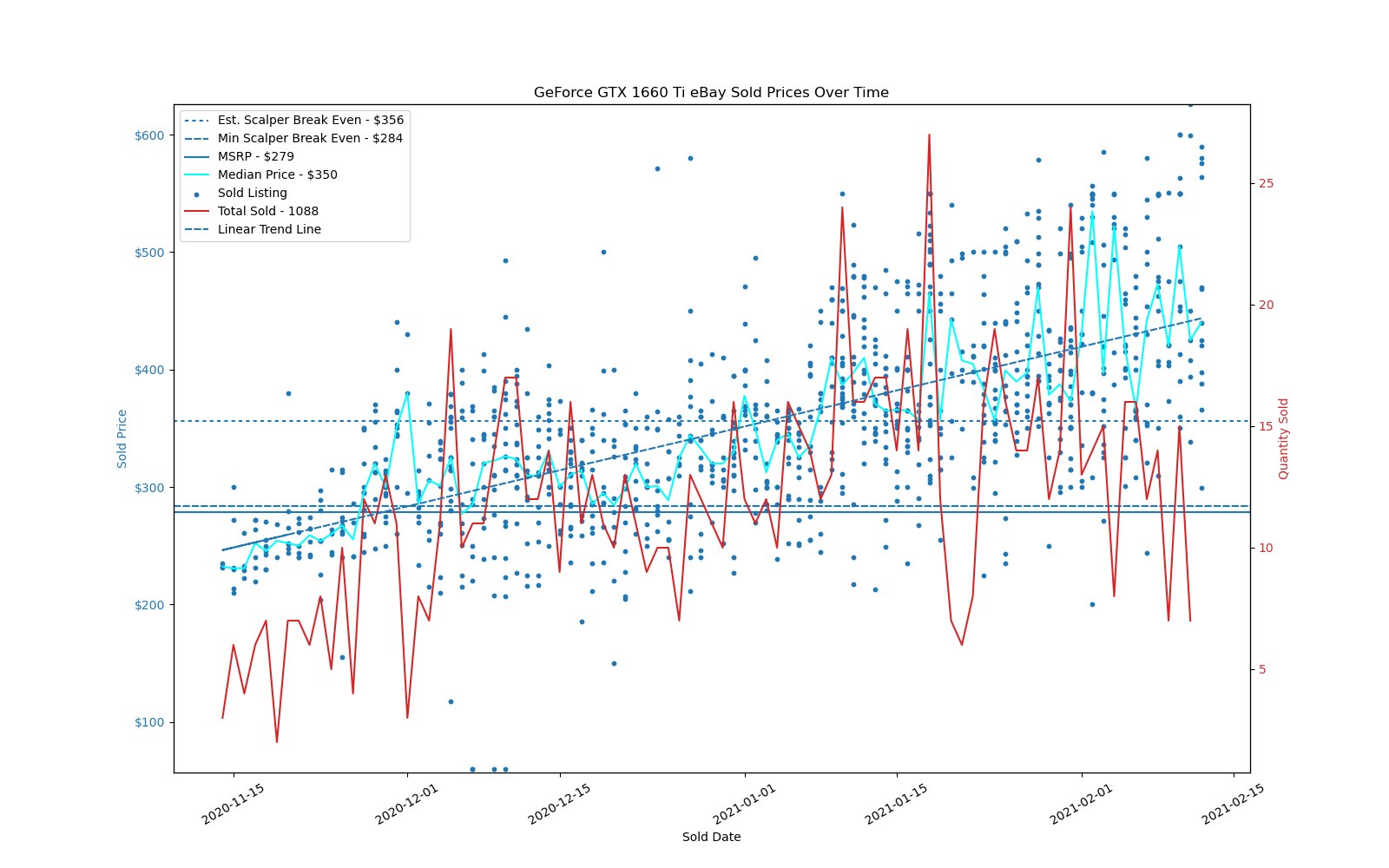

A couple of weeks back, we wrote about Michael Driscoll tracking scalper sales of Zen 3 CPUs. Driscoll also covered other hot ticket items like RTX 30-series GPUs, RDNA2 / Big Navi GPUs, Xbox Series S / X, and PlayStation 5 consoles. Thankfully, he provided the code to his little project, and we've taken the opportunity to run the data (with some additional filtering out of junk 'box/picture only' sales) to see how things are going in the first six weeks of 2021. Here's how things stand for the latest AMD and Nvidia graphics cards:

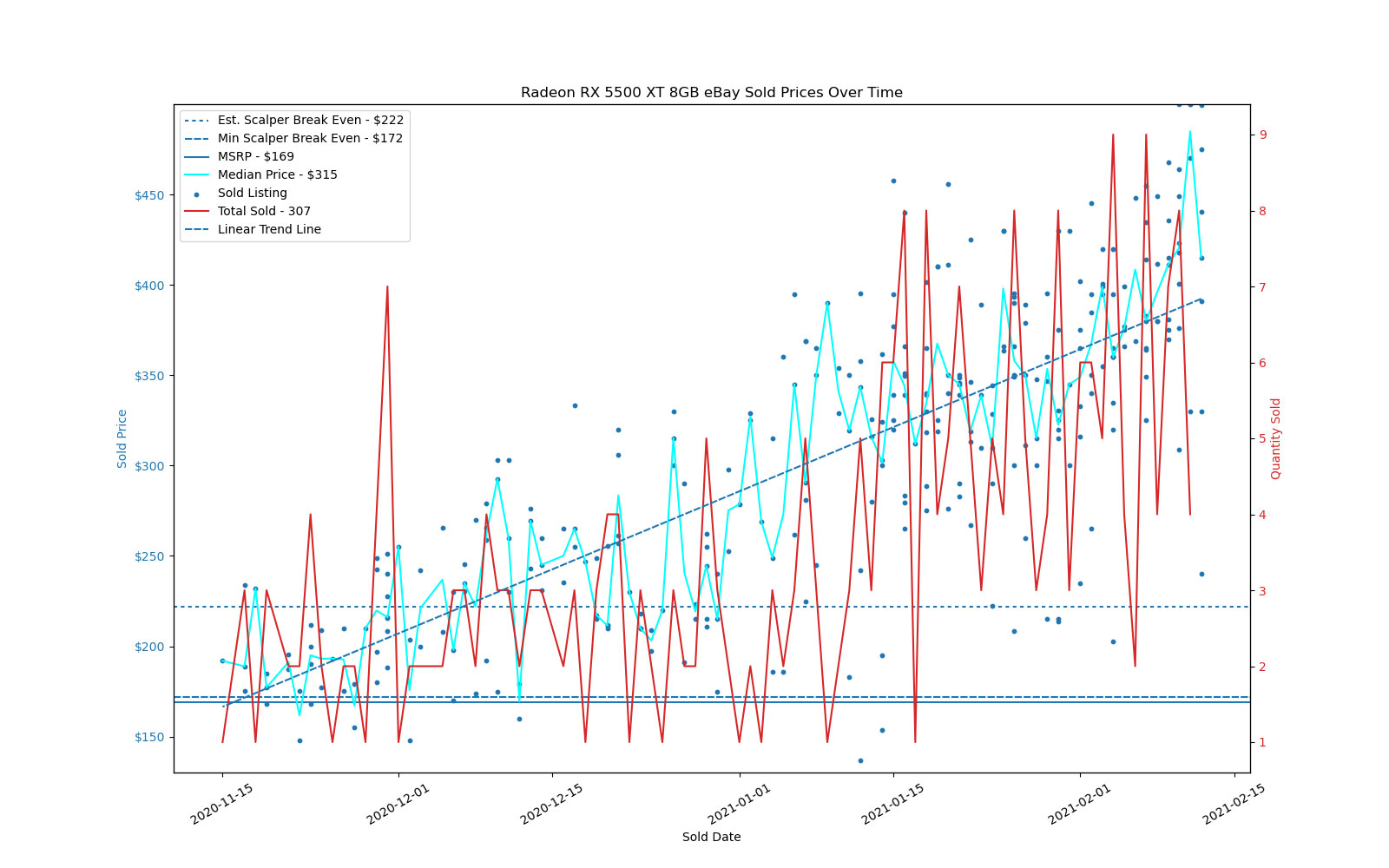

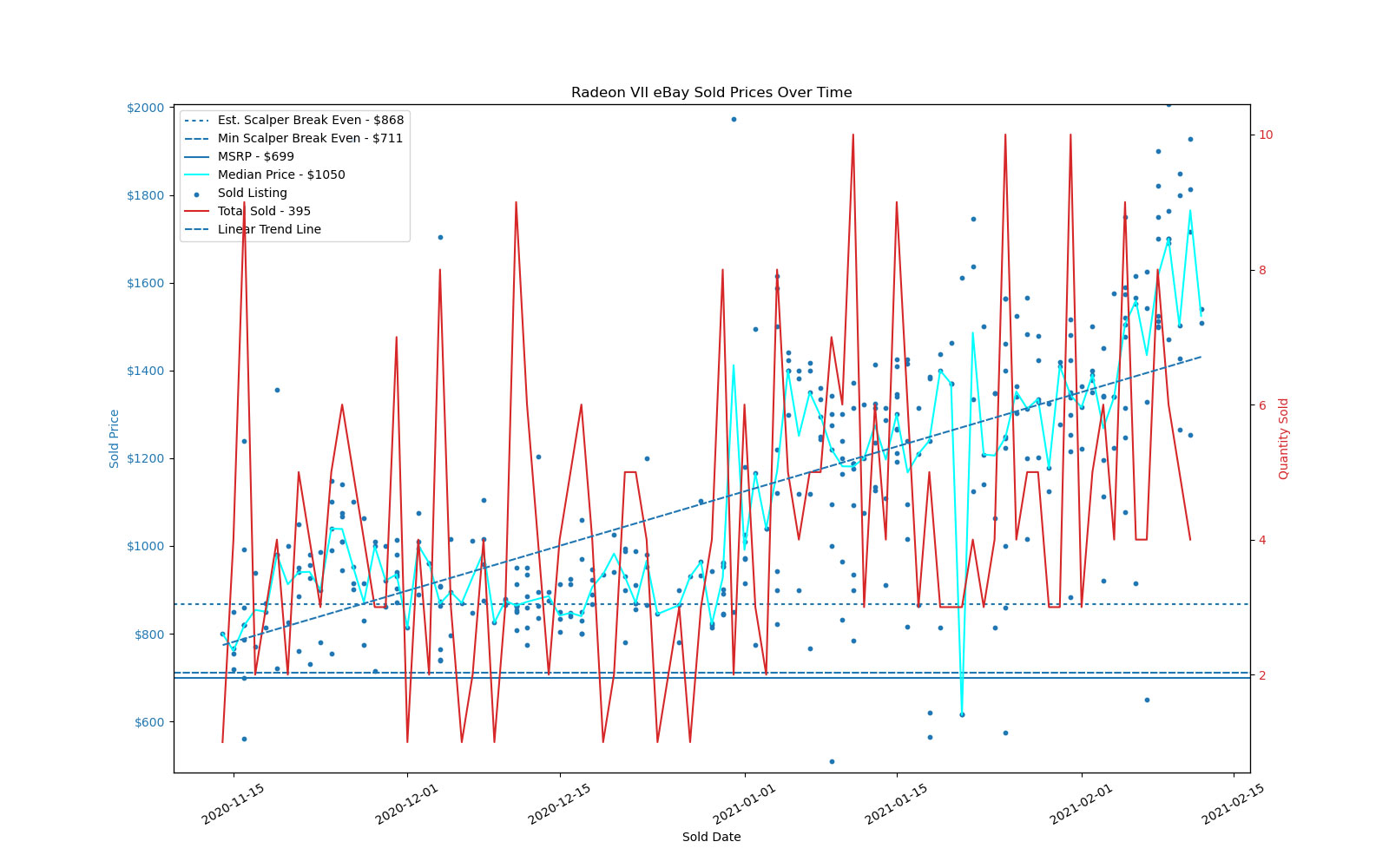

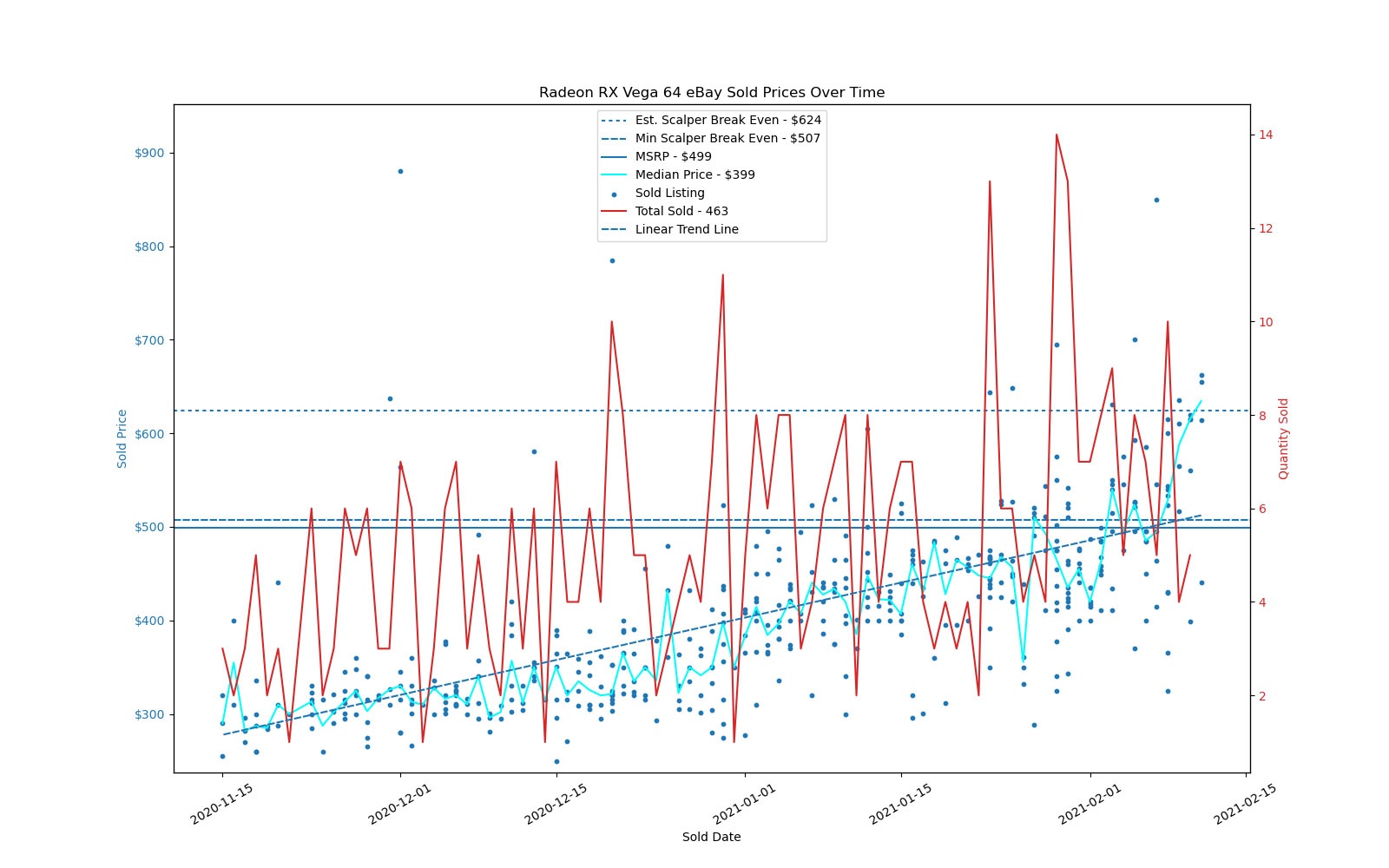

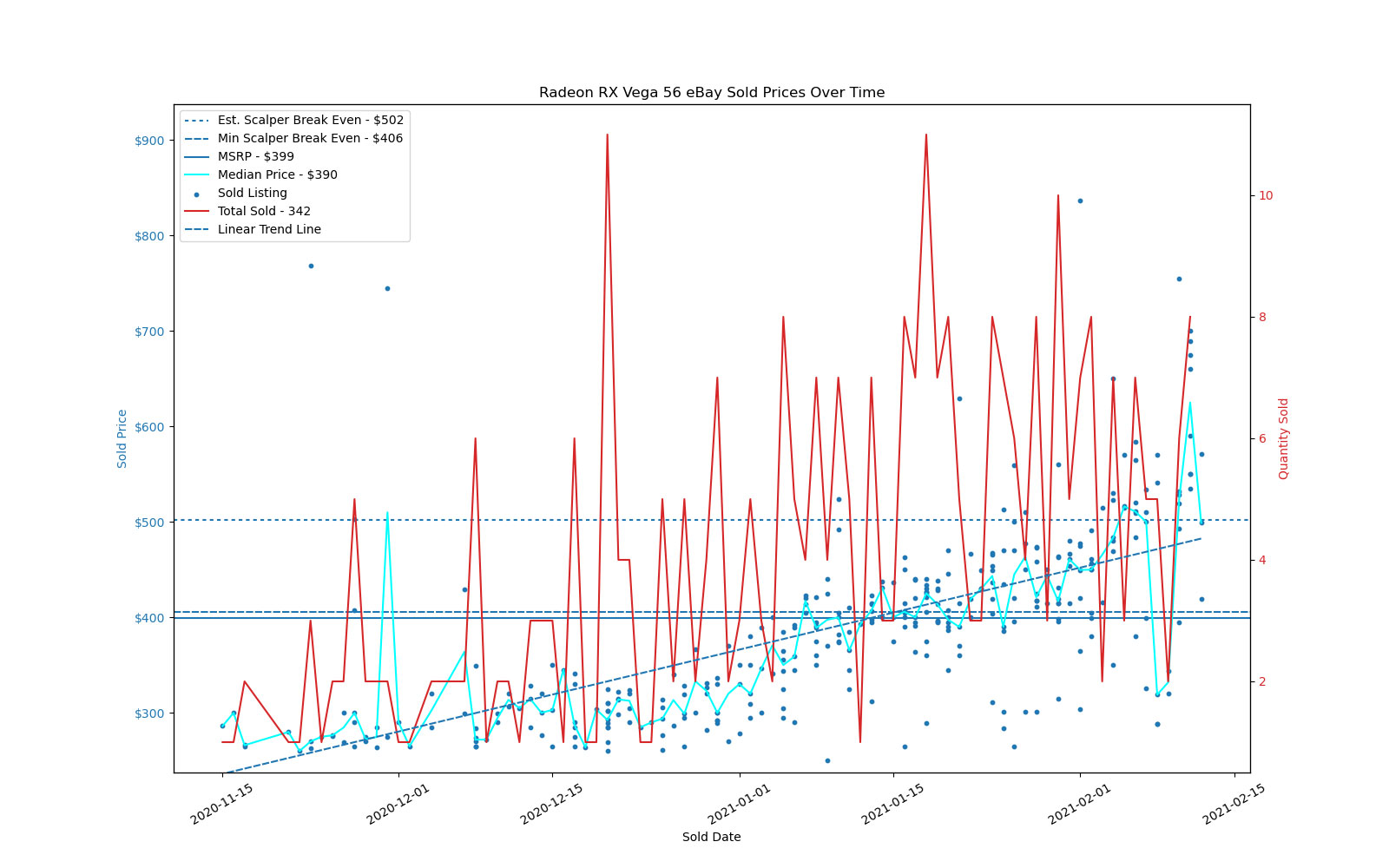

[Update: We've added all 30 of the best mining GPUs most commonly used for Ethereum mining.]

That's ... disheartening. Just in the past month, prices have increased anywhere from 10% to 35% on average. The increase is partly due to the recent graphics card tariffs, and as you'd expect, the jump in prices is more pronounced on the lower-priced GPUs.

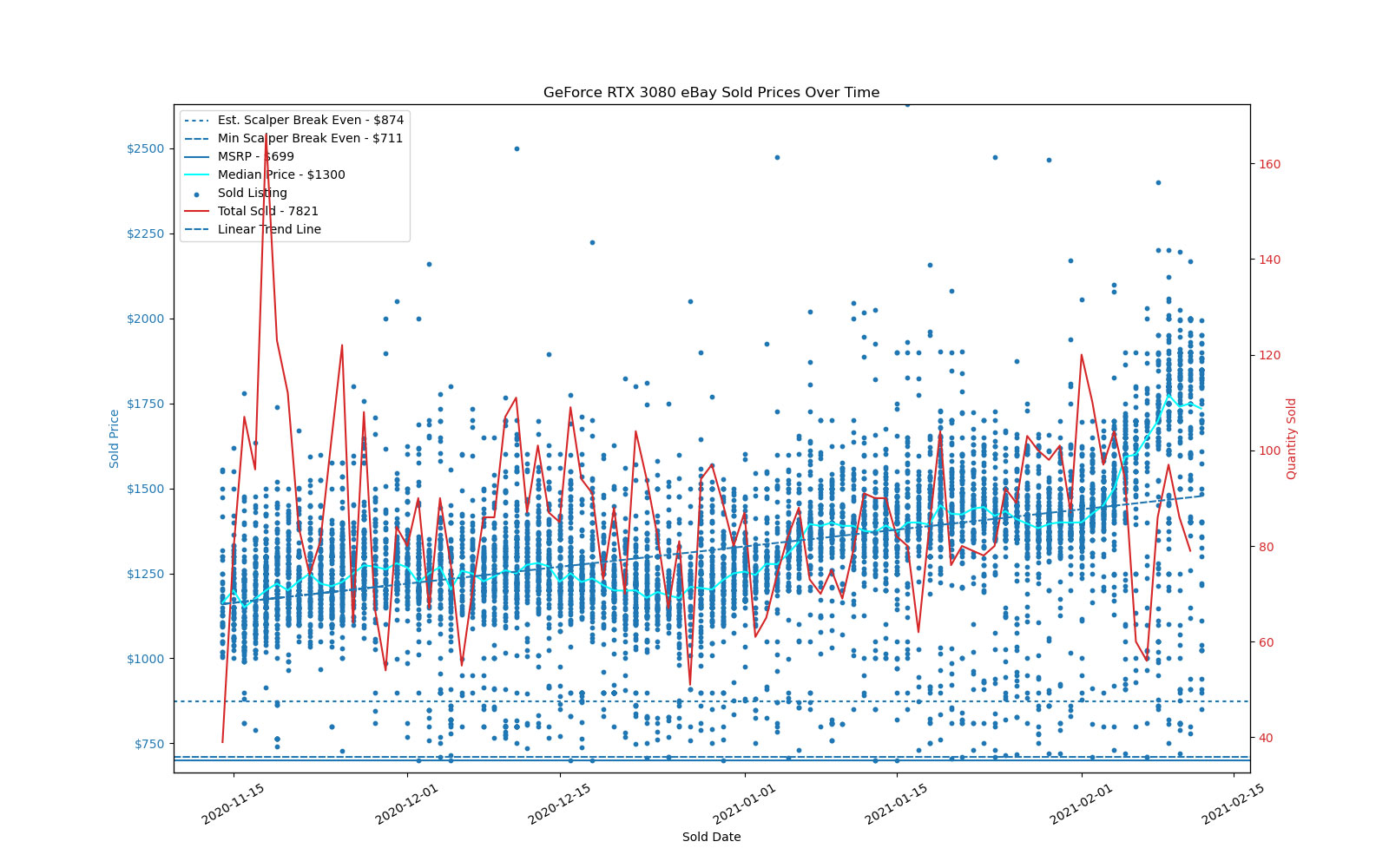

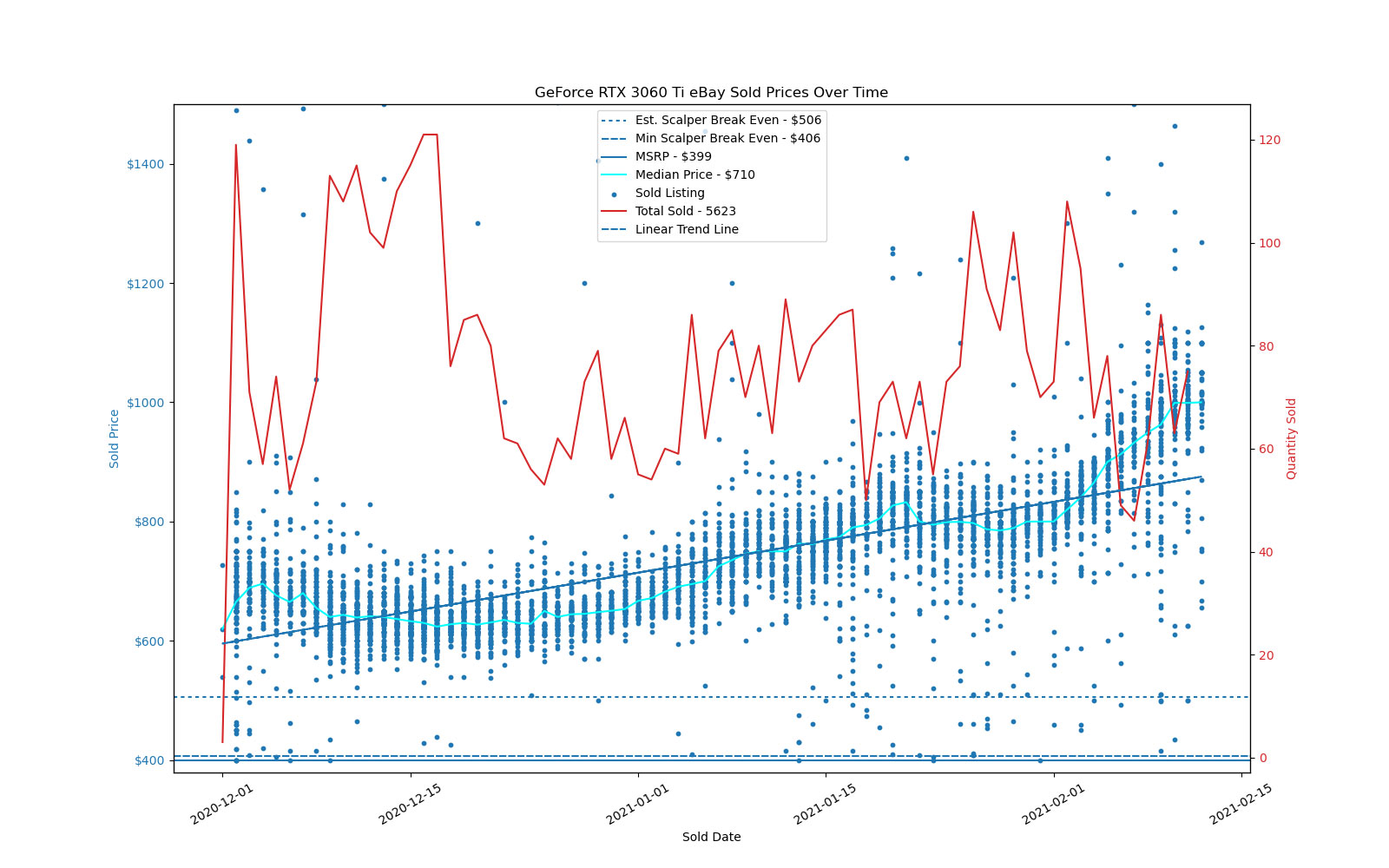

For example, the RTX 3060 Ti went from average prices of $690 in the first week of January to $920 in the past week. It also represents nearly 3,000 individual sales on eBay, after filtering out junk listings — and these are actual sales, not just items listed on eBay. RTX 3080 saw the next-biggest jump in pricing, going from $1,290 to $1,593 for the same time periods, with 3,400 listings sold.

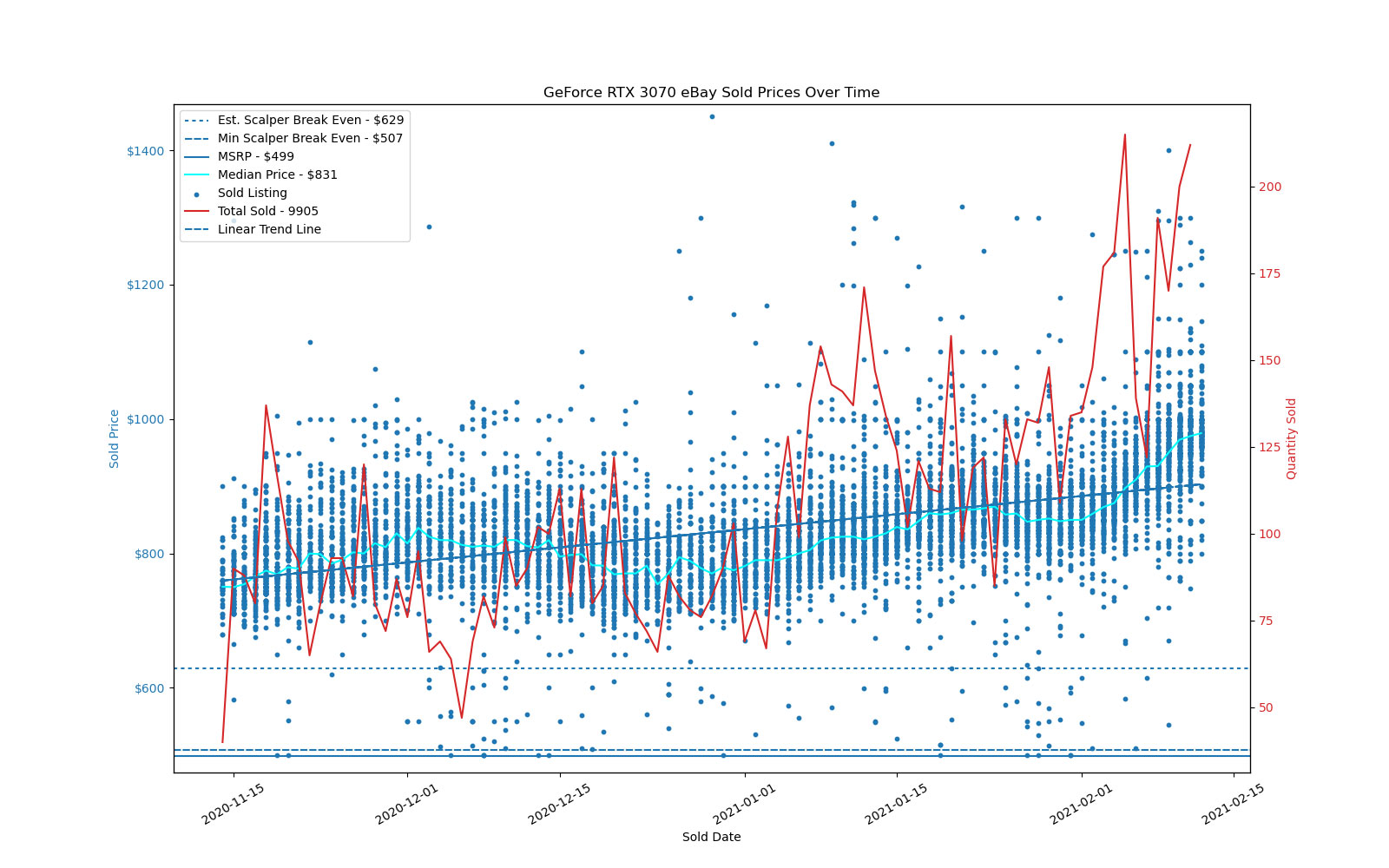

Nvidia's RTX 3070 represents the largest number of any specific GPU sold, with nearly 5,400 units, but prices have only increased 17% — from $804 in January to $940 in February. The February price is interesting because it's only slightly higher than the RTX 3060 Ti price, which suggests strongly that it's Ethereum miners snapping up most of these cards. (The 3060 Ti hits roughly the same 60MH/s as the 3070 after tuning since they both have the same 8GB of GDDR6 memory.)

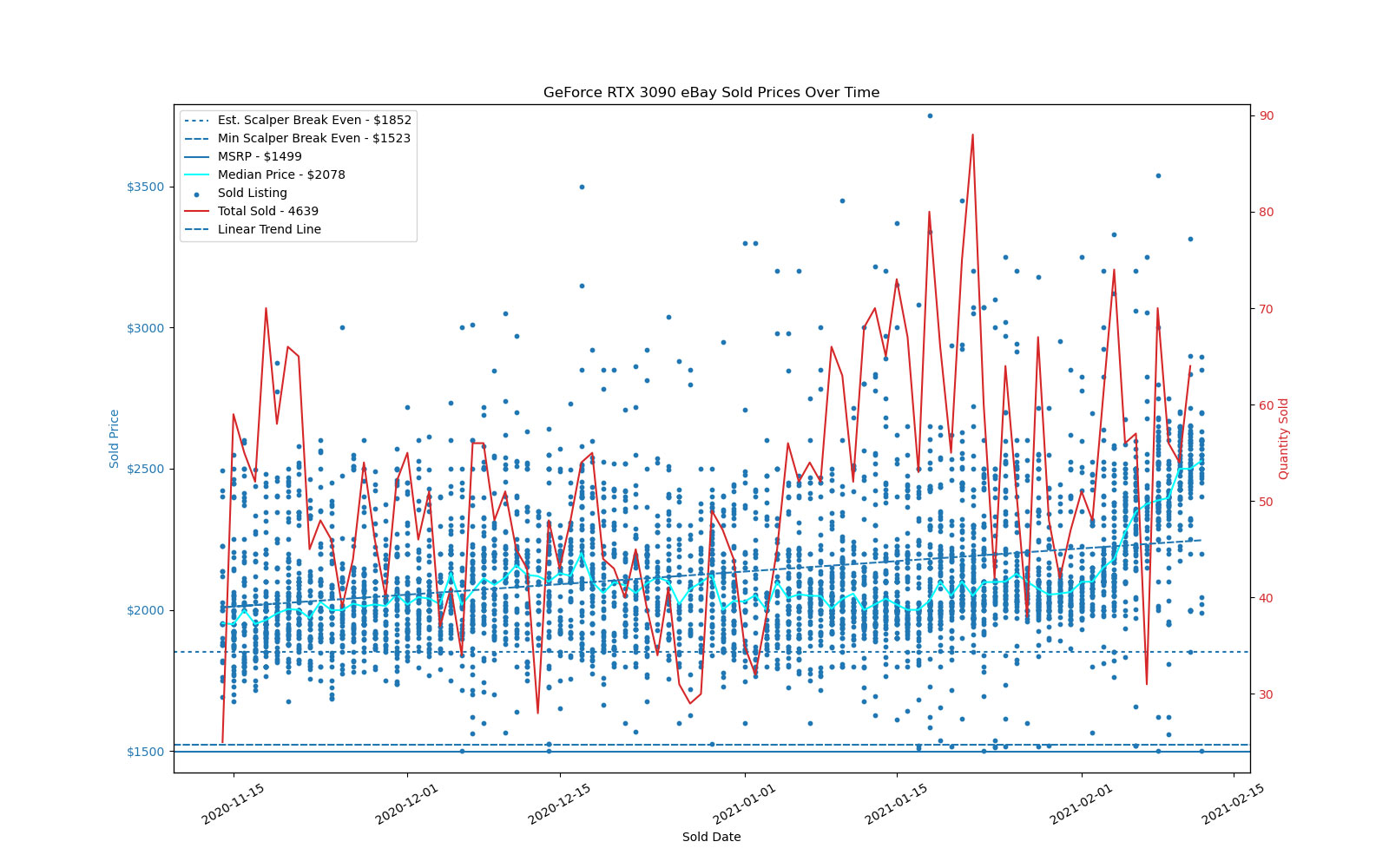

Wrapping up Nvidia, the RTX 3090 accounts for 2,291 units sold on eBay, with pricing increasing 14% since January. For the most expensive GPU that already had an extreme price, it's pretty shocking to see it move up from $2,087 to a new average of $2,379. I suppose it really is the heir to the Titan RTX throne now.

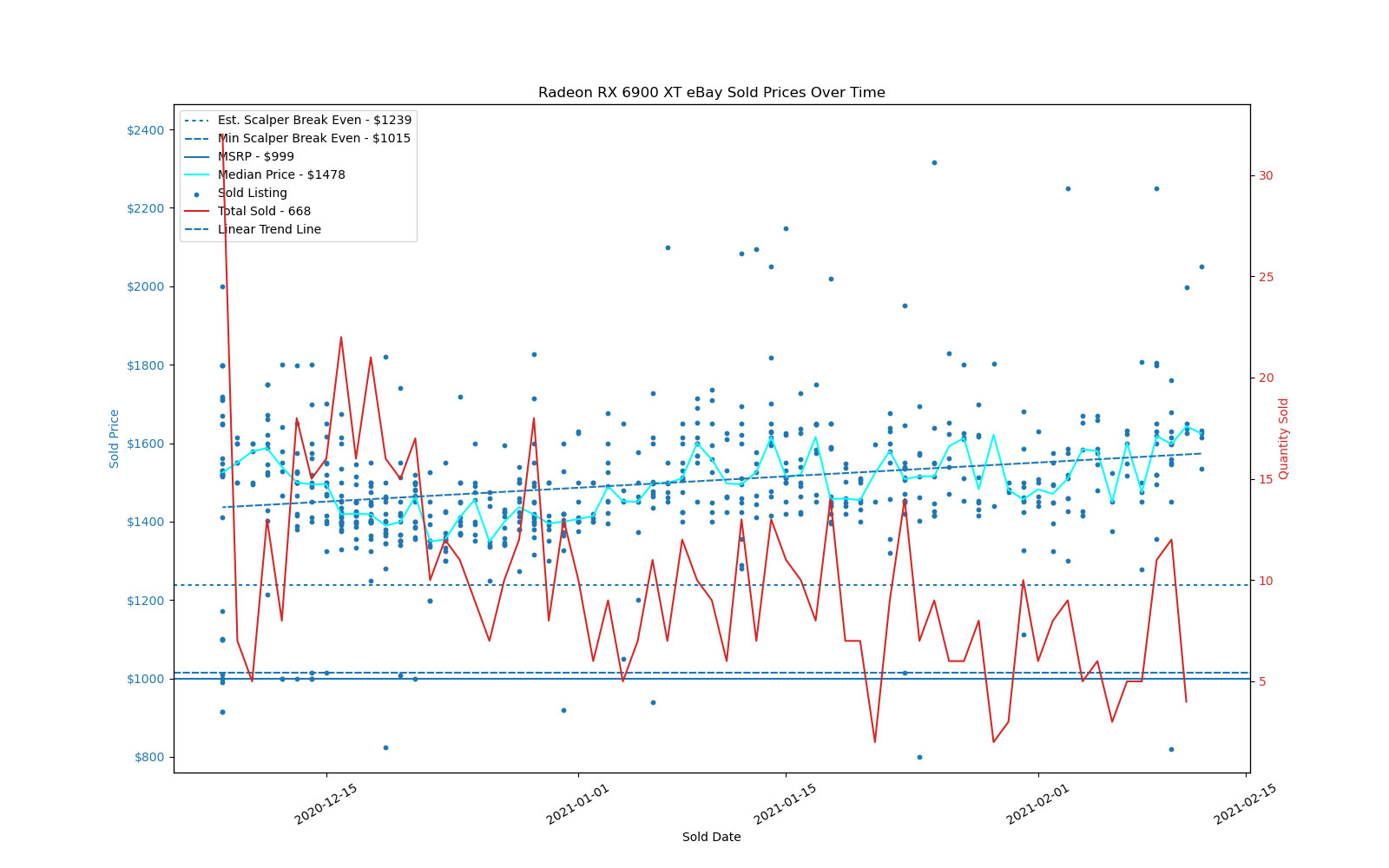

We see a similar pattern on the AMD side, but at far lower volumes in terms of units sold. The RX 6900 XT had 334 listings sold, with average pricing moving up just 8% from $1,458 to $1,570 during the past six weeks. Considering it delivers roughly the same mining performance as the less expensive Big Navi GPUs, that makes sense from the Ethereum mining perspective.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

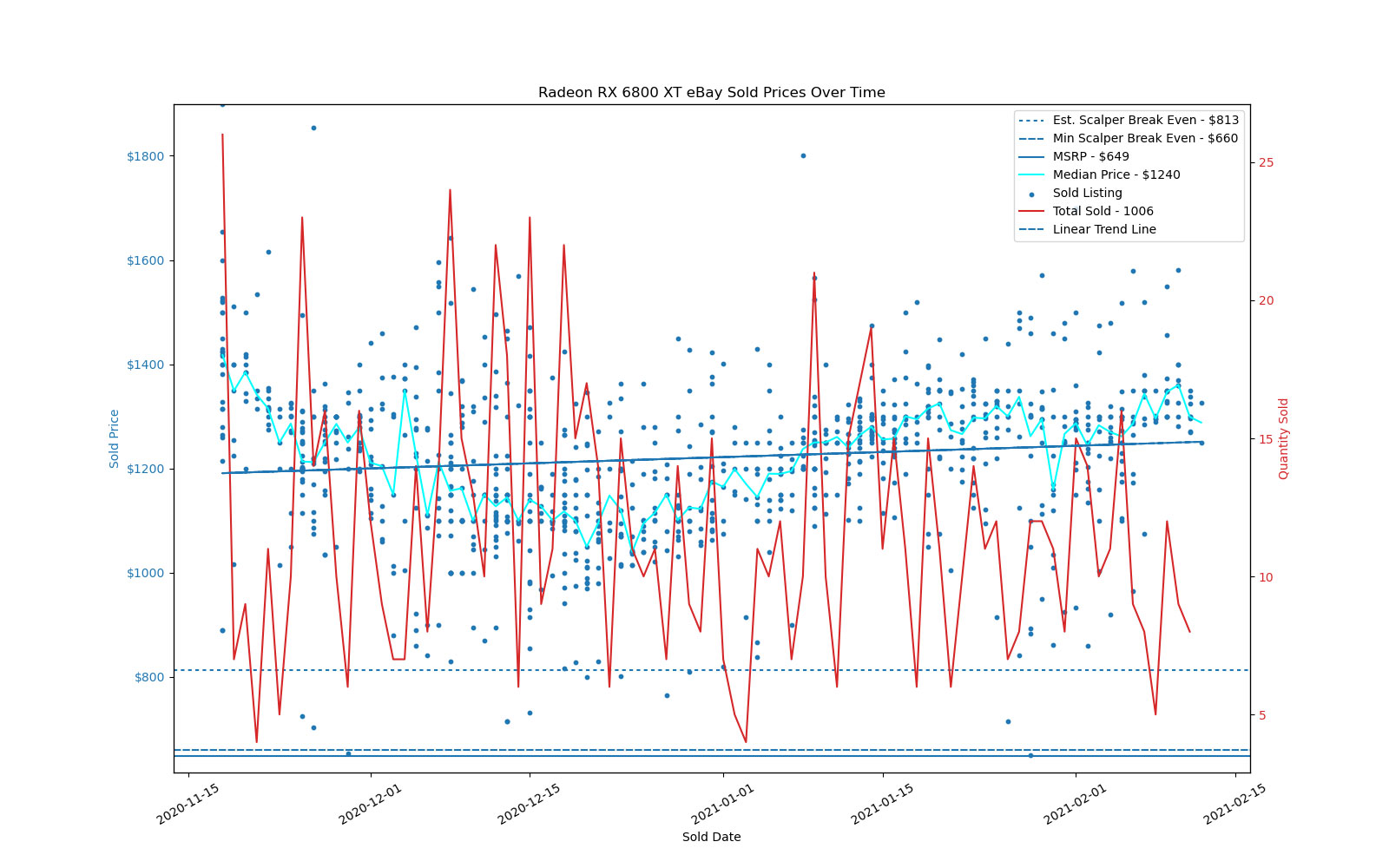

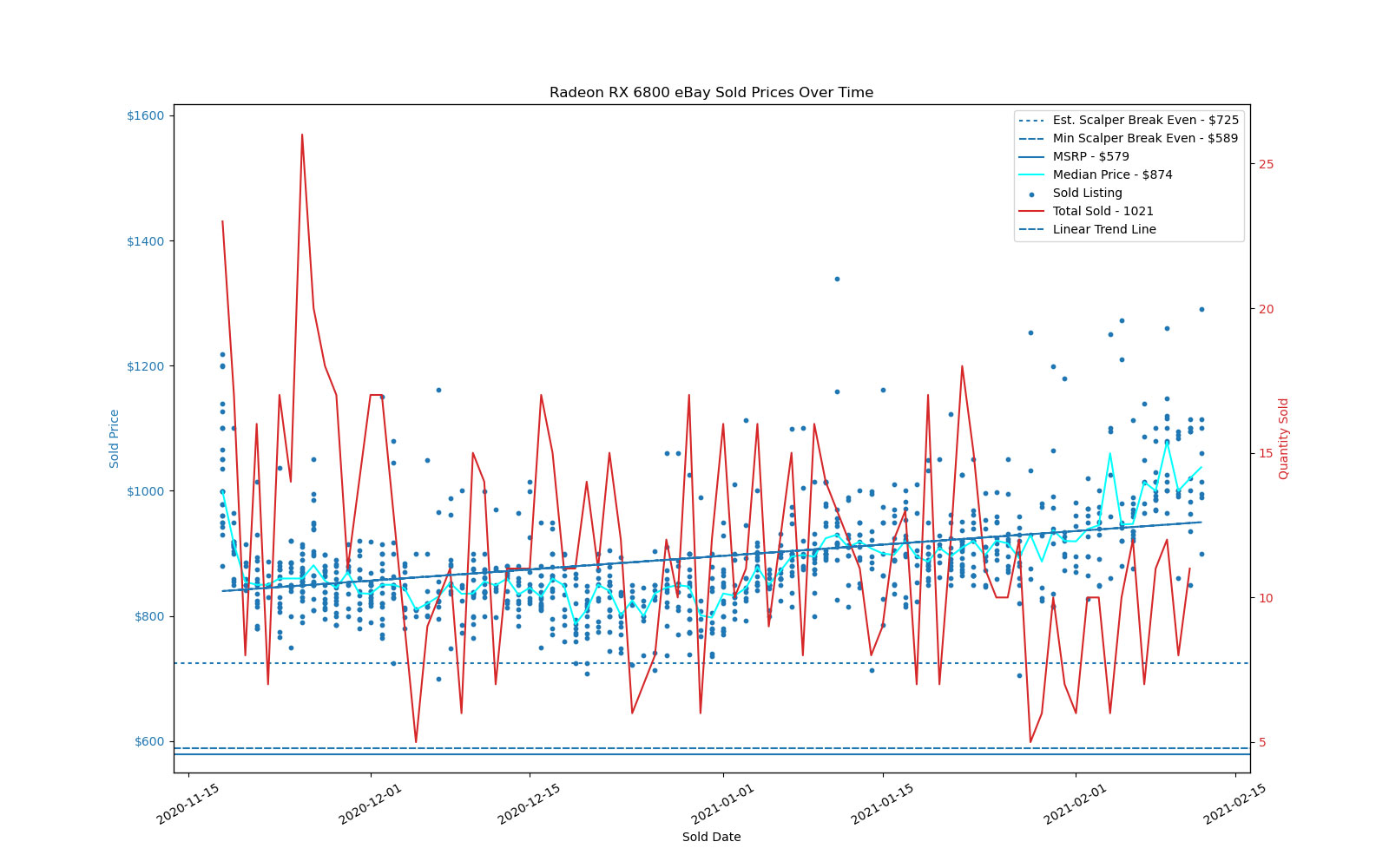

Radeon RX 6800 XT prices increased 11% from $1,179 in January to $1,312 in February. It's also the largest number of GPUs sold (on eBay) for Team Red, at 448 graphics cards. Not far behind is the RX 6800 vanilla, with 434 units. It saw the biggest jump in pricing over the same period, from $865 to $1,018 (18%). That strongly correlates with expected profits from GPU mining.

That's both good and bad news. The good news is that gamers are most likely being sensible and refusing to pay these exorbitant markups. The bad news is that as long as mining remains this profitable, stock and pricing of graphics cards isn't likely to recover. It's 2017 all over again, plus the continuing effects of the pandemic.

Jarred Walton is a senior editor at Tom's Hardware focusing on everything GPU. He has been working as a tech journalist since 2004, writing for AnandTech, Maximum PC, and PC Gamer. From the first S3 Virge '3D decelerators' to today's GPUs, Jarred keeps up with all the latest graphics trends and is the one to ask about game performance.

-

JarredWaltonGPU Reply

It's not so much a surprise as it is a reveal of actual hard data from eBay. Prices today are 10-35% higher for the same parts compared to prices in early January. And it's likely to get worse before it gets better.Loadedaxe said:Why should they, people keep buying from them. -

roadrunner343 Reply

Exactly. It's frustrating, no doubt. But at the end of the day, miners are just another customer base, and the idiots buying from scalpers are the bigger problem. I was planning on upgrading my PC (7 years old) with a RTX 3080/ Ryzen 5900x, but I'd rather wait for a year or more if needed than pay scalpers.Loadedaxe said:Why should they, people keep buying from them.

EDIT: And of course, nVidia/AMD/retailers do have their share of the blame too for not properly setting purchase limits (Or allowing pre/backorders), but I still think the biggest problem are the people that continue to purchase at absurd prices. -

JarredWaltonGPU Reply

I've said it elsewhere, but I STRONGLY suspect the problem isn't so much AMD and Nvidia, as it is the third party AIBs making bulk deals with miners. (Actually, AMD and Nvidia almost certainly allocate some percentage of cards direct to miners as well these days, for the same reasons as I'll outline here.)roadrunner343 said:Exactly. It's frustrating, no doubt. But at the end of the day, miners are just another customer base, and the idiots buying from scalpers are the bigger problem. I was planning on upgrading my PC (7 years old) with a RTX 3080/ Ryzen 5900x, but I'd rather wait for a year or more if needed than pay scalpers.

EDIT: And of course, nVidia/AMD do have their share of the blame too for not properly setting purchase limits (Or allowing pre/backorders), but I still think the biggest problem are the people that continue to purchase at absurd prices.

You can't tell me that if someone approaches Gigabyte, Asus, MSI, Sapphire, or whatever other graphics card company you care to name and says, "We'll pay you 50% more than MSRP for 5000 graphics cards -- and we'll pay you in cash, right now," that there won't be some sort of back room deal struck. If you have enough money, you can make the contacts and deals to get what you want. Miners are willing to pay scalper prices direct to the graphics card manufacturers. And the AIBs normally sell the cards to a distributor who sells to a retail outlet who sells to the customer -- so basically subtract 10-15% profits for each level of sales.

Example:

A) AIB sells 5000 RTX 3080 cards to a miner at $1000 each = $5 million to AIB.

Versus:

B) AIB sells 5000 RTX 3080 cards to a distrubutor at $500 each = $2.5 million to AIB. (Then the distributor sells to retail chain at $625 each, and the retailer sells to customer at $750 each -- or sells via eBay at $1200 each.)

Considering the cost of the cards to the AIB is probably around $400-$425 (GPU, RAM, PCB, cooler, packaging, etc.), the AIB makes perhaps $500,000 in profit on option B (and still needs to pay salaries and such), compared to making $3,000,000 in profit on option A. There's no way you have a company choose option B if it's given option A -- it just needs to maintain the facade of doing option B, for at least some percentage of cards, while selling as many cards as possible via option A. -

roadrunner343 ReplyJarredWaltonGPU said:I've said it elsewhere, but I STRONGLY suspect the problem isn't so much AMD and Nvidia, as it is the third party AIBs making bulk deals with miners. (Actually, AMD and Nvidia almost certainly allocate some percentage of cards direct to miners as well these days, for the same reasons as I'll outline here.)

You can't tell me that if someone approaches Gigabyte (or Asus, MSI, Sapphire, or whatever other graphics card company you care to name) and says, "We'll pay you 50% more than MSRP for 5000 graphics cards -- and we'll pay you in cash, right now," that there won't be some sort of back room deal struck. If you have enough money, you can make the contacts and deals to get what you want. Miners are willing to pay scalper prices direct to the graphics card manufacturers. And the AIBs normally sell the cards to a distributor who sells to a retail outlet who sells to the customer -- so basically subtract 10-15% profits for each level of sales.

Example:

A) AIB sells 5000 RTX 3080 cards to a miner at $1000 each = $5 million to AIB.

Versus:

B) AIB sells 5000 RTX 3080 cards to a distrubutor at $500 each = $2.5 million to AIB. (Then the distributor sells to retail chain at $625 each, and the retailer sells to customer at $750 each -- or sells via eBay at $1200 each.)

Considering the cost of the cards to the AIB is probably around $400-$425 (GPU, RAM, PCB, cooler, packaging, etc.), the AIB makes perhaps $500,000 in profit on option B (and still needs to pay salaries and such), compared to making $3,000,000 in profit on option A. There's no way you have a company choose option B if it's given option A -- it just needs to maintain the facade of doing option B, for at least some percentage of cards, while selling as many cards as possible via option A.

Yeah, great points. It looks like I actually edited my post while you were making yours =) Once I thought about it a bit more, I definitely realized the most likely culprit was retailers/distributors. I'm sure nVidia/AMD aren't faultless (Apart from not anticipating/meeting demand), but they're also certainly not the main issue, as you've pointed out. -

vanadiel007 The solution is simple, but Nvidia nor AMD will not do it because in the end everyone is making a lot of money from this situation. All Nvidia has to do is ban those board partners that sell in bulk from receiving any chips until they stop that practice. They need to be forced to choose option B.Reply

It's a perfect situation for AMD and Nvidia, as they can blame miners, scalpers and board partners, while raking in the cash and extending the lifecycle of their current offerings by at least a year. All a consumer can do is complain, but that's it. In the end if you need a GPU you are either going to pay the price, or wait for a long time. I see this lasting until 2022 minimum.

I did something I said for the past 25 years I would never do: I bought an Alienware with an RTX 3080. Not because I wanted it, but because I wanted an RTX 3080 and there's no realistic way to get one at a half decent price. It was the only way to get one for a decent price. -

hotaru.hino Reply

Unfortunately anticipating demand is as good as asking a palm reader to tell you if you're going to win the lottery today. All they have to go off of is recent and historical data, along with what's happening when they decided to plan out the next X amount of time.roadrunner343 said:I'm sure nVidia/AMD aren't faultless (Apart from not anticipating/meeting demand), but they're also certainly not the main issue, as you've pointed out.

Case in point, auto manufacturers having production issues due to chip shortages. Around the time they were planning how many cars to produce last year, the pandemic was just starting and they figured demand would be lower. So they didn't order as much chips for the next year. But somehow they managed to sell a lot more than they normally do and since all of the chip manufacturing was signed off for, they were left with a limited supply.

With graphics cards, nobody anticipated that crypto was going to take off as much as it did. And even if it's doing great now, there's no telling how long that'll last. In the next two years BTC could balloon up to $100K, or it could pop and drop back down to $5K or something. -

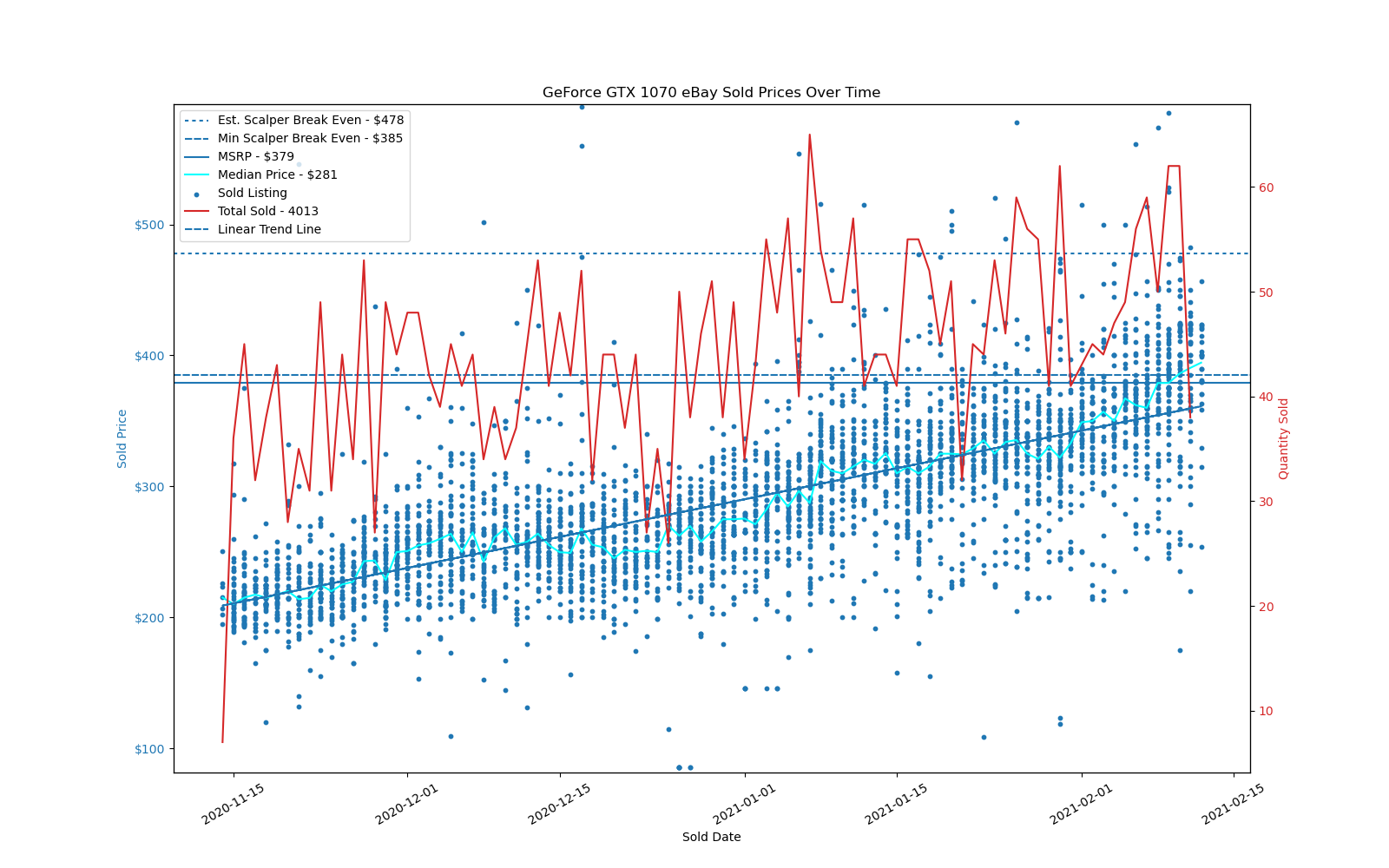

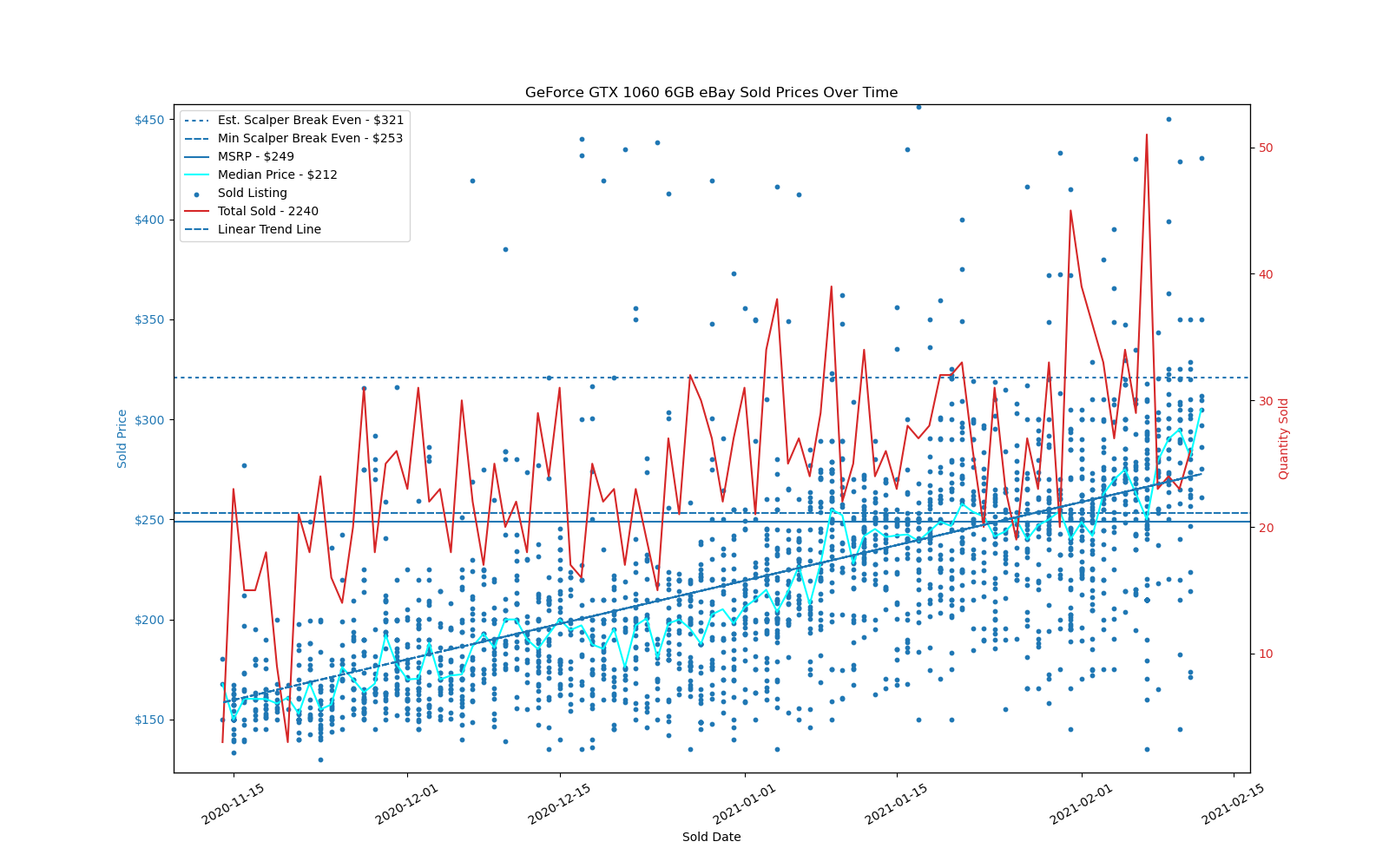

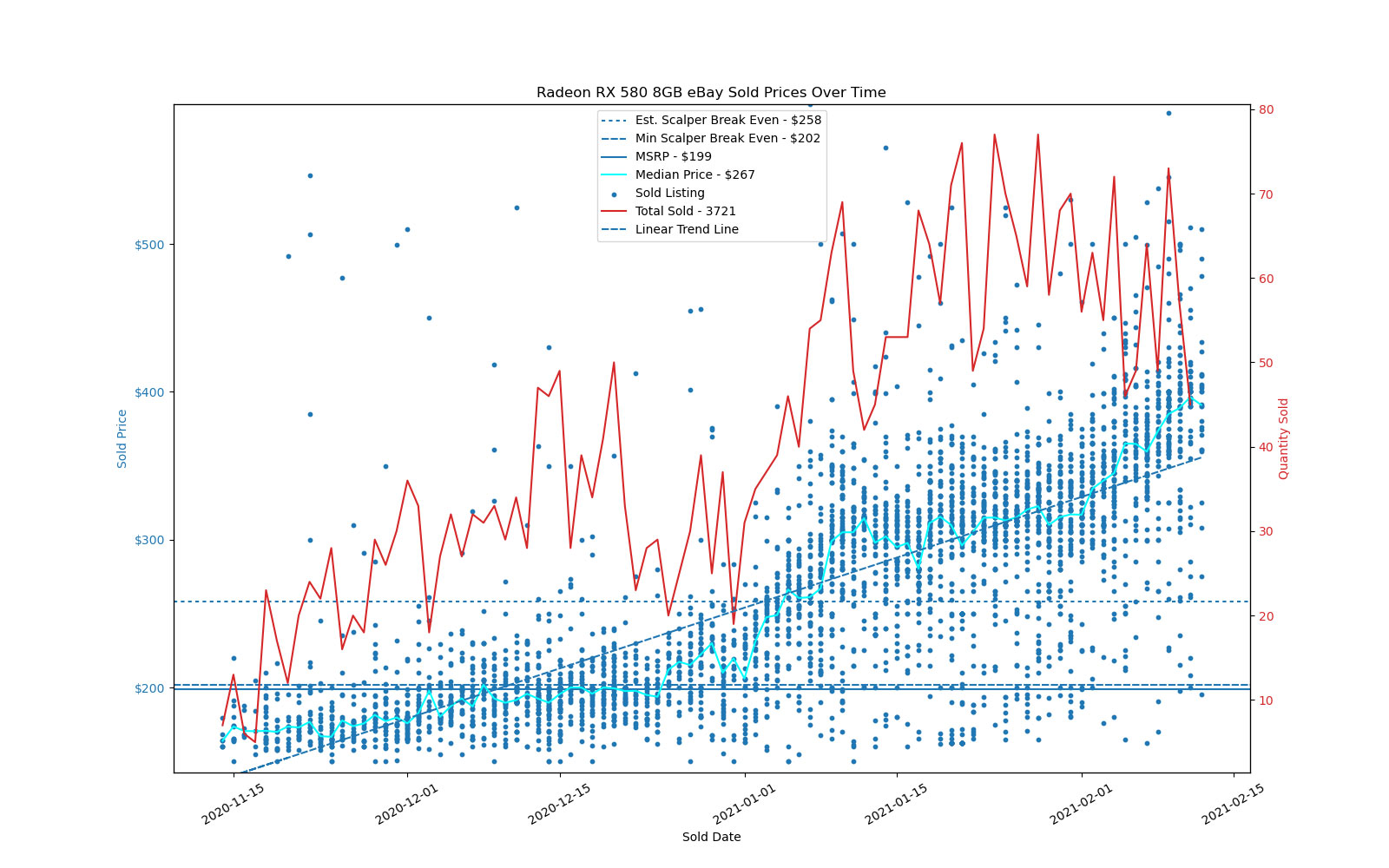

metalfan49 You might also be interested in checking out older GPUs. With all this craziness going on, older parts like GTX 1070 and RX480 are going for nearly $400.Reply -

JarredWaltonGPU Reply

I hear you, but what you're really saying is: "All AMD and Nvidia have to do is make less money and force their AIB partners to do the same! And leave the profits to scalpers and eBay." Which is NOT going to happen.vanadiel007 said:The solution is simple, but Nvidia nor AMD will not do it because in the end everyone is making a lot of money from this situation. All Nvidia has to do is ban those board partners that sell in bulk from receiving any chips until they stop that practice. They need to be forced to choose option B.

It's a perfect situation for AMD and Nvidia, as they can blame miners, scalpers and board partners, while raking in the cash and extending the lifecycle of their current offerings by at least a year. All a consumer can do is complain, but that's it. In the end if you need a GPU you are either going to pay the price, or wait for a long time. I see this lasting until 2022 minimum.

I did something I said for the past 25 years I would never do: I bought an Alienware with an RTX 3080. Not because I wanted it, but because I wanted an RTX 3080 and there's no realistic way to get one at a half decent price. It was the only way to get one for a decent price.

I see this lasting until three months after the price of Bitcoin and Ethereum plummets by 50% or more. When will that happen? Some time between tomorrow and 2025. -

roadrunner343 Replyhotaru.hino said:Unfortunately anticipating demand is as good as asking a palm reader to tell you if you're going to win the lottery today. All they have to go off of is recent and historical data, along with what's happening when they decided to plan out the next X amount of time.

Case in point, auto manufacturers having production issues due to chip shortages. Around the time they were planning how many cars to produce last year, the pandemic was just starting and they figured demand would be lower. So they didn't order as much chips for the next year. But somehow they managed to sell a lot more than they normally do and since all of the chip manufacturing was signed off for, they were left with a limited supply.

With graphics cards, nobody anticipated that crypto was going to take off as much as it did. And even if it's doing great now, there's no telling how long that'll last. In the next two years BTC could balloon up to $100K, or it could pop and drop back down to $5K or something.

I get your point, and I mainly agree, but I somewhat disagree. Obviously, there are a lot of unknowns when predicting demand, but there's also full teams dedicated to analyzing and predicting the market, just like any other industry. The crypto surge definitely was not a total surprise, it's been gaining traction for years now and we've been in the midst of a pandemic for a year now, so even that was not a complete surprise that there would be increased demand. Those are definitely perfectly valid reason to misjudge demand, but at the same time, I don't think it means they are completely faultless either. Still, I'm personally not upset at either nVidia or AMD. I'm mainly upset at dummies buying from scalpers =P