TSMC Hikes Price of Chip Production: CPU & GPU Costs Set to Rise

As demand increases, chip production costs rise.

Taiwan Semiconductor Manufacturing Co. has reportedly notified its customers about substantial incoming chip production price hikes. The world's largest maker of semiconductors will increase prices for virtually all advanced and popular process technologies in a bid to improve its gross margins. Meanwhile, augmented quotes will make costs of products like CPUs, GPUs, SoCs, and controllers higher.

TSMC plans to increase prices of wafer processing using its 7 nm and thinner fabrication processes by as much as 10%, whereas prices of wafers processed using 16 nm-class and thicker nodes will increase by 20% for orders set to be fulfilled starting December, reports DigiTimes citing sources among chip developers. Just like other foundries, TSMC does not disclose its quotes publicly, but the company intends to increase the price of one wafer processed using its 28 nm to 'nearly $3000 staring from January,' the report says.

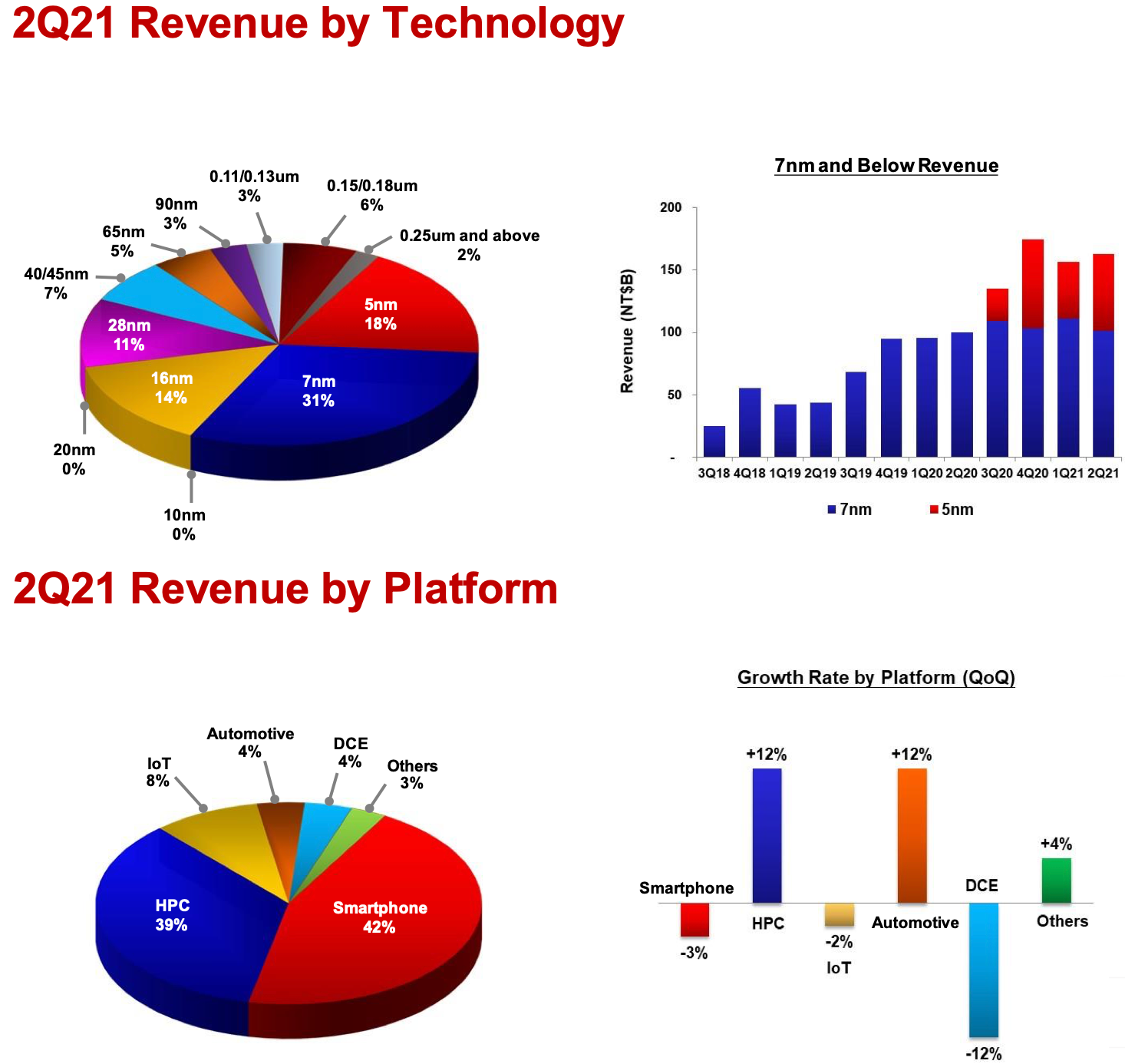

TSMC’s N5 and N7 fabrication technologies accounted for 49% of the company’s $13.29 billion revenue in the second quarter, so increasing quotes for these nodes by 10% will likely bring TSMC well over $600 million of extra revenue in Q1 2022 (assuming that the company’s sales will remain on Q2 2021 level). The foundry’s N16 and N28 processes accounted for 25% of TSMC’s revenue in Q2, so increasing their prices will also bring a sizeable sum to the company. In general, TSMC may increase its revenue by over $1 billion.

What remains to be seen is how higher production costs will affect the price of actual hardware, such as CPUs and GPUs designed by AMD or SoCs developed by Apple. Apple sells expensive smartphones and PCs, so a 10% increase of chip costs will not harm the company's balance sheet significantly. Meanwhile, companies like AMD and Qualcomm sell chips and a 10% increase of their costs will either harm their financial results, or will force them to increase their prices.

Demand for chips hit an all-time-high in the recent quarters and contract makers of semiconductors have to increase production to fulfil orders from their customers. In many cases this means more production and less maintenance, which increases risks and faster depreciation of equipment. As a result, contract makers of semiconductors have to increase their prices to offset their risks and costs. Meanwhile, for companies that heavily invest in new manufacturing capacities, like TSMC, price hikes help to improve margins and profitability.

TSMC is not the only foundry to increase prices of chip production in the recent months, DigiTimes says. GlobalFoundries, Powerchip Semiconductor Manufacturing (PSMC), Semiconductor Manufacturing International (SMIC), United Microelectronics (UMC) have all increased their chip production prices because of extraordinary demand.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Anton Shilov is a contributing writer at Tom’s Hardware. Over the past couple of decades, he has covered everything from CPUs and GPUs to supercomputers and from modern process technologies and latest fab tools to high-tech industry trends.

-

InvalidError The oligopoly working as intended: companies have practically no choice about where to go to get their chips fabbed, so the only 2-3 games in town can arbitrarily jack up prices for whatever capacity they can squeeze out of their fabs and only add the strict minimum manufacturing capacity required to keep up with booked orders.Reply

The EU and other countries/unions really need to get cracking on national fabs to secure supply diversity and availability as it becomes increasingly difficult for independent fabs to keep up with tech and demand. -

scottsoapbox It's called supply and demand.Reply

BTW gloom and doomers: increased profits is what attracts new players to enter the industry thus increasing competition. -

InvalidError Reply

For supply-vs-demand to work properly, you need to have a working competitive market.scottsoapbox said:It's called supply and demand.

In a healthy competitive environment, every supplier has an incentive to maintain spare manufacturing capacity to seize new market opportunities and steal customers from other manufacturers. If you refuse to supply something for a price the market will bear, one of your competitors will.

In an oligopoly situation, manufacturers have every incentive to increase capacity by the absolute minimum amount required since their customers have nowhere else to source their parts from and the prices go out of control.

The various component shortages likely wouldn't have been half as bad if there hadn't been so much semiconductor manufacturer consolidation over the last 20 years. -

Jim90 Replyscottsoapbox said:It's called supply and demand.

BTW gloom and doomers: increased profits is what attracts new players to enter the industry thus increasing competition.

Not if sales start dropping due to unacceptable product price increases - that is, unless our pay packets increase by at least the same percentage, and for the vast, vast unlucky majority of us, that never ever happens! -

Kamen Rider Blade Reply

We need a simple multi-national law to prevent mergers / acquisitions once the # of players in any industry hits this ___ floor.InvalidError said:The various component shortages likely wouldn't have been half as bad if there hadn't been so much semiconductor manufacturer consolidation over the last 20 years.

IMO, if an industry has 9 or less major players, there should be a BAN on All Acquisitions and Mergers.

International and/or domestic. -

waltc3 Everything in the US is going up--and I mean rapidly. Inflation is being felt in all market segments. Much of that is because of increased transportation costs that can be pegged to the Biden administration making the US dependent on foreign sources for oil, again. Prior to Biden's meddling we were 100% energy independent!Reply -

watzupken To be honest, does it really matter anymore? I've practically lost track of how many times I read about price increasing. At the end of the day, it just dampens demand. I can't even be bothered to look up for any new hardware at this point. Just going to sit back and use my existing devices and wait it out. They can increase all they want, but at some point, it may come back to bite them hard.Reply