AMD chips now comprise 55 percent of Puget Systems orders — AMD makes big inroads in professional systems

Is Zen 5 that good or is Arrow Lake falling short of expectations?

Puget Systems, a custom computer building company specializing in configuring workstations for professional users, has published its annual Hardware Trends statistics. As a disclaimer, this data only reflects the preferences of Puget Systems' customers, who have vastly different needs than the average consumer, requiring high-end machines for content creation and scientific research. You get the idea.

Before we jump into the data, the statistics only include workstation and rackstation sales, not including servers and mobile counterparts. The data has been reported as percentages instead of raw numbers for a better overview. For basic terminology, client CPUs typically refer to AMD's Ryzen and Intel's Core lineup of processors. Moving over to workstations, we have Threadripper and Xeon W, whereas EPYC and Xeon Scalable / Xeon 6 families are designated for servers.

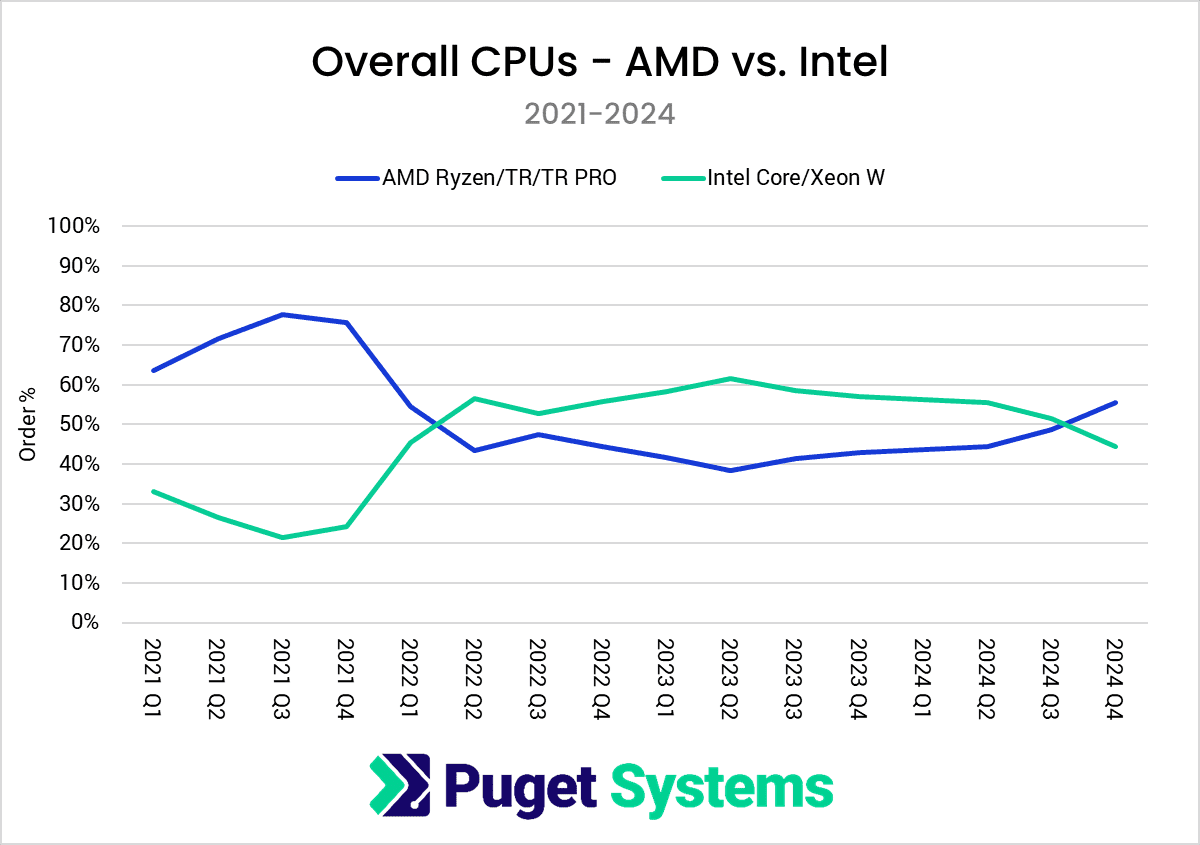

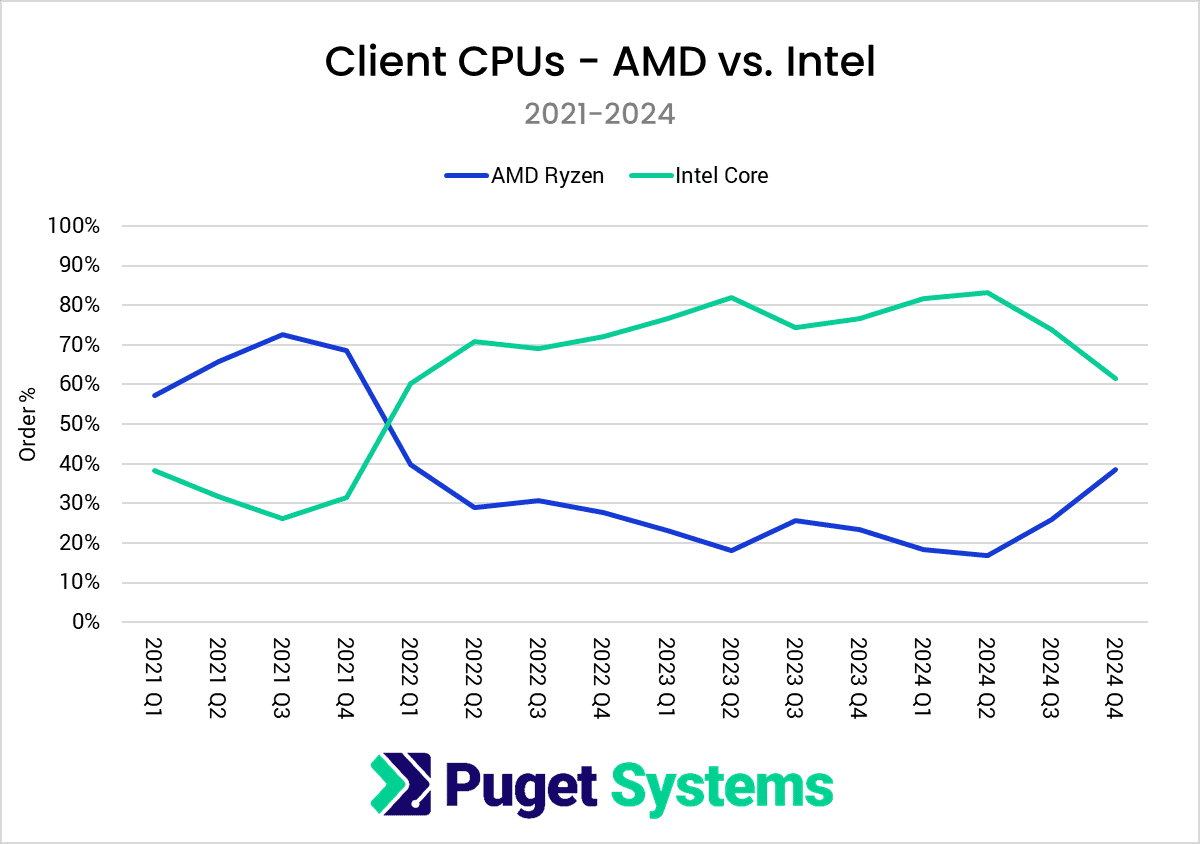

In terms of overall CPUs sold, AMD has finally dethroned Intel after four long years, capturing almost 55% of all orders in Q4 2024. Since this number encapsulates both consumer and workstation-grade offerings, let's go over them individually for more insight. Client CPU sales (Ryzen/Core) see AMD slowly creeping up to Intel, with a substantial jump from just 20% of CPUs sold at the start of 2024 to almost 40% by the end. This is, for the most part, an outcome of Intel's shortcomings; see the Raptor Lake degradation fiasco and Arrow Lake performance hiccups.

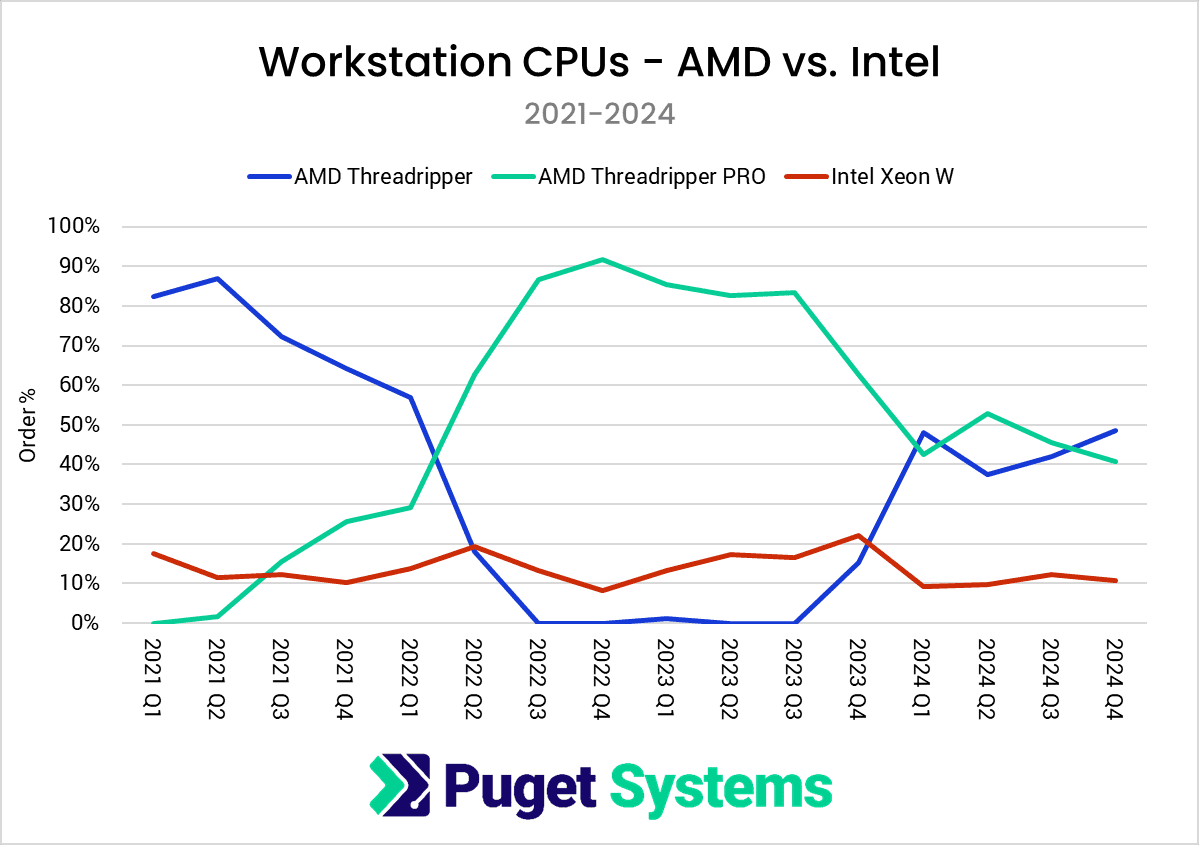

On the contrary, enthusiasts haven't paid much attention to Intel's workstation lineup which has been in AMD's shadow for many years. Since the start of 2021, Intel's workstation market share, per this limited data, has been hovering between 10% and 20% and has not improved since. Just in the last quarter, nine out of ten professionals opted for a Ryzen Threadripper-equipped workstation at Puget Systems.

The data also revealed the preference for consumer-grade RTX GPUs (80%) over Nvidia's professional offerings (20%). Moving over to Operating System choice, Linux is now in more demand than Windows 10 but still pales in contrast to Windows 11; installed on 90% of all workstations. With Windows 10's EOL approaching this year, Microsoft has now made it possible to install Windows 11 on unsupported hardware but does not guarantee a stable experience.

Overall, other aspects remain mostly unchanged but there is a high probability that AMD's Ryzen sales could overtake Intel this quarter. Budget Ryzen 9000 non-X CPUs will go neck and neck against Arrow Lake non-K, though AMD has a clear platform advantage.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Hassam Nasir is a die-hard hardware enthusiast with years of experience as a tech editor and writer, focusing on detailed CPU comparisons and general hardware news. When he’s not working, you’ll find him bending tubes for his ever-evolving custom water-loop gaming rig or benchmarking the latest CPUs and GPUs just for fun.

-

ravewulf Seeing AMD as the blue line and Intel in green is tripping me up lol. Throwback to when AMD used green for their branding instead of red prior to the ATI acquisitionReply -

bit_user Reply

The blame for slumping Xeon W sales is Intel's own dumb fault, for not bothering to bring Emerald Rapids to that market, and instead just "refreshing" their existing Sapphire Rapids models. Let's hope Granite Rapids gets some Xeon W models, not that I'm personally invested in the matter. I've been priced out and don't really need that amount of horsepower, anyhow.The article said:On the contrary, enthusiasts haven't paid much attention to Intel's workstation lineup which has been in AMD's shadow for many years.

As for desktop platforms, Intel has been lagging on "unlocking" ECC support for their mainstream CPU models and there's not yet an Arrow Lake platform for that. Again, blame -> Intel.

Speaking further about mainstream sockets (including Xeon E-series), Intel also hurt themselves with professional users by withdrawing AVX-512 support from that platform, even when they could've still had it in the latest models on offer (which are just Raptor Lake CPUs with the E-cores disabled). Again, blame -> Intel. -

thestryker The way Intel has shrugged off the Workstation market (TR/Xeon W) reminds me of their reaction to TR 3000 and HEDT. Rather than compete on price and capability they released a token 10 series, kept the price of entry high and just compressed top down. They also didn't make many of those parts as 9 series was still available while most 10 series weren't. The approach to Xeon W feels identical: they're making enough for the market that uses the parts already rather than trying to regain what was lost.Reply

I imagine 2025 will see a client increase for Intel as the rest of the ARL SKUs launch and the workstation LGA 1851 chipset should as well. There's no indication that Intel is doing anything on the workstation side, but maybe they'll put a new Xeon W architecture out.

Just one note on the data from Puget which wasn't mentioned in the article here. I certainly agree with Puget's choice as it makes for a lot more meaningful data, but it does not signify absolute sales numbers:

We also want to clarify that this data is pulled on a per-order basis, rather than per-system. A good percentage of our sales are for multiple units at a time, but reporting on a per-system basis introduces quite a bit of noise to the data in a way that isn’t helpful or useful. For example, we typically sell a significant amount more systems with AMD Threadripper than Intel Xeon W, but we could have a single order for a large number of systems using Intel Xeon W processors that throw that ratio off for a short time period. Those kinds of atypical sales are most often for a very specific or niche workflow, and we have found it more useful to count those systems as a single order for this type of report, rather than allowing a single large quantity order from skewing the data.

edit:

Budget Ryzen 9000 non-X CPUs will go neck and neck against Arrow Lake non-K, though AMD has a clear platform advantage.

Not sure what exactly this means, but other than ECC support for 9000 series and none for ARL AMD's client platform is just worse than Intel's (Puget customers are highly unlikely to be buying a CPU to drop in). -

bit_user Reply

I'd just point out that this happened when Intel was critically short on 14 nm manufacturing capacity. I think that's why they didn't ramp up the Cascade Lake HEDT models like they perhaps originally intended.thestryker said:The way Intel has shrugged off the Workstation market (TR/Xeon W) reminds me of their reaction to TR 3000 and HEDT. Rather than compete on price and capability they released a token 10 series, kept the price of entry high and just compressed top down. They also didn't make many of those parts as 9 series was still available while most 10 series weren't.

Right. Trying to maintain a market presence, rather than truly competing for market share. I'm not even saying they're wrong to do so, based on the economics. I just think it's disappointing to see, from a user's perspective.thestryker said:The approach to Xeon W feels identical: they're making enough for the market that uses the parts already rather than trying to regain what was lost.

What if they do a Bartlett Lake-based 12-core Xeon E with AVX-512 enabled? That'd be something.thestryker said:I imagine 2025 will see a client increase for Intel as the rest of the ARL SKUs launch and the workstation LGA 1851 chipset should as well.

I think they absolutely have to do a Granite Rapids Xeon W, if they want to stay in this market. I feel like I've read something about that, maybe on one of their roadmap slides. Again, I'd pay more attention, if I were remotely in the market for something like that.thestryker said:There's no indication that Intel is doing anything on the workstation side, but maybe they'll put a new Xeon W architecture out.

I disagree. If their quarterly data is noisy, then filter it with a sliding window. It bugs me that we're not seeing relative unit volumes.thestryker said:Just one note on the data from Puget which wasn't mentioned in the article here. I certainly agree with Puget's choice as it makes for a lot more meaningful data, but it does not signify absolute sales numbers:

Yeah, I think it must've been referring to ECC support. I can't think of anything else in AM5's favor, these days.thestryker said:Not sure what exactly this means, but other than ECC support for 9000 series and none for ARL AMD's client platform is just worse than Intel's (Puget customers are highly unlikely to be buying a CPU to drop in). -

thestryker Reply

They launched towards the end of 2019 which would certainly explain the low launch volume, but that doesn't explain persistent bad availability. A year post launch it was still easier to get any 9th Gen part than 10th Gen. Volume was so low they actually had some RMA problems within 2-3 years or so of launch. The lack of volume also goes hand in hand with motherboard manufacturers left holding the bag on excess X299 chipsets and why you can still buy major brand new X299 boards today.bit_user said:I'd just point out that this happened when Intel was critically short on 14 nm manufacturing capacity. I think that's why they didn't ramp up the Cascade Lake HEDT models like they perhaps originally intended.

For in depth absolutely I too would rather see everything. I don't think that serves their purposes though and I'd rather see bad takes based on this data than the overall sales data which doesn't reflect the general market.bit_user said:I disagree. If their quarterly data is noisy, then filter it with a sliding window. It bugs me that we're not seeing relative unit volumes.

I view it kind of like all the bad takes regarding AMD desktop CPU sales. AMD has great CPUs, but I would be shocked if ARL didn't sell more units than 7000 and 9000 combined. I have no doubt AMD dominates retail box sales, but that's such a narrow part of the market it doesn't mean much. -

redgarl That chart is a monstrosity...Reply

Anyone saying that they root for Intel because AMD needs competition, need to understand that this chart is showing what is wrong with Intel. No matter how bad their products are, they bribe their way in to prevent their competition from getting market share. With a product like Arrow Lake, their marketshare should be closer to 10%. Mindfactory numbers for Arrow Lake is saying it all... nobody is interested in Arrow Lake. The last month numbers are showing Coffee Lake beating Arrow Lake in sales.

https://cdn.mos.cms.futurecdn.net/LpxRD5GtNg4kR68nvciUW5-1200-80.png.webp -

spongiemaster Reply

Ice Lake. First 10nm Xeons from Intel and first non-Skylake derivative in 7 years. What's remarkable is that's all it took for Intel to regain the market share lead. Intel hasn't been competitive in the market for years, and AMD was still some how trailing in market share.adamXpeter said:What did Intel offer in 2022 to almost double the orders?

If we're being realistic, Intel isn't even trying in this market. Desktop market with higher core counts has cannibalized most of the workstation market and this market is likely irrelevant to Intel's bottom line.

Edit: I misread the chart. Though Puget caters to the workstation market, the chart includes mainstream platform sales as well. The spike in Intel sales is definitely from the release of Alder Lake in Q4 2021, though Ice Lake released in Q3 2021 probably helped a little as well. Not surprised by the chart any more. Numbers makes sense. -

spongiemaster Reply

When's the next meeting for the flat earthers?redgarl said:That chart is a monstrosity...

Anyone saying that they root for Intel because AMD needs competition, need to understand that this chart is showing what is wrong with Intel. No matter how bad their products are, they bribe their way in to prevent their competition from getting market share. With a product like Arrow Lake, their marketshare should be closer to 10%. Mindfactory numbers for Arrow Lake is saying it all... nobody is interested in Arrow Lake. The last month numbers are showing Coffee Lake beating Arrow Lake in sales.

https://cdn.mos.cms.futurecdn.net/LpxRD5GtNg4kR68nvciUW5-1200-80.png.webp -

bit_user Reply

The Xeon W version of Ice Lake launched in Q3 of 2021. The Puget data excludes servers and laptops, so that's the only Ice Lake that matters. The Sappire Rapids Xeon W didn't launch until Q1 of 2023. Those Xeon W's weren't competitive against Threadrippers - it was mostly people who needed AVX-512 or had to stick with Intel that were buying them.spongiemaster said:Ice Lake. First 10nm Xeons from Intel

Their data does include both Core-branded mainstream CPUs and Xeon E. However, the last Xeon E to launch in that timeframe was a Rocket Lake rebadge that launched in Q3 2021, which probably didn't see much demand at a time when Alder Lake was also launching.

So, 2022 sales would probably been propelled by Alder Lake and then Raptor Lake launched in Q4 of 2022.

If you're talking strictly about Xeon, then yes. As I mentioned above, the Xeon E-2300 series was Rocket Lake-based, but that's essentially a 14 nm version of the same microarchitecture as Ice Lake.spongiemaster said:and first non-Skylake derivative in 7 years.

Are you taking the Puget data to infer overall market share? That would be a mistake.spongiemaster said:What's remarkable is that's all it took for Intel to regain the market share lead.

But, I'm confused that you think Intel's resurgence had anything to do with Ice Lake, because this clearly shows that when restricted just to Threadripper vs. Xeon W, Intel has pretty much stayed bumping along between 10% and 20% the whole time. Pay attention to the legend, because the graph colored Intel red, for some reason.

Note, as well, that Puget's CEO sits on Intel's Technical Advisor Board and (as Stryker pointed out), their data is listing orders rather than unit volume and not limited to just Xeon W & Threadrippers. Their blogs push Intel pretty hard by way of using some benchmarks that significantly benefit from Intel's Quicksync Video acceleration and they also match SKUs by model number rather than price or specs, in order to give an apparent edge to the Intel models. Puget's data cannot be taken as unbiased.

I guess you're looking at their overall orders, but the real turn-around was in the desktop processors, which was isolated in this graph:spongiemaster said:Intel hasn't been competitive in the market for years, and AMD was still some how trailing in market share.

That clearly seems triggered by the launch of Alder Lake. Weirdly, the launch of Ryzen 7000 was barely enough to maintain AMD orders until Raptor Lake launched.

So, if you look at the Xeon W vs. Threadripper chart, not much happens for Intel until a bump in Q2 2022 and then it quickly drops back down until Sapphire Rapids launches. So, I'd say Ice Lake really didn't seem to do much for Puget's overall Intel order volume.spongiemaster said:Edit: I misread the chart. Though Puget caters to the workstation market, the chart includes mainstream platform sales as well. The spike in Intel sales is definitely from the release of Alder Lake in Q4 2021, though Ice Lake released in Q3 2021 probably helped a little as well. Not surprised by the chart any more. Numbers makes sense.