Intel lost $16.6 billion in Q3, reports $13.3 billion in revenue

Margin plummets to 15%

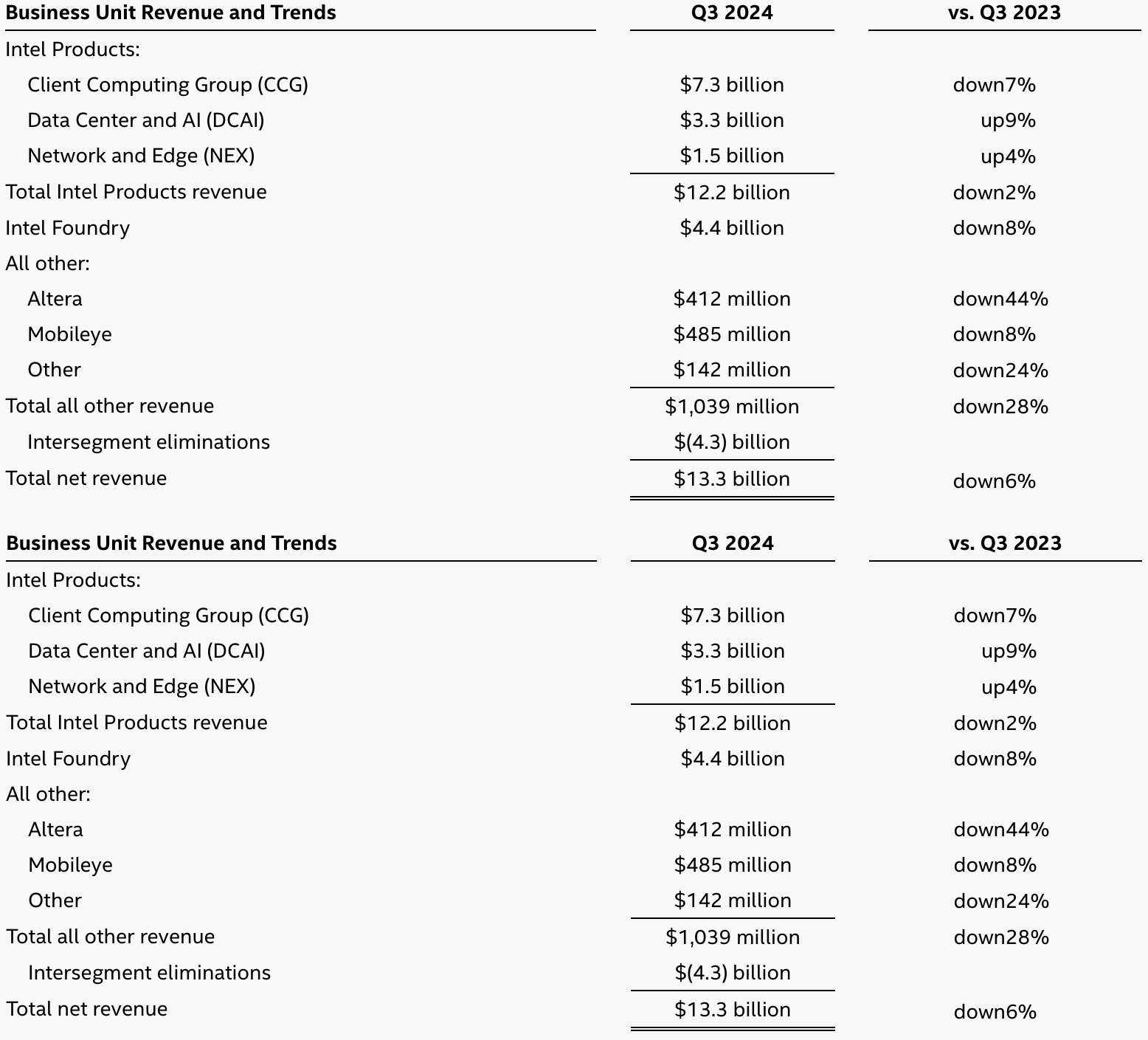

Intel unveiled its financial results for the third quarter of 2024 on Thursday. While the company's revenue beat expectations and totaled $13.3 billion, Intel took massive impairment and restructuring charges and reported a huge $16.6 billion loss. Surprisingly, the company's stock initially jumped up to 12% on the news, though that was closer to an 7% gain at press time.

Intel's revenue reached $13.3 billion, down 6% year-over-year but up $0.5 billion from the previous quarter. The company's net loss totaled an unprecedented $16.6 billion due to massive impairment and restructuring charges and substantial losses by the manufacturing unit. Intel's gross margin dropped to 15%, a historical minimum for the company.

Intel's products group reported profits and generated revenues of around $12.997 billion. The company's Foundry unit earned $4.4 billion, up slightly from $4.3 billion in the previous quarter but down from $4.7 billion from the same quarter a year ago. However, the chip production unit lost a whopping $5.8 billion.

"Our Q3 results underscore the solid progress we are making against the plan we outlined last quarter to reduce costs, simplify our portfolio and improve organizational efficiency," said Pat Gelsinger, Intel CEO. "We delivered revenue above the midpoint of our guidance, and are acting with urgency to position the business for sustainable value creation moving forward. The momentum we are building across our product portfolio to maximize the value of our x86 franchise, combined with the strong interest Intel 18A is attracting from foundry customers, reflects the impact of our actions and the opportunities ahead."

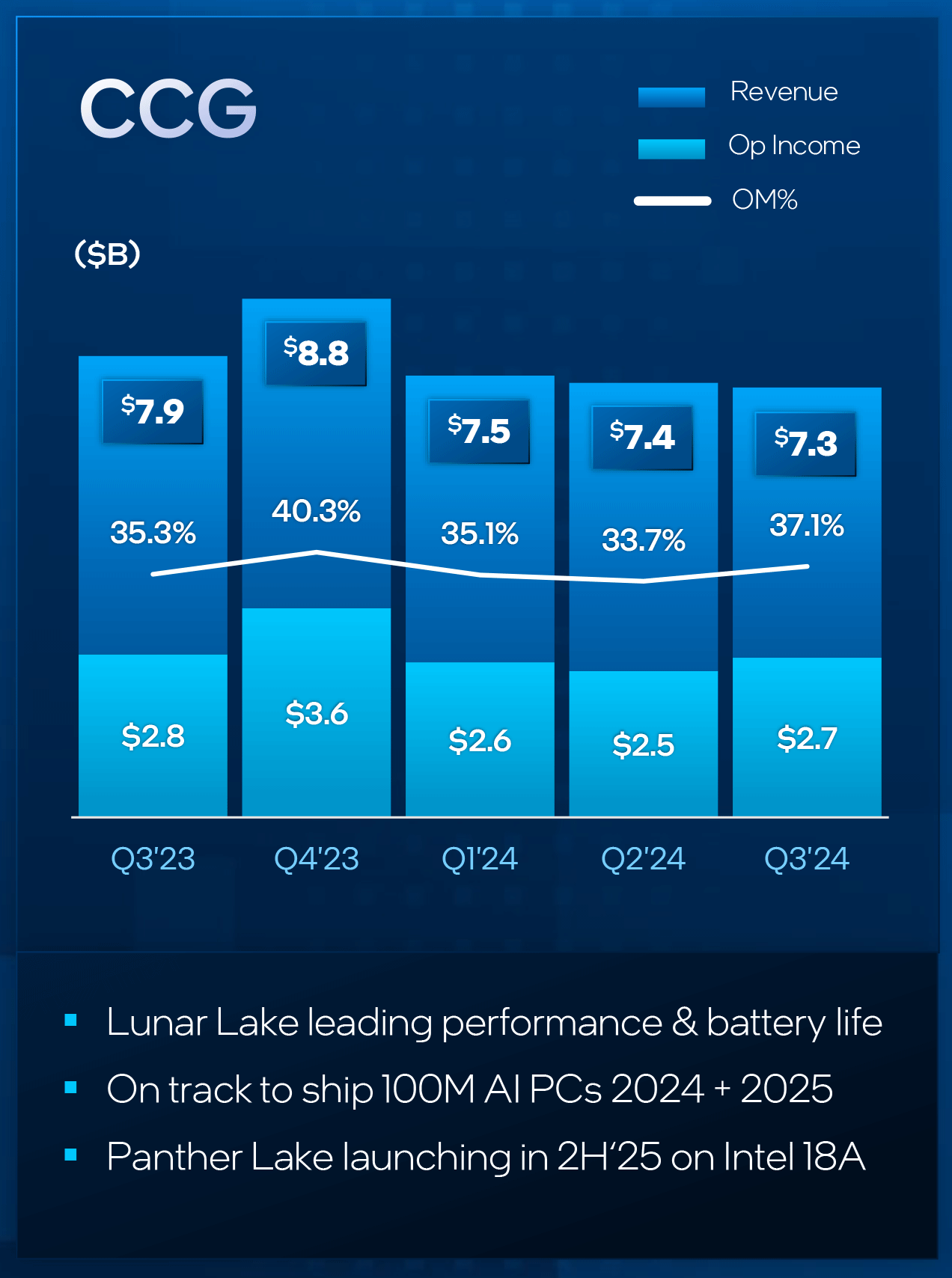

Intel's Client Computing Group: A slight sequential increase

Intel's Client Computing Group remains the top-performing division within the company, generating $7.3 billion in revenue during the third quarter. This marks a decrease from $7.9 billion in the same period last year, and it is also a slight $100 million decrease compared to the second quarter of 2024. The group achieved an operating margin of 37.1%, resulting in an operating profit of $2.7 billion.

During the quarter, Intel began shipments of its Arrow Lake-S processors for enthusiasts and Lunar Lake CPUs for compact laptops. Apparently, these new products have yet to impact Intel's CCG sales.

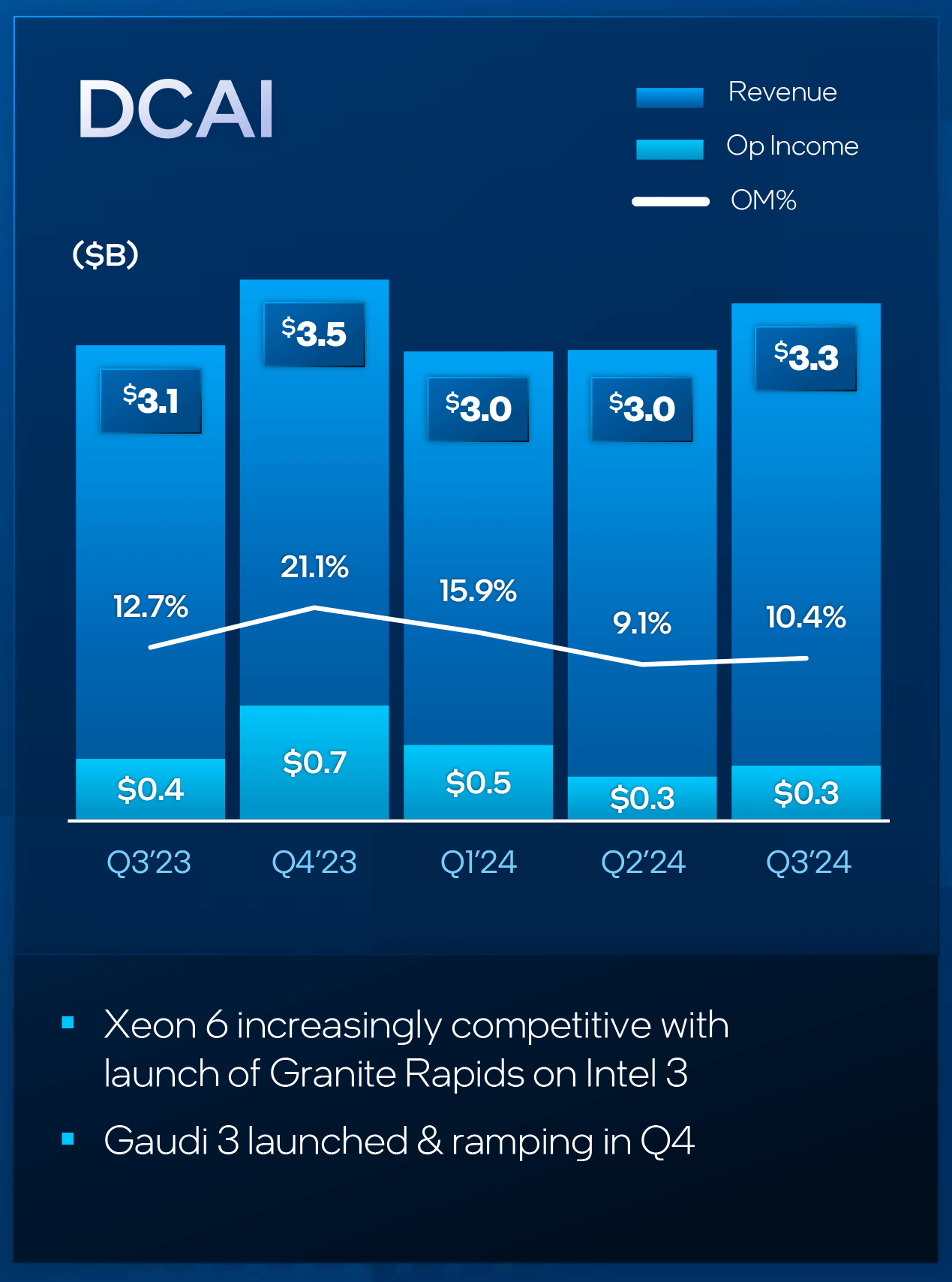

Intel's Datacenter and AI Group: Finally, going up

Intel's Data Center and AI Group (DCAI) earned $3.3 billion in revenue, up both sequentially and year-over-year, which is much-needed good news for the company. The unit's operating margin rose to 10.4%, but its operating profit remained at just $0.3 billion, which is surprising as the company began to ship its high-margin Xeon 6 data center CPUs.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Perhaps the volumes of Xeon 6 were too low to have a greater impact on DCAI's performance, which wouldn't be entirely surprising given that the company is early in the ramping process.

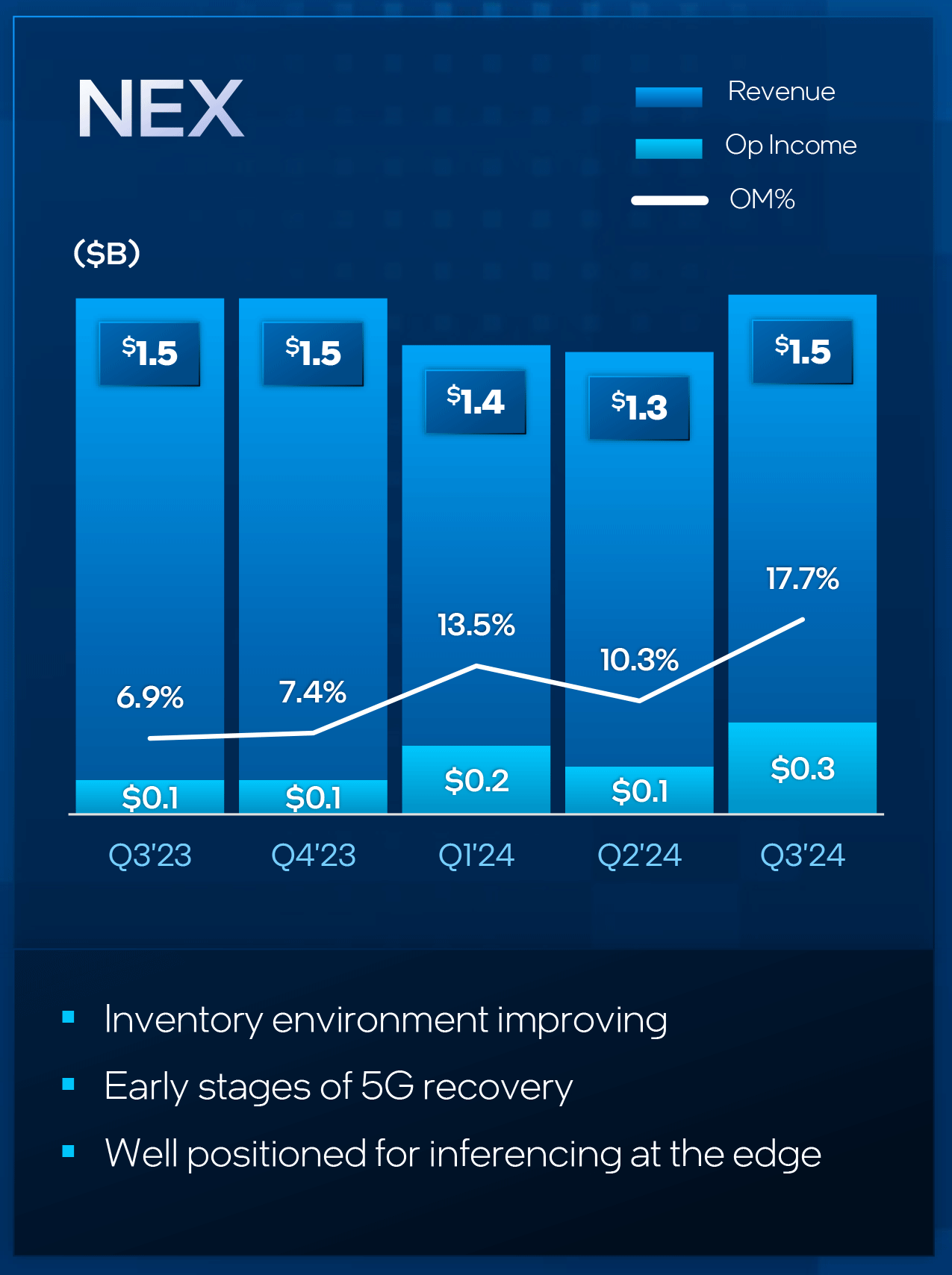

Altera, Edge, Network, and Mobileye: Mixed results

Intel's NEX division, which develops products for 5G, edge computing, networking, and telecommunications, recorded $1.5 billion in revenue, flat year over year and $200 million up quarter over quarter. Along with higher earnings, the business unit also increased its operating profit to $300 million.

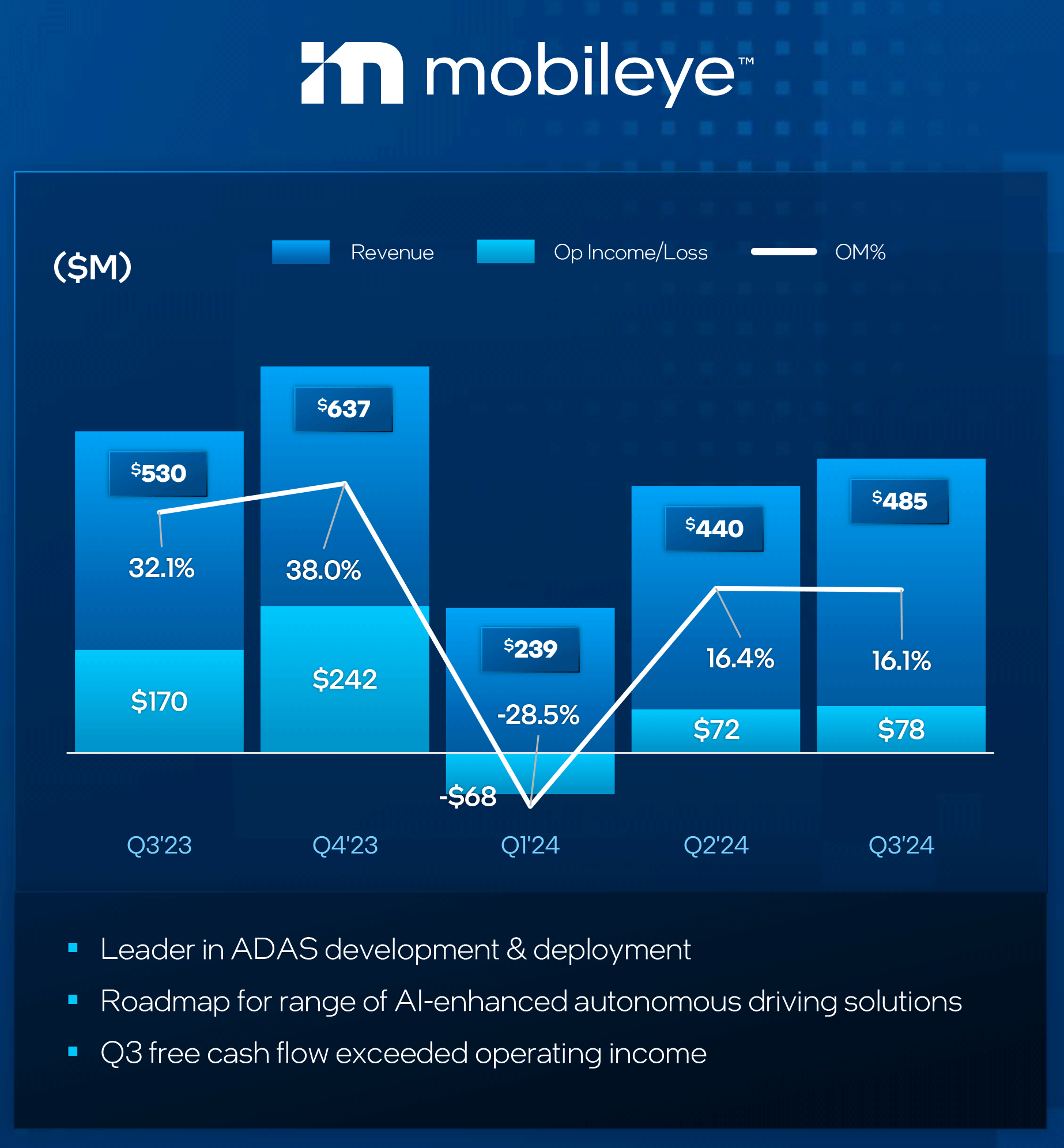

Mobileye saw another surge in revenue, reaching $485 million in Q3 2024, up from $440 million in Q2, but stilly below $530 million reported in Q3 last year. The segment posted $78 million in operating income, a decrease from $170 million in Q3 2023 and flat with the prior quarter.

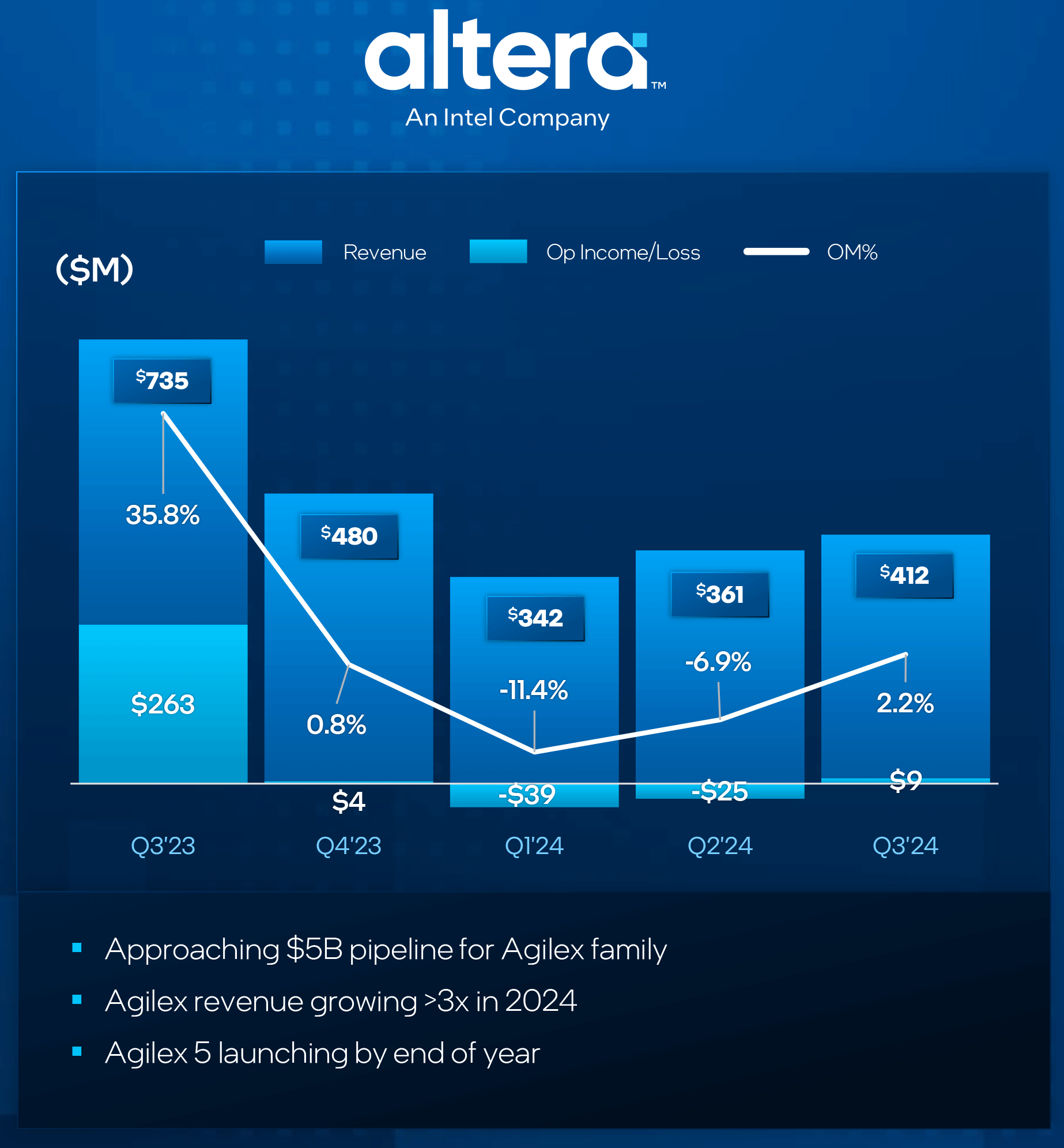

Altera, on the other hand, again experienced a challenging quarter, with revenue reaching $412 million, up significantly from $361 million in the prior quarter, but still down significantly from $735 million in the third quarter of 2023. The unit posted a $9 million profit, a steep drop from the $263 million profit it achieved in the same period last year, but at least up from $25 million loss in Q2 2024.

Modest outlook

Intel forecasts revenue between $13.3 billion and $14.3 billion for the fourth quarter of 2024, down from $15.4 billion reported in the same quarter last year, despite the company's updated product lineup. Additionally, Intel anticipates its GAAP gross margin to fall to increase to 36.5%, reflecting the impact of more competitive products and lack of charges.

Anton Shilov is a contributing writer at Tom’s Hardware. Over the past couple of decades, he has covered everything from CPUs and GPUs to supercomputers and from modern process technologies and latest fab tools to high-tech industry trends.

-

thestryker When they were talking about Gaudi they mentioned that they had a harder time with software migration than expected which impacted sales. Seems they're banking on the Gaudi 3 rollout and contract with IBM to push sales up over here.Reply

Spoke a bit about PTL and NVL saying 70% of silicon is in house, so just a wild guess on my part: GPU tile still TSMC (I'm hoping they aren't being shady and counting interposer).

LNL sounds like a one off part as not only did using TSMC hurt the margin but the on package memory was singled out. They mentioned no parts with on package memory on the road map. LNL did turn out better than expected so the order from TSMC was tripled.

They overbought equipment for Intel 7 during the pandemic which was part of the write downs.

information from (a lot of analysis and more information here too):

https://morethanmoore.substack.com/p/intel-q32024-financials-halloweenhttps://nitter.poast.org/IanCutress -

ekio Karma for milking us as bad as they could without providing any innovation before ryzen came out hits strong.Reply -

TheOtherOne And if we dig deeper into the books, we might find the CEOs and higher Executives still got hefty "bonuses" since those are based on the revenue! 😉Reply -

Elusive Ruse Reply

They have been lying about Gaudi for a long time:thestryker said:When they were talking about Gaudi they mentioned that they had a harder time with software migration than expected which impacted sales. Seems they're banking on the Gaudi 3 rollout and contract with IBM to push sales up over here.

Spoke a bit about PTL and NVL saying 70% of silicon is in house, so just a wild guess on my part: GPU tile still TSMC (I'm hoping they aren't being shady and counting interposer).

LNL sounds like a one off part as not only did using TSMC hurt the margin but the on package memory was singled out. They mentioned no parts with on package memory on the road map. LNL did turn out better than expected so the order from TSMC was tripled.

They overbought equipment for Intel 7 during the pandemic which was part of the write downs.

information from (a lot of analysis and more information here too):

https://morethanmoore.substack.com/p/intel-q32024-financials-halloweenhttps://nitter.poast.org/IanCutress

Gelsinger touted the $1 billion figure in public. On Intel’s July 2023 earnings-results call, he told analysts of “surging demand for AI products.” He added: “Our pipeline of opportunities through 2024 is rapidly increasing and is now over $1 billion and continuing to expand with Gaudi driving the lion's share.”

According to one of these sources and another person briefed on the matter, Intel at the time of Gelsinger's announcement had not secured anything near the supply needed from TSMC to sell $1 billion in AI-accelerator chips. After Gelsinger demanded the billion-dollar target, Intel tweaked its math to justify it, lumping in chips unrelated to its marquee AI offering, two sources said.

As recently as January of this year, Intel told investors it had more than $2 billion in possible AI chip deals in the pipeline. In April, Gelsinger revealed to analysts a much lower AI revenue goal for this year: more than $500 million.

https://www.reuters.com/technology/inside-intel-ceo-pat-gelsinger-fumbled-revival-an-american-icon-2024-10-29/ -

Mattzun The revenue info is shown twice in the first chartReply

Is the second copy supposed to show expenses? -

vanadiel007 I am thinking they are going to have a hard time recovering from this. I expect more restructuring in the common months, more cutting in order to shore up costs.Reply

I think they are going to have an uphill battle this time, because the market is highly competitive and they have no competitive edges in any of the markets right now.

Their latest CPU's are underwhelming, their GPU's are underwhelming, they are loosing market share in the server market fast, server market is more about GPU than CPU power these days, and they are unable to capitalize on the emerging AI market bubble.

Their best bet of survival would be forming an alliance of some sorts. -

bit_user Reply

Sierra Forest and Granite Rapids got a slight jump on AMD's Turin, but Turin is cheaper and managed a commanding lead over the 128 P-core Xeon 6980P, core-for-core:The article said:Intel's Data Center and AI Group (DCAI) earned $3.3 billion in revenue, up both sequentially and year-over-year, which is much-needed good news for the company. The unit's operating margin rose to 10.4%, but its operating profit remained at just $0.3 billion, which is surprising as the company began to ship its high-margin Xeon 6 data center CPUs.

https://www.phoronix.com/review/amd-epyc-9965-9755-benchmarks

Intel reduced the gap vs. the previous generation, but it's still sizeable and some of their biggest customers (Amazon, Microsoft, Google) now have in-house ARM CPUs. If Intel doesn't jump on the ARM bandwagon soon, it could plausibly find itself fighting for mere table scraps of the cloud/datacenter market. -

JamesJones44 The headline number (lost 16.6 billion) isn't exactly what it looks like. There are two, one time charges for separation packages (layoffs) and impairment charge largely around equipment write downs. When you factor those two accounting tricks out their net income was actually 1.7 billion.Reply

It's still a bad quarter without a doubt, but the headline number makes it look a lot more dire than it really is.