Intel posts mixed financial report, demonstrates growth but 2023 revenues are down

10% year-over-year sales growth in the fourth quarter, but revenue for the year as a whole dropped 14% over 2022

On Thursday Intel posted a rather mixed financial report. On the one hand, the company's sales increased 10% year-over-year in the fourth quarter. On the other hand, its revenue for the whole year 2023 dropped 14% from 2022. Because of higher demand for PCs, shipments of Intel's client products increased by 33% YoY in Q4 FY2023, but at the same time sales of datacenter products declined 10% year-over-year.

Mixed Quarter Results

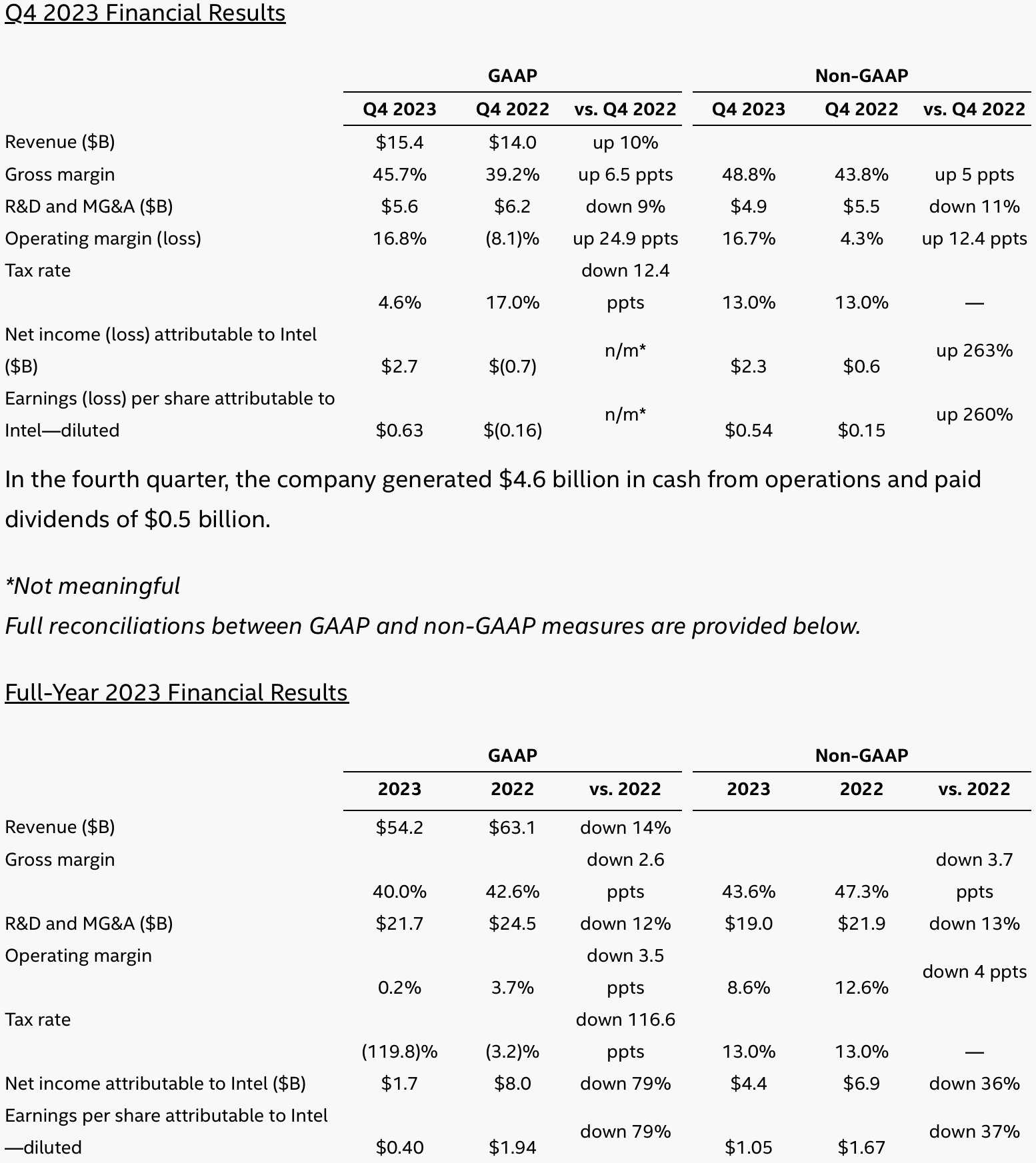

Intel's Q4 FY2023 revenue increased to $15.4 billion, which is 10% higher than in the same quarter a year ago. The company's net income totaled $2.7 billion, whereas gross margin also improved to 45.7% from 39.2% in the Q4 FY2022. Intel's fourth quarter results certainly look better than in the last quarter of 2022. But if we compare them to Intel's report for Q4 FY2021 ($20.5 billion revenue, $4.6 billion net income, 53.6% gross margin), the situation does not look too good.

For the whole fiscal year 2023, Intel posted revenue of $54.2 billion, down 14% from $63.1 billion in 2022 and $79 billion in 2021. The company's net income declined drastically to $1.7 billion, down from $8 billion in 2022 and $19.9 billion in 2021. Sales of all products groups — including client, datacenter, and network — declined significantly year over year. By contrast, Mobileye and Intel Foundry Services managed to increase their earnings.

Intel's results in 2023 were impacted by multiple factors. A slow demand for client and server machines in general throughout the year, increased competition from AMD, adoption of custom silicon by Apple and cloud service providers, and delays of crucial products. In general, when it comes to Intel's products, their competitive positions were determined by the company's decisions from years ago. As for competition, Intel will have to navigate a world full of custom silicon and competitors with highly competitive CPUs based on x86, Arm, and RISC-V instruction set architectures. Indeed, Intel admits that 2023 was another transformative year for Intel.

"We delivered strong Q4 results, surpassing expectations for the fourth consecutive quarter with revenue at the higher end of our guidance," said Pat Gelsinger, Intel CEO. "The quarter capped a year of tremendous progress on Intel's transformation, where we consistently drove execution and accelerated innovation, resulting in strong customer momentum for our products."

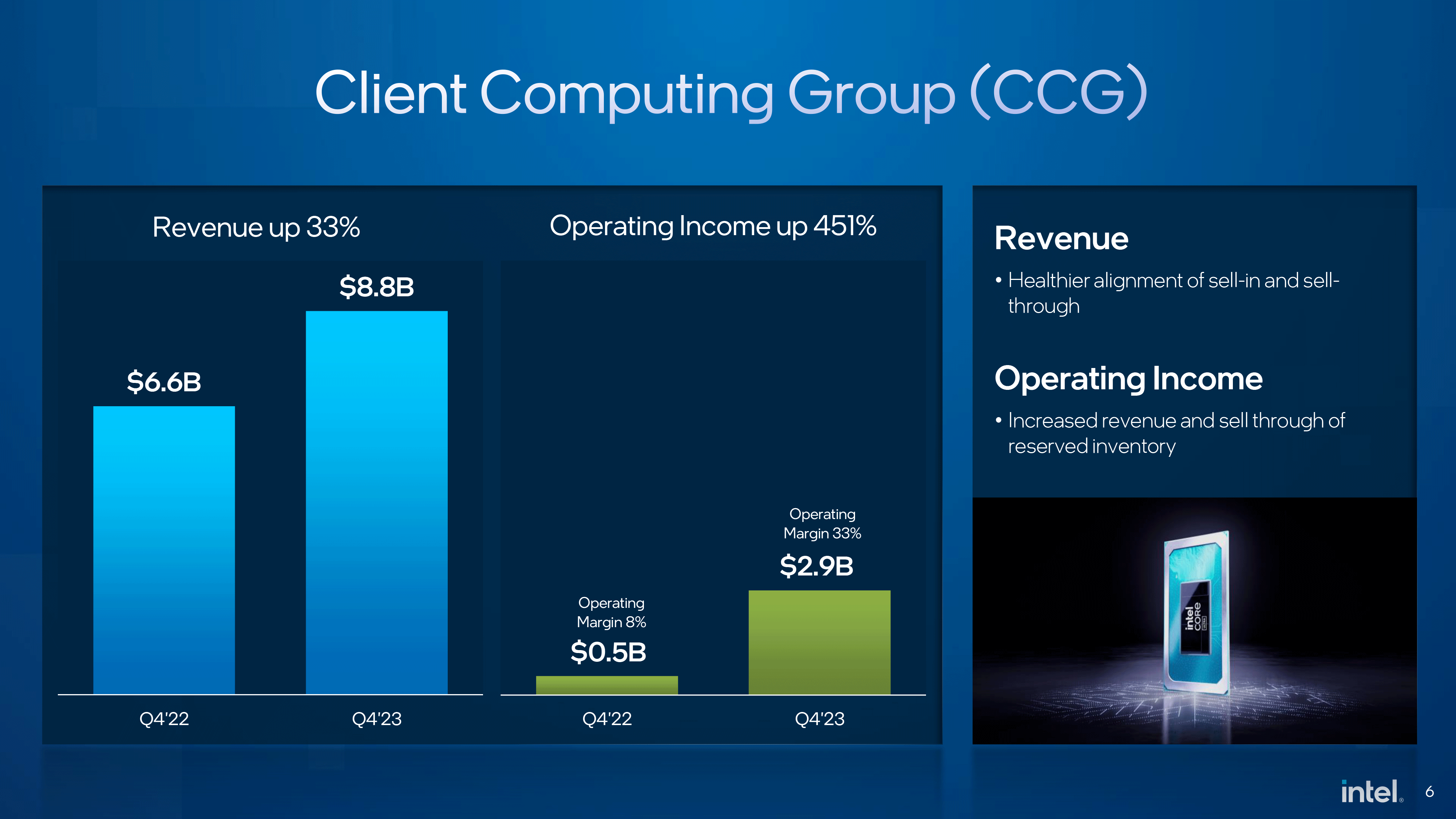

Intel's Client Computing Group in Q4: A Highly Profitable Business

Intel's Client Computing Group has always been the company's bread and butter. Last quarter it earned $8.8 billion, up from $6.6 billion a year before. Furthermore, CCG posted a $2.9 billion non-GAAP profit, up significantly from $0.5 billion in Q4 2022.

The company attributes this success to a healthier alignment of sell-in and sell-through as well as beginning of high-volume revenue shipments of the company's Core Ultra 'Meteor Lake' processors for laptops.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

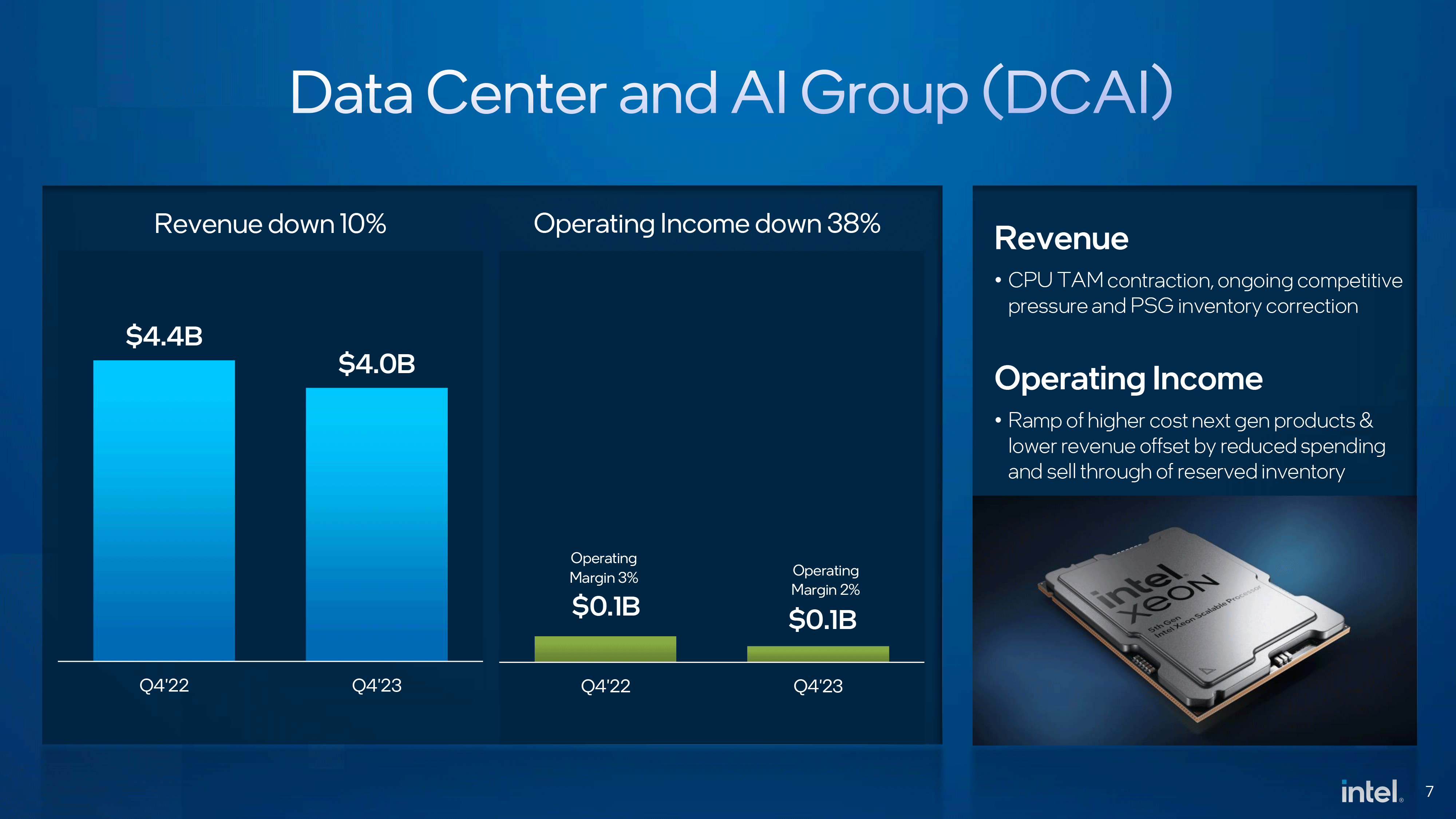

Intel's Data Center and AI Group: Sales Down, Profits Down

Intel's datacenter business used to be the company's crown jewel. In the fourth quarter of last year the company's DCAI group earned $4 billion in revenue, down from $4.4 billion in Q4 2022. The unit posted a non-GAAP $100 million profit, but its operating margin was 2%, even lower than in Q4 2022.

Intel said that declines of its datacenter product sales could be attributed to contraction of the total available server CPU market, competitive pressure from AMD, and inventory corrections. Meanwhile, the company ramped up production of expensive next generation parts, which affected its profitability.

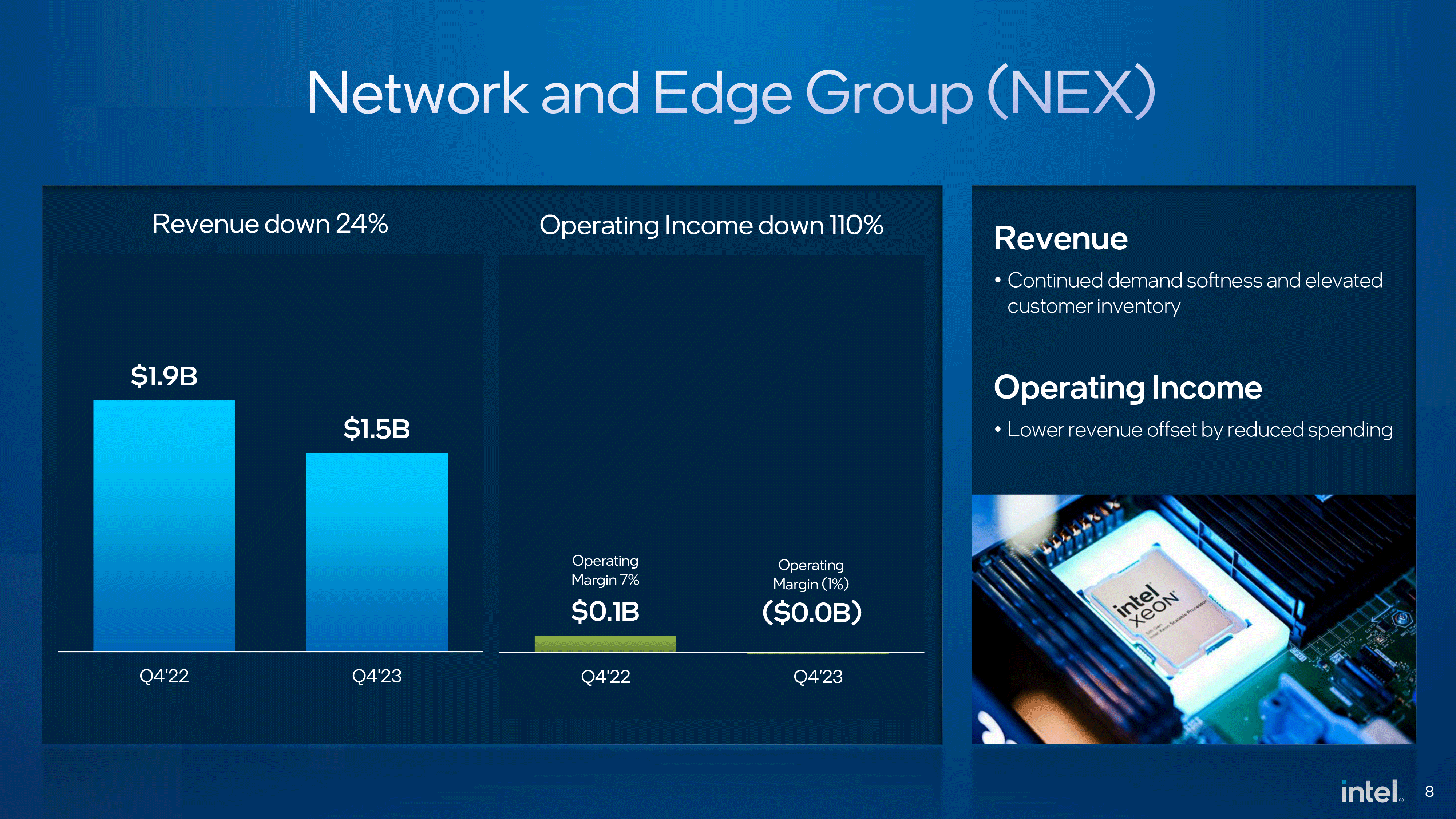

Network, Foundry, and Mobileye

Performance of other Intel's business units was also a mixed bag in Q4 2023. Network and Edge (NEX) group earned $1.5 billion, down from $1.9 billion a year before. The operating profit margin of the unit was 1% and it earned nothing.

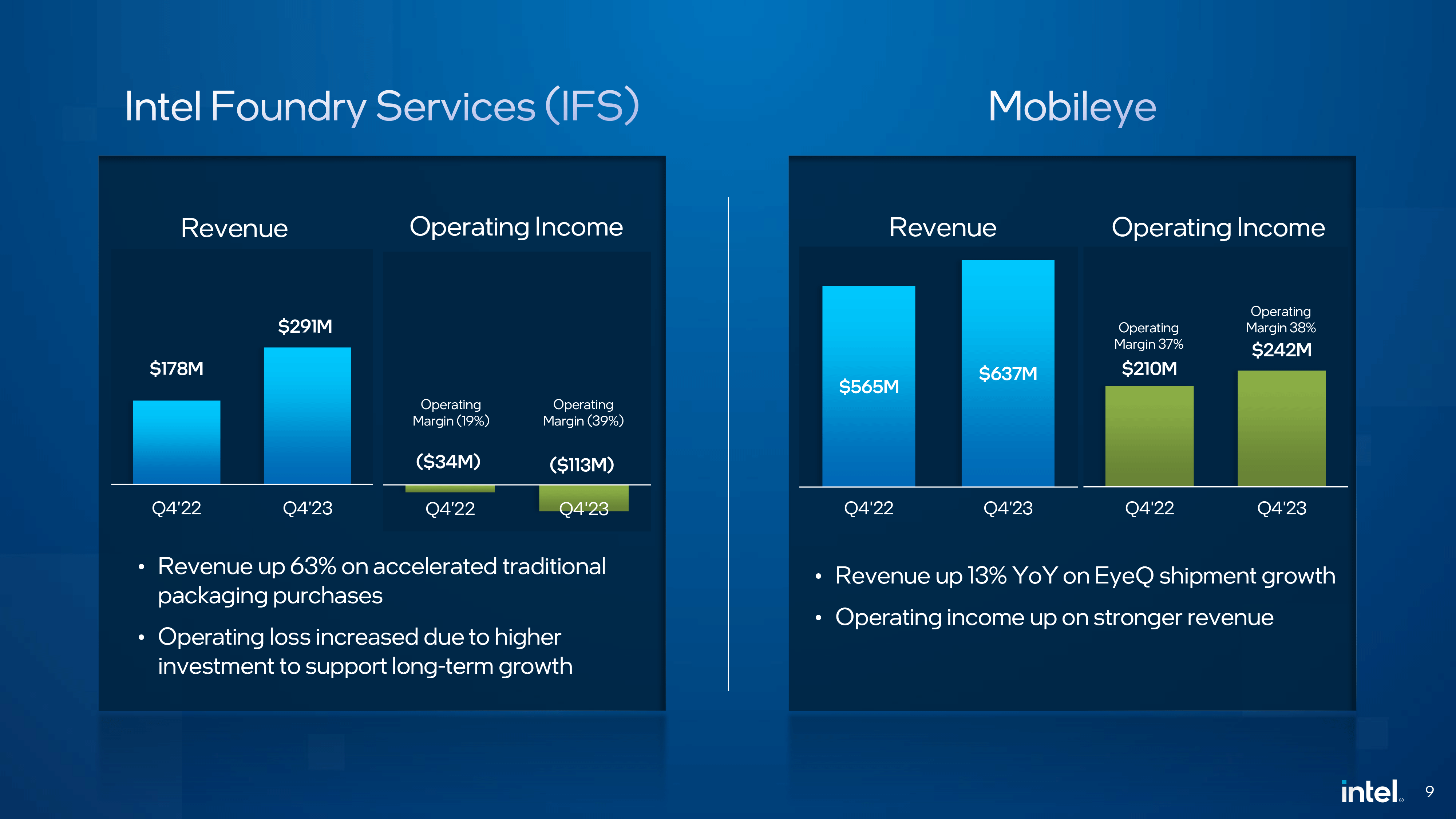

By contrast, Intel Foundry Services (IFS) increased its revenue to $291 million, up 63% from $178 million. Meanwhile, the group lost $113 million, which Intel believes is a result of its increased investments.

Mobileye earned $637 million, up from $565 million a year before thanks to increased EyeQ shipments. The business unit also increased its profitability to $242 million in Q4 2023 from $210 million in Q4 2022.

Modest Guidance

Intel expects its GAAP revenue to be between $12.2 billion and $13.3 billion, up around 8% year-over-year. The company also believes that its gross margin will increase 44.5%.

"In 2024, we remain relentlessly focused on achieving process and product leadership, continuing to build our external foundry business and at-scale global manufacturing, and executing our mission to bring AI everywhere as we drive long-term value for stakeholders," said Gelsinger.

Anton Shilov is a contributing writer at Tom’s Hardware. Over the past couple of decades, he has covered everything from CPUs and GPUs to supercomputers and from modern process technologies and latest fab tools to high-tech industry trends.