Intel's revenues are up year-over-year, but foundry unit loses $2.5 billion

As PC market comes back, so do Intel's financial results.

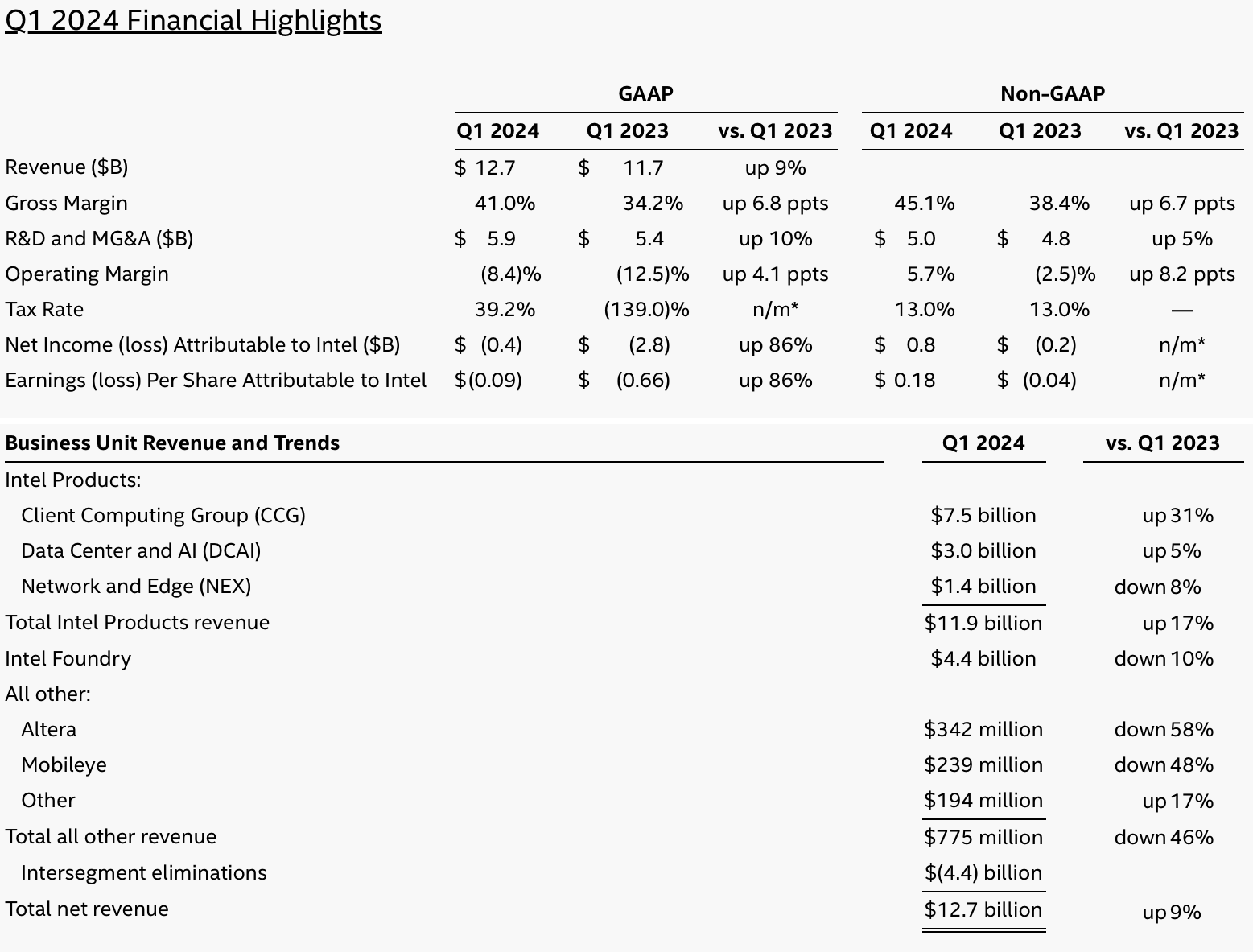

Intel this week posted its financial results for the first quarter of 2024. As the PC and datacenter market rebounded compared to last year, so did sales of Intel's key product units. Intel's client computing group (CCG) and datacenter and AI (DCAI) group demonstrated an aggregated 17% growth and earned $11.9 billion. But Intel's manufacturing unit lost $2.5 billion due to continued investment in capacity, which is $100 million more than in Q1 2023.

Mixed Quarter

In general, Intel's first quarter of 2024 was a mixed bag. The company posted $12.7 billion in revenue, a 9% increase year-over-year, and lost $400 million, down from $2.8 billion in the same quarter a year ago. The company's gross margin grew to 41%, a significant uptick from 34.2% in Q1 2023, and the company's operating margin increased to -8.4% from -12.5% a year ago.

Intel Products posted $11.9 billion in sales, a 17% year-over-year, whereas Intel Foundry earned $4.4 billion, down 8.4% year-over-year. The overall growth of Intel's Products unit was offset by inventory challenges that affected Mobileye, Altera, and 5G applications. Additionally, the phase-out of various non-core business areas, including the traditional packaging division within Intel Foundry, had a significant ($1 billion) impact on the company's results. "Q1 revenue was in line with our expectations and we delivered non-GAAP EPS above our guidance, driven by better-than-expected gross margins and strong expense discipline," said Intel CFO David Zinsner,." Our new foundry operating model, which provides greater transparency and accountability, is already driving better decision-making across the business. Looking ahead, we expect to deliver year-over-year revenue and non-GAAP EPS growth in fiscal year 2024, including roughly 200 basis points of full-year gross margin improvement."

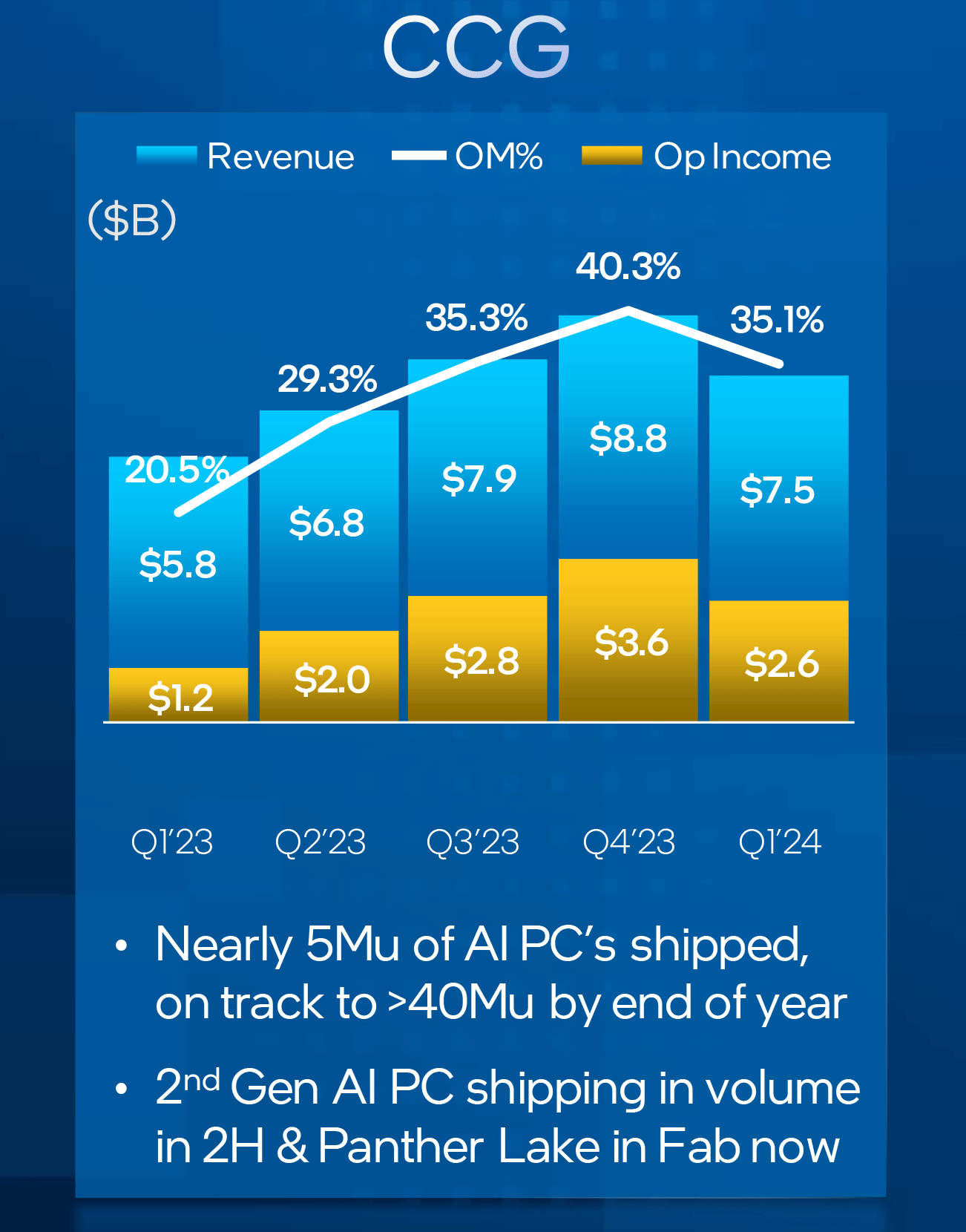

Intel's Client Computing Group: Another Good Quarter

Intel's Client Computing Group had a good quarter. Its revenue increased to $7.5 billion, up 31% year over year, while its non-GAAP profit totaled $2.6 billion, up significantly from $1.2 billion in the same quarter a year ago.

The company attributes CCG's success in the first quarter to good sales of its CPU products (thanks to depleted inventory at PC makers and OEMs), mainly to better sell-through of reserved inventory. Meanwhile, the company warns that in Q2 ,its client business will be constrained by 'wafer-level assembly supply,' which will particularly impact its Core Ultra-badged products.

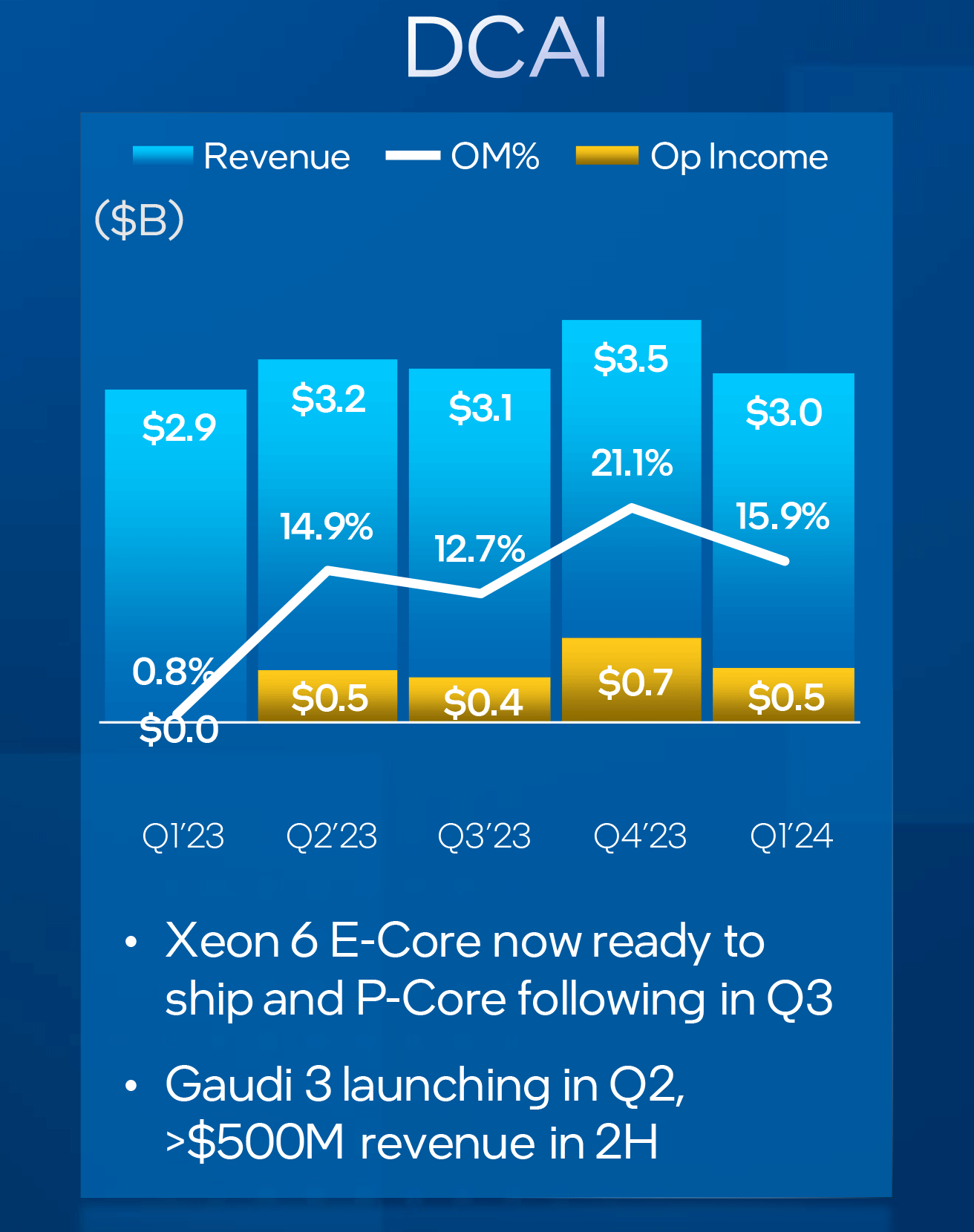

Intel's Datacenter and AI Group: Another Quarter

Intel's Data Center and AI business earned $3 billion in revenue (up 5% YoY from $2.9 billion) and $0.5 billion in operating income.

Intel attributes better results of its DCAI group to higher average selling prices of its Xeon Scalable products. However, the quarter can still be considered slow for the company, given the historical success of the blue giant's datacenter unit.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

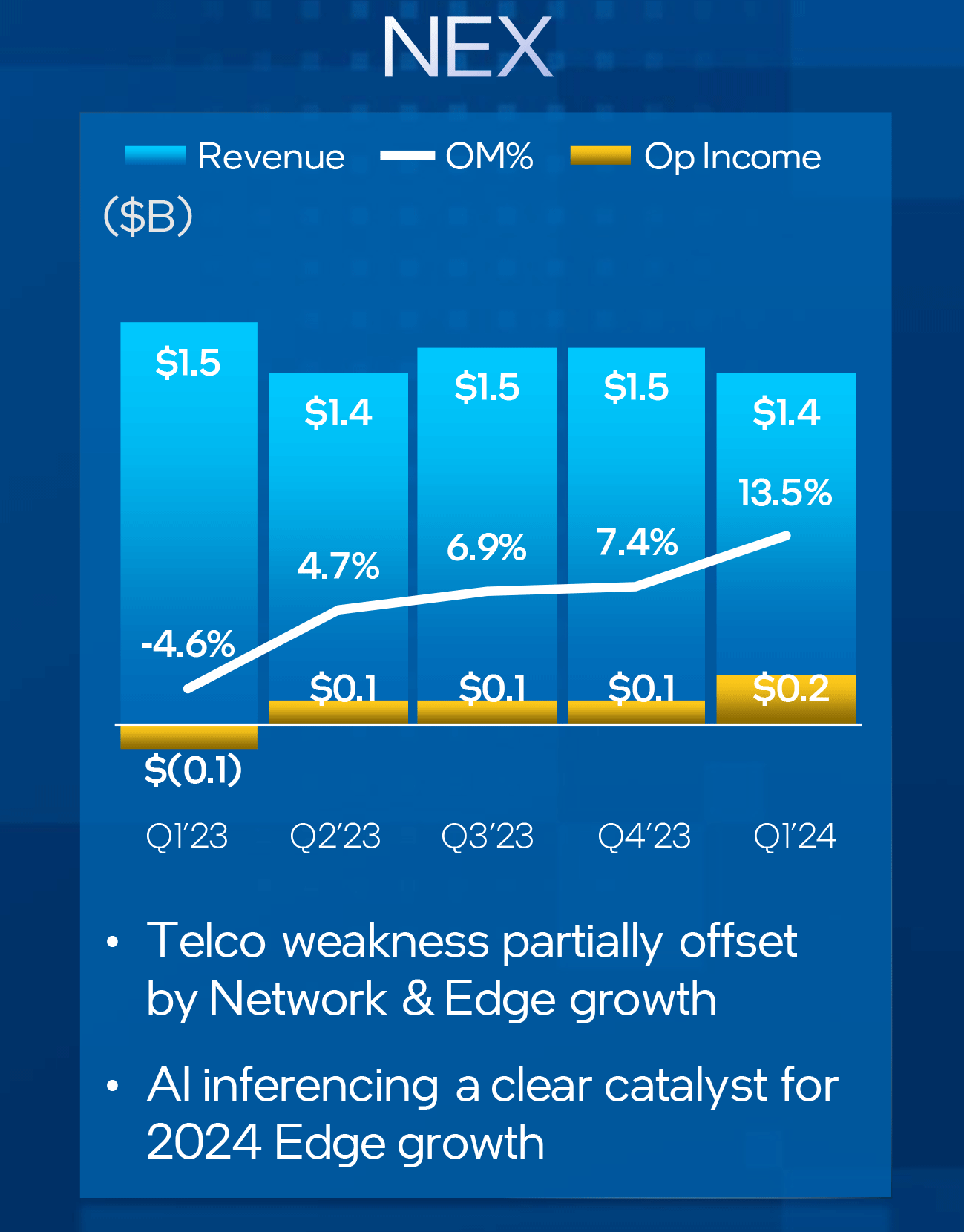

Altera, Edge, Network, and Mobileye: Another Mixed Bag

Intel's NEX products unit—which sells 5G, edge, network, and telco products—posted $1.4 billion in revenue in Q1 2024, down 8% from $1.5 billion in Q1 2023. The good news is that this business returned to profitability and earned $200 million.

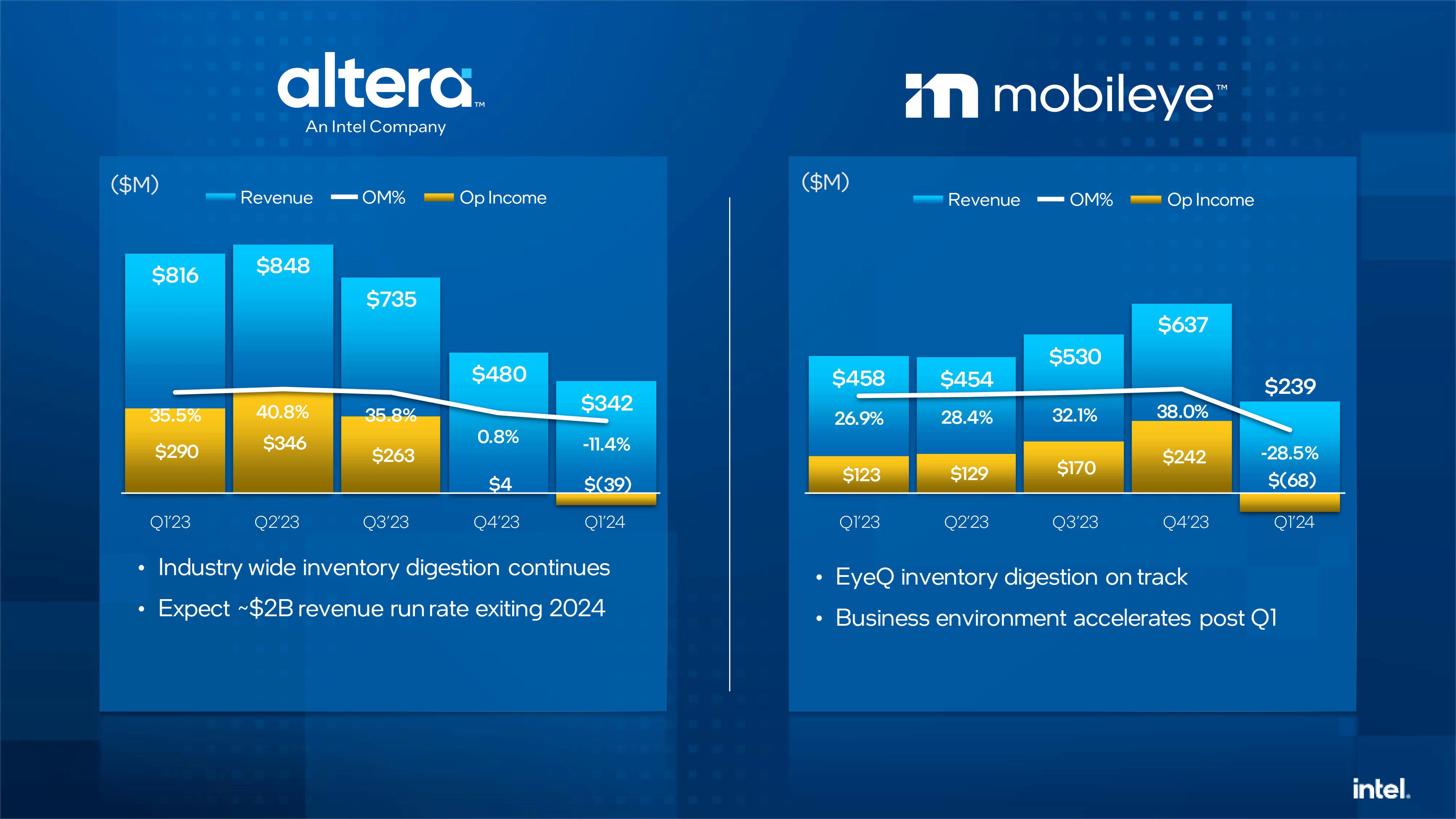

Altera and Mobileye were not that lucky, though. Altera's revenue totaled $342 million, down massive 58% from $816 million in the same quarter a year ago. The Intel company also lost $39 million, a dramatic nosedive from $290 million profit in Q1 2023.

Mobileye earned $239 million in the first quarter, down from $458 million in the same quarter a year before, and lost $68 million. By contrast, the division posted operating income of $123 million a year ago. Intel blames high inventory levels at Altera and Mobileye but claims that inventory digestion is on track.

Intel Foundry: Huge Investments Incur Losses

Intel's Foundry unit produces products for all of Intel's Products group and invests in capacities required both for Intel and third-party foundry customers. As a result, Intel Foundry has to make losses as its investments are not absorbed by Intel's current products.

In Q1 2024, the foundry unit earned $4.4 billion, down 10% year over year. The division's losses also deepened to $2.5 billion as it made massive investments into next-generation capacity and R&D.

Humble Guidance

Intel believes its GAAP revenue will be between $12.5 billion and $13.5 billion in Q2 2024, which is flat year-over-year due to constraints with meeting demand for its orders. The company expects its gross margin to achieve 43.5%, which is higher than in Q2 2023 but lower than in Q1 2024.

"We are confident in our plans to drive sequential growth throughout the year as we accelerate our AI solutions and maintain our relentless focus on execution, operational discipline and shareholder value creation in a dynamic market," said Pat Gelsinger, chief executive of Intel.

Anton Shilov is a contributing writer at Tom’s Hardware. Over the past couple of decades, he has covered everything from CPUs and GPUs to supercomputers and from modern process technologies and latest fab tools to high-tech industry trends.

-

cyrusfox Down 33% YTD may not yet be oversold...Reply

Revenue is not benefiting from the AI "Gold rush" (NVidia is 6x revenue of years past), in the midst of the largest build out of fabs in Intel's history, while still playing catch up to the competition (claimed turnaround in performance in 2025) and bleeding money building up foundry with not seeing a profit till 2027... the bottom of market sentiment might be a bit further down.

-

JTWrenn I think long term they have a shot of really turning around but will hurt for at least another 2 years. It's all going to be about wether their fab investment pays out or not. They have bet the farm on it, and from what I can see it's not a bad bet. The question is have they learned from their past fab issues and will the investment turn into real chip production capacity.Reply -

dalek1234 Reply

Pat will become famous for that onesubspruce said:I've been predicting Intel's bankruptcy for a long time by now