Chinese memory maker gets $2.4 billion to build HBM for AI processors — Shanghai packaging facility to open in 2026

China may be inching closer to its own HBM memory.

Innotron, the parent company of ChangXin Memory Technologies (CXMT), plans to invest $2.4 billion in a new advanced packaging facility in Shanghai. According to Bloomberg, this plant will focus on packaging high-bandwidth memory (HBM) chips and will begin production by mid-2026. Innotron will build the facility using money from various investors, including GigaDevice Semiconductor.

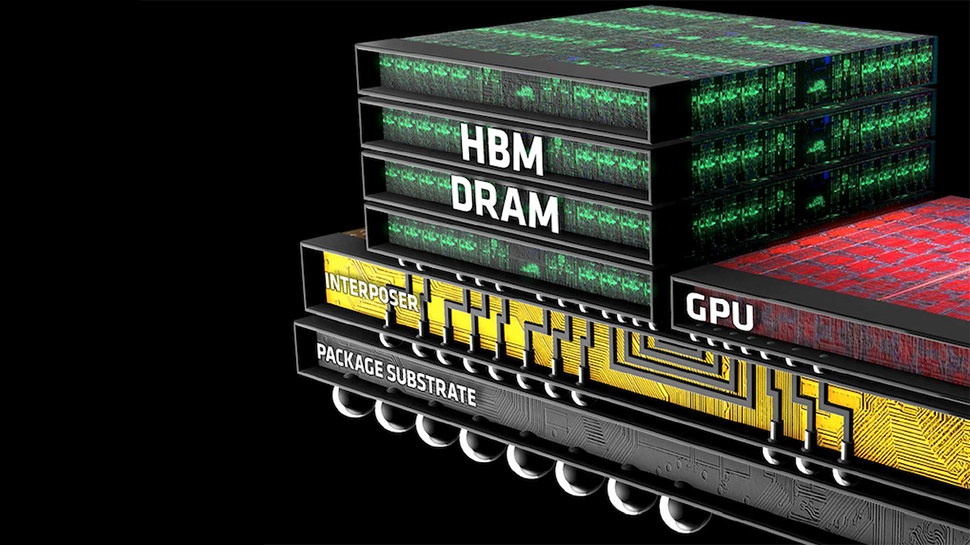

The new facility will concentrate on various advanced packaging technologies, such as interconnecting stacked memory devices using through-silicon vias (TSV), which is crucial for producing HBM. According to the Bloomberg report, the facility is anticipated to have a "packaging capacity of 30,000 units per month."

If the information about the packaging facility is accurate, CXMT will produce HBM DRAM dies (something it has been planning for a while), while Innotron will assemble them in HBM stacks.

Given that the packaging facility will cost $2.4 billion, it will not just produce HBM memory for AI and HPC processors but will also provide other advanced packaging services. We do not know whether this includes HBM integration with compute GPUs or ASICs, but this could be a possibility if Innotron, CXMT, or GigaDevices manage to secure a logic process technology (e.g., 65 nm-class) required to build silicon interposers used to connect HBM stacks to processors.

Leading Chinese OSATs, such as JECT, Tongfu Microelectronics, JCET, and SJ Semiconductor, already have HBM integration technology, so Innotron does not have to develop its own method. Earlier this year, JECT reportedly showcased its XDFOI high-density fan-out package solution, which is specifically designed for HBM. Tongfu Microelectronics is reportedly working with a leading China-based DRAM maker, likely CXMT, on HBM projects, too.

China needs its own HBM. Chinese companies are developing AI GPUs but are currently limited to using HBM2 technology, according to DigiTimes. For instance, Iluvatar Corex's Tiangai 100 GPU and MetaX C-series GPU are equipped with 32 GB and 64 GB HBM2, respectively, but HBM2 is not produced in China.

This $2.4 billion investment is a part of China's broader strategy to enhance its semiconductor capabilities in general and advanced packaging technologies in particular. Whether or not this one is going to be a financial success is something that remains to be seen. Given that the U.S. government does not allow the export of advanced components made using American technology to China without a license, it has no other choice but to build its own HBM supply chain.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Anton Shilov is a contributing writer at Tom’s Hardware. Over the past couple of decades, he has covered everything from CPUs and GPUs to supercomputers and from modern process technologies and latest fab tools to high-tech industry trends.

-

thisisaname I wonder how they will get around the patents involved in HBM?Reply

It was invented by AMD and South Korean chipmaker SK Hynix would the USA allow the export of this technology? -

LabRat 891 The CCP can get HBM, but we can't?Reply

At this point, I feel like the only 'party' being sanctioned, is us.

Pretty sure that China has a history of ignoring International Intellectual Property protections, when it's convenient.thisisaname said:I wonder how they will get around the patents involved in HBM?

It was invented by AMD and South Korean chipmaker SK Hynix would the USA allow the export of this technology? -

nookoool Maybe I am dumb but If China is sanction or ban from buying HBM, why would they abide to any patent or IP regarding it?Reply