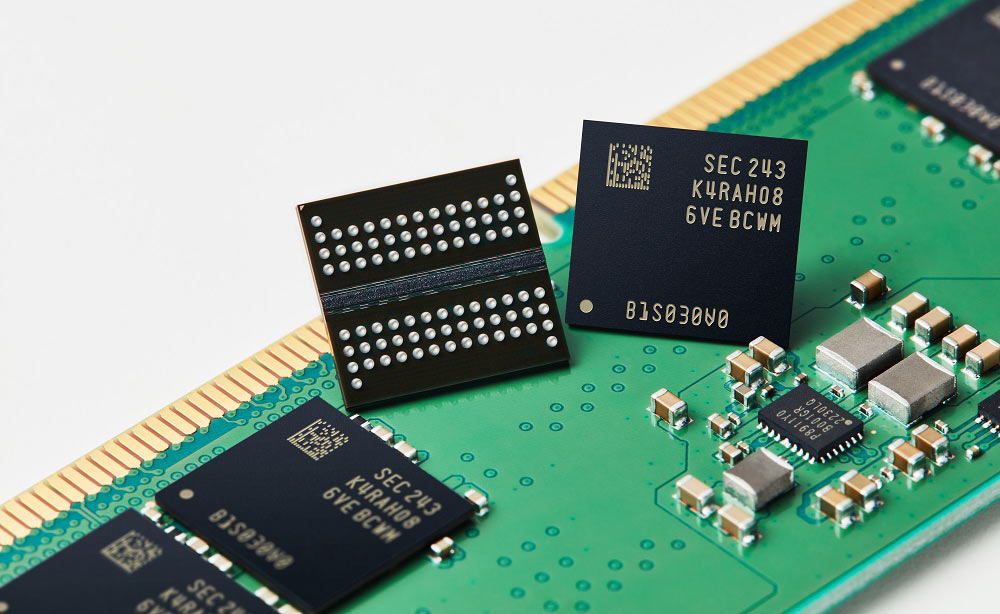

Leading DRAM makers may stop producing DDR4 and DDR3 by late 2025 — China memory makers flood the market with half-price memory

Chinese DRAM manufacturers CXMT and Fujian Jinhua have usurped Micron, Samsung, and SK Hynix by undercutting prices.

Leading DRAM makers — Micron, Samsung, and SK hynix — may cease production of DDR3 and DDR4 memory by the end of the year. The decision is due to low prices caused by dumping (by Chinese makers) and declining demand, reports DigiTimes. This may potentially cause shortages of DDR4 memory that is still used in entry-level PCs and consumer electronics.

Chinese DRAM manufacturers Changxin Memory Technology (CXMT) and Fujian Jinhua have been ramping up production of DDR4 while aggressively lowering prices. Late last year their DDR4 chips were priced at half the cost of similar products from South Korean competitors. In some cases, Chinese DDR4 memory ICs were even 5% cheaper than refurbished chips. As a result, leading DRAM producers may no longer earn profit by selling DDR4, which is why they may have to phase out this type of memory while focusing on more profitable DDR5 (well, until Chinese companies start to produce it in volumes and dump on the global market) and HBM.

However, there is a catch, as demand for DDR4 is quite strong, and Chinese makers may not meet it. Thus, as soon as Micron, Samsung, and SK hynix cease to make DDR3 and DDR4 memory for the spot market, DDR4 supply constraints could emerge after mid-2025, according to DigiTimes analysts.

Taiwanese producers may step in to bridge the gap, but both Nanya Technology and Winbond Electronics only produce specialized types of DRAM, which means relatively low volumes and high prices. Yet, some industrial customers are unlikely to adopt China-made DRAMs and are more likely to adopt specialized memory from Nanya and Winbond instead.

Nanya Technology predicts the market will reach its lowest point in early 2025, followed by a recovery in the second quarter. This rebound will be fueled by stronger demand, better stock management, and economic stimulus. AI-related cloud computing is expected to remain a major driver, while general consumer demand is projected to see only a slight improvement.

Winbond Electronics, facing weakening demand for older DDR versions, is moving to a more advanced 16nm process in late 2025. This upgrade from 20nm will allow the company to produce higher-capacity 8Gb DDR chips.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Anton Shilov is a contributing writer at Tom’s Hardware. Over the past couple of decades, he has covered everything from CPUs and GPUs to supercomputers and from modern process technologies and latest fab tools to high-tech industry trends.

-

Pierce2623 CXMT had decent performing ddr4 modules. They were much better than Samsung C die but not in the same league as Samsung b die obviously.Reply -

bit_user Reply

There are zillions of embedded devices which still use DDR3 and DDR4 DRAM. Just think about everything that has an embedded computing capability more complex than a simple microcontroller - cars, routers, TVs, industrial equipment, etc. Heck, even a lot of SSDs have embedded DRAM! This is not only about PCs and servers.Anth said:Would the solution not be for entry-level motherboards to be released with DDR5 support?

And while some of them could switch to DDR5, a lot of them are using CPUs that are still perfectly fine for their intended task and don't support DDR5.

FWIW, I don't exactly know how much of those markets are served by Nanya and Windbond, but I'm sure not all of it. -

mitch074 I'm perplexed : if Chinese companies can sell those RAM chips for so cheap, what's the risk, exactly ? Those are mature technologies using outdated processes, thus there is little added value to them... The Big Ones getting out of the market is, as such, not unexpected. But the article mentions that the Chinese companies may not be able to meet market demands : why wouldn't they ? Because of a possible US embargo ? China can now domestically produce petty much everything up to 14nm processes, including the machines needed for this kind of production - if there's demand for cheap DDR3/DDR3L/DDR4 chips, they sure as heck can meet it, and if demand goes up (likely, as domestic demand alone could drive it), they can increase capacity without needing to wait on anybody.Reply -

bit_user Reply

The article mentions that they might be selling at below-cost to drive others out of the market. Then, in the resulting shortage (because the Chinese producers can't adequately satisfy demand by themselves) prices will surge and make the devices using them more expensive.mitch074 said:I'm perplexed : if Chinese companies can sell those RAM chips for so cheap, what's the risk, exactly ?

It's just a matter of scale. They're looking at production volumes of all the existing producers and what fabs the Chinese makers have, in order to determine there's a mismatch. Just because it's China we're talking about doesn't mean they can snap their fingers (if they even wanted to) and scale up overnight. Worse, they could cut off DRAM for export first, thereby benefiting their domestic OEMs and hurting foreign consumers disproportionately.mitch074 said:But the article mentions that the Chinese companies may not be able to meet market demands : why wouldn't they ? -

Pierce2623 ReplyPierce2623 said:CXMT had decent performing ddr4 modules. They were much better than Samsung C die but not in the same league as Samsung b die obviously.

There’s even a vibrant market of tiny ARM based emulation handhelds using mostly DDR3 as well and collectively those ship millions of units a year. A ton of lower end phones haven’t gotten on ddr5 either.bit_user said:There are zillions of embedded devices which still use DDR3 and DDR4 DRAM. Just think about everything that has an embedded computing capability more complex than a simple microcontroller - cars, routers, TVs, industrial equipment, etc. Heck, even a lot of SSDs have embedded DRAM! This is not only about PCs and servers.

And while some of them could switch to DDR5, a lot of them are using CPUs that are still perfectly fine for their intended task and don't support DDR5.

FWIW, I don't exactly know how much of those markets are served by Nanya and Windbond, but I'm sure not all of it. -

bezmozachen Reply

I still design devices with SDRAM (not DDR, DDR2, or DDR3), and it is still in production.logainofhades said:I figured DDR3 production ended a long time ago. -

LolaGT I don't see any problem, outside of the big names lamenting about being beat at their own game. As long as their is a demand for it, someone will step in.Reply

The retro guys will be happy to buy it if it works, I have seen the odd name DDR3 2400 ram recently and it gets enough real reviews that it works as it should that I would not hesitate to try it.

Also, there are still boatloads of people on ivy bridge and haswell machines for their daily driver still, because they run windows just fine.